Summary:

- When it comes to Nvidia Corporation, I believe that the crash and the last few weeks have significantly improved the risk-reward ratio.

- There are a number of (good) reasons why Nvidia will outperform the market over the next two to three years.

- Nvidia is certainly no longer a meme stock.

- However, Nvidia Corporation shares are still not a bargain. I remain in the skeptics’ camp for the time being in view of the still high valuation and the advance laudations that have already been priced into Nvidia shares.

Justin Sullivan

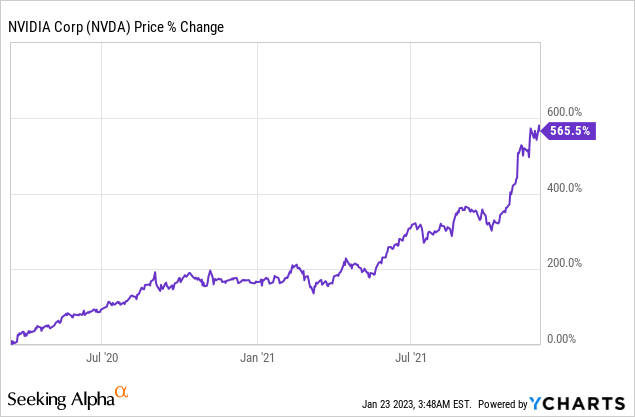

Sometimes you have to know when things are too good to be true. This was the case with the Nvidia Corporation (NASDAQ:NVDA) share price performance from March 2020 until the end of 2021.

Well, no one can predict stock prices, but it is clear that a parabolic price increase eventually leads to a deep fall, or in the words of Irving Kahn who was looking back at the time before the great crash of September 1929:

“I wasn’t smart, but even a dumb young kid could see these guys were gambling. They were all borrowing money and having a good time and being right for a few months and, after that, you know what happened.”

And so it was with the Nvidia shares, which at times became completely inflated into a hype investment and then crashed sharply. The shares lost more than 60 percent of their value by October 2022. With my article from November 2021 and my forecast that the shares were poised to fall by 50 percent, I was still far too optimistic. The timing of my article was also more luck than skill, so I wouldn’t hang this article too high. Nevertheless, it shows that there are some things that are well worth investors’ attention when they invest in assets such as equities.

And when it comes to Nvidia, I believe that the crash and the last few weeks have significantly improved the risk-reward ratio. Even if we have probably passed the bottom, there are some reasons that speak against an outperformance of Nvidia. But let’s look at the optimistic view first.

Reasons why Nvidia will outperform the market

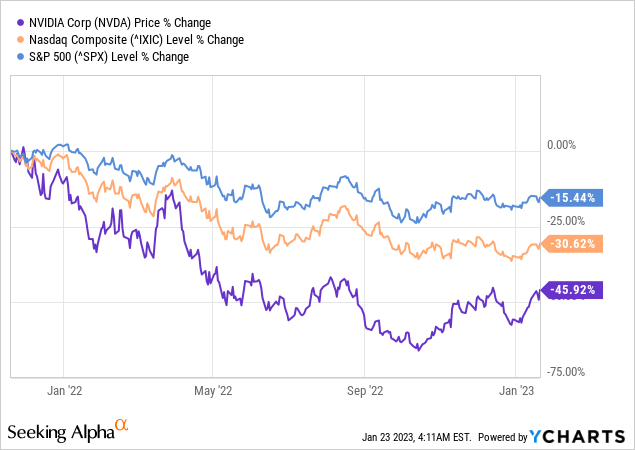

Admittedly, there are a number of (good) reasons why Nvidia will outperform the market over the next two to three years. As is usual for tech stocks, Nvidia has lost much more value than broad indices. While the S&P 500 (SP500) is 15 percent below its December high, Nvidia is still 45 percent below its 2021 high.

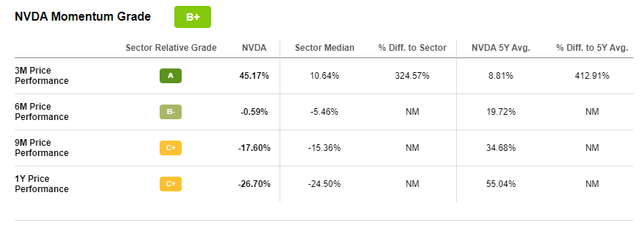

Now, just like downward exaggerations, upward exaggerations are offset by equally strong counter-movements. And we can already see that the price movement of Nvidia follows stronger rises than in the overall market. Nvidia’s momentum over the last three months has been more than 4 times stronger than the sector as a whole.

NVDA Momentum Grade (Seeking Alpha)

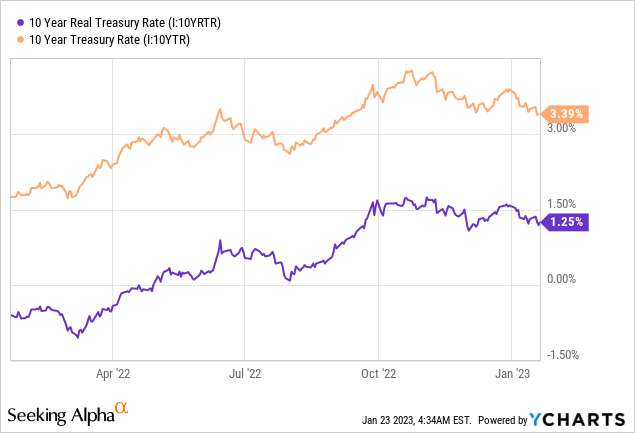

In addition, the macroeconomic environment speaks for tech stocks and thus also for Nvidia. It is in the nature of tech stocks that they tend to react in a phobic fashion to rising interest rates. Now, however, it could be that we are already behind the wave with regard to the interest rate turnaround. The market already seems to be anticipating this development. This is indicated by the rising prices of tech stocks and the falling interest rates on U.S. treasuries.

In this respect, this would be a good setup for investors who want to set foot in tech stocks or add to their existing holding.

Fundamentally, too, there is nothing to be said against such an outperformance. Nvidia is a company with a visionary CEO and a well-performing business that is ideally positioned to continue to profit in the high-growth future markets around IoT, autonomous driving, and cloud computing/gaming and data centers. For example, revenue from the data center business increased 31 percent in the third quarter to more than $3.8 billion. Multi-year partnerships with Microsoft (MSFT), Oracle (ORCL), and Nuance Communications will further strengthen Nvidia’s position in the coming years. The automotive business also grew 86 percent compared to 3Q 2022 and 14 percent compared to 2Q 2023, showing high growth momentum. Nvidia has also partnered with contract manufacturer Foxconn to build electric cars based on Nvidia’s Drive Hyperion platform for autonomous driving. The Omniverse is also an extremely promising business area where customers can digitally recreate twins of physical objects such as individual parts or entire factories:

Lowe’s is using it to help design, build and operate digital twins for their stores. Charter Communications and advanced analytics company, HEAVY.AI are creating Omniverse power digital twins to optimize Charter’s wireless network.

And Deutsche Bahn, operator of the German National Railway is using Omniverse to create digital twins of its rail network and train AI models to monitor the network, increasing safety and reliability.

(Source: Q3 2023 Earnings Call Transcript.)

Even in the gaming business, where revenues fell by more than half in 3Q, the business could pick up in the coming quarters. In 3Q, Nvidia was still strongly affected by the lockdowns in China, while in North America sales in the gaming segment were solid. However, the reopening of China and the launch of new products could give the business a boost:

Our new Ada Lovelace GPU architecture had an exceptional launch. The first Ada GPU, the GeForce RTX 4090 became available in mid-October and a tremendous amount and positive feedback from the gaming community. We sold out quickly in many locations and are working hard to keep up with demand.

[…]

There is tremendous energy in the gaming community that we believe will continue to fuel strong fundamentals over the long term. The number of simultaneous users on Steam just hit a record of 30 million, surpassing the prior peak of 28 million in January.

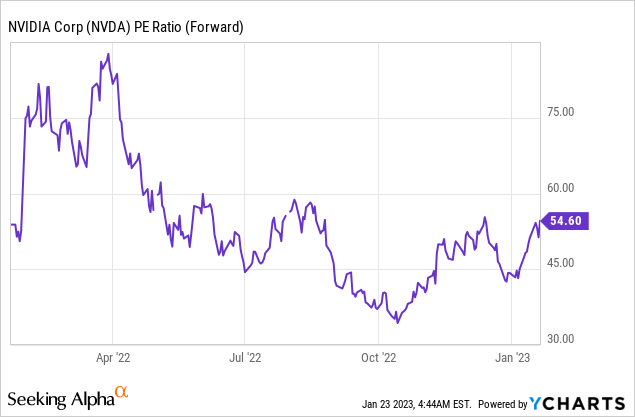

The multiples have also fallen significantly. The forward P/E ratio, for example, fell from over 80 to under 40 and is now around 55. Investors could therefore now invest more in tech stocks overall, and in this respect Nvidia offers an excellent business model.

Reasons why this is not the bottom but a trap

It often happens that we, at least unconsciously, project past share prices onto future performance. But that is a big mistake. Highs may not be reached again for 5 or even 10 years, as was the case with Microsoft (MSFT) after the dotcom bubble burst.

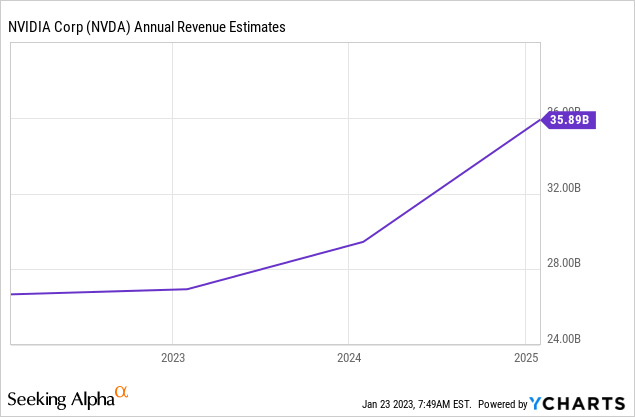

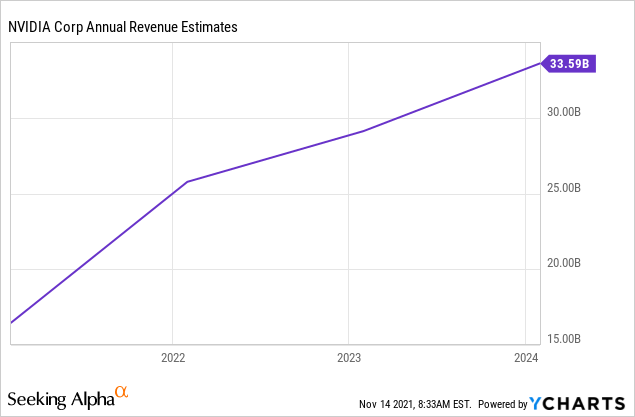

With Nvidia, too, there is the risk that the market sentiment has now changed permanently and investors are no longer looking at rosy prospects for the future but at the tough business figures. And it is questionable whether Nvidia is currently delivering enough to justify higher prices. For example, sales for FY 2023 will be at a similar level as in 2022. Only in the following years should sales pick up again.

We can see here that expectations for the coming years have already been reduced. In November 2022, for example, analysts were still expecting a turnover of 33.6 billion USD for 2024.

NVIDIA Corp Annual Revenue Estimate (Seeking Alpha YCharts)

Data by YCharts.

In addition, it is by no means guaranteed that the forecast sales growth will filter through to profits. The analysts’ expectations for the adjusted profit as published by FactSet diverge widely for the following years:

- FY 2024: 34 analysts expect a range of USD 3.35 to USD 5.20.

- FY 2025: 22 analysts expect a range of USD 3.92 to USD 7 USD.

- FY 2026: 3 analysts expect a range of USD 4.18 to USD 7.89 USD.

For 2022, by the way, Nvidia’s adjusted earnings per share were USD 4.44. So the most conservative analyst for 2026 assumes that adjusted earnings in 2026 will be below 2022. Although I think this is unlikely given the enormous growth potential, investors should be warned that not all market participants expect profits to keep rising.

In my last Nvidia analysis, I stated that there is no such thing as eternal dominance, especially not in the innovation- and competition-driven tech sector. This statement was, is, and will be true, and investors have to take that into account when looking into Nvidia’s supposedly golden future. Competitors like Advanced Micro Devices (AMD), Intel (INTC), and Qualcomm (QCOM) will be on Nvidia’s heels and trying to steal market share. Qualcomm, in particular, has created good conditions with the Nuvia takeover to go back into the server market. The Arm deal would certainly have been an opportunity for Nvidia, which might have given Nvidia a moat for decades, but the transaction was not without reason so critically eyed by competition authorities that Nvidia and SoftBank voluntarily withdrew the transaction.

In this respect, the next few years will not be any easier than the last, in which Nvidia profited massively from the fact that its GPUs are better suited for data centers than CPUs and were also in massive demand for gaming and mining Bitcoin. This (what many Nvidia bulls forget) was more about luck and being in the right place at the right time rather than strategy, and investors should not expect a company to be kissed by such luck all the time.

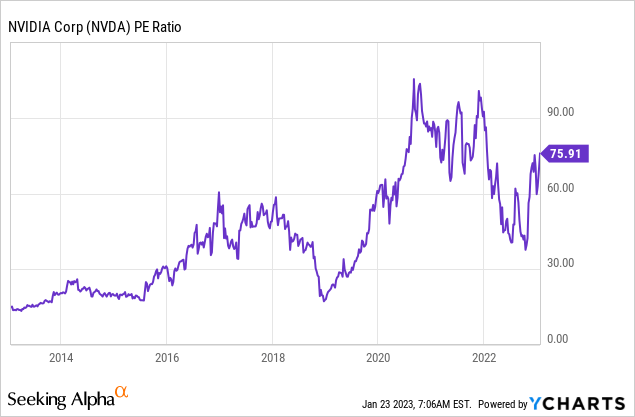

This brings us to what I consider the second most important point when it comes to investing: expectation management (the most important point being risk management). There are good reasons for Nvidia to have found a bottom after the crash. But since then, the stock has already gained more than 60 percent. In the long term, Nvidia is still massively overvalued, and a P/E ratio of over 70 is certainly no bargain. Of course, future profit increases will push the P/E ratio down again, but we have seen above that there is a wide range. And even with a doubling of earnings in the next 3 years (which hardly any analyst expects), the P/E ratio would still be more than 35, in my view still too much even for a growth company. Even in 2016 and 2017, the market never valued Nvidia higher than a P/E ratio of just under 60

Against the backdrop of this valuation, investors should scale back their expectations of future share price performance. Even at an adjusted P/E of 25, this results in a negative performance of 15 percent in relation to the average earnings per share expected by analysts for 2026. So, at the projected earnings growth, Nvidia will not reach an adjusted earnings multiple of 25 until 2026. I would only use such a multiple for the fair value of a company like Nvidia. In this respect, investors would have to wait 3 years for Nvidia to reach fair value.

Conclusion

It’s all about managing risk and expectations. When it comes to Nvidia Corporation, then in my view there are many reasons why we should not see the low from October 2022 again for a while. At the current price, Nvidia Corporation is certainly no longer a meme stock. However, the NVDA share price is still not a bargain. After the recent price increases, I remain in the skeptics’ camp for the time being about Nvidia Corporation in view of the still high valuation and the advance laudations that have already been priced in. For me, Nvidia Corporation shares are, therefore, currently only a Hold.

Disclosure: I/we have a beneficial long position in the shares of QCOM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.