Summary:

- I previously published 23 buy ratings for Nvidia here. This no. 24 thesis will explain why Nvidia is now a sell.

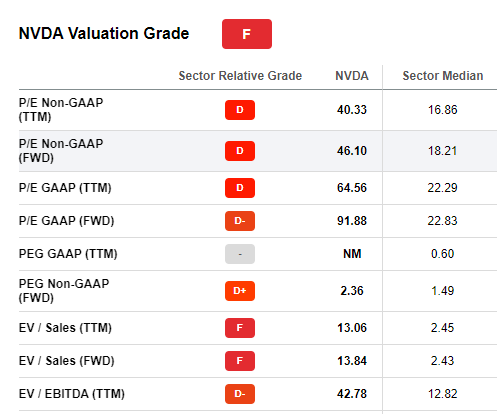

- The -49.52% YTD price performance of NVDA has not eliminated its gross overvaluation. NVDA isn’t a Buy due to its 91.88x forward P/E metric.

- My rule is that growth stock should only get 22x forward P/E. A growth stock should deliver 20% revenue CAGR.

- Nvidia’s TTM revenue CAGR is now only 17.68%. This is significantly lower than its past 3-year average of 41.80%.

- Bearish technical indicators are saying the general market emotion will help push down NVDA’s price.

Justin Sullivan

Investment Thesis

Nvidia’s YTD performance is -49.52%. This big dip has not eradicated the relative overvaluation of NVDA. I endorsed Nvidia before as a buy 23x here at Seeking Alpha up to 2018. My older self now rates NVDA as a sell. I surmised NVDA is still flying too high at 91.88x forward GAAP P/E valuation. Nvidia’s TTM revenue CAGR is now only 17.68%. This is a big drop from its 3-year average 41.8% revenue CAGR. My fearless forecast is that NVDA’s negative price momentum has more downbeat fuel.

My rule is that a high growth stock needs to produce at least 20% revenue CAGR. Nvidia is no longer a high-growth stock with its TTM 17.68% revenue CAGR. NVDA is underweight at 91.88x forward GAAP P/E. Not even the biggest company in the world, Apple (AAPL) can match the super high forward P/E of Nvidia. Apple’s forward GAAP P/E valuation is only 21.24x. Nvidia has a forward Price/Sales valuation of 13.84x. This is again an anomaly because Apple only has 5.17x forward P/S.

The point is that it is a market aberration that Nvidia is being valued far higher than the world’s biggest publicly traded company in the world. I opine this market anomaly will eventually get corrected.

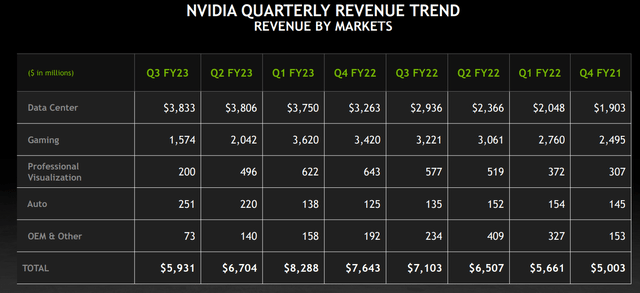

The chart below says Nvidia’s Data Center’s revenue is stagnating. Gaming Segment’s revenue dropped big time in Q2 and Q3 FY23. We could blame this on crypto miners reselling their used GPUs. Retail prices of new GPU products were already getting cheaper in February. A flood of used crypto mining GPUs makes it harder for Nvidia to sell new GPUs.

Nvidia.com

If you compare the screenshot above to the screenshot below, we are free to speculate that the substantial drop in Gaming segment revenue directly correlates with the big drop in quarterly net income.

Seeking Alpha

October 2022’s quarterly net income of $680 million is a massive decline from October 2021’s $2.464 billion.

Negative Price Momentum Could Worsen

I opine Nvidia’s valuation could fall further. GPU mining for Ethereum died last September. For the near-term I don’t expect the Gaming segment to contribute more than $3.5 billion/quarter again to Nvidia’s topline. It was GPU crypto mining that was responsible why the Gaming segment was generating so much quarterly sales. Yes, Jon Peddie Research’s Q3 report confirmed that Nvidia has 88% market share in discrete GPUs. This is nothing to celebrate about. NVDA is a sell because the Q3 2022 discrete GPU shipments of 14 million is a big drop by Q3 2022’s 24 million units.

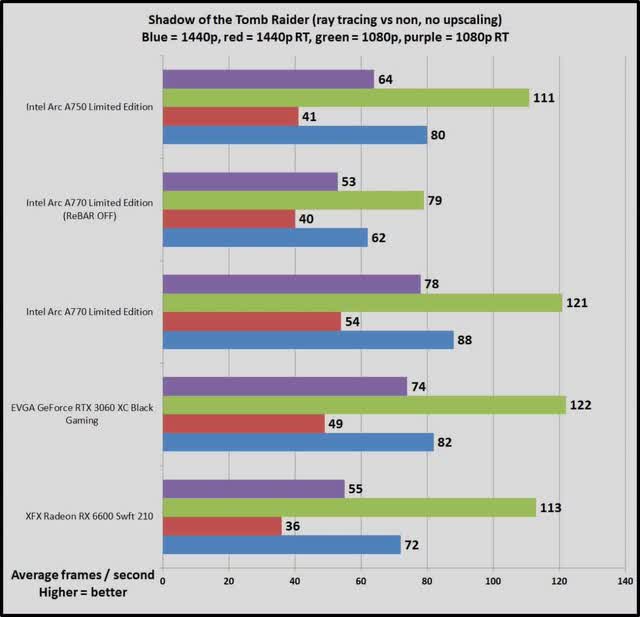

Nvidia is the top discrete GPU vendor, it should suffer the most from this big decline in quarterly shipments. It should also worry Nvidia’s management to see Intel (INTC) having 4% in Q3 discrete GPU shipments. Intel only launched its desktop PC Arc GPUs in China last June.

The worrisome future scenario is that Intel has 86% market share in desktop x86 processors. Intel could use its contra-revenue tactic to encourage its PC OEM partners to bundle discrete Intel Arc 7 desktop GPUs in their future Windows 11/ Windows 12 computers. The Arc 770 is competitive against the gaming benchmark scores of Nvidia’s GeForce 3060 XT Limited Edition.

PCworld.com and Thiago Trevisan

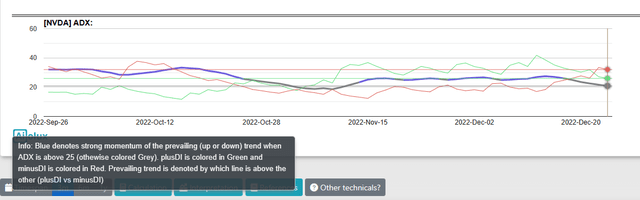

The technical/emotional indicators are congruent with my bearish outlook for Nvidia. NVDA’s RSI dipped below 50 again in the week before Christmas Day. NVDA RSI is now only 42.51, below the neutral level of 50. RSI is saying investors and traders are again bearish on NVDA. Recent trades also triggered a short-term bearish signal called Stochastic Oversold Buried. It means NVDA’s fast stochastic has been below 20 and has been so for the past five trading days.

Nvidia’s Average Directional Index or ADX trend is also bearish. The downward or minusDI colored red line is above the plusDI. The downward trend prevails.

aiolux.com

The other reason why I cannot rate NVDA as a buy or hold is its stingy dividend payments. Nvidia is very profitable. Management could use some of that $13 billion in total cash to improve that $0.16 dividend annual payment. The super-optimism of other NVDA shareholders deserves to be better rewarded. Nvidia management should learn from Apple’s forward annual dividend payment of $0.67. My takeaway is that it is not smart to do more of that$15 billion share buyback when NVDA is trading at 91.88x GAAP forward P/E. Increasing the dividend payments would be a better idea in my opinion.

Seeking Alpha Premium

It is another letdown that Nvidia surrendered and failed to buy ARM Holdings. That failed attempt cost Nvidia $1.25 billion in unrecoverable pre-payment to SoftBank Group (OTCPK:SFTBY). That $1.25 billion could have been spent instead on increasing dividend payments this year. It could also have been used to pare down Nvidia’s total debt of $11.9 billion.

Why Nvidia Has More Downside Risks

The fabless hardware-centric business of Nvidia should not receive a 91.88x forward P/E valuation. The net income margin of this company is now only 20.85%. This is big drop from its 5-year average net margin of 30.08%. Nvidia’s usual manufacturing partner Taiwan Semiconductor Manufacturing Company or TSMC (TSM) has a much higher net income margin of 42.51%. TSM’s GAAP forward P/E is only 11.78x. Nvidia’s future prosperity is tied to the manufacturing process of TSMC. The political tension between China and Taiwan is also a dark cloud over Nvidia.

The rumor last April was that Nvidia made TSMC its sole GPU manufacturing partner. NVDA has become overly reliant on TSMC. The China threat has forced TSMC to commit $28 billion more to build factories in Arizona. Unfortunately, the first $12 billion TSMC factory being built in Arizona will only start 5-nanometer production in 2024. Nvidia loyalists could only pray that Samsung (OTCPK:SSNLF) Foundry could fix its factory yield issues.

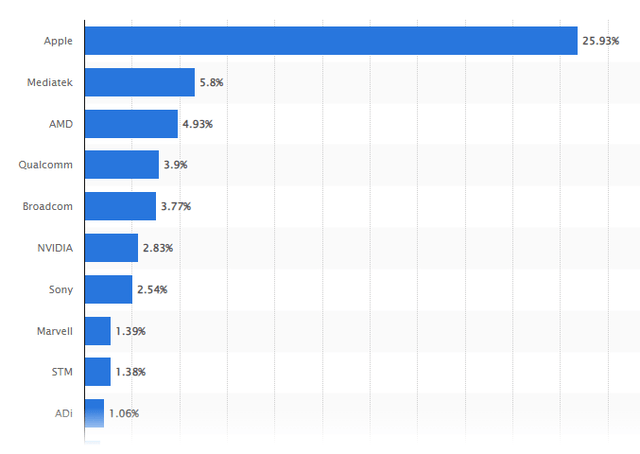

Nvidia is a fabless semiconductor firm that cannot rely one just one foundry partner. TSMC has an extensive list of foundry customers. I opine Nvidia is not going to get a preferential treatment. TSMC’s biggest customer is Apple.

Leading customers of Taiwan Semiconductor Manufacturing Company (TSMC) in 2021, based on revenue share

Statista.com Premium

The reduced profitability of Nvidia could probably worsen. The $3.8 billion/quarter Data Center segment is doing well against Advanced Micro Devices’ (AMD) Instinct MI200 Series of GPU Accelerators. Going forward, the Xilinx Alveo data center accelerators and the recently-acquired Pensando infrastructure DPU (Data Processing Unit) could now be bundled with AMD EPYC processors and Instinct data center GPUs. Bundling is an effective way for AMD to disrupt Nvidia’s $3.8 billion/quarter data center business.

Intel’s Flex Series data center GPUs is another major headwind for Nvidia. Intel currently has a negative revenue CAGR. It needs the 25% CAGR of the $17.89 billion data center accelerator market. Intel can also bundle its new AI-centric scalable 4th-Gen Xeon processors with its Max Series and Flex GPUs, FPGA accelerator cards, Movidius VPUs, and Habana Gaudi 2. Intel’s multiple hardware products for AI/ML/DL are nicely complemented by the free no-code OpenVino framework. Intel’s oneAPI toolkits are its equalizer to Nvidia’s CUDAtoolkits for AI, machine learning, and deep learning.

The extremely high valuation ratios of NVDA are not going to last forever. Intel’s Habana Gaudi 2 can outperform Nvidia’s A100 on MLFPERF ResNet-50 and MLPERF BERT training time benchmark metrics. The old Intel Ponte Vecchio (now known as Intel Max GPU series) could also outperform the A100. It will take some time, but companies and individual developers will eventually learn oneAPI and OpenVino. When this time comes, they would be using Intel MAX and Flex GPUs instead of Nvidia A100 or v100.

Probable Upside?

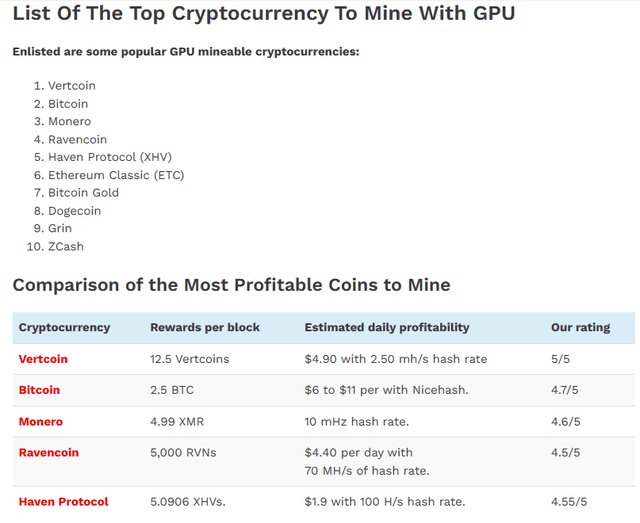

Nvidia could pray hard that another GPU mining-friendly crypto currency becomes a hit. The die-hard loyalists of NVDA could argue that Ethereum is not the end of GPU crypto mining. There are still at least 10 worthy crypto currencies that could be mined using Nvidia’s list of discreet GPUs.

Softwaretestinghelp.com

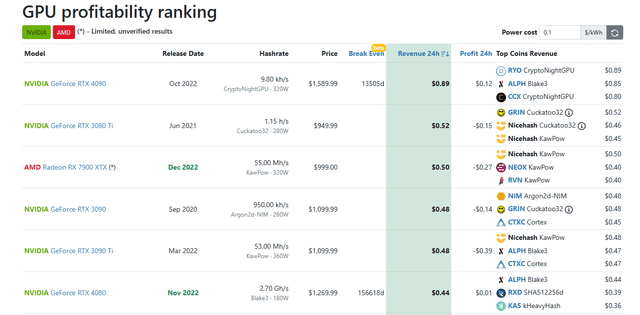

Nvidia could spend some of that $13 billion cash to market and accelerate the growth of Vertcoin or Monero. Monero’s market cap is only $2.68 billion. Nvidia reportedly paid $7 billion to TSMC to secure 5-nanometer production for RTX 4080/4090 GPUs. Crypto mining is a solid tailwind for NVDA. Some of the most profitable GPUS for crypto mining are still made by Nvidia. It is an upside tailwind that Intel Arc 7 GPUs are still not being used for mining.

whattomine.com

The other upside catalysts could come from Nvidia’s recent acquisitions. The cloud storage focus of Excelero could help Nvidia rely less on GPU sales. The $59.2 billion global cloud storage industry is growing at 24.3% CAGR. I understand why Nvidia purchased interactive avatar tech company, Animatico. It is Nvidia’s diversification move to join the $18.375 billion digital signage solutions industry. Bright Computing’s cluster computing management platform complements the deep learning and machine learning GPUs of Nvidia.

The acquisition of DeepMap could help Nvidia’s strategy on autonomous vehicles. I speculate that Nvidia could trade above $200 again if it comes up with an all-in-one product for the fast-growing (67.8% CAGR) $1.03 billion robo taxi industry. Intel and Nvidia are one of the collaborators why Baidu (BIDU) now operates its Apollo Go robo taxis in China.

My Verdict

My usual valuation for profitable and still-growing hardware firms like Nvidia is only 22x forward P/E. The January 2024 EPS estimate for Nvidia is $4.37. My fair value price target for NVDA is therefore only $96.14. It is well below the recent closing price of NVDA, $152.06.

The decline in gaming GPU sales is hurting the net income and growth CAGR. NVDA is underweight at 98x forward GAAP P/E and 13.84x forward P/S. Take your losses and run. Please remember that my August 19, 2021 sell rating was when Nvidia was still trading above $219. I rarely do sell analyses since 2013. I only do bearish essays when I want to wake up other people from the mirage of overvalued companies like Nvidia.

If you are a long timer, take your profits. NVDA is +144.58% since my no. 23, May 2018 buy recommendation. NVDA is +3,142.22% since my first buy recommendation for NVDA in April 10, 2014. NVDA has peaked and is on its way down. Intel and AMD are long-term headwinds for Nvidia’s Data Center segment. Intel and its contra-revenue tactic are going to chip away against that 88% market share of Nvidia in discrete GPUs.

I’m just a computer technician/graphic designer. You can ignore my sell thesis. You can follow the consensus buy rating of Wall Street analysts for NVDA. Wall Street’s average price target for NVDA is $203.17.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.