Bank Of America: I Expect It To Report Strong Net Income In The Following Years

Summary:

- Bank of America’s 3Q 2022 net income was higher than in 2Q 2022 and lower than in 3Q 2021.

- Using the FCFE model, I evaluate that BAC is worth more than $43 per share.

- BAC’s efficiency ratio has been improving in the past years.

tupungato

Year to date, Bank of America’s (NYSE:BAC) stock price is down by 19%. According to the company’s 3Q 2022 financial results, its net income decreased by 8% YoY. However, compared with the second quarter of 2022, its net income is up 15%. Using the free cash flow to equity (FCFE) model, I evaluate that BAC is worth more than $43 per share. In my valuation, I estimate Bank of America’s total assets growth rate from 2022 to 2032, based on the company’s performance in the past years and the macroeconomic outlook. Then, based on the company’s total revenue to total assets ratio (which is relatively stable), and BAC’s capital Tier 1 ratio, I estimate its net income from 2022 to 2023. The stock is a buy.

Quarterly results

In its 3Q 2022 financial results, BAC reported total revenue (net of interest expense) of $24.5 billion, compared with $22.7 billion in 2Q 2022 and $22.8 billion in 3Q 2021. The company’s provision for credit losses increased from $0.5 billion in 2Q 2022 to $0.9 billion in 3Q 2022. BAC’s noninterest expense of $15.3 billion in 2Q 2022 remained the same in 3Q 2022. Bank of America reported a net income of $7.1 billion in 3Q 2022, compared with $6.2 billion in 2Q 2022 and $7.7 billion in 3Q 2021. In the third quarter of 2022, BAC’s net interest income (NII) increased by 24% YoY to $13.8 billion, driven by benefits from higher interest rates, including lower premium amortization expense, and solid loan growth. Also, due to lower investment banking and asset management fees as well as lower service charges, BAC’s noninterest income decreased by 8% YoY to $9.8 billion. The company’s net reserve release of $1.1 billion in 3Q 2021 turned into a net reserve build of $378 million in 3Q 2022. In the third quarter of 2022, BAC’s average loan and lease balances increased by 12% YoY and 1% YoY to $1.0 trillion and $2.0 trillion, respectively.

In the consumer banking segment, BAC’s net income increased from $2.9 billion in 2Q 2022 to $3.1 billion in 3Q 2022, driven by increased consumer checking accounts, and digital sales growth of 36%. In global wealth and investment management, BAC’s net income of $5.4 billion in 2Q 2022, remained the same in 3Q 2022. In the global banking segment, BAC’s net income increased from $1.5 billion in 2Q 2021 to $2.0 billion in 3Q 2022. In global markets segment, the company’s net income of $1.0 billion in 2Q 2022 increased to $1.1 billion in 3Q 2022.

“We continued to see strong organic client growth across our businesses, with increased client activity helping to drive revenue up by 8%. Our U.S. consumer clients remained resilient with strong, although slower growing, spending levels and still maintained elevated deposit amounts,” the CEO commented. “Across the bank, we grew loans by 12% over the last year as we delivered the financial resources to support our clients. Our team adapted well to our new capital requirements and improved our CET1 ratio by 49 basis points to 11%, above our new regulatory minimums,” he continued.

Valuation

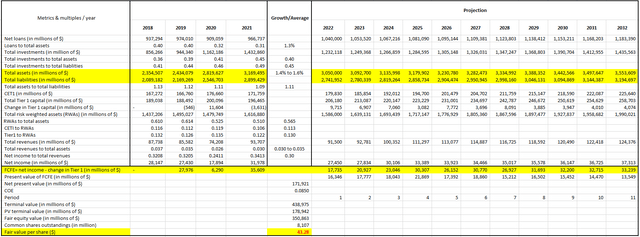

Using the FCFE model, I calculate the fair value of BAC. I used two approaches to build my way of using the FCFE model for evaluating bank stocks. According to the first approach of using the FCFE model to evaluate bank stocks, I estimate total assets, total liabilities, Tier 1 ratio, total risk-weighted assets (‘RWAs’), net revenues, and net income of BAC from 2022 to 2032. Also, according to the second approach, I calculate the FCFE of the company. Estimation of total assets growth is one of the main parts of my valuation. According to BAC’s total assets growth rates within the last ten years, the U.S. inflation and recession outlook, and FED’s monetary policies, I estimate total assets growth rate of 1.4% to 1.6% for BAC from 2022 to 2032. I used this growth rate to estimate BAC’s total assets from 2022 to 2032. After projecting the stock’s total assets, I calculate its RWAs from 2022 to 2032.

Table 1 shows that BAC’s RWAs-to-total assets ratio is relatively stable. Thus, relying on this stable ratio, I estimate the RWAs of Bank of America from 2022 to 2032. Also, the revenues-to-assets ratio of BAC was relatively stable during the last 10 years (except in 2019, which reflects the effects of the COVID-19 pandemic). Using these stable ratios, I estimate the total revenues and net income of BAC from 2022 to 2032. Another element in my valuation is the stock’s Tier 1 ratio. In the third quarter of 2022, Bank of America reported a Tier 1 ratio of 12.8%. According to Table 1, BAC’s Tier 1 ratio decreased from 13.5% in 2020 to 12.2% in 2020. Due to the risk management history of the company and the macroeconomic outlook, I expect BAC’s Tier 1 ratio to be around 13% in the following years. According to my calculations, with total assets CAGR of 1.4% to 1.6%% from 2022 to 2032, Tier 1 ratio of 13%, and COE of 8.5% ( I calculated the COE of BAC using the company’s P/B value, ROE, and U.S. 10-year treasury bond yield), Bank of America stock is worth $43.28 per share in my view. Thus, I think the stock is a buy.

Table 1 – Valuation of Bank of America

Author’s calculations based on SA data and BAC’s financial reports

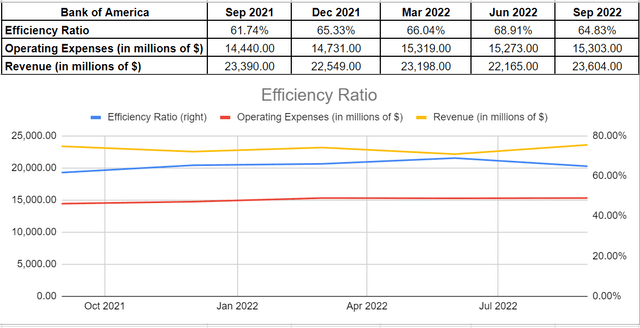

BAC’s efficiency ratio

To analyze the management’s ability to keep expenses and revenues in check, I consider Bank of America’s efficiency ratio in 3Q 2022, and compare it with the third quarter of 2021. Considering BAC’s quarterly efficiency ratio indicates that, in December 2021, the company increased its ratio as its revenue decreased albeit its expenses increased very slightly. These amounts led to an increase of 359 bps to 65.33%, compared with the quarter that ended in Sep 2021. In the first quarter of 2022, which ended on 31 Mar 2022, both revenues and expenses increased and led to 71 bps improvement and sat at 66.04% in BAC’s efficiency ratio. In the third quarter of 2022, notwithstanding a slight decline to 64.83% versus its previous level of 68.9% at the end of 2Q 2022, BAC’s efficiency ratio is still well higher than its level at the same time in 2021. As a result, it is observable that Bank of America has improved its efficiency ratio in recent quarters except in the third quarter of 2022 (see Figure 1).

Figure 1 – BAC’s efficiency ratio

Summary

Bank of America’s net income dropped in 2020. However, in the past two years, despite all the macroeconomic challenges, the company was able to make huge profits and develop its operations. Due to BAC’s continuing organic growth in the consumer banking segment, global banking segment, global wealth & investment management segment, and global markets segment, I expect the company to report solid financial results in the following years. I evaluate that the stock is worth $43 per share. I am bullish on BAC.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.