Summary:

- Rivian Automotive, Inc. is both undervalued and overvalued at the same time.

- Volatile names tend to provide higher options premium, especially around earnings, but risks exist.

- Buying Rivian at $15 may not be a bad deal, as I’ve explained below.

Mario Tama

I am generally a conservative investor, but I sometimes indulge in a bit of fun with some riskier bets. What is “risky” is for each investor to determine. For me, even a cash-secured put on a stock like Rivian Automotive, Inc. (NASDAQ:RIVN) is a bit risky, as the company is far from being profitable and the stock is extremely volatile. But a little bit of thrill/risk is recommended and perhaps even needed to stay disciplined for the long run. The key is to know your limits.

Rivian is reporting earnings after the market closes today (February 28), and the stock has been trading up, as Seeking Alpha has reported here. Rivian’s stock is a conundrum to me, as it appears both overvalued and undervalued at the same time. Arguments in favor of the overvalued thesis are straightforward, including but not limited to (a) having a market cap of $17 Billion with a trailing twelve months revenue of $1 Billion. That is, 17 times revenue. Are we back in 2021? And (b) the fact that the electric vehicle (“EV”) space is already getting too crowded.

Arguments in favor of the undervalued thesis are straightforward, too: (a) the fact that the EV space is still in its infancy and has growing support from the Government to reach 50% market share by 2030 (b) Rivian, despite arguably being the 2nd biggest EV name (in terms of brand awareness), sold just about 4% of what Tesla did in Q3 2022, which underscores the potential to chip away at the competitors.

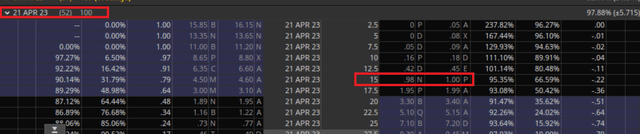

In short, both bulls and bears have their case. In such scenarios, I avoid going all in and play via options. More to the point in this case, I’ve placed a limit order ($1 premium) to sell Rivian puts at a strike price of $15, expiring April 21st. The put seller nets $100 per each contract (100 shares) for setting aside $1,500 to be able to buy Rivian shares at $15 should the price reach that or lower by the expiration date. This represents a return of 6.67% in less than two months. Not a bad return at all. The market assigns roughly a 70% probability that the stock will be trading above $15 at the time of expiration. If the option expires worthless, I retain the near 7% return. If I get assigned at $15, I am still comfortable with that, as explained below.

RIVN Options Chain (Think or Swim)

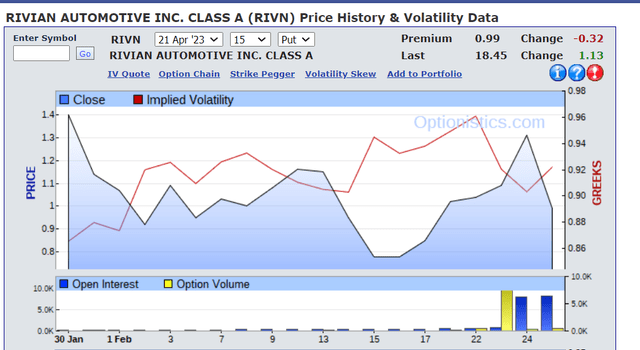

Generally, the put premium goes down as the stock price goes up and/or time decays. It is interesting that, in this case, the premium for the option chain I am considering has not gone down much in one month (chart below) despite the stock’s wild ride in the last one month, where it has seen a range of $17 to $21. In other words, this trade presents more bang for the buck (likely due to earnings report) right now as shown by the near 7% return in less than two months. However, there are risks with this trade.

Option History (optionistics.com)

Risks

- The first and most obvious risk is that Rivian is reporting earnings today, February 28th. Should the company disappoint on the numbers or, more importantly, on production ramp-up, the stock could easily breach $15 over the next few days.

- With inflation showing its strength again recently, it is widely expected that The Fed will be more aggressive with interest rate hikes. This means risk-on names like Rivian could face heavy selling pressure, with its beta of 2.29 indicating how wild the move could be compared to the general market.

- While Rivian’s stock has just taken out its 5-day moving average and is close to taking out its 20- and 50-day moving averages, it is more than 50% away from the all-important 200-day moving average. The upcoming earnings report will dictate where the new base for the stock will be, but for now, it is safe to assume that the stock has not found a floor yet.

Why $15?

- In the April 2023 chain I am considering, the rest of the strike prices and premium are either too close or less attractive. For example, using the $17.50 strike price expiring in April presents a 10% return, but the strike price is too close to the current stock price. On the other hand, the $12.50 strike price does not present an attractive premium. The $15 strike price at $1 presents a near 7% return on premium while being 20% away from the current share price.

- At $15, Rivian’s median price target will represent a double-bagger, which I believe presents a nice risk-reward for an undoubtedly riskier-than-average stock.

- This does not make a fundamental difference, but at $15, Rivian will be trading not just at 52-week lows but all-time lows. While the space is getting too crowded, Rivian has already established a niche for itself and should benefit from its early mover advantage as the market grows and mature. Trading at all-time lows may present a compelling enough story in this regard.

Conclusion

Rivian Automotive, Inc. has sometimes unfairly been combined with the likes of Affirm Holdings, Inc. (AFRM) and Zoom Video Communications, Inc. (ZM) as a company that made it to the big leagues just because of the low-interest rate policies and COVID. While Rivian Automotive, Inc. undoubtedly benefitted from macro conditions in 2021, it is operating in a space that clearly is the future.

However, the ride will be bumpy. As a long-term holder and follower of Tesla, Inc. (TSLA), I know this well. But I cannot help feeling the future of Rivian is going to be alright, as I see more and more R1S and R1T on the road, with some of my friends waiting for their deliveries well into 2024.

I sell puts to test the waters on stocks I may not mind owning but am wary of going all in with stock purchases directly. But please note that selling puts can be a risky business in bearish market conditions like the present. The capital set aside to sell this put is a small fraction of my overall portfolio, and the risk-reward appears favorable enough to be in both cases (expiring worthless or being assigned at $15) as explained above.

What do you think about Rivian as a company and a stock? Please leave your comments below.

Disclosure: I/we have a beneficial long position in the shares of TSLA, AFRM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am not yet long RIVN but I have a limit order to sell puts.