Summary:

- Nvidia Corporation’s explosive growth in the Data Center market is safeguarding the company’s overall financials.

- With falling revenues in the Gaming market, Nvidia management will need to find ways to regain momentum or find growth opportunities elsewhere.

- Nvidia Corporation will have a difficult time holding up the pace of shareholder returns it provided during the previous twelve months.

Justin Sullivan

Investment Thesis:

Nvidia Corporation (NASDAQ:NVDA) has robust financials and a strong reputation in markets such as the Data Center and Gaming markets, giving the company substantial opportunity for growth. However, the high volatility it has experienced not only in its financial results but also in its share price poses important risks. It would be wise to wait for better results and more stability before investing in the company’s stock.

Business Overview:

Nvidia Corporation is an important player in the semiconductor industry, operating as a fabless chip designer. I will now provide an overview of where NVDA stands in the semiconductor ecosystem. To think about the role of semiconductors and the players in the industry, let’s deconstruct the value chain from the end use of the product. I will use a smartphone as an example and work backwards. A phone has many chips inside of it, these chips are designed by companies such as Apple (AAPL), NVDA, Qualcomm (QCOM), etc. The semiconductor chips are made at fabrication plants from companies such as TSMC (TSM), Intel (INTC), or Samsung. The most advanced semiconductors are made using equipment sold by ASML Holding (ASML). NVDA is called a Fabless chip designer because it does not own fabrication plants to manufacture the chips it designs. In essence, Nvidia Corporation pays for the manufacturing process of the chip and specializes in designing the chips.

Now that we have that covered, lets continue with NVDA business overview. The company designs a range of products, including graphics processing units also called GPUs, central processing units (CPUs), data processing units (DPUs), and network interface controllers (NICs). NVDA is truly known for its GPUs which one could argue are the backbone of the company’s business. With this range of products, NVDA serves markets including gaming, data centers, professional visualization, autonomous vehicles, and OEMs.

Financial Overview

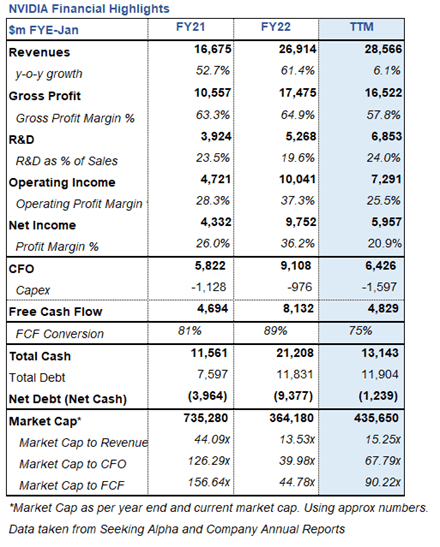

NVIDIA Financial Highlights (Seeking Alpha & Company´s Annual Reports)

Nvidia Corporation generates revenue through two main segments: the Graphics segment, which accounts for 67% of total revenues, and the Compute and Networking segment, accounting for the remaining 23%. The Graphics segment includes the sales of NVDA GPUs and generates a fantastic operating income margin. This segment is primarily driven by demand for NVDA GPUs in the gaming market, as well as in the data center and professional visualization markets. The Compute & Networking segment includes sales of NVDA CPUs, DPUs, and NICs, and is driven by demand from the data center and networking markets.

NVDA financial performance has seen a slowdown from the momentum it experienced during the previous two years (please see table above). The company TTM revenues stand at $28.6 billion, cash flow from operations at $6.4 billion, and free cash flow at $4.8 billion. This is a completely different picture than the numbers NVDA posted in FYE 2021. During FYE 2021, NVDA brought in revenues of $26.9 billion, generating cash flow from operations of $9.1 billion and free cash flow of $8.1 billion.

The company invests heavily in research and development, with the TTM spend on R&D standing at $6.9 billion. R&D usually accounts for around 15% to 20% of total revenues. These investments have given and continue to give NVDA an edge in the design of semiconductors. Such high R&D capabilities allow the company to continue to innovate and stay ahead of the competition. NVDA R&D investments are focused on areas such as artificial intelligence, autonomous vehicles, and data centers. These are key areas of growth for the company.

Despite Nvidia’s relatively high expenditures in R&D, the company is still able to generate very attractive net profits with TTM profits standing at $ 6 billion. It should be noted that net profit margin has dropped compared to the previous two years and currently stands at 20%. For reference, the company had attained a 26% and 36% net profit margin during FYE 2021 and 2020, respectively. A similar down trend can also be seen in the free cash flow generated during the previous twelve months. To end on a positive note, it’s important to remark the historically strong cash flow from operations NVDA has been able to generate. This strong cash flow generation translates into a cash conversion rate typically above 80% and during some years even above 90%.

Shareholder Returns

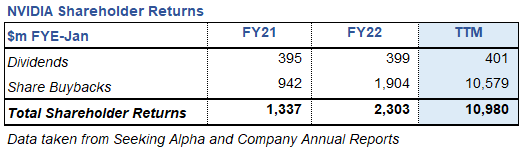

On May 2022 NVDA, increased and extended its share repurchase program to a total of $15 billion through December 2023. Management would later add an additional $8.28 billion to repurchase shares through December 2023.

Management did not waste time increasing shareholder returns, with approximately $11 billion distributed to shareholders in the last twelve months. These returns have come to a large extent through share buybacks and to a much lower extent dividends. The company was able to pursue this much more aggressive initiative thanks to its strong balance sheet, bolstered by $13.1 billion in cash and cash equivalents and net cash position.

NVIDIA Shareholder Returns (Seeking Alpha and Company´s Annual Report)

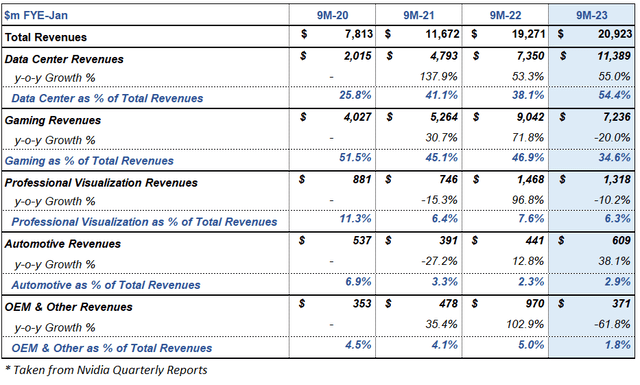

Challenging FYE 2023

From the table below it can clearly be seen that NVDA has had a challenging FYE 2023. During the first nine months of FYE 2023, Gaming revenues have decreased by 20%. The previous year, this same market was experiencing explosive revenue growth of approx. 72%. Data Center is truly the market that has been safeguarding the overall revenues of the company. This market continues to see an outstanding and sustained growth of 55% compared to the previous year. It should be mentioned here that Data Center revenues have increased 138%, 53% and 55% during the previous 3 years, respectively. Additionally, the Data Center market now accounts for more than 50% of total revenues and shows no sign of stopping.

The challenge for NVDA will be to regain momentum in the Gaming market. The combination of revenue growth in both the Gaming and Data Center markets would significantly enhance the company’s top line. When looking at the rest of the markets NVDA serves, we can also see mixed results. This shows the company is going through challenging year and it will be very interesting to see how management reacts to return to a positive momentum.

NVIDIA Revenues per Market (Company´s Quarter Reports)

Growth Opportunities

As explained earlier and evidenced by NVDA R&D spend, the company is constantly innovating and investing in new technologies. These investments go toward artificial intelligence, autonomous vehicles, and data centers, which are key areas of growth for the company. NVDA strong R&D efforts have enabled it to consistently bring new and cutting-edge products to market. This has helped the company to maintain its competitive edge in the semiconductor industry.

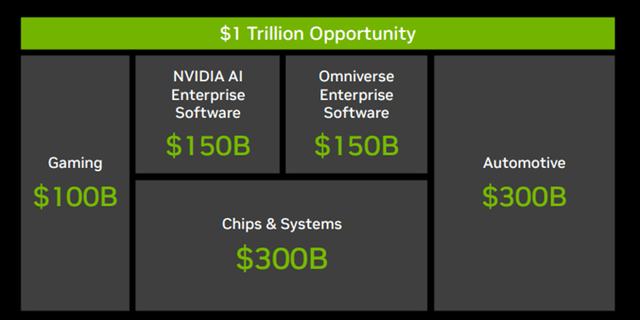

All of the markets that NVDA currently serves are key areas for growth. Management sees a $1 trillion opportunity throughout all the markets the company is active in. Specifically, management sees growth potential in the following markets:

- $100 billion opportunity in the Gaming market, fueled by over 3 billion gamers and creators.

- $150 billion opportunity in AI enterprise software driven by 50 million enterprise servers installed base.

- $150 billion opportunity within Omniverse Enterprise software with over 45 million designers and creators.

- $300 billion opportunity in the Automotive market with a hardware opportunity of 100 million vehicles per year .

- $300 billion opportunity in Chips & Systems, driven by approximately 20 million servers per year which need GPUs, CPUs, DPUs, NICs, and switches.

Growth Opportunities (Company Investor Presentation)

The Data Center and Gaming markets are truly the biggest opportunities for the company to expand. The Data Center market is driven by cloud computing companies that are growing at double digit rates in the tens billions of dollars. NVDA will be able to take advantage of this tailwind, as it is already serving the world’s leading cloud service providers, including: Microsoft (MSFT), Amazon (AMZN), and Google (GOOGL, GOOG). Regarding Gaming, even though NVDA has struggled this current year, the market as a whole is set to continue its expansion. With the increasing popularity of e-sports and mobile gaming, NVDA is well-positioned to catch this tail wind.

Valuation

NVDA has experienced substantial volatility during the past two years reaching its peak market valuation at approx. $825 billion in November 2021. The bullishness was shortly lived as the company´s market valuation dropped by more than 65% to $280 billion within one year. Since this low, the company has seen an appreciation of almost 50%. Investors could have gotten either caught by the decline or could have taken advantage of the bottom. Regardless, these fluctuations pose a significant risk to investors and should not be ignored.

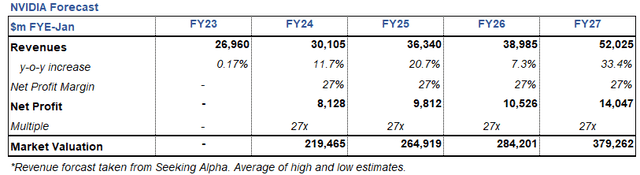

For the valuation of the company, I have used the market multiple method, using future forecasted earnings to a 27x multiple. This is a high multiple, however since 2019 the company has had a market multiple above this number. As such, I believe it is reasonable. I have obtained the analysts’ revenues forecast from Seeking Alpha data and have applied net profit margin of 27%. This net profit margin is slightly below the previous 3 years average. With this numbers I arrive to a market valuation by FYE 2027 of $379 billion. Now, please understand this is based on estimates and assumptions which can change. The company could in fact return back to its highest valuation, however, I always try to be conservative with assumptions and estimates.

NVIDIA Forecast (Seeking Alpha & Author´s Estimates)

Risks

Intense competition in the semiconductor industry: NVDA competes with other major players in the industry such as AMD, Intel, and Qualcomm. Further to this, we now see OEMs designing their own chips which add more competition to this part of the industry. NVDA will need to spend substantial resources in order to remain at a technological advantage.

Volatility of the cryptocurrency market: A portion of the company’s revenues comes from the sales of its GPUs to cryptocurrency miners. For example, during the latest quarter report, the company mentioned the following:

“The year-on-year decrease was driven by lower GPU sales for both desktops and laptops; the sequential decline was primarily driven by lower GPU sales for laptops. We believe the recent transition in verifying Ethereum cryptocurrency transactions from proof-of-work to proof-of-stake has reduced the utility of GPUs for cryptocurrency mining.”

Given the cryptocurrency market is highly volatile, it could lead to big swings for the demand of NVDA products.

Export Controls: The U.S. government has become stricter with what semiconductor chips China is able to import. This has already had an impact on NVDA, as the company was ordered to halt sales of top AI chips to China. Due to Nvidia’s position in the market, it is caught in the middle of the chip war, and this will hinder revenues to the second largest economy in the world.

Conclusion

NVDA is a well-established player in the semiconductor industry. The company’s robust financials combined with its strong position in key markets such as the Data Center and Gaming markets give it substantial room for growth.

Nonetheless, there are also risks with the high volatility faced by NVIDIA Corporation stock in recent months. Further, there is uncertainty on the challenges NVIDIA Corporation is facing in Gaming, which used to be its highest revenue market. Therefore, while NVIDIA Corporation has strong growth prospects, the challenges and volatility risks it faces are too important to ignore. It would be wise to wait for a more attractive entry point before investing in the company’s stock.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.