PayPal: Bullish Again, How We Are Trading The Stock

Summary:

- Having exited our position via a covered call trade when PYPL stock was in the $90s, we have patiently waited for a new entry point.

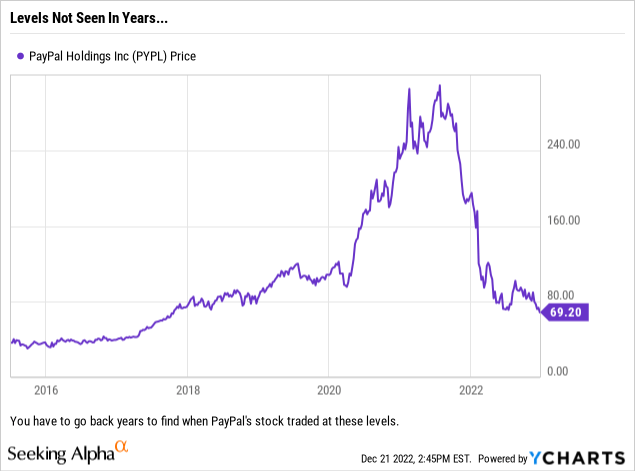

- PYPL stock is trading at multi-year lows but the growth story and profitability is still intact, making this look like a good entry point.

- While purchasing shares outright is attractive, we think that cash secured puts could generate a better return if 2023 is a tough year.

bizoo_n

We last wrote about PayPal (NASDAQ:PYPL) back on July 27, 2022 shortly after news broke that Elliott Management had established a position in the company. That article, ‘PayPal: How To Play The Elliott Management News And Earnings’, focused on a position that we had previously established and how to trade that position around the Elliott news and the company’s upcoming earnings – which were set to be released the next week. The trade ultimately turned a profit and saved us a lot of heartache over the months as we have continued to watch the stock trend lower; hitting fresh 52-week lows, which are also multi-year lows.

While readers may have paid more attention to the two trades we laid out, the most important part of that article may have been the following:

“For those who do not currently own shares but are now interested in establishing a position, we think it would be wise to not chase during a bear market. That rule has generally served us well over the years and prevented some bad trades. So, instead of rushing in and buying shares, we think that utilizing the options market is a better proposition and pays you to establish your desired position at your target price.”

After our shares were called away we took our own advice and, as it pertained to PayPal, mostly sat on the sidelines. We wrote a few puts here and there, but nothing aggressive, which led us to not reopening an equity position since then. Instead, we just collected the option premiums and were shielded from what would have been pretty significant losses. Today we also do not own any shares, but we do want to once again work towards establishing a position.

So What Has Changed?

To be honest, not a whole lot. For all of the reasons we previously liked PayPal, we still do, and today we have even more reasons to be bullishly postured. The last few earnings calls have been upbeat on the company’s long-term prospects and earlier this month PayPal’s CEO, Dan Shulman, seemed to be upbeat about this current quarter – noting that revenues were on track for the company’s roughly 9% guide while the company seems to have gotten a grip on operating expenses.

The whole crypto story remains a distraction; we have never liked the idea but recognize that PayPal was forced to move into the space due to competitors such as Block (SQ), formerly known as Square, offering more and more tools with crypto being one of the main ones that caught on with consumers. The recent headlines out of the space probably are not helping with customers and the business in general, but so long as the industry fallout is contained outside of PayPal’s realm we can deal with the distraction as an investor.

The business remains positioned to take advantage of both the PayPal and Venmo offerings, and with some of the deals that PayPal has entered into recently we continue to feel that the company has not only positioned itself to be one of the dominant players in the industry for years to come, but also reap the rewards of that market share as the company has mostly focused on profitable services/offerings and not gotten too distracted with unprofitable/low-margin offerings.

Data by YCharts

As PayPal continues to scale the PayPal and Venmo offerings, manage costs more effectively and focus on the overall performance of the company, the fruits of those labors will begin to show up in the operating results and by extension the stock performance – which is why today with the stock trading below $70/share we are once again interested in the name.

So What Are The Trades?

With the stock trading down at these levels, we think it is fair to say that anyone buying the shares outright is not chasing the name. Even if they were, if they exited as we did in the low $90s (effectively around $95/share with the option premium), then a reentry at these levels can be viewed favorably. We manage various accounts, with different purposes, so we are going to lay out our real money trades:

Long-Term Accounts

For the long-term accounts we manage, that have a slant towards growth, we are going to simply purchase the shares at these levels. With the stock trading at $69.30/share, one can comfortably tuck this name away for a while and ride the economic storm out.

Aggressive Income/Growth Accounts

These accounts tend to have some type of leverage involved, be it margin, options, etc. Our plan here is to utilize unused margin in the accounts to use PayPal puts to generate a healthy options premium. These accounts are currently fully invested on a cash basis, however in an attempt to generate some additional return, we are going to utilize the buying power within the account to write a cash secured put. The benefit here is that while we utilize the buying power to write the put, it does not create a margin loan and we avoid the carrying cost of shares. By not buying calls we also avoid carrying cost (via the option premium paid upfront and the actual margin resulting from that as it requires cash to do the trade), although we do have more capital at risk.

We like the PayPal January 19, 2024 Puts with a strike price of $67.50 that can be sold for around $11.10 in premium. Each contract will generate a total of $1,110 minus the small exchange fees/commissions. This trade essentially locks in a maximum potential profit of 16.44% (we risk $6,750 and generate about $1,110) while keeping the trade profitable all the way down to $56.40/share. In what could be a difficult year for the market, this trade looks like a decent way to generate some cash upfront (which could be invested safely at 4.50%+ in the interim) while creating a nice large pocket for the stock to trade in without creating any losses.

For anyone worried about missing out on any move higher, it is important to remember that we have created a trade that on a max profit scenario would result in a move to $78.60/share equivalent (that is where the stock would have to go to create the same gain for those buying the equity outright). As the stock moves higher, at any time the put can be purchased for a lower price and one can move to a higher strike price. So for anyone worried about opportunity cost, we think that can be managed too if one is actively watching their portfolio.

Closing Thoughts

We remain bullish on the prospects for PayPal’s business, and for the first time in a few months, we are bullish on the prospects for PayPal’s stock now that it has pulled back strongly and is appealing on a valuation basis. With an estimated P/E at 17 we think that the door is open for management to utilize buybacks more aggressively; this is as low as it has been in a while and around the time of the Elliott news the estimated P/E was north of 20 – so if buybacks looked attractive then, they certainly look attractive now.

Buying the stock outright at these levels is attractive, but we do like the option trade which utilizes other people’s money at no cost to generate a cash inflow which will also generate income over the course of this trade. Creating a profitable trade down to $56.40/share from current levels is attractive, and even if the stock jumps 30% from current levels, we would find it difficult to be upset about only capturing the first 16.44% of that move with the way the market is right now.

Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: We sold puts in personal and client accounts. Purchased PYPL in client accounts. May trade further in the next 24-72 hours.