Summary:

- Financial performance from Nvidia Corporation has been anything but good over the last couple of quarters, with YoY growth turning negative.

- Despite recent bad performance, Nvidia is still exposed to strong growth drivers across its segments.

- The gaming segment will most likely have seen its peak, and I do not expect this segment to report record revenues anytime in the next few years.

- While the share price has dropped by over 60% YTD, Nvidia is still not cheap and remains slightly overvalued, as I calculate a fair price of $140 per share.

- I foresee a bright future for Nvidia, but the current valuation makes it hard to recommend buying the stock right now.

Justin Sullivan

Introduction

Semiconductors are called “the oil of the future,” meaning these will be, and increasingly become, the drivers of our society, in a similar way as oil has fulfilled this exact role since the industrial revolution. As a result, it should come as no one’s surprise that the semiconductor industry has easily outperformed over the last 5 years, with the exchange-traded fund (“ETF”) following the semiconductor industry, the iShares Semiconductor ETF (SOXX), increasing by over 100%, while the S&P 500 Index (SP500) only managed to increase by 43%. This already includes the immense hit that the semiconductor industry has taken over the last year.

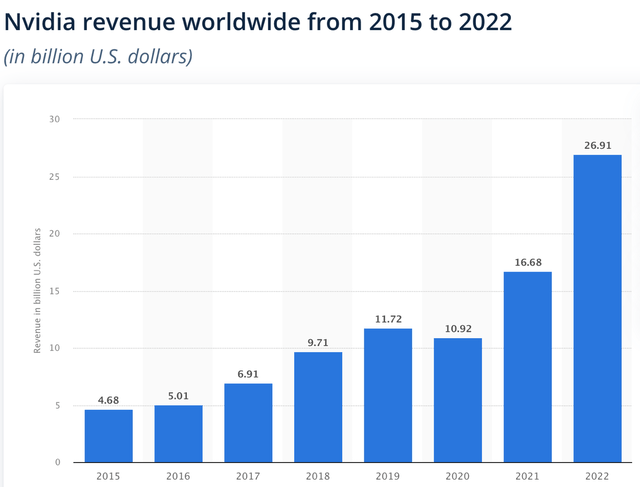

One of the driving forces in the semiconductor industry, and one of the main out-performers over the last 5 years, is NVIDIA Corporation (NASDAQ:NVDA). Nvidia saw its stock price increase by over 200% over the same period. This increase in share price has not been without any reason, as Nvidia has also seen its revenue explode from approximately $7 billion in FY17 to $27 billion in 2022.

As illustrated in the graph above, revenue got a massive boost as a result of the covid-19 pandemic and the fact that people were bound to stay at home. This caused a massive increase in demand for the high-end GPUs designed by Nvidia for gaming and visualization purposes. Combine this with the high demand for GPUs for the use of crypto mining and massive growth in data centers, and you end up with a massive tailwind for Nvidia as the largest and most dominant player in the GPU market.

Yet, in 2022, the odds turned against Nvidia with tailwinds disappearing. Some of these new headwinds were Ethereum switching from proof-of-work to proof-of-stake, the highly cyclical gaming industry being hit by lower consumer spending, covid-19 tailwinds disappearing, and higher interest rates pressing down on Nvidia’s high valuation. As a result, Nvidia has witnessed a severe slowdown in revenue growth and a serious drop in margins. This has made many investors worry about the future of Nvidia, and some contributors on Seeking Alpha even believed Nvidia to have already seen its peak revenues.

This is my initial thesis on Nvidia after having owned the stock for many years before selling it at the end of 2021. Within this article, I want to determine whether Nvidia is a buy at current levels after having lost half of its value over 2022. To do this, I will go through its fundamentals, 3Q23 results, risks, and most importantly: its growth drivers.

I can already tell you one thing; I definitely do not believe Nvidia has seen its peak revenue as it continues to be exposed to massive growth industries.

Q3 2023 results

With Nvidia being one of the largest companies in the world, it will probably not need much of an introduction, but I will give a very short one anyways.

Nvidia is an American software and fabless company which specializes in the design of graphics processing units (GPUs). The company also designs application programming for high-performance computing as well as SoCs for mobile computing and automotive solutions. In addition to this, Nvidia is a global leader in AI hardware and software. Nvidia is one of the most important players in the general GPU market as well and continues to design the highest-performing GPUs for gaming, data centers, and automotive purposes.

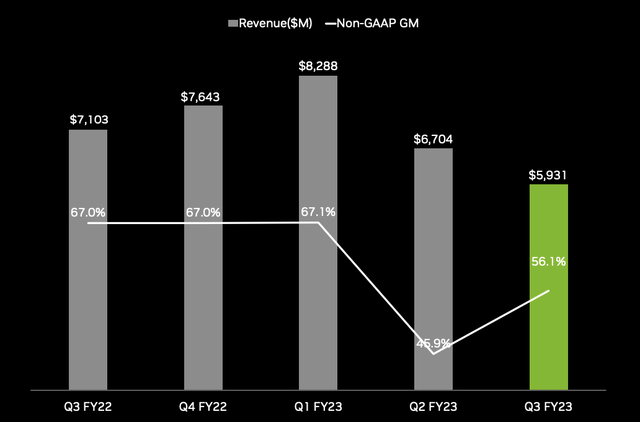

Nvidia reported its third-quarter results on November 16th and saw revenue fall by 17% YoY to $5.93 billion. A drop in revenue YoY is never good to see from a high-growth company such as Nvidia. At the same time, this drop in revenue was expected, as Nvidia is feeling the consequences of high inflation and less consumer spending, which results in a massive drop in demand for its GPUs. Nvidia still managed to outperform analyst estimates for the quarter by $110 million. Despite the low estimates, Nvidia did miss on EPS by $0.12 as EPS was down by 50% YoY. Gross margin was 56,1% which is an increase compared to the previous quarter but still down significantly compared to 3Q22 when Nvidia reported gross margins of 67%.

CEO Jensen Huang said the following in the earnings release:

We are quickly adapting to the macro environment, correcting inventory levels and paving the way for new products. The ramp of our new platforms ― Ada Lovelace RTX graphics, Hopper AI computing, BlueField and Quantum networking, Orin for autonomous vehicles and robotics, and Omniverse ― is off to a great start and forms the foundation of our next phase of growth.

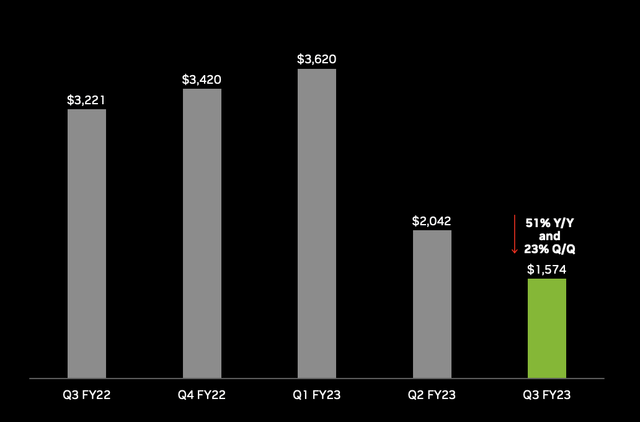

If we dive a bit deeper, we can see that some segments recorded record revenue numbers, while others saw significant decreases. The segments that got hit the hardest were the professional visualization and gaming segment. With the visualization segment only accounting for a little over 3% of total revenue the impact of the decrease for the segment was not as significant. The gaming segment was the largest segment for Nvidia for many years before it was overtaken by the data center segment. Gaming still accounted for 26% of revenue and therefore has a significant impact on revenue growth and has been the main contributor to the significant slowdown in revenue growth for Nvidia. The gaming segment reported revenue of $1.57 billion and fell by over 50% YoY.

The significant weakness in the gaming segment was caused by general weakness for the gaming industry as many consumers are cutting back on spending due to increasing interest rates and high inflation. Also, many gamers updated their equipment during the covid-19 lockdowns and with this gaming tailwind easing now that the world re-opens, Nvidia is seeing a drop in revenues for the segment. Also, over the last few years, the crypto boom caused many crypto miners to buy the highest end GPUs from Nvidia to power their equipment, but with crypto losing popularity and Ethereum switching for proof-of-work to proof-of-stake, crypto mining is not as lucrative anymore and demand for GPUs dropped significantly. With less demand, the prices for GPUs have also come down, resulting in a drop in margins. Add to this that lesser demand required Nvidia to mark down its excess inventory, and margins fell even more, resulting in what we have seen over the past two quarters.

Nvidia Gaming revenues (Nvidia)

Does this then mean that the gaming industry is broken, and crypto-induced revenue won’t return? Well, I do believe Nvidia has had a significant crypto tailwind over the last couple of years, and this will not be returning. Yet, the gaming industry is still seeing huge growth potential going forward and still offers significant potential for Nvidia. I do expect it to take a while for the gaming segment to report record revenue again.

Segments that did perform very well were automotive & embedded and data center. The automotive & embedded segment was only good for a little over 4% of total revenue for the third quarter, but did manage to grow by a staggering 86% YoY to $251 million. This even represented 14% sequential growth. Nvidia launched several new software packages for the automotive industry. Automotive remained strong despite the economic turmoil and the drive towards more advanced and self-driving cars is still strong.

The data center segment has been the driving force for Nvidia over the last couple of years, with the segment growing out to be the largest and most important segment for Nvidia. This segment reported revenue of $3.83 billion, representing 64.5% of revenue. The segment grew by 31% YoY, but by just 1% sequentially. This is still very strong growth, but a slowdown compared to the growth rates witnessed over the last couple of years. Many investors feared this segment to be hit by new export restrictions laid on by the U.S. government regarding the export of high-end AI and data center chips to China, but Nvidia managed to largely offset this headwind by releasing new chip models that are allowed to be shipped to China.

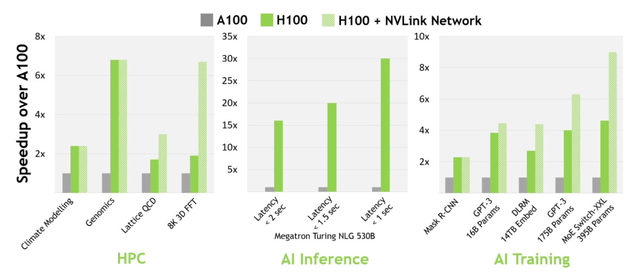

Nvidia also began shipping its new H100 chipset based on the new Hopper architecture, which will need to drive data center growth for Nvidia. In addition to this, Nvidia announced a partnership with both Microsoft Corporation (MSFT) and Oracle (ORCL) to advance their data center computing and AI capabilities. With Microsoft and Oracle being two of the largest players in the data center industry, these are very promising partnerships.

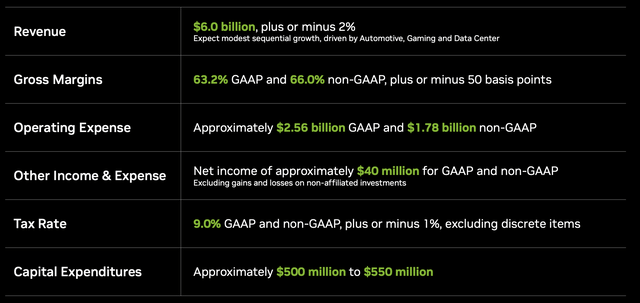

All in all, growth for the quarter was not good, but the outlook is what kept Nvidia up the day after the earnings release. Nvidia expects revenue of $6 billion, plus or minus 2%. Margins are expected to recover to 66% showing resiliency and possibly indicating that we have already seen the bottom.

Nvidia outlook for 4Q23 (Nvidia)

Growth drivers

Now that we have gotten a clearer picture of Nvidia financially, we can continue by looking at future growth drivers. Despite recent growth weakness Nvidia continues to be a growth company and therefore it is crucial to determine whether we will see new growth from Nvidia. In this section, I will discuss some of the highest conviction growth opportunities for Nvidia.

AI

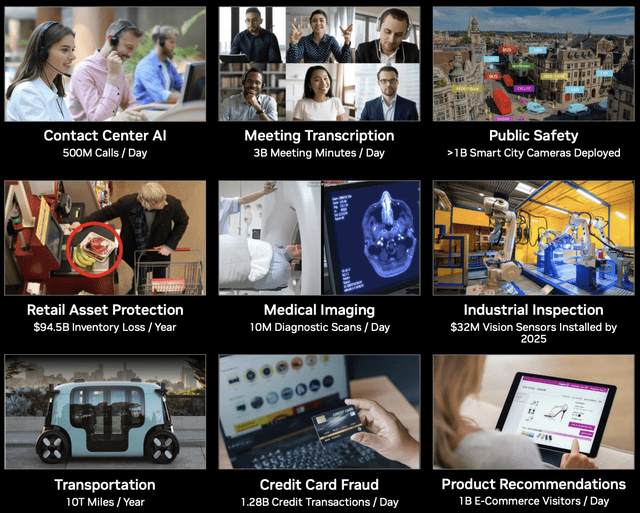

“AI is the greatest technology force of our time” is a sentence Nvidia used in its 3Q23 results presentation, and I fully agree with them. In my view, AI technology will very much dictate what our future will look like as it opens us up to many opportunities. Please, do not think we will see high-end human-like robots in the near future, because this is not what AI is about. AI will be used in many daily tasks in order to improve these. The picture below illustrates some of these tasks.

In order to realize and work with highly advanced AI, you need a lot of processing power, and the best way to realize this is by using Nvidia GPUs. This is what Nvidia says on its website:

Deep Learning relies on GPU acceleration, both for training and inference. NVIDIA delivers GPU acceleration everywhere you need it—to data centers, desktops, laptops, and the world’s fastest supercomputers. If your data is in the cloud, NVIDIA GPU deep learning is available on services from Amazon, Google, IBM, Microsoft, and many others.

Analyst firm Omnia stated in 2020 that Nvidia had an 80% market share in the AI processor market through its AI expertise and best-performing GPU chipsets. AMD-owned Xilinx (AMD) was ranked second by Omnia. It is highly likely that Nvidia will at least still be the main player in the AI processor market in 2022 and entering 2023 as the company continues to develop the best performing GPUs. The global AI chip market is expected to grow at a stunning 37.1% CAGR until 2031 and reach a market size of $263.6 billion. With Nvidia being by far the most dominant player in the fast-growing industry, the company is well-positioned to benefit from this growth. The broad AI industry is expected to grow at a 20% CAGR between 2022 and 2029 to reach a market size of $1.4 trillion. This once again illustrates that the AI industry is poised for incredible growth with Nvidia being a dominant player.

Automotive

According to Nvidia, the automotive industry could be a $300 billion opportunity for the company. This is made of the various solutions Nvidia offers like hardware (semiconductors) and software. Nvidia currently has an automotive pipeline that exceeds $11 billion spread over the next 6 years.

Nvidia offers multiple software solutions build on its own chips. Nvidia Drive is the company’s end-to-end platform for automotive purposes ranging from AI cockpit solutions to autonomous driving. Nvidia adds the following:

Tapping into decades-long experience in high-performance computing, imaging, and AI, NVIDIA has built an end-to-end, software-defined platform for the transportation industry that enables continuous improvement and deployment through over-the-air updates. It delivers everything needed to develop autonomous vehicles at scale.

Nvidia has many partnerships with car OEMs from China and large western car manufacturers like Volvo (OTCPK:VOLAF), Polestar (PSNY), Hyundai (OTCPK:HYMLF), General Motors (GM), and Mercedes (OTCPK:MBGAF). The increasing number of smart capabilities in cars requires an increasing number of chipsets and smart car software, and Nvidia offers the full stack to OEMs. As a result, the automotive chip market is projected to grow at a 12.27% CAGR until 2028 to reach a market size of $118 billion. Although this represents solid growth, the next two markets are even more important to Nvidia and show even higher growth rates. The autonomous car market is projected to grow at a 25.7% CAGR until 2030 to reach a market size of close to $200 billion. It is important to keep in mind that the autonomous driving industry is highly competitive, with companies such as Mobileye (MBLY), Waymo (GOOGL), and also Qualcomm (QCOM) tapping into the space. Finally, the automotive software market is projected to grow at a 15% CAGR until 2030 and is expected to be valued at $57.68 billion by then.

Automotive continues to be a high growth opportunity for Nvidia driven by general industry growth trends in addition to product superiority from Nvidia allowing it to increase its market share. Nvidia seems to be well-positioned to increase its automotive revenue significantly over the next few years, as proven by its $11 billion pipeline.

Nvidia Omniverse

On many occasions, Meta Platforms (META) is the first company mentioned when talking about the Metaverse. This is no surprise at all since Meta even changed its name in order to be linked it the Metaverse. Yet, an article in Forbes was titled the following: NVIDIA Omniverse: The Useful Metaverse. I believe this is exactly right. The Metaverse from the Meta point of view is all about being social, advertising, and entertainment, without actual good products with a useful function, whereas the Nvidia Omniverse is actually already serving really valuable purposes. This is how Nvidia describes is:

NVIDIA’s omniverse digital twins creates comprehensive and photo-realistic design platforms for professional teams to enable better designs with fewer costly mistakes in less time.

The Omniverse offers companies, governments, and organizations the possibility to build highly accurate digital twins of objects, buildings, cities, and even the world in order to improve at a low cost and prevent failure. Nvidia is currently working on a digital twin of our very own planet in order to simulate the consequences of climate change and look for solutions. It is not consumers looking for a nice time that use the Nvidia Omniverse, but instead it is the world’s leading companies like Amazon (AMZN), AT&T (T), BMW (OTCPK:BMWYY), Ericsson (ERIC), PepsiCo (PEP), and Siemens (OTCPK:SIEGY) that use the platform to improve operations and designs.

To give you an idea of the market size of digital twins, in which Nvidia is a frontrunner through the Omniverse, the market is expected to grow at a massive 40% CAGR until 2030 to reach a market size of over $120 billion.

At the same time, the Metaverse market size is expected to increase at a 43.7% CAGR until 2030 and to reach a total size of over $1.5 trillion. The Omniverse puts Nvidia in a great position to benefit from both high-growth industries.

Datacenter

According to IDC, Nvidia held 91.4% of the enterprise GPU market, much higher than AMD’s 8.5% in 2021. This puts Nvidia in the prime position to benefit from the massive increase in data center capacity worldwide as cloud computing is taking over from on-premises data storage with remote working as final diver following the covid-19 pandemic. That Nvidia is doing well in the data center market is shown by its massive increase in data center revenue over the last couple of years and the fact that 90% of all supercomputers worldwide are powered by Nvidia GPUs.

Cloud and data centers will continue to be a revenue driver for Nvidia with the cloud computing market expected to increase at a 15.7% CAGR until 2030. This increase will require higher-performance GPUs developed by Nvidia to power an increasing number of data centers. Nvidia recently showed that it is not finished developing as its recently released H100 chip is much faster than its predecessor and is in high demand by companies such as Microsoft, Amazon, IBM (IBM), Oracle, and Google.

Nvidia looks set to continue growing its data center segment at a rapid pace driven by innovation, increasing demand for high-performance chips, and an ever-increasing AI market.

Nvidia H100 performance comparison (Nvidia)

Balance sheet & valuation

Nvidia reported total cash of $13.14 billion, which was down significantly from $19.30 billion a year ago and $17.04 billion a quarter ago. This is mainly due to continued buybacks from management and lower free cash flow as a result of a significant drop in revenue and margins. Total debt stood at $11.9 billion and was up slightly compared to a year ago.

While the balance sheet has been deteriorating over the last couple of quarters, Nvidia still holds a solid net cash position. With margins expected to significantly increase over the following quarters as well, cash flows should be expected to improve in the near future.

Now, the valuation could very well be the largest hurdle for any investor to invest in Nvidia, as the company has been extremely highly valued over the last few years. It even continues to be relatively highly valued right now, despite the company reporting negative growth YoY. It seems like many of the future growth drivers which I mentioned above are already priced into the stock. According to Seeking Alpha, Nvidia is valued at a forward P/E of 46x which is 10% above its 5 years average valuation. Now, I will say again that this is despite the company reporting negative YoY growth and lower margins.

Analysts are currently projecting Nvidia to report $3.89 in EPS over the next 4 quarters. Personally, I am projecting Nvidia to report $3.97 in EPS over the same time period and slightly outperform analysts’ estimates. Considering the current negative growth, uncertain macroeconomic outlook, but also high growth prospects, I believe a 35x P/E is fair for Nvidia right now. Based on these numbers, I end up with a $140 price target for Nvidia. With the company currently at $146 per share, it is slightly overvalued. Yet, with only a 4% overvaluation, I do not think the company is a sell, as Nvidia has great growth prospects and the potential to outperform current EPS estimates.

Risks

As with many companies, for Nvidia, the economy seems to be the biggest risk. Nvidia was one of the first companies to face the financial results of an uncertain macroeconomic climate with consumer spending decreasing. This will continue to be a decisive factor over the next year or so, as the economy will find its way towards either a recession or the much-hoped-for soft landing. In the case of a recession, we should expect higher unemployment levels and, therefore, an even bigger hit to consumer spending, which will result in lower demand for Nvidia products. In addition to this, lower revenues for companies will also be followed by lower Capex spending and lower IT investments. This will then continue to be a drag on revenue growth and margins for Nvidia and will not allow the company to continue its growth trajectory. Still, right now, it’s hard to say where the economy is headed, and it continues to be important to be aware of these risks.

Following a tough economy and lower expectations, we will probably also most likely see valuation multiple compression in the case of an economic recession. With Nvidia currently valued at a forward P/E of over 40x, there is much room for downside if the company should see a longer period of weak growth, as investors will not be willing to pay a premium.

A specific risk for Nvidia would be the ban on advanced AI semiconductors from the U.S. for export to China. Nvidia has been able to offset the tailwind last quarter thanks to strategic new product releases and product alternatives, but if the situation between the U.S. and China should worsen, restrictions could very well increase. China is a huge market for the AI and data center industry, and increasing restrictions are therefore a drag on revenue growth for Nvidia.

Conclusion

Nvidia has been hit significantly in 2022, with the share price declining over 50% and financial growth turning negative YoY. The outlook for the next quarter is a more positive one, with higher margins as the most important factor.

Considering the growth drivers mentioned above, I feel like it is safe to say that Nvidia is poised to grow over the next decade. Does this then make it a buy right now? No, not necessarily. An investment in Nvidia comes with serious risks, as the company is quite exposed to economic prosperity, consumer spending, and China. These risks can become a drag on share price growth and are important to keep in mind when considering an investment.

With only a 4% overvaluation, I do not think the company is a sell, as Nvidia has great growth prospects and the potential to outperform current EPS estimates. At the same time, I would only consider buying Nvidia when the share price dips below $130 a share, as it did in 2022. For now, I rate Nvidia a hold, as economic uncertainty will continue to be a drag on shares and the near-term upside looks very limited to me.

I rate Nvidia a hold.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.