Summary:

- PayPal reported a decent quarter related to Q4 2022, while its guidance for 2023 was more upbeat.

- Top-line growth remains resilient despite slowing customer acquisition, showing that its diversification strategy is bearing fruit.

- Cost cutting measures should lead to higher earnings, something that is not reflected in its valuation.

JasonDoiy

PayPal (NASDAQ:PYPL) is reporting improved operating trends after a difficult year, but its valuation is still quite depressed creating an interesting buying opportunity for long-term investors.

As I’ve covered in previous articles, I’m bullish on PayPal over the long term, as I see the company as one of the best investments in the secular growth theme of digital payments. PayPal is a leading company in its industry, enjoying some competitive advantages over its peers that aren’t easy to challenge, which makes it likely to be a leading company in the digital payments industry for many years to come.

As I’ve recently covered, I think PayPal’s current valuation is clearly undemanding for a company with its business profile, a situation that hasn’t changed following its most recent earnings announcement.

Earnings Analysis – Q4 2022

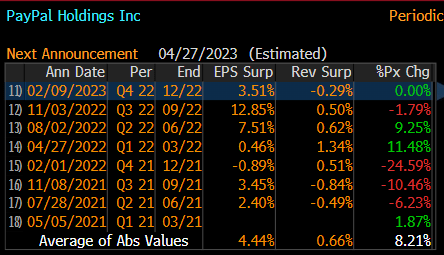

PayPal announced yesterday its financial figures related to Q4 and full year 2022, which were mixed compared to market expectations. As shown in the next graph, while its EPS was 3.5% above street estimates, its revenue was slightly below expectations. Moreover, its earnings surprise beat was smaller than its historical beat over the past few quarters, which means Q4 results aren’t likely to have a great impact on its share price.

Earnings surprise (Bloomberg)

In the last quarter of 2022, volume slowed more than expected, being another sign that consumer spending is slowing down due to macroeconomic headwinds even during a usually busy period. Total payment volume was $357 billion in Q4 (+9% YoY), but was below expectations of $365 billion. This was the main reason for PayPal not being able to beat top-line expectations, with revenue coming in in-line with estimates at $7.83 billion in the quarter.

At the end of 2022, its total active accounts were 435 million, a small increase of only 2% YoY, of which about 35 million were merchant accounts. This is the smallest net new accounts gain over the past few years, showing that the 2020-21 pandemic boom was temporary, and consumers shopping habits haven’t changed much following the pandemic.

Nevertheless, despite a slower customer acquisition in recent quarters than compared to its historical trend, PayPal’s customer engagement has improved, given that total payment volume and transactions growth have been much stronger than customer growth in recent quarters. This is a positive factor for revenue growth, as PayPal’s existing customer base is using the platform more frequently, supported by its strategy to enlarge its product and services offering.

Indeed, while PayPal only increased its net new accounts by 8.6 million during the past year, its total payment volume increased 9% YoY to $1.36 trillion, which is a good achievement during a challenging year for the company. Moreover, its total payment volume growth ex-eBay (EBAY) was 11% YoY, showing that eBay’s impact on PayPal’s top-line is now much smaller than it was in previous years.

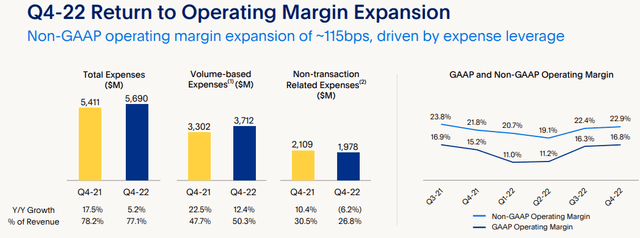

Regarding its costs, PayPal’s recent efforts to reduce administrative and staff expenses, plus other general expenses, led to a 6.2%YoY decline on non-transaction related expenses, while volume-based expenses increased by 12.4% YoY driven by higher funding costs. Total expenses amounted to nearly $5.7 billion in Q4 (+5.2% YoY), increasing at a smaller growth rate than revenue, and leading therefore to some margin recovery compared to the previous quarters.

These efforts to improve operating leverage are expected to continue in 2023, of which its plan to reduce headcount by some 7,000 (about 7% of its workforce) is expected to have a significant impact on PayPal’s operating margin in 2023. Indeed, according to PayPal, cost savings amounted to about $900 million in 2022, and it expects an additional $1.3 billion savings during 2023, which are key to achieving higher operating leverage in the coming quarters.

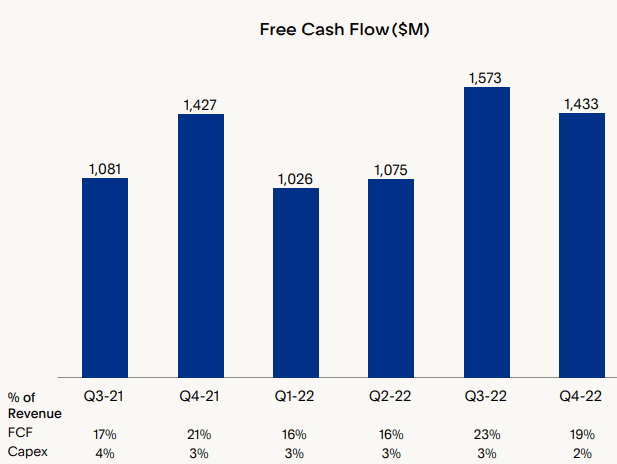

Its net profit in Q4 was $1.06 billion, a small increase compared to the same quarter of last year, while its free cash flow was $1.4 billion (19% of revenue), and practically flat year-on-year. For the full year, PayPal’s free cash flow was $5.1 billion, an increase of 4% YoY.

FCF (PayPal)

Regarding its balance sheet, it remains rock-solid given that at the end of 2022, PayPal had more than $15.9 billion in cash and cash equivalents, while its total short and long-term debt amounted to some $10.8 billion. Given that PayPal has a net cash position and a strong capacity to generate cash, it continues its strategy to return significant excess cash to shareholders.

In 2022, PayPal repurchased some $4.2 billion of its own shares, which means share buybacks were above 80% of its annual free cash flow. This is a higher percentage of free cash flow allocated to share repurchases than in previous years, as the company did not perform sizable acquisitions during the prior year.

Going forward, PayPal is likely to maintain its strategy of using free cash flow and excess cash to perform acquisitions and share buybacks, while a dividend payment has not been announced so far. I think that starting a dividend payment would be positive step for PayPal’s stock, as it would increase the investor base to include income-oriented investors, as the company clearly has now a mature and highly-cash generative business that can sustainably distribute dividends to shareholders over the long term.

Regarding its guidance for 2023, it raised its expectations which is a positive sign that management sees higher growth ahead, after a difficult past year. It now expects non-GAAP EPS growth of 18% YoY, while previously expecting 15% growth, supported by higher operating margin (about 125 bps expansion expected) due to its cost cutting initiatives. Its free cash flow should be about $5 billion, and it expects to use some 75% of free cash flow to perform share buybacks. For Q1, it expects net revenue growth of 9% YoY and a non-GAAP operating margin of about 23%.

Going forward, PayPal’s growth strategy should continue to be focused on user growth and increased engagement, through new services like Buy Now Pay Later, crypto, or contactless in-store payment capabilities. Its expanded product and services offerings are also expected to boost PayPal’s total addressable market, thus PayPal’s structural growth prospects remain quite good despite some slowdown reported over the past few quarters.

Estimates & Valuation

PayPal’s recent growth has clearly decelerated compared to its historical trend, but its long-term growth prospects remain strong supported by its good business fundamentals. Indeed, according to analysts’ estimates, PayPal’s revenue should grow to about $36.2 billion by 2025, which represents a compounded annual growth rate (CAGR) of 9.6% over the next three years, which is clearly slower than its IPO in 2015, but still a good growth rate for a relatively large company like PayPal. Its net profit is expected to be above $5.4 billion by 2025, which seems somewhat conservative given that it represents a net profit margin of only 14.9% (vs. 16.4% in 2021 and 8.8% in 2022).

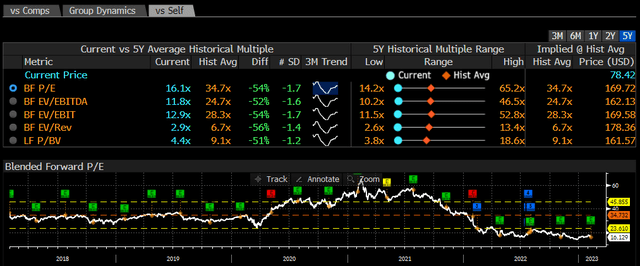

Regarding its valuation, like many growth stocks, PayPal has severely de-rated from its peak valuation achieved during 2021, when it was trading at more than 60x forward earnings. As shown in the next graph, its shares are currently trading at some 16.4x forward earnings, at a steep discount compared to its historical average over the past five years (about 34x).

This valuation is quite low and close to the bottom of the past five years, despite improving performance over the past couple of quarters and upgraded guidance related to next year. While PayPal’s growth is not likely to return to historical levels in the next few years, this valuation seems to be undemanding for a leading company like PayPal, which means its shares are currently undervalued.

Conclusion

PayPal reported a decent quarter and is showing signs of improved operating momentum, after a difficult year that led to lower expectations. Its current depressed valuation is a sign that investors are still cautious about the company’s growth prospects ahead despite its improved performance recently, providing an attractive risk/reward proposition right now for long-term investors.

Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

If you are a long-term investor and want to be exposed to several secular growth trends, check out my marketplace service focused on different secular growth themes, namely: Digital Payments / FinTech, Semiconductors, 5G / IoT / Big Data, Electric Vehicles, and the Metaverse. If this is something that you may be interested in sign up today.