Abbott Laboratories: Good Execution And Attractive Valuation

Summary:

- Abbott is a market leader in medical device businesses such as vascular care and diabetes care. It also leads in the in-vitro diagnostic market.

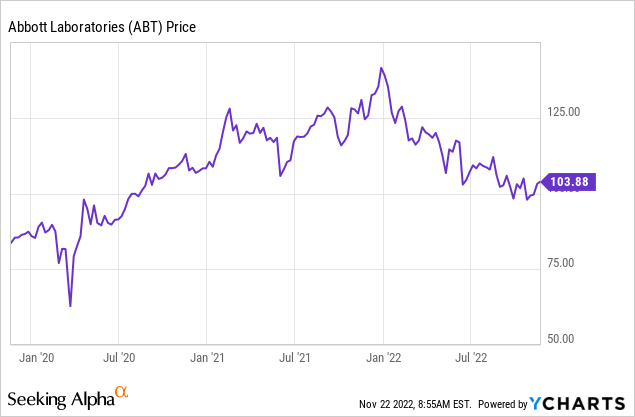

- The likely decline of COVID testing heavily impacted the share price.

- It keeps growing at a decent pace but suffers from temporary currency headwinds.

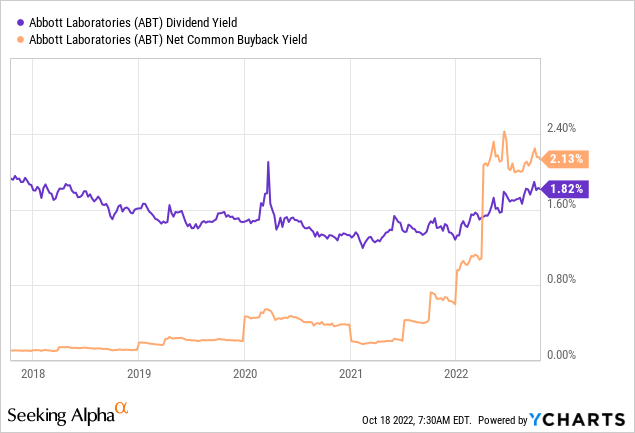

- It’s cheaply valued and offers an attractive long-term business case. Abbott pays a growing dividend for 49 years and strongly increased its buybacks.

Sundry Photography

Abbott Laboratories (NYSE:ABT) is an excellent long-term healthcare grower. Its pandemic tailwinds faded and it’s back on its initial growth path with a strong financial position. The company is the market leader in glucose monitoring and insulin dosing. It continuously innovates with new products in four areas: medical devices, diagnostics, established pharmaceuticals, and nutrition.

Abbott’s share price surged during the corona pandemic due to its testing capabilities. It recently came down as the need for testing should fade and Abbott’s sales and earnings normalize. I believe it could prove to be an opportunity at this price.

A Long-Term Buy And Hold

I’m always looking for free cash flow growth companies with solid shareholder returns. Abbott’s past performance indicates a healthy growth company with the right focus on value creation. It innovates with new products to remain a leader in its markets.

I look for these specifics:

- Substantial revenue per share growth.

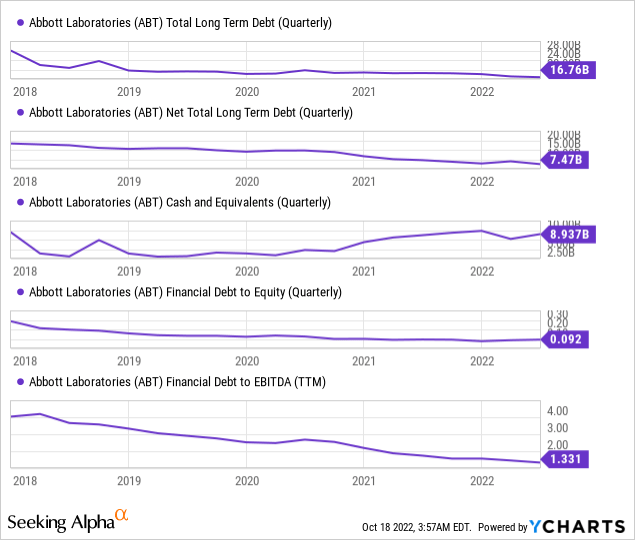

- A sturdy balance sheet with low leverage.

- Reasonable valuation based on FCF and PE ratios relative to their growth.

- Stocks that return cash to shareholders with buybacks and/or dividends are often run by shareholder-friendly management. I look for regular returns.

Abbott is one of the stocks I recently included in this list of growth stocks.

Growth

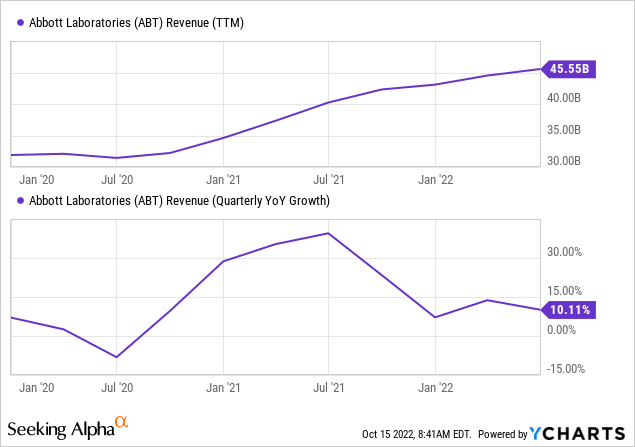

Abbott’s past growth is impressive. It grew revenue per share at an average of 8% CAGR over the past decade. Its normalized EPS outpaced revenue growth by a landslide at 22.1% CAGR 2012-2022.

The pandemic put a temporary booster on Abbott’s results due to the selling of COVID test kits. This tailwind fades as governments cut back on their testing strategies.

The long-term trend of increased testing still favors Abbott in the future. As it stands, every Covid test sold extra is a bonus for ABT that doesn’t affect my long-term view.

Growth Without Covid

Abbott achieved $43B in sales in 2021 of which $7.7B was related to Covid testing. The $35.3B non-Covid sales still look good compared to 2019 when Abbott’s total revenue amounted to $31.9B. A 5.2% annual growth of non-Covid sales is impressive considering the distraction and troubles that Covid caused.

In 2022, non-Covid growth will be approximately flat. This is mainly due to positive organic growth that is offset by declining currency exchange rates. Foreign exchange is a temporary headwind that’s hard to predict and could change quickly.

Future Growth

Abbott targets $5.20 adjusted EPS in 2022. A large increase from the previous guidance of $4.90 EPS and on par with last year’s $5.21 EPS. Foreign currencies have a negative impact this year as noted earlier.

The near future remains unpredictable as Covid testing seems to slow down, but any new variant could cause another surge in testing. It guides rather conservatively for Covid testing and beat guidance several quarters in a row with much higher testing sales.

It looks good beyond 2023. Abbott innovates in several booming healthcare markets with new products:

- Abbott launched the Amplatzer Talisman in Europe to make it easier for physicians to use.

- It received FDA approval for a new spinal cord stimulation device in August.

- Weightwatchers and Abbott partnered to support people with diabetes.

Balance Sheet

Abbott’s balance sheet is rock solid:

Its long-term debt is neglectable if you consider the large cash position. It’s only slightly leveraged and could quickly repay debt with its cash flow. Abbott looks for M&A opportunities. A deal could increase its debt position again. The company hasn’t been overly keen on acquisitions which is a good sign for shareholders.

Free Cash Flow

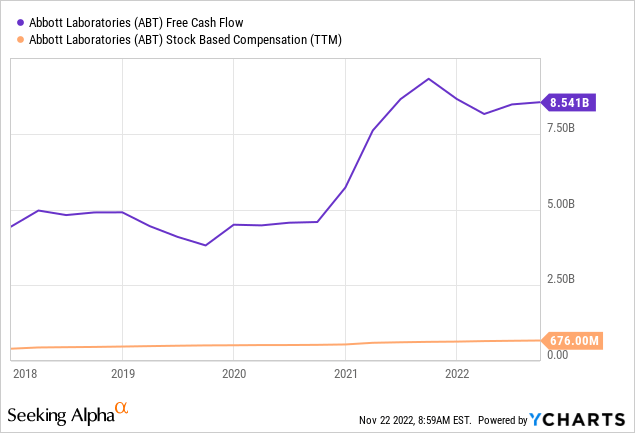

Free cash flow is vital as this is what a company could use for shareholder returns. Potential buybacks or dividends are only possible if the company produces enough cash.

Abbott is a free cash flow machine. Over the past twelve months, it converted ~19% of revenue into FCF. Its SBC is reasonable.

A fallback in FCF is possible as Covid-testing reduces. It won’t take Abbott long to pick it up again with new products.

Shareholder Returns

Buybacks and/or dividends are signs of shareholder-friendly management. Abbott makes a prime example of such a company.

It’s two years away from paying a consecutive dividend for a century and increased its dividend over the past 50 years, making the company both a dividend aristocrat and king. Its dividend growth remains strong with an average 12.14% increase over the past 5 years.

It recently also kicked the buybacks into a higher gear. The reduced share price and absence of acquisitions induced the management to return some excess cash to shareholders. The current use of cash shows management that acts in the shareholders’ interest.

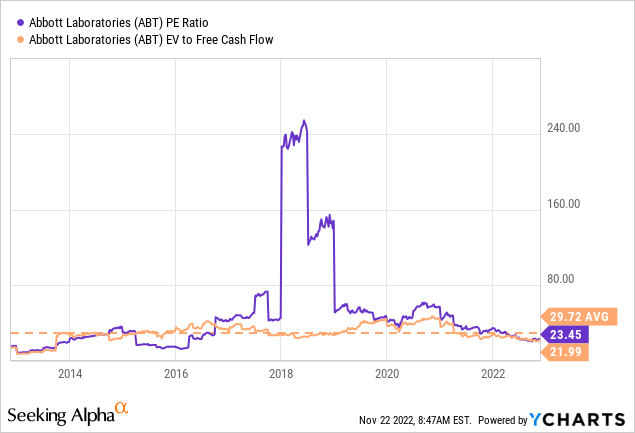

Valuation

Abbott looks very reasonably valued in relation to its history. It showed tremendous growth over the past decade and was handsomely rewarded on the stock market. Still, in terms of valuation, it’s now cheaper than historically. Near-term growth will slow, but the long-term outlook remains strong.

Multiple expansion is possible once the market gets past the Covid testing situation. Abbott is now cheaper than in before 2020 in terms of valuation, the business case hasn’t changed that much. It’s still a leader in many of its products and profits from market trends like increased disease diagnostics.

Even without multiple expansion, the future looks bright. It can grow organically with its growing markets and new products. A possible acquisition could incite new market interest.

Conclusion

I believe the market is too focused on the Covid testing department of Abbott and ignores the long-term potential. A potential catalyst would be an acquisition. Organic USD growth returns once the currency headwinds are gone.

I believe Abbott offers an excellent entry point at this price. The valuation is reasonable compared to the fast growth. The company innovates and grows on all fronts. The Covid tailwinds provide extra returns to shareholders and put ABT in a very healthy financial position, with no testing needed.

Disclosure: I/we have a beneficial long position in the shares of ABT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Any investments you would take after a piece or discussions with me are your responsibility. Please do your own due diligence before an investment.