Summary:

- PayPal reported solid first quarter results and the stock is still undervalued.

- But without a clear catalyst, it could take quite some time before the stock is moving higher again.

- And especially improving margins and an improving number of active accounts might turn sentiment for PayPal around.

Sundry Photography

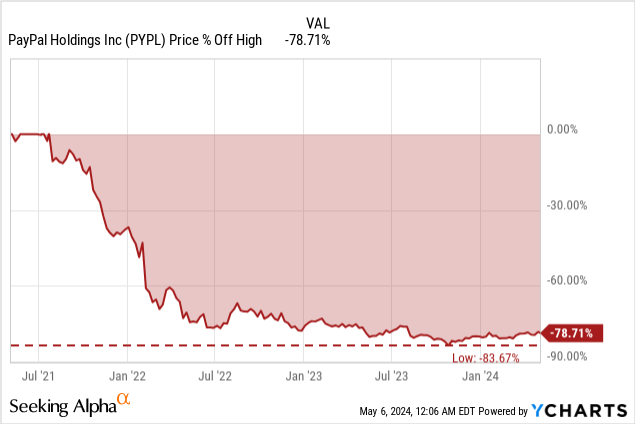

In my last article about PayPal Holdings, Inc. (NASDAQ:PYPL) I asked the question how long the market can be wrong. And while PayPal is still far away from its previous all-time high, the stock increased about 14% since my last article was published (and PayPal outperformed the S&P 500). But performing well in one single quarter or for a few months is certainly not enough to qualify as a great long-term investment and during the last few years, PayPal was still a horrible investment.

About two weeks ago, PayPal reported earnings once again and despite earnings being solid (in my opinion) the stock is once again not really moving higher. In the following article, we will look at the last reported results, reiterate my long-term “Buy” rating and explain why the stock might still not move higher and what must happen.

Quarterly Results

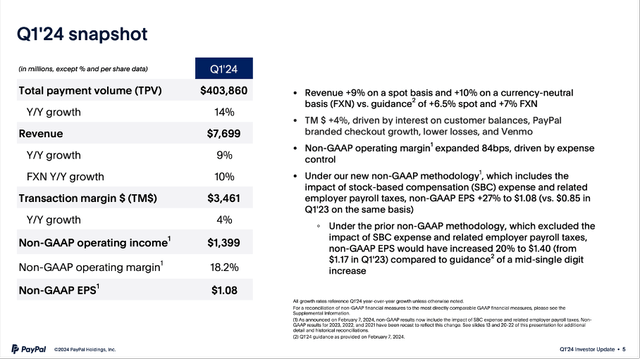

Let’s start by looking at the first quarter results for fiscal 2024, which PayPal released on April 30, 2024. Similar to the last few quarters, revenue increased with a solid pace and year-over-year we saw a 9.4% increase from $7,040 million in Q1/23 to $7,699 million in Q1/24. Operating income also increased from $999 million in the same quarter last year to $1,168 million this quarter – resulting in 16.9% year-over-year growth. And finally, diluted net earnings per share increased from $0.70 in Q1/23 to $0.83 in Q1/24 – resulting in 18.6% bottom line growth.

These are already solid (double-digit) growth rates for PayPal, but especially free cash flow jumped. Compared to $1,000 million in Q1/23, free cash flow was $1,763 million in Q1/24 – resulting in 76.3% year-over-year growth. Adjusted free cash flow increased even more – from $1,000 million in the same quarter last year to $1,856 million this quarter.

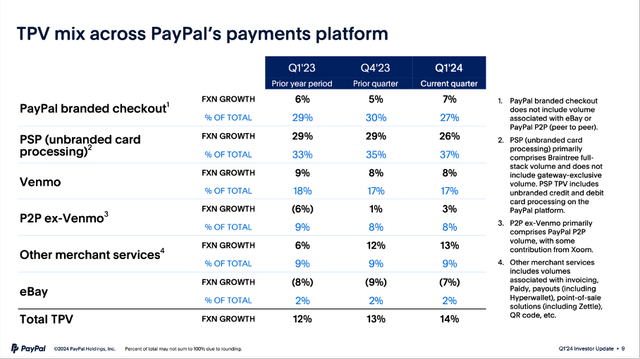

In the past, PayPal did not really disclose how revenue was distributed between the different platforms and what growth rates these different platforms had. Of course, we had the big picture and knew for example that total payment volume generated by eBay declined steeply, while the unbranded payment volume was increasing. But now we have more detailed results for the second time (management already reported these metrics in its Q4/23 presentation).

And when looking at the results, we actually see PayPal branded check-out still being responsible for almost one third of total revenue with total payment volume increasing in the mid-to-high single digits. But with growth rates being below average, the share of branded checkout is declining. High growth rates are especially stemming from Venmo und PSP (unbranded card processing). While Venmo (which is responsible for 17% of total TPV) is growing in the high single digits, unbranded card processing – mostly Braintree – is growing almost 30% YoY, and it is responsible for 37% of total TPV.

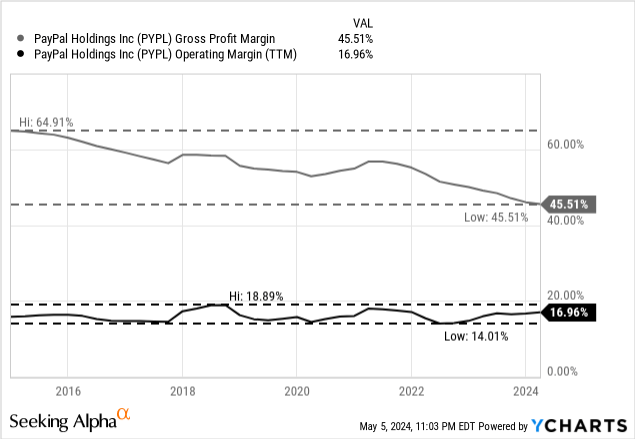

By the way, these numbers are also helpful to better understand the development of margins. And knowing that unbranded checkout is growing three to five times faster than branded checkout is also explaining the declining gross margin, as unbranded will not generate similar margins as branded. And with the mix shifting more and more, gross margins might decline further in the coming quarters.

Intrinsic Value Calculation

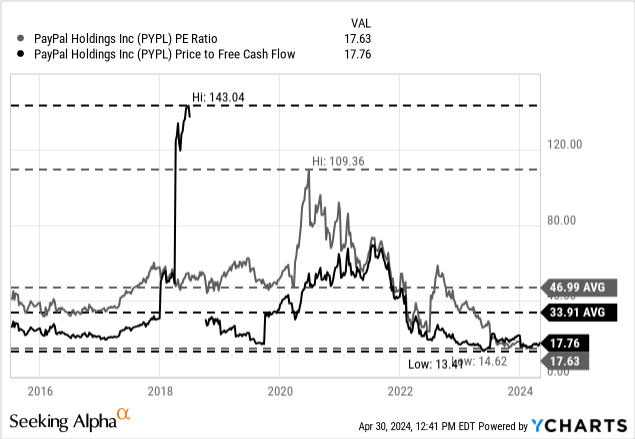

PayPal is continuing to report solid results and the stock is also continuing to be undervalued. Trading for 17 to 18 times earnings and free cash flow is not extremely cheap but does not seem justified for a business being able to grow at least in the mid-to-high single digits.

It is obvious – at least in retrospect for those not seeing it in 2021 – that PayPal was overvalued in the past and trading for unrealistic valuation multiples. But now we can point out that PayPal is clearly trading below its average P/FCF ratio (33.91 since IPO) and average P/E ratio (46.99 since IPO) and is undervalued.

Using only valuation multiples can make it a little difficult to come to a conclusion if a stock is actually fairly valued or not as it can’t take into account different growth rates, growth slowing down or cyclicality. A discount cash flow calculation is the much better choice in such a scenario. As basis for our calculation, we can take the free cash flow of the last four quarters, which was $5,410 million (the number is actually higher than in the last few years, but it is not unreasonable, and PayPal is a growing business). Additionally, we are calculating with 1,072 million outstanding shares and – as always – a 10% discount rate. For the years to come, let’s assume 6% growth from now till perpetuity. This leads to an intrinsic value of $126.17 for PayPal, and the stock therefore trading for about half its intrinsic value.

Realistic Growth Targets?

So far, we pointed out once again that PayPal is reporting solid results, and the stock remains deeply undervalued. But the question why the stock is still trading for a price that is hard to justify hasn’t been answered. One very simple and obvious reason would be false growth assumptions. If PayPal won’t be able to grow with the estimated 6% annually, the intrinsic value calculation is wrong, and a lower stock price is justified.

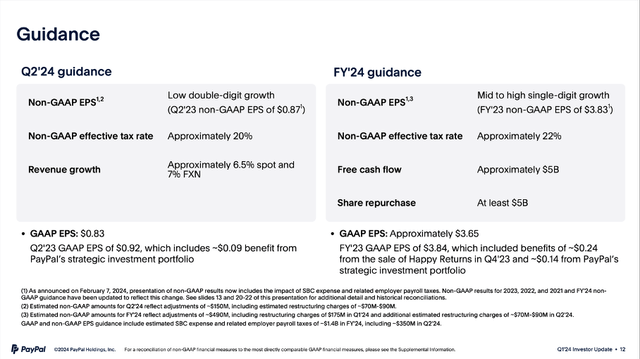

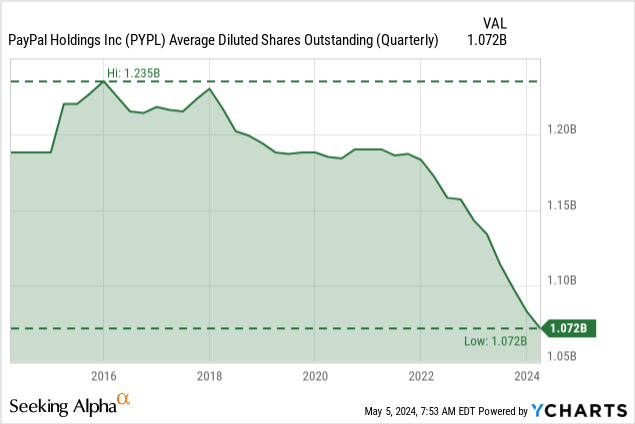

But in my opinion, we can not only justify 6% growth, we can even argue that these growth assumptions are probably too conservative. For starters, PayPal will continue to use its entire free cash flow in the coming quarters to buy back shares. According to the company’s guidance for fiscal 2024, PayPal will use at least $5 billion to repurchase shares. In fiscal 2023, the company spent $5,259 million on share buybacks, in fiscal 2022 about $4.5 billion and in fiscal 2021 about $4.4 billion.

Since 2016, the company reduced the number of outstanding shares with a CAGR of 1.75%. In the last three years, PayPal could even lower the number of outstanding shares with a CAGR of 3.34%, which seems like a good decision as the stock price has constantly been declining making share buybacks a good capital allocation tool. And when taking the current market capitalization of $69 billion and at least $5 billion spent on share repurchases, PayPal could repurchase more than 7% of its outstanding shares.

Therefore, share buybacks seem enough to lead to 6% bottom line growth (at least at current share prices). But such an argument is rather tricky as it always depends on the stock price and if sentiment should change and PayPal is suddenly trading for $150 or $200, the number of shares that can be repurchased would be much lower. But at this point, using the entire free cash flow for share buybacks seems like the best use of cash and a clever decision by management.

The Need For A Catalyst

At this point, we still must ask ourselves: If PayPal is so clearly undervalued, why is the stock not moving higher and towards an intrinsic value. At this point, you can certainly criticize me for writing quarter after quarter that PayPal is undervalued and a great investment, but the stock is not really moving higher.

In a recent article about McKesson (MCK), I pointed out the important role sentiment is playing when investing in the stock market. In this article, I talked about Meta Platforms (META) and McKesson on the one side and companies like PayPal or Alibaba (BABA) on the other side and in the article I wrote:

All four companies have in common that they were trading at extremely low valuation multiples (low double digits or even single digits). Aside from trading for extremely low valuation multiples, all four are also companies growing at a solid (or rather high) pace. Of course, all struggled a bit when the stock price declined.

And I continued:

One of the interesting questions now is: What drove the stock price of Meta Platforms and McKesson higher, and why are Alibaba and PayPal still struggling. The answer (in my opinion): sentiment. In the case of Meta Platforms and McKesson, sentiment among investors changed. And it probably needs a clear sign for investor sentiment to change. It needs a clear sign that growth rates are accelerating again or positive narratives surrounding the company, which make investors more confident again.

If a company is just continuing to perform in a similar way as before (for example with similar growth rates), the stock will remain undervalued, and we won’t see any sentiment change. Undervaluation alone is probably not enough to drive a stock price higher – the stock might move a little bit higher but will remain deeply undervalued. It needs some kind of catalyst for investor sentiment to change.

Being undervalued is not enough for a stock to really move higher. We need a catalyst or a clear reason for sentiment to change and as long as investors don’t see a reason to get more optimistic the stock won’t rise. In the short run (quarters or a few years) fundamentals don’t move the stock price, the biggest impact stems from sentiment. And as long as the stock is just remaining undervalued (an information investors already had before), the stock price won’t move as sentiment won’t really change. The reasons (or narratives) for a declining stock price need to be addressed.

In an article about PayPal published last year I talked about two major issues I see for PayPal and two problems that could be part of the reason for the bearish sentiment – the declining margins as well as the declining number of active accounts.

Declining Margins

I already mentioned declining margins above, and we see that the shift to unbranded checkout can explain declining margins – at least to some degree. But let’s be honest, we already knew in the previous quarters that margins are probably declining due to the shift towards unbranded check-out.

And while the gross margin is still declining, the operating margin is improving again in the last few quarters. Overall, operating margin can be seen as stable since 2015 with only small fluctuations and this is actually a good sign.

In my opinion, stabilizing gross margins or clearly improving operating margins could be a catalyst for higher stock prices – and when put into the appropriate narratives, it could change sentiment and ultimately lead to higher stock prices.

Declining Accounts

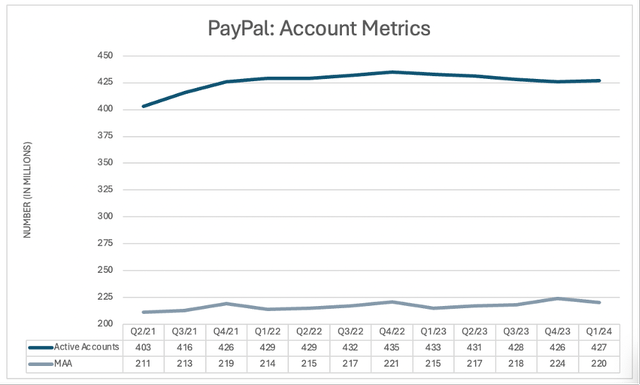

A second problem identified in the article was the declining number of accounts. Or to be more accurate: the number of accounts did not really decline – it rather stagnated, but that was already perceived as terrible sign for a business growing with higher rates before.

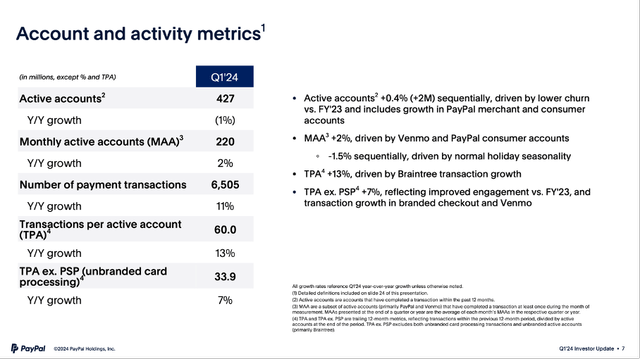

When looking at the number of active accounts we actually see a small improvement – compared to 426 million in Q4/23 we now have 427 million active accounts in Q1/24. This can be seen as slight slimmer of hope but is probably not enough (especially as we could talk only about a few thousand accounts). However, I already pointed out in my last article that the monthly active accounts (MAA) are probably the better metric to look at. And here we see a constant increase over the last few years. In Q1/24, the MAA increased from 215 million in the same quarter last year to 220 million this quarter – resulting in 2.3% year-over-year growth. Of course, these are rather moderate growth rates, but growth nevertheless.

Aside from the number of active accounts, the number of total payment transactions is still increasing with a healthy pace as the number of transactions per active account is still increasing. The number of payment transactions increased from 5,835 million in the same quarter last year to 6,505 million this quarter – resulting in 11.5% YoY growth. And payment transactions per active accounts increased 13.0% YoY from 53.1 in the same quarter last year to 60.0 this quarter.

I don’t think PayPal’s overall market is already saturated and in my opinion the number of active accounts can increase again, which might also lead to narratives with the potential to change sentiment and lead the stock price higher.

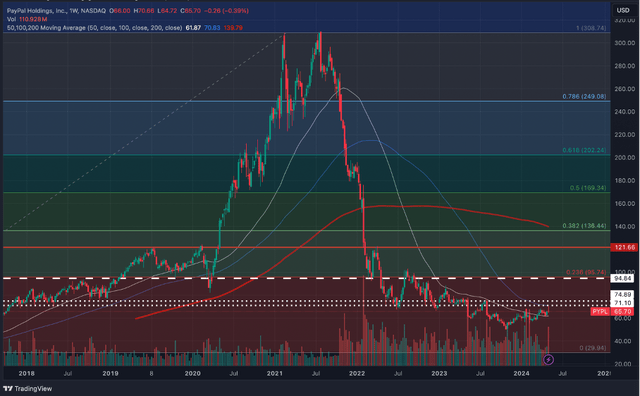

Technical Picture

And finally, the chart is telling us that PayPal is still not a stock to be bullish about – at least from a technical point of view. When looking at the chart in the last two weeks, we saw how PayPal bounced back from the resistance level between $70 and $75 and so far, the stock does not seem able to move higher.

PayPal Chart With Support and Resistance Levels (TradingView)

At least when looking at the chart, there is not much reason for optimism. PayPal is still clearly in a downtrend and every upward wave only turns out to be a correction of the previous downward wave and is followed by another downward wave. The next steps for PayPal are the jump above $75 but to be honest before the stock price does not climb above $100 (the previous high) the stock remains in a downtrend and it is difficult to get really optimistic.

Conclusion

Basically, the situation is the same as three months earlier. PayPal is still performing well and growing with a solid pace. Additionally, the stock is clearly trading below its intrinsic value and is a clear “Buy” from a fundamental point of view.

However, the sentiment surrounding PayPal is still negative and without some catalyst changing the sentiment surrounding the business and stock, it could take several more quarters before PayPal will move higher. But as a long-term investment, PayPal is a clear “Buy” and I can’t image PayPal not trading for a much higher price in 10 years from now.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BABA, META, PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.