Summary:

- This article argues that the current sell pressure is only temporary and that Tesla still offers a winner-take-all potential in the long term.

- Two of the key catalysts to this potential are its recent battery development and FSD technologies.

- Both technologies help to create a win-take-all potential in the EV future that could be similar to what the QWERTY keyboard did.

- For batteries, the current lack of standardization offers a window for one player to dominate.

- For FSD, especially when combined with enhanced batteries, it’s such a highly nonlinear technology with so many higher-order benefits to come.

AdrianHancu

Thesis

Readers familiar with my writings know that I hold the following truth to be self-evident in investing: linear thinking does not apply to nonlinear stocks like Tesla, Inc. (NASDAQ:TSLA). Although anticipating nonlinear effects is hard – to say the least. The most effective way that I’ve learned is to draw analogies to other nonlinear situations. And it is crucially important that we do NOT draw analogies from similar situations. If I find myself drawing analogies from “similar” situations, it is a red flag, and I must be doing something wrong; nonlinear effects have no similar situations.

This above idea is best elucidated in a book by David Epstein entitled “Range: Why Generalists Triumph in a Specialized World.” In this bestseller, Epstein presented plenty of case studies to illustrate why RANGE (or distance) is the key. To quote an example from his book:

If you try to analyze the new competing landscape amid M&As in a dynamic market, analyzing “similar” M&As won’t be too helpful. Most likely, there are no “similar” prior examples. It is more helpful to draw analogies from a completely different domain, for example, the power struggle of countries during a dynamic time (say Europe during the 1500s and 1600s).

Against this background, the remainder of this article will compare two of TSLA’s key technologies (battery and FSD, full self-driving) – not to its competing technologies in the electric vehicle (“EV”) space that you are familiar with – but to the QWERTY keyboard. The central thesis is to argue that, despite (or should I say thanks to) the wide gap between EV technologies and the QWERTY keyboard, TSLA offers the potential for a winner-take-all situation just like the QWERTY keyboard did in the keyboard industry.

Is The QWERTY Keyboard “Good” Or “Bad”?

On the off chance that you never paid attention to the history of the QWERTY keyboard, the layout of keys was designed to prevent jamming in mechanical typewriters (in the 1870s). Thus, it is arguably the WORST layout if jamming is not an issue – like in the keyboards we are using now. There were other alternative designs. But once the QWERTY layout gained dominance, it became the ONLY one left even though jamming is not an issue anymore.

A few important analogies that I can see here that are relevant to TSLA’s battery and FSD technologies:

- I see both technologies in a similar phase as the keyboard industry in the 1870s due to the lack of standardization and fragmentation. For batteries, TSLA itself is still using a variety of cells ranging from the 2170 cells to the 4680 cells. The situation is similar in the FSD technology, where different EV manufacturers are developing their own proprietary technologies.

- Out of all the enabling technologies for the EV future, I picked the battery and FSD for a good reason. I see both technologies as the “front” to the EVs, a similar role that the keyboard played in the typewriter industry. Customers do not see (or care) how/where the cars are manufactured. But driving range, charging capacity, and autonomous driving interface are among the first things that they check (besides the price tag, that is).

- And finally, the winner that gets to take all does not have to be (and often is not) the “BEST” technologically. Again, the QWERTY case is a good example in point here. I am sure you’ve seen many articles analyzing the technical pros and cons between TSLA’s battery or FSD technologies vs. those of its competitors. I am not trying to convince you that technical superiority is unimportant. My thesis is that many non-technical factors play a large role too. And once dominance is established, it tends to reinforce itself and perpetuate – just like the QWERTY keyboard.

And next, I will elaborate on these above points in more detail.

Full Self-Driving (“FSD”)

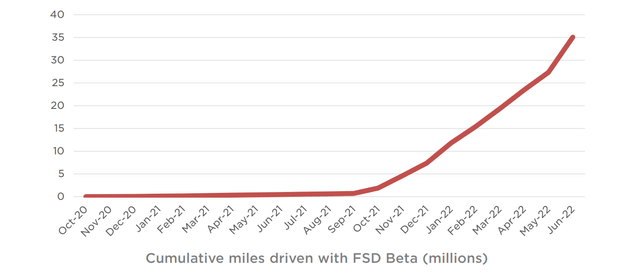

First, I see the FSD technology to hold the key for TSLA to transition from a traditional and hardware-based player to a platform-based player. The FSD technology is largely software-based, and hence circumvents all the limitations of traditional hardware and manufacturing processes. And TSLA’s autonomous driving technology is scaling up rapidly as you can see from the chart below. The chart was taken from TSLA’s 2022 Annual Meeting of Stockholders. And as Musk commented:

As of the end of Q2-2022, over 100,000 Tesla drivers in North America had access to FSD Beta. Cumulative miles driven by our customers using City Streets supervised autonomy continue to grow at an unprecedented scale. Fleet data is an important part of improving and expanding the system.

As the number of drivers (more than 100k) and the EV fleet size grows (more than 3 million sold), the nonlinear and snowballing effects of a platform will begin to grow. For example, results from research done at the Institute of Transportation (University of California) demonstrated that automated driving technologies like TSLA’s FSD can encourage people to drive more (i.e., increase the VMT, vehicle miles traveled), which would create far-reaching effects in areas like service revenues and insurances revenues.

TSLA’s 2022 Annual Meeting of Stockholders

Battery

The way I see things, the battery is THE bottleneck for EV. And TSLA seems to share this view. TSL has repeated emphasized the importance of batteries and has even named an annual “Battery Day.” It has announced a long-term plan to improve the design, manufacturing, and integration of battery cells into its business. As of 2022, TSLA has produced more than one million 4680 cells in house as Musk announced on his Twitter. One million sounds like a lot, especially with Musk’s talent to create fanfare. Each of its model Y needs about 1,000 of the cells. And hence 1 million is only enough for 1,000 of the model Y. But this is only the beginning, and many other ripple effects could follow. And I will project a few of them next.

The 4680 cell holds about 5x more energy than its earlier 2170 cell. A typical misconception about cell sizes (or cell capacity) is why cell size matter at all. First, of course, 5x larger size does not equate to 5x better. If everything else is the same, it is a zero-sum game, since each 4680 is 5x larger than 2170 and delivers 5x more energy. But not everything is the same. Using larger, and subsequently fewer, cells does leads to efficiency enhancement -both technically and economically.

As you can see from the chart below, the new cells also provide 16% improvement in driving range and 6x more power, as you can see from the presentation below. It would not be able to provide the extra driving range or the 20% more power if it is a zero-sum game.

The key is that not all the components scale linearly as a function of cell size. Some components do scale up about nearly with the size, such as volume, weight, and the total amount of materials used. However, there are a multitude of components that do not. For example, the casings would be a smaller fraction of the cell volume (or weight) compared to the active components as cell size grows (which you can show by simple geometry). Fewer cells used per vehicle also leads to a reduced number of connectors. In terms of manufacturing processes, fewer cells also simplify logistical and assembling difficulties.

Risks & Final Thoughts

There are many risks associated with TSLA, and many of them have been detailed by other Seeking Alpha authors. Here, I will just focus more specifically on the risks associated with its FSD and batteries. Despite its name, I still consider FSD to be a level two driver-assist system. And other competitors such as Waymo and Cruise have demonstrated their own systems too. For batteries, TSLA has been facing supply chain disruptions and material cost. TSLA has decided to increase the prices of its EVs last year largely due to these material cost hikes. As a hedge, TSLA has announced plans to enter the lithium mining itself. But the plan has not progressed too much, as Musk last Tweeted (the emphases were added by me):

“Price of lithium has gone to insane levels! Tesla might actually have to get into the mining and refining directly at scale, unless costs improve. There is no shortage of the element itself, as lithium is almost everywhere on Earth, but pace of extraction/refinement is slow.”

To summarize, the main thesis is that despite the many issues TSLA faces now, it still offers a winner-take-all potential in the long term. And two of the key catalysts to this potential are the advancements of its FSD and battery. Both catalysts could generate non-linear and non-technical effects in the EV space that could be comparable to the what the QWERTY keyboard did in the typewriter space. With the largest EV vehicle fleet on the road and a good FSD user base, TSLA is accumulating data at a rapid pace. Combined with better cells (and inhouse integration further helps), TSLA has the potential to transform from a traditional hardware firm into a platform player. Such transformation could lead to exponentially expanding revenue possibilities including service revenues, insurances revenues, and also battery-software integration for driving range optimization.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.