Summary:

- JPMorgan is one of the largest financial institutions in the US, and its cost of capital is generally low.

- The bank made the smart decision to issue preferred shares in 2021 when yields were pretty low.

- I decided against investing in a relatively new issue back in January of this year, but the recent share price decrease has made the preferred securities more attractive.

Michael M. Santiago/Getty Images News

Introduction

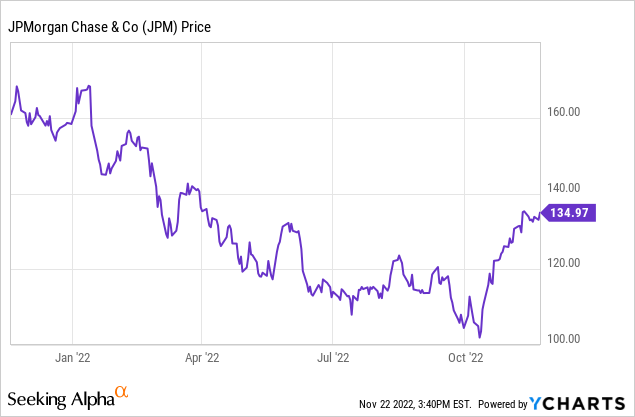

In January, I discussed the preferred shares series M (NYSE:JPM.PM) issued by JPMorgan (NYSE:JPM) as I was looking to increase my exposure to preferred shares. In the article, I explained I decided against investing in the preferred shares as in my specific situation, the after-tax yield was less than 2.7%. That was a person-specific conclusion, but I have always kept an eye on the preferred shares, and as the share price has lost in excess of a quarter of its value, I thought it was time to revisit my investment thesis on these preferred securities.

The preferred shares have dropped

This series of preferred shares were issued in Q3 2021. The M-series are a non-cumulative preferred share with an annual preferred dividend of 4.20% per year. The annual dividend is $1.05 per share, paid in quarterly installments of $0.275 per share per quarter. The 80 million units have a total value of $2B, so this was a relatively sizeable issue by JPMorgan.

While the initial yield of 4.20% may be low, the recent decrease in the preferred share price makes the yield more attractive. At the current preferred share price of $18.40, the yield has increased to 5.7%.

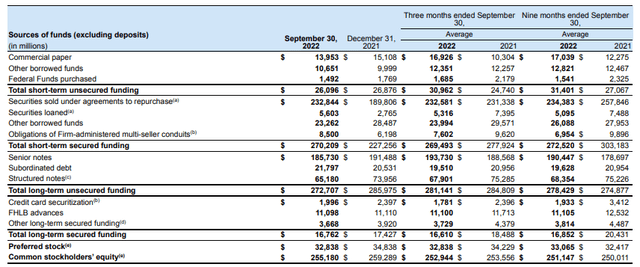

JPMorgan has been pretty active in buying back preferred shares. While the bank had in excess of $32B in preferred capital as of the end of September, it called two sizeable issues subsequent to the end of the quarter. On Oct. 3 the $2.5B Series V preferred shares were called, and on Oct. 31 JPM redeemed the $2.93B in Series I preferred shares after issuing $3.5B in subordinated notes during the month of September.

With a substantial amount of common equity ranking junior to the preferred shares, I’m not too worried about the preferreds (even though the preferred dividends are non-cumulative).

The performance of JPMorgan in the third quarter was pretty decent

With hundreds of billions of dollars in common equity ranking junior to the preferred securities, let’s now have a look at how well the preferred dividend is covered by earnings.

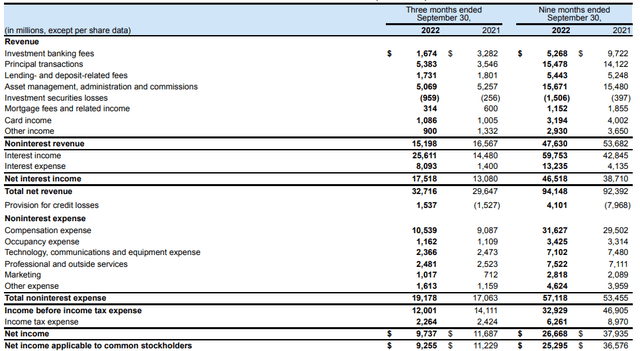

In the third quarter of this year, JPMorgan saw its net interest income increase by in excess of 30% compared to the $13.1B in the third quarter of last year. Even on a QoQ basis there is a very clear acceleration as the net interest income in the third quarter represented almost 38% of the 9M 2022 net interest income.

That being said, the bank also saw its non-interest revenue decrease while the non-interest expenses increased by more than 10%. This caused the pre-tax and pre-loan loss provision income to come in at approximately $13.5B, compared to $12.6B. A nice increase, but that doesn’t get reflected in the reported net income. The explanation is pretty straightforward: The bank was able to undo some of the previously recorded loan loss provisions as the fall-out from the COVID pandemic was not as bad as initially feared. But in the third quarter of this year, JPM had to record a $1.54B loan loss provision which means the combination of both caused a $3.1B swing in the loan loss provisions and that is the main driver behind the seemingly weak pre-tax income.

We see the reported net income in the third quarter of this year was $9.74B and of that amount, about $9.25B was attributable to the common shareholders. This means the preferred dividend coverage is very strong as JPM only needs a small portion of its reported net income to cover the dividend payments. So although the preferred dividends are non-cumulative, there’s no reason why JPMorgan shouldn’t or won’t continue to pay them as it can clearly afford to do so. When discussing the Q3 results, JPMorgan also sounded pretty upbeat about next year which isn’t a big surprise considering the net interest income should continue to increase.

Investment thesis

While the current yield on the preferred shares Series M has definitely improved to 5.7%, the new issue is that due to the increase in interest rates several other preferred shares and bonds from other issuers have seen their prices decrease as well, making them still more attractive than this specific JPMorgan security. JPMorgan has other series of preferred shares as well and perhaps I should cast a wider net. That being said, I’m also quite happy with the preferred shares of banks that I do own. My OZKAP, for instance, currently yields 6.8% at the current share price. And sure, Bank OZK is no JPMorgan, but all I care about is the issuer being able to pay the preferred dividends.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Consider joining European Small-Cap Ideas to gain exclusive access to actionable research on appealing Europe-focused investment opportunities, and to the real-time chat function to discuss ideas with similar-minded investors!