Summary:

- PYPL is trying to bounce back after three years of underperformance, and its valuation hitting rock bottom all-time lows after 80% sell-off.

- PayPal’s first-quarter results show a 9% revenue increase and a 14% rise in Total Payment Volume, driven by enhanced features in Venmo and strategic market expansions.

- Bolstered by Fibonacci retracements and a positive Volume Price Trend, PayPal’s stock is projected to reach $79 by the end of 2024, balancing bullish indicators with existing market volatility.

- In 2024, PayPal targets $5 billion in FCF and buybacks, bolstering shareholder value supporting our $90 DCF valuation.

chameleonseye

Investment Thesis

Our investment thesis for PayPal Holdings, Inc. (NASDAQ:PYPL) remains robust, maintaining our strong buy rating for the stock from our previous coverage, with a medium-term target price of $90, supported by strategic shifts in the company’s product mix that responds to market dynamics and competitive pressures. Technically, PayPal’s stock is projected to reach $79 by 2024 end, supported by bullish technical indicators like the Volume Price Trend and Fibonacci retracements, despite current short-term consolidations and potential downside risks.

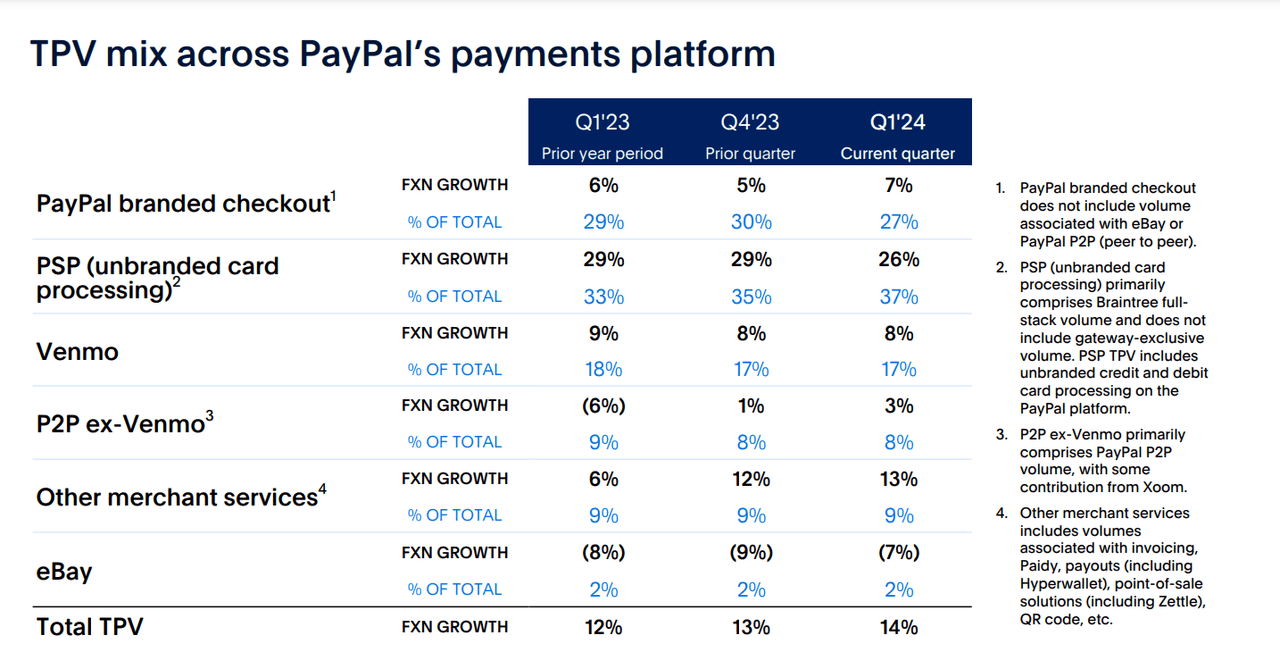

From 2021 to 2023, PayPal strategically changed its product mix and reduced its reliance on high-margin Branded Checkout from 29% (23Q1) to 27% in the last quarter (24Q1), diversifying into Unbranded Processing, which grew from 33% to 37% for the same period. This shift aims to capture market share in lower-margin areas, balancing volume growth with profitability.

To offset margin pressures, PayPal is implementing cost-cutting measures and enhancing Venmo’s features to boost user engagement and payment volumes. Hence, these strategic initiatives are expected to drive long-term value and sustain profitability, reinforcing our positive outlook and confidence in reaching our price target.

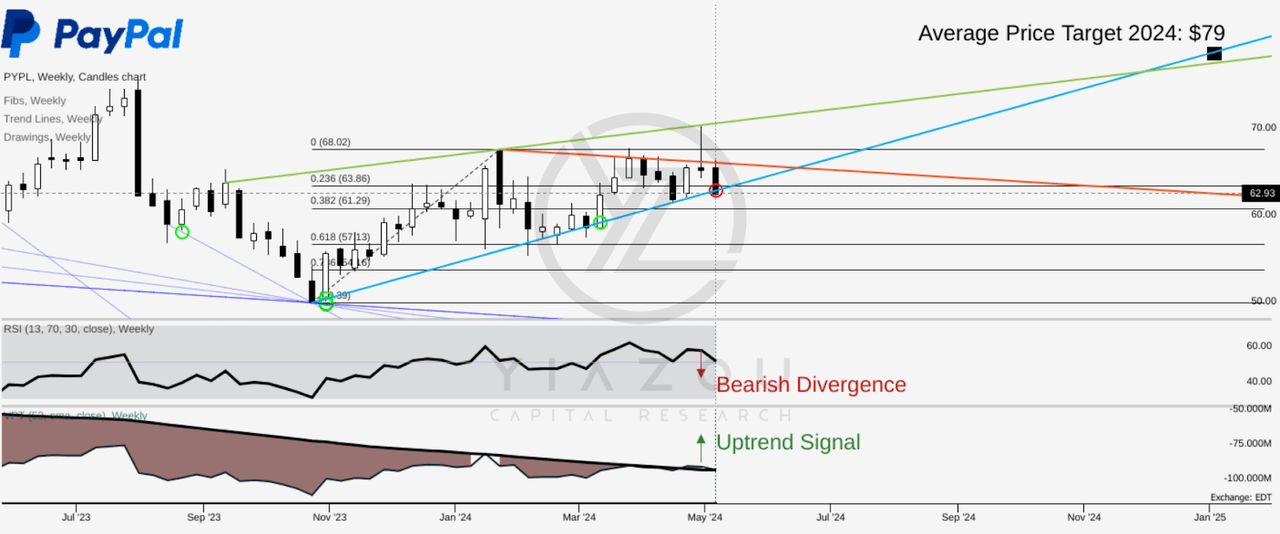

Poised for $79 Peak Amidst Bullish Signals and Technical Tendencies

PYPL may hit $79 by the end of 2024 based on the current momentum of higher lows and Fibonacci extensions. This makes the target conservative. The stock price is currently experiencing downside moves in a short-term price consolidation.

On the positive side, the Volume Price Trend (VPT) crosses the 1-year average. This signals the initiation of short-term bullish momentum, which will intensify over the red trend line. Following the Fibonacci retracement, derived from the current price swing, the price may revert back to $61 (0.382 level) before making upward progress to breach the double top resistance formation at $68.

Moreover, the possibility of downside price moves on the weekly time frame also aligns with the bearish divergence that emerged in the Relative Strength Index (RSI). The current level of RSI, which is 50, suggests a neutral state of the trend’s strength so that the price may have a limited downside. However, in a more pessimistic scenario, the price may go deep at $57, with the RSI hitting $30.

PayPal Q1 Growth Triumphs: Expands Braintree and Boosts International Revenues

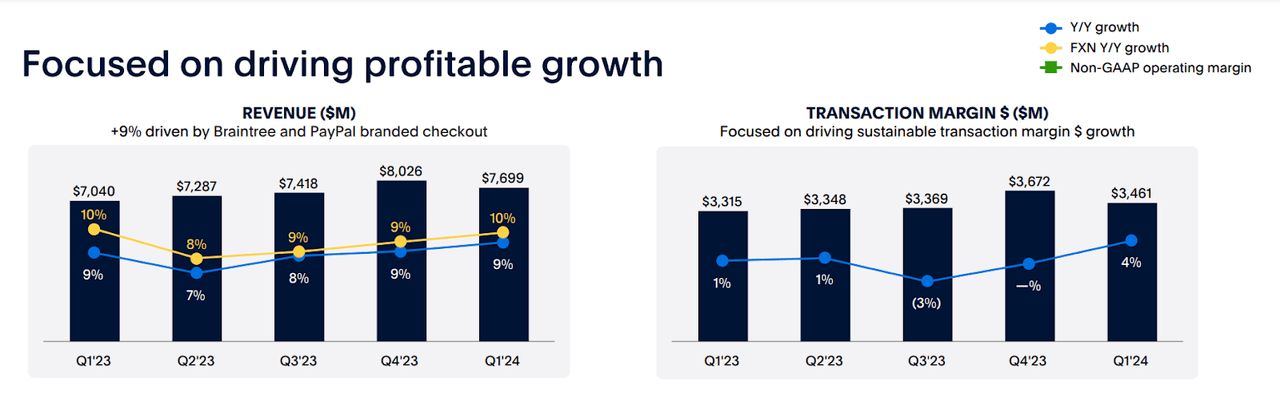

During the first quarter of 2024, PayPal grew its transactional margin dollars by 4% year-over-year (YoY), reaching $3.46 billion. This was when the company had to cope with issues about decreasing take rates and transaction margins. For the three months that ended March 31, 2024, the company registered a 9% increase in revenues to $7.7 billion.

The driver behind it is a substantial

14% increase in Total Payment Volume ((TPV)), which reached $403.86 billion. This signals that volume growth is managed to compensate for lower profitability per transaction, allowing PayPal to work from a larger revenue base and enhance its overall profitability. Similarly, payment transactions per active account increased by 13% to 60 from 53 a year ago.

PayPal’s first-quarter earnings illustrate strategic adaptation and robust growth, particularly in the Braintree (unbranded) and international business. As a vital part of PayPal’s e-commerce gateway business, Braintree has been growing significantly, even outpacing the broader e-commerce market.

Braintree has driven PayPal’s growth in the last quarter through strategic market share acquisitions and expansion into full-stack volume services. Despite operating at lower take rates than PayPal’s branded checkout, Braintree’s substantial transaction volume growth has been crucial, expanding 26% in Q1. Moreover, Braintree has the potential to enhance its profitability through expansion into value-added services, such as fraud prevention, and possibly integrating payment processing in-house.

PayPal is also making significant strides internationally, with international revenue stable at 42% (for a consecutive quarter) of total revenue and growing 14% YoY in Q1 2024. This growth is notably driven by solid performance in Continental Europe and Asia, where PayPal’s operations are crucial for its global expansion strategy.

Despite past declines in core product revenues, there was an 11% increase in transaction revenues in Q1 2024, indicating a resurgence in branded checkout bolstered by enterprise and international strengths. This recovery suggests that concerns over competitive pressures from other digital wallets might be overestimated, as PayPal’s branded offerings continue to contribute significantly to its revenue and gross profit. This positive momentum is underpinned by a steady number of monthly active accounts, which grew by 2% to 220 million, showing that despite the competitive landscape, PayPal maintains a loyal user base, which is crucial for sustaining long-term growth.

In addition, the increased focus on branded checkout in these markets is strategically vital as it traditionally carries healthier take rates than unbranded processing. This shift comes amidst a broader context where branded checkout is beginning to show signs of recovery after previous declines, indicating a successful rebalancing of PayPal’s portfolio towards more profitable and sustainable growth areas.

Finally, the buildup in upward momentum comes from the payment giant delivering more robust than expected first-quarter results that underscored growth in the core business. The fintech giant has already started benefiting from healthy transaction volumes and reduced operating costs under new measures implemented by CEO Alex Chriss that took over six months ago. Lastly, transaction margins improved by 4% in the quarter to $3.461 billion as non-operating income increased 18.2% yearly to $1.4 billion.

Fueling Future Growth with Innovative Payment Solutions

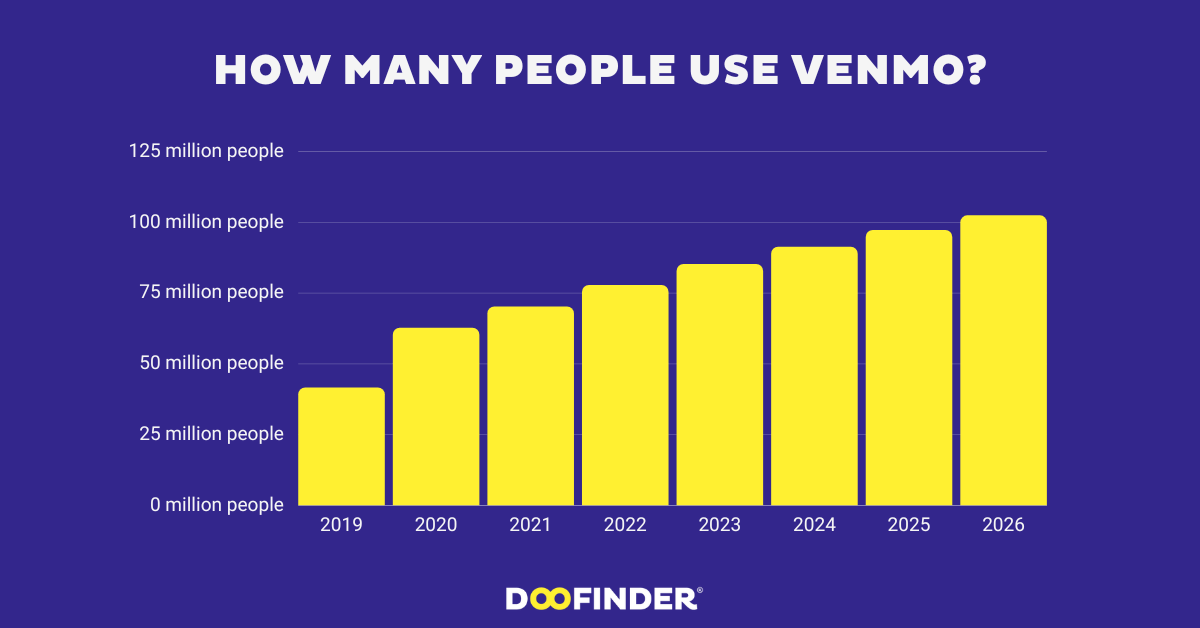

According to the CEO, the improved financial results come as PayPal benefits from streamlined processes for enterprises and small businesses increasingly using PayPal and Venmo. Venmo has always been an important aspect of the PayPal payment network as it offers a convenient way for people to pay, request money from friends and family, and make payments at authorized merchants.

While Venmo generates revenues through a 2.9% transaction fee for businesses, PayPal has always seen it as a key revenue generator for the future. The number of people using Venmo has gradually increased, from a low of 3 million in 2015 to a high of nearly 78 million as of the end of 2023.

Doofinder

The gradual increase in the number of people using Venmo to make and receive payments has been the catalyst behind the increase in the total payment volume that the app handles. Likewise, the total payment volume handled by the Venmo app grew by 8% in the first quarter of 2024.

While PayPal’s cross-border payment unit Xoom has underperformed recently, there are no plans to divest it. Last year, reports emerged that the payment company had engaged Goldman Sachs’ (GS) services as it explored the possibility of selling the remittance service. The push came as the company embarked on an aggressive cost-cutting spree that laid off 7% of staff.

With the proposed sale of Xoom, there were reports that PayPal wanted to concentrate on its core segments of Checkout digital wallets and Braintree. However, the claims have since been refuted, with the CEO insisting that the focus now shifts to rebuilding the unit to make it competitive. Part of the plan involves reducing the cost of cross-border transfers to entice more people to use Xoom at the expense of other alternatives. In addition, PayPal is exploring eliminating transaction fees when funding, utilizing the company’s stablecoin to attract more users.

In addition to reinvigorating Xoom, PayPal is also considering transitioning its higher-revenue branded checkout experiences to include a range of value-added services. By testing a rebranded checkout approach, Fastlane is already allowing the company to attract more businesses of all sizes.

Finally, to attract more users to the PayPal app, the payment giant has already revamped the core app and started offering consumers new ways of earning rewards when shopping. The company is also exploring new ways to force businesses of all sizes to accept Venmo to attract more users and ensure it accounts for more of the total revenue generated. Currently, Venmo attracts nearly $18 billion in new funds monthly, with 80% of the dollars leaving within ten days.

PayPal’s Bold Comeback: Soaring Free Cash Flow Sparks Major Buyback

The valuation of PayPal’s stock has become an exciting case for any modern investor looking at its free cash flow (FCF) performance. Over the last several years, this company’s FCF yield has fluctuated dramatically due to market movements and various internal corporate actions. For instance, from a 5.8% peak in 2022, FCF yield declined to 4.8% by 2023 because growth started tapering off once the pandemic’s impact receded.

A recent upturn has been noticed, with the FCF yield rebounding to 7.5% as of March 2024, supported by a massive 76% YoY growth in FCF, which touched $1.763 billion in Q1 2024 alone. This resurgence can be attributed to, among other factors, robust management strategies, such as buying back shares aggressively in response to the stock’s depressed valuation, which suffered from a significant pullback of 80% in the last few years.

In 2023 alone, PayPal redirected $4.4 billion to buybacks, aiming for $5 billion by year-end, reflecting a robust share buyback yield of 7.35%. Capital returns to shareholders have been substantial. In the first quarter of 2024 alone, PayPal returned $1.5 billion to its stockholders through share repurchases, totaling $5.1 billion in buybacks over the last 12 months. These repurchases contributed to a 5% reduction in the weighted average number of shares, enhancing shareholder value.

PayPal’s $90 DCF valuation remains intact, supported by growth, buybacks, and persistently strong FCF generation. Similarly, financial stability is evident in PayPal’s balance sheet, with cash, cash equivalents, and investments totaling $17.7 billion against a debt load of $11.0 billion as of Q1 2024. Therefore, this solid financial footing enables continued aggressive share repurchase programs and other shareholder-friendly actions.

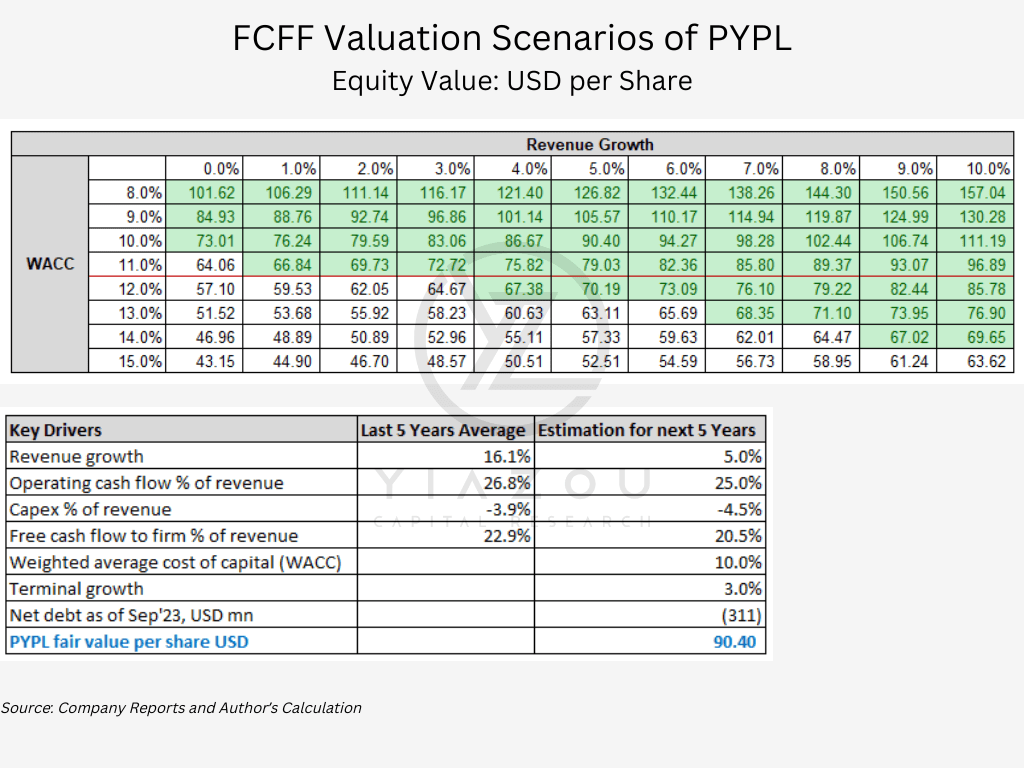

Our DCF model is based on diverse financial projections, including revenue growth, operating cash flow, capital expenditures, and weighted average cost of capital (WACC). Our conservative revenue growth estimate stands at 5%, lower than the company’s long-term 10-year average of 16%. Similarly, the forecasted operating cash flow growth is set at 25%, substantially lower than the company’s 5-year average of 73%. Lastly, the WACC is set at 10%, slightly above its 5-year average of 9.4%. As a result, with a terminal growth rate of 3.0%, our model suggests a fair value of $90/share for PYPL.

Author

Bottom Line

PayPal has underperformed over the past three years, and its growth metrics have taken a significant hit. While the company remains less attractive regarding growth potential, it is more attractive in valuation after imploding by more than 80% from the 2021 highs. The first quarter results affirm the start of a transitional year as the company bounces back to growth in revenue and earnings growth.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Author of Yiazou Capital Research

Unlock your investment potential through deep business analysis.

I am the founder of Yiazou Capital Research, a stock-market research platform designed to elevate your due diligence process through in-depth analysis of businesses.

I have previously worked for Deloitte and KPMG in external auditing, internal auditing, and consulting.

I am a Chartered Certified Accountant and an ACCA Global member, and I hold BSc and MSc degrees from leading UK business schools.

In addition to my research platform, I am also the founder of a private business.