Opendoor: Headwinds Are Lifting – H1 2024 Will Likely Be Better

Summary:

- With the inflation already cooling, mortgage rates declining, and the Fed dovish, it appears that the worst is already behind us, with a near-term Fed pivot more likely than not.

- Most importantly, OPEN’s old inventory book is mostly sold, with its new purchases likely to generate improved gross and contribution margins by H1’24.

- Combined with its decent balance sheet and the stock’s upward momentum, it appears that the stock may also break out of the $3 resistance level.

- However, given the elevated short interest of 13.29%, investors must temper their near-term expectations, since the volatility from aggressive short sellers may temporarily negate the potential upside from these bottom levels.

Jan-Otto

We previously covered Opendoor Technologies (NASDAQ:NASDAQ:OPEN) in September 2023, discussing its improved prospects then, as the management prudently moderated the acquisition pace in order to maintain its balance sheet health at a time of uncertain macroeconomic outlook.

Combined with the bottoming market sentiments, we had cautiously rated the stock as a Buy then, with the existing home sales in July 2023 already nearing the historical bottom during the 2008 recession and March 2020 pandemic period.

In this article, we will explain why we are maintaining our Buy rating on the OPEN stock, with most of its older inventories already sold and the newer book bringing forth improved profit margins.

Combined with the cooling inflation, reversal in the mortgage rates, and the Fed’s dovish stance, it appears that the worst may very well be behind us.

The iBuying Investment Thesis Has Improved Drastically

For now, OPEN delivered an excellent FQ3’23 earnings call, with revenues of $980M (-50.4% QoQ/ -70.8% YoY) and a stabling average selling prices of $364.7K (inline QoQ/ -7.4% YoY), nearing the US median existing home prices of $391.8K in October 2023 (inline MoM).

While its gross profits of $96M (-35.5% QoQ/ +122.5% YoY) has been underwhelming, we believe that H1’24 may bring forth improved numbers, since the management has already sold most of its older inventories, with “less than 150 old book homes not in resale contract at quarter-end.”

In addition, OPEN has made the excellent choice of optimizing its newer inventories, with a lower average cost price of $327.1K (+1.3% QoQ/ -9.4% YoY), giving the management the much needed buffer for improved profit margins.

As a result, it is unsurprising that its new book of homes already generate an exemplary gross margin of 12% (-2.4 points QoQ) and contribution margin of 9.2% (-1.4 points QoQ/ +4.2 YoY) in the latest quarter. With the new book already comprising over 70% of its existing inventories, we believe that the management has executed brilliantly.

This is on top of the drastic cost optimizations, with a much lower operating expense of $173M (-16% QoQ/ -55% YoY) thanks to the headcount reductions in April 2023.

The management’s prudent efforts have also been reflected in OPEN’s healthier balance sheet, with $1.22B of cash/ equivalents (inline QoQ/ -18.6% YoY) and $2.83B of long-term debts (-6.2% QoQ/ -39.1% YoY) by the latest quarter.

The iBuying company remains well-capitalized as well, with $8.4B in available borrowing capacity, allowing the management to opportunistically accelerate their home acquisitions over the next few quarters, once the macroeconomic outlook lifts.

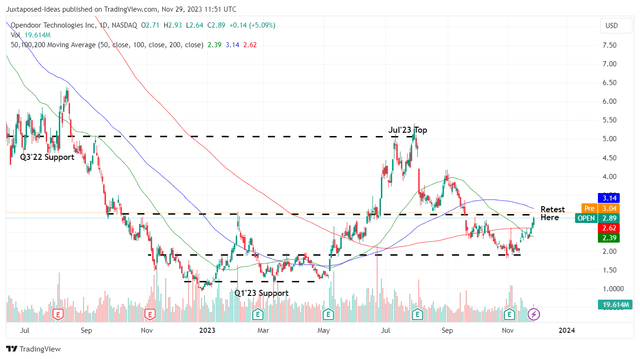

OPEN 1Y Stock Price

Trading View

For now, OPEN has already bounced from its critical support levels of $2.03 and successfully broke through its 50/ 100 days moving averages, with the upward momentum seemingly on its way to retest the upcoming resistance level of $3.

We believe that much of the recovery is attributed to the optimistic October 2023 CPI, which is showing signs of cooling inflation, with some already speculating a Fed pivot as soon as Q1’24.

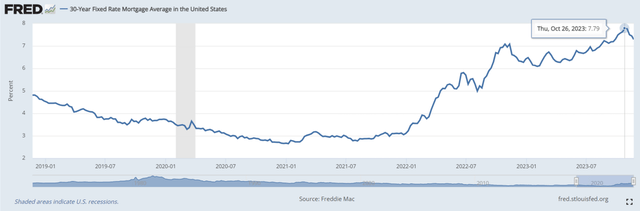

30-Year Fixed Rate Mortgage Average in the United States

Freddie Mac

Most importantly, the 30Y National Fixed Rate Mortgage Average has already peaked at 7.79% by October 26, 2023 (+1.21 points YoY) while moderating to 7.29% at the time of writing (+0.71 points YoY), though still elevated compared to the 2019 averages of 3.8%.

Combined with the Fed’s latest dovish commentary, it appears that the worst may very well be behind us, with OPEN likely to benefit once the borrowing costs ease and more homeowners transact their properties.

So, Is OPEN Stock A Buy, Sell, or Hold?

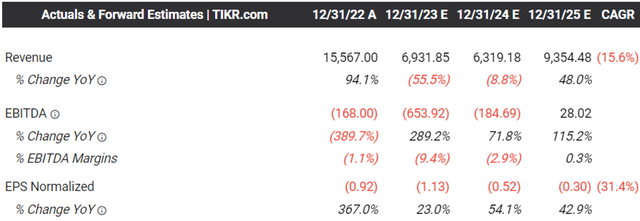

The Consensus Forward Estimates

Tikr Terminal

On the one hand, OPEN may still face near-term top/ bottom line headwinds, based on the FQ4’23 revenue guidance of $825M (-15.8% QoQ/ -71.1% YoY) and adj EBITDA of -$100M at the midpoint (-104% QoQ/ +52.6% YoY).

The consensus estimates appear to be rather bearish over the next few years as well, with the iBuying company not expected to generate any profitability over the next few years.

On the other hand, we maintain our Buy rating for OPEN, attributed to the attractive risk/ reward ratio and the stock’s well-supported levels at $2s, especially since its top-line reversal may slowly occur over the next few quarters.

Naturally, since the macroeconomic headwinds have yet to fully subside, the stock is only suitable for investors with higher risk appetite and long-term investing trajectory.

Combined with its elevated short interest of 13.29%, they must also temper their near-term expectations, since the volatility from aggressive short sellers may temporarily negate the potential upside from these bottom levels.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.