Summary:

- Despite favorable fundamentals for value investors, Opendoor’s business model is reliant on razor-thin operating margins, leaving the company susceptible to unfavorable macroeconomic conditions.

- COGS that are directly proportional to revenues make scaling such a business very difficult.

- Several valuation metrics hint at a risk of bankruptcy barring a reduction in federal interest rates.

- Despite the inherent flaws in the business model, Opendoor’s resources and dominant market share provide an opportunity to potentially pivot, e.g., offering rentals to provide a steady cash flow.

The Good Brigade

Summary

A traditional home transaction typically involves a long, drawn-out process that includes finding an agent, marketing the property, staging open houses, receiving and negotiating offers, and repeating a similar process to purchase a new home. In a time when technology is king and efficiency is invaluable, several companies have developed platforms focused on streamlining this process by leveraging data science and technology to help users offload or purchase homes as quickly and efficiently as possible.

This process is referred to as instant buying (iBuying) and has paved the way for several companies to establish their own platforms. Among these organizations is Opendoor (NASDAQ:OPEN), who owned 51% of the iBuying market in 2021. Opendoor’s value proposition primarily focuses on efficiency and risk reduction for home sellers and buyers alike. Furthermore, Opendoor’s position as both buyer and seller allows them to take a 5% service fee from the purchase price, allowing a slight range for profitability in a given sale.

Industry

The iBuying industry has rapidly grown its market share within the real estate world, with more homes being sold via iBuying brokerages in 2021 than in the years 2020 and 2019 combined (70,402 vs. 50,081).

Aside from Opendoor, several companies have made attempts to enter the industry. Among them was Zillow (ZG), the leading real estate marketplace organization, who launched Zillow Offers back in 2018, before shutting down the program late in 2021. Other names to have entered the market include Redfin (RDFN) and Offerpad (OPAD). However, Opendoor is the premier player in the industry as it currently stands, controlling over half of the market and operating in 31 major metropolitan areas.

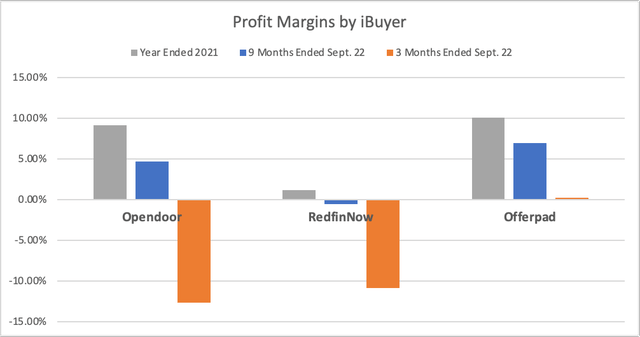

However, despite its status as the largest iBuying platform, Opendoor has yet to achieve profitability. Displayed below are the 2021 net profits for each of the primary iBuyers.

Of the 3 iBuying platforms that remain in operation, Opendoor recorded the largest losses, despite owning the largest market share. Profit margins tell a similar story, as all three of the remaining iBuyers struggle to achieve profitability even before accounting for any expenses besides COGS.

Latest 10-K and 10-Q filings for Opendoor, Redfin, and Offerpad

The most notable takeaway from the above chart is that, for all three organizations, profit margins have been steadily thinning over the past year. As a result, Redfin now has, perhaps smartly, begun scaling back their operations, opting to instead focus on their other real estate services. While these declines may be largely attributed to elevated inflation levels and spikes in interest rates (discussed further in next section), the fact that these macroeconomic changes can wreak such havoc on the profitability of this business model illustrates the inflexibility of these businesses to respond to changing circumstances and reveals concerning underlying problems that perhaps go deeper than interest rates. Additionally, while Redfin has other aspects of their business which provide a more diverse revenue stream, Opendoor and Offerpad do not have other sources of revenue that can help sustain the business in times of trouble.

Even in positive housing markets such as 2021, the iBuying industry has struggled with profit margin. The very nature of the home flipping business implies low operating margins. Traditionally, home flippers aim for profit margins between 10-20%, with 10% being well on the lower end of that scale. The chart above reveals that the only iBuying platform that has even skimmed the 10% threshold since the start of last year has been Offerpad, who hit that number on the dot in 2021. To make matters worse, those numbers don’t account for the natural overhead involved with running a business which will inevitably reduce already very slim profit margins.

With Redfin scaling back their iBuying platform, there may be an opportunity for Opendoor and Offerpad to expand their market shares. However, both organizations will need to find a solution to the apparent scalability problems with the iBuying business model for this to be successful. Beyond that, the loss of Zillow Offers proves that, even with a large competitor exiting the space, their market share won’t necessarily spill over to other companies. In Q1 2022, just after Zillow shut down its iBuying platform, the total market share of iBuying within the real estate industry fell to 1.3% of all homes sold, representing a 23% YOY drop.

Market Conditions

The most notable market news over the past several months has been the combination of the elevated inflation levels coupled with the combative interest rate spikes from the Federal Reserve. In June 2022, inflation reached as high as 9.1%, the largest number in nearly 40 years. As a result, Fed interest rates have been incrementally increased from less than 0.50% back in March to nearly 4% today. These two factors intertwined have forced the average rate on a 30-year fixed-rate mortgage to jump over 6% for the first time since 2008.

These macroeconomic changes have forced potential buyers out of the market, putting a downward pressure on housing prices. Given the variability in the real estate market from location to location, it can be difficult to calculate just how much of a decline home prices are experiencing nationally. However, estimates indicate that median home prices may drop anywhere from 5-10%.

Furthermore, not only have the prices of homes been affected, but houses are generally remaining on the open market for longer periods of time, as the number of buyers in the market drops. Real estate sales generally fluctuate throughout any given year, with the fastest sell times occurring during the summer months. Over the past 5 years barring 2020 (COVID presented an outlier), the median number of days a house remains on the open market has posted rises between 15-19% from May to October of those respective years. From May 2022 to October 2022, the median number of days a home has remained on the market has sharply risen from 31 to 51, or an increase of 65%, representing a drastic change compared to previous years.

Financial Analysis

In the three months ended September 30, 2022, Opendoor recorded $3.361B in total revenue, up from $2.266B year over year (+48.3%). Furthermore, the company recorded $12.71B in revenue in the first nine months of 2022, up from $4.199B in the same period the year prior (+202.7%). Naturally, much of the slowed revenue growth in the last 3 months as opposed to the last 9 can be attributed to recent economic downturns and slowdowns in real estate activity due to rises in federal interest rates. Another result of the changing macroeconomic environment is a rise in the recorded Cost of Revenues for Opendoor at a rate that outpaced revenue growth, jumping from $2.064B in the third quarter of 2021 to $3.786B in the third quarter of 2022 (+83.4%), and from $3.741B to $12.114B in the first three quarters of 2021 and 2022 respectively (+223.8%). Opendoor also increased their sales, marketing and operations expenses to $260M (+69.9% YOY) and $812M (+154.5% YOY) for the third quarter of 2022 and first three quarters of 2022, respectively. Each of these metric changes demonstrate Opendoor’s aggressive attempts at growth, at least earlier in the year. However, with the now-unfavorable macroeconomic conditions, Opendoor has resolved to slow down their rate of home purchases, opting to instead focus on improving the spreads of their home purchases to optimize margins.

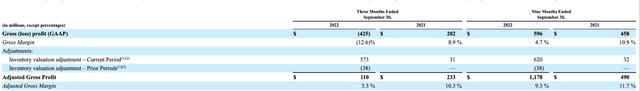

When it comes to real estate investing, the importance of cash and a steady cash flow cannot be understated. From a quick glance at Opendoor’s Cash Flow Statement, a few areas of note represent drastic changes over the first 9 months of 2022 compared with the first 9 months of 2021. For starters, Opendoor’s revenue recognition policy includes inventory valuation adjustments in the costs of revenue, which are then added back in on the Cash Flow Statement to coalesce the differences. These inventory valuation adjustments apply to homes that remain in inventory at a given period’s end, and are calculated by adjusting the value of properties owned to the lower of their carrying value or net realizable value. That number jumped from $32 million over the first 9 months of 2021 to a whopping $663 million during the same timeframe of 2022. What’s more is that of that 2022 total, $573 million of that has been recorded over the third quarter alone.

Factoring in these changes actually presents a fairly more optimistic angle on Opendoor’s margins for the 2022 year, even rendering adjusted gross margins as a positive number over the last 3 months. What’s more is that, should the housing market turn for the better, having these value adjustments already accounted for will further improve the appearance of Opendoor’s margins, and could help the company’s stock price take off. However, prospective shareholders must move forward with severe caution: should the housing market continue to fall, these write-offs may continue, further worsening the financial outlook of the company.

The company has done well building up cash reserves in order to prepare themselves for hard times ahead, having added over $500 million to their total cash supply. The company achieved this feat by completely changing the way they’ve done business over the past few months. In the 9 months ended September 2021, Opendoor used over $5.9 billion in operating activities. They used just $665 million during the same span in 2022. As a result, Opendoor appears to have become less reliant on taking on debt, having reduced their cash input from financing activities from $6.67 billion over the first three quarters of 2021 to $956 million in the same time frame this year. Much of these changes can be attributed to massive slowdowns in home purchase rates ($5.8B Q1-3 2021 to $663M Q1-3 2022).

So what does this all mean for Opendoor? Is it smart to retreat during a time when housing prices are dropping? For starters, that change in business policy may not entirely be of their own accord. As mentioned earlier, average home listing times have shot up over the last several months. Opendoor’s business model is heavily reliant on their ability to churn out home sales, and to use overall volume to make up for poor margins and fuel further acquisitions/expansion. With the current enhanced difficulties in selling homes, holding costs have shot up (+423% YOY) and volumes are down (Q3 represented only 26.9% of total 2022 homes sold via Opendoor), making their volume-based business model prove more difficult. While an extended economic downturn could prove catastrophic for the survival of Opendoor, their vast cash balances should help to keep them afloat in the short-term.

Valuation/Financial Metrics

Based purely on today’s economic environment, it should come as no surprise that Opendoor’s share price has tumbled over the last several months, even prior to the combative rate hikes. In fact, the company has been in a consistent downtrend since the start of the year, resulting in a 88.59% loss in market cap.

A quick overview of the fundamental metrics of the company tell two separate stories: on one hand, these steep price drops have presented an undervaluation of the company based purely on book assets and sales. Their price/book, price/cash, and price/sales values are all less than 1, indicating potentially good value on the stock. In particular, their P/S of 0.07 is lower than 98% of real estate businesses as a whole. As it stands, despite their current share price of $1.72, they possess a net current asset value of $2.04/share and a tangible book value of $2.24/share, so there is some opportunity for the stock to bounce back. Notably, Offerpad offers very similar metrics and an even lower P/S (0.04). However, Opendoor’s vast amounts of assets allow them better Quick and Current ratios, indicating a better ability to evade trouble.

On the other hand, several other indicators of financial health demonstrate severe warnings. Their debt-to-equity ratio is currently 5.43, worse than 96% of other real estate businesses, which generally have poor debt-to-equity ratios to begin with. Their debt-to-EBITA ratio of -11.31 paints an even less favorable picture, ranking worse than 100.0% of real estate companies. Their cash-to-debt ratio of 0.19 demonstrates that, despite a large war chest of cash, their ability to pay off debts in the long run may be handicapped, especially considering their recent slowing home purchase rates.

Taking all of these factors into consideration, Opendoor may be forced to completely adapt the way they do business, or face bankruptcy. They currently possess an Altman Z-score of 1.86. A Z-score of 1.8 or less is generally regarded as standard for an organization that is in serious danger of bankruptcy, indicating that Opendoor is pushing towards the lower limit of a financially stable company. By comparison, Offerpad maintains an Altman Z-score of 3.07, indicating more financial stability than their largest competitor, despite Opendoor dominating market share.

Even more problematic is that Opendoor has yet to achieve profitability even when the state of the economy worked in their favor. A reversal in macroeconomic trends could stand to signal a strong bullish correction closer towards Opendoor’s book value based on the undervaluations of their inventory at the moment. However, should the housing market struggle to revert back into positive territory for an extended period of time, Opendoor’s stock could continue to push lower and lower. Over the past week, both CEO Eric Wu and CIO Daniel Morillo have sold shares in the company. Until the company can figure out the direction it wants to take, it may be best to follow suit.

Strengths/Competitive Advantages

Opendoor’s competitive advantages can be analyzed through two different lenses: what the iBuying industry can offer as opposed to more traditional real estate firms and what Opendoor can offer as compared to other iBuying platforms. iBuying can offer home sellers and buyers a simple, convenient option to alleviate the stresses of buying or selling properties. In return, iBuyers are able to purchase properties at a slight discount of approximately 1.3%. iBuyers are also able to own the entire transaction process, from controlling the purchase price, mortgage loans, service fees on both the buying and selling ends, selling price, and a variety of other costs generally incurred during a homesale. This level of control is unattainable for most real estate firms. iBuying currently owns 1.3% of the real estate industry. As such, this market share has plenty of room for growth.

As iBuying national market share grows, Opendoor could benefit the most if it’s able to survive. Opendoor owned a 51% iBuying market share in 2021. Since then, Zillow Offers went defunct and Redfin began to scale back their iBuying platform, paving the way for Opendoor to expand their domination over the niche industry. Should Opendoor continue with their aggressive expansion, the opportunity to establish themselves as the premier player in the industry is apparent. Their large infrastructure and access to home sales data can help provide a moat to ward off future competitors. In the nine months ended September 30, 2022, Opendoor spent $121 million on technology and development, while Offerpad spent $9.1 million, according to each company’s latest 10-Q filing. Additionally, despite Zillow’s failure with their own iBuying platform, they partnered with Opendoor to allow their users to request Opendoor offers on their homes directly through Zillow’s platform. This may provide an even greater opportunity for Opendoor to distance themselves from their competitors.

Risks

To summarize, poor margins that don’t expand with revenue growth, limited liquidity, and a weak ability to respond to macroeconomic factors both limit the flexibility of the business model to profit in times of hardship and anchor future growth perspectives. Economic issues beyond their control have already caused many of the homes in their inventory to depreciate in value and limit their resale potential. Redfin and Zillow have already come to fall back on the other aspects of the business as a result of the difficulties with automated home flipping. There is a reason Opendoor has never achieved profitability.

What’s more is the inherent disadvantages Opendoor finds itself in in terms of customer acquisition. Zillow, for example, has built-in lead-generating functionality in the form of its home discovery platform. As users browse the platform, they are offered the ability to browse locations across the globe for any price range, and based on search results, Zillow is able to utilize information to paint a picture of a given user in the market, making it an effective lead-generation tool. Such a feature makes the partnership between the two companies a strong match, but Opendoor’s lack of such an effective feature makes it susceptible to its reliance on a competitor.

Another risk involved with this model is the possibility of Opendoor’s home evaluation algorithms being incorrect. One of the largest problems with Zillow Offers was an inconsistent assessment algorithm that would frequently over inflate the value of homes on the market. As a result, Zillow was frequently purchasing homes above market value, creating problems in turning a profit. When it comes to an automated home purchasing process, every aspect of the transaction must be under control.

Possible Solutions

As mentioned earlier, one of the largest issues facing Opendoor at present is their inability to respond to a regressing housing market, forcing them to sit on their properties for longer periods of time and incur elevated holding and carrying costs, while also preventing them from further expansion. There is a clear solution that would provide them with a steady cash flow, limit their risk, and vastly improve their operating margins: rentals.

With each passing day that an Opendoor home goes unsold, the organization incurs greater costs such as taxes and insurance, without a guaranteed income supply to justify said costs. Renting out houses that go unsold would provide a strong solution to the problem at hand, while also fueling further expansion.

The biggest problem Opendoor faces when purchasing houses at present is the lack of a guarantee they will be able to sell the asset in a timely manner at a suitable profit, given that most homes are currently depreciating in value, as is evident by Opendoor’s massive increase in inventory valuation adjustments. Purchasing a home to instead rent out, however, can help Opendoor limit their downside in a given acquisition as well as their costs of revenues, while simultaneously acquiring the property at a relative discount given the state of the housing market.

While adapting the business model could prove costly, Opendoor possesses both the cash balance, current home inventory, and technological infrastructure to make such a possibility realistic. As described earlier, Opendoor’s ability to leverage their technology in making accurate valuations of homes has been one of their biggest strengths to date, fueled by their vast access to home data. Converting their preexisting technology stack to also analyze the upside of renting as a comparison would allow the company far greater flexibility, regardless of economic conditions. This would simultaneously maximize profit potential by providing them the ability to make an informed decision on whether flipping or renting a property would yield greater returns. Doing so may require spending on more infrastructure, particularly in the form of a network of property managers, but the upside would make such an endeavor well worth it.

And here is the best part: while a 20% return on investment may be considered a home run for home flippers, rental property managers can average profit margins of a whopping 30.8%. Opendoor’s latest 10-Q filing reports $4.209B of homes listed for sale. If, for example, half of those properties were deemed to yield more profits by being rented out for 1% of the value of each property per month, Opendoor would be able to generate over $250 million in steady cash flow at a higher profit margin, on top of the revenue generated from selling homes. This is a route that Opendoor should seriously consider, and could salvage the financial state of the company.

Recommendation

Opendoor’s current stock price represents an undervaluation of the company based on its book value, presenting a possible buy opportunity for value investors looking for a price correction. Furthermore, the company has been smart in terms of building its cash supply, which may help alleviate some of the distress. These features make OPEN an appealing target once the condition of the housing market improves. However, the lack of sales diversity coupled with struggles to scale the business properly pose severe risks to the financial health of the company, which may not be able to survive an extended period of economic turmoil. A change in Opendoor’s business model may cause me to revisit our recommendation, but as it stands, we would strongly suggest selling shares of the stock until evidence of improvements in the condition of the housing market.

We would like to thank B. Peskin for his contribution to this piece.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.