Summary:

- Rivian announces Q4 revenue miss but beats on bottom line.

- 2023 production forecast well short of expectations.

- Capital raise may be required by the middle of 2024.

Mario Tama

After the bell on Tuesday, we received fourth quarter results from Rivian (NASDAQ:RIVN), seen in this shareholder letter. The electric vehicle maker showed decent growth in its first major production year in 2022, but growing this upstart business came at a significant cost. Unfortunately for investors, guidance for this year was quite disappointing, meaning shares could retest their public trading low at some point this year.

For Q4, Rivian reported revenues of $663 million. This number was up dramatically in percentage terms, as the year ago period was still working off very low deliveries and revenue. Headlines will show that the company missed street estimates for $730 million in the period. I will note that since the company reported deliveries back in January, the analyst revenue estimate average had only come down by around $20 million or so, despite deliveries seeming to be quite a bit light. There could have been some stale revenue estimates in there that caused the miss to be larger than it could have been.

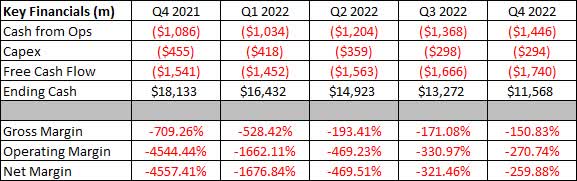

The problem for Rivian right now is that expenses are just too high. Even though revenues jumped by more than $125 million sequentially, the cost of goods sold rose even more. The company was forced to take more inventory charges and it saw a premium on materials in Q4 as well as expedited freight expenses. As the table below shows, the company’s gross margin percentage did actually improve because of the higher revenue base.

Rivian Key Financials (Company Earnings Reports)

However, Q4 gross margin dollars were a negative $1 billion, more than $80 million worse than Q3 2022. Operating expenses did come down a little sequentially, but not enough to keep the company’s operating loss from expanding to nearly $1.8 billion. The company’s non-GAAP per share loss of $1.73 did beat street estimates by more than 20 cents, but we’re still talking about major GAAP losses here that were over $1.7 billion dollars for the third straight quarter.

Luckily for Rivian, the company went public with a huge IPO that raised a lot of money. That has prevented further capital raises for now, but as seen above, over $6.4 billion was burned in 2022. Of that, more than $5 billion was from operating activities, primarily the net losses, with another $1.3 billion plus spent on capital expenditures. Capex is forecast to rise about 50% this year over 2022 levels, and those net losses aren’t exactly going away anytime soon. Thus, while there’s no bankruptcy risk here at the moment, it seems like more capital will be needed in the next two years.

The worst part of Tuesday’s report happened to be guidance. Management stated that production this year will be 50,000 vehicles. Unfortunately, the street was looking for more than 60,000, as analysts were also looking for total revenues to nearly triple to more than $5 billion. As detailed in the shareholder letter, there’s scheduled downtime in production this year to enhance products and production processes. The supply chain also was cited as a limiting factor. Rivian says that its gross margin dollar losses should decrease as it continues to ramp production, and expects to reach positive gross profits sometime next year. The adjusted EBITDA loss is expected to improve by about $900 million this year, but still come in well above $4 billion.

Rivian vehicles are not exactly cheap, going for around $80,000 each, which does limit the company’s market to some extent. The company does have a big financial backer in Amazon (AMZN), which also ordered 100,000 electric delivery vans from Rivian. The problem right now is that consumers are looking for more affordable electric vehicles, especially if it allows them to take advantage of large tax credits thanks to the Inflation Reduction Act.

Things for Rivian could get a bit more interesting on Wednesday when Tesla (TSLA) holds its Investor Day. If Tesla decides to announce a delivery van or some other new product lines, it could provide even more competition for Rivian. On the pickup truck side, there’s already competition from the likes of industry incumbents like Ford (F), which was looking to cross the 20,000 unit sale mark of it F-150 Lightning electric pickup this quarter.

In the after-hours session, Rivian shares were down about 8%, trading below $18. That means that they have lost about $10 since the company’s previous earnings report. Since then, the average analyst price target has come down further to $37 and change, which would seemingly imply tremendous upside. However, I think that average is going to drop, given the weaker than expected guidance, and let’s not forget that the street saw this name as worth around $140 when it went public. Now, we are less than $3 from a new low.

In the end, Rivian’s Q4 report on Tuesday was rather disappointing. The company’s revenues came in a bit light, even when considering some analyst estimates may have been a bit stale. While losses weren’t as bad as expected, the electric vehicle maker is still losing tons of money and burning significant amount of cash at these low production volumes. Management expects production this year to roughly double, but expectations called for a lot more growth, and gross margins aren’t expected to become positive this year.

As competition in the space only gets tougher and another capital raise is perhaps needed, I would be careful with shares in the near term. If the market does not hold up in the coming weeks with the Fed continuing to hike rates more than the street is looking for, Rivian shares could easily hit a new low. This company seems to have a nice growth plan lined up for its future, but it needs to execute better and perhaps have more affordable vehicles in the short term for shareholders to do well.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.