Summary:

- Rivian is facing strong competition in the EV segment as Tesla and other companies have announced big price cuts to attract customers.

- Rivian has cash reserves of $9.4 billion at the end of 2023 while it produced 57,000 cars in 2023.

- Higher cash reserves compared to current delivery volumes give Rivian flexibility for additional discounts, like they gave on Earth Day.

- The company is also cutting costs and improving supply chain, which should help it achieve positive gross profit by the end of the year.

- Rivian’s PS ratio is quite attractive considering the revenue base of the company and forward growth runway.

hapabapa

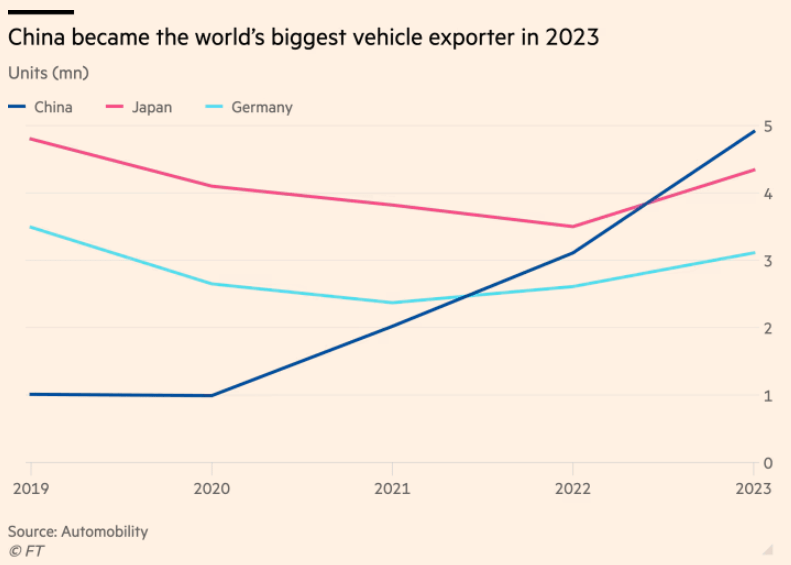

Rivian (NASDAQ:RIVN) along with the entire EV industry is going through a trial by fire. The next earnings will be reported on 7th May. The high-interest rate environment has already dented demand and at the same time, the supply of EV vehicles has increased significantly due to intense competition. The EV supply from China is also heating up, which has forced other automakers to give bigger discounts to retain customers. The European market is especially suffering from the rapid influx of Chinese auto brands. According to Financial Times, Chinese-made EVs will grab a staggering 25% of EV market in the European market this year.

Rivian has a few aces up its sleeves and a successful strategy can help improve the stock trajectory. It has recently announced massive layoffs, which should improve the gross margins. We should start seeing positive impact of these layoffs in the upcoming quarterly earnings. Rivian’s new R2 model has received good reviews and high booking order. The company is also focusing on improving profitability by building a better supply chain and finding cost reductions in production.

Rivian had over $9.4 billion in cash reserves at the end of 2023. This should allow the company enough wiggle room until the end of 2026. Rivian can also afford to give discounts on vehicles to improve short-term demand due to its lower delivery numbers. In 2023, it delivered close to 50,000 cars. If the company decides to give $10,000 additional discount for next 100,000 deliveries, it will increase the burn rate by $1 billion. With the current cash reserve of $9.4 billion, the company should be able to absorb these discounts. Rivian has already offered customers $5,000 discount on Earth Day if they trade select gas vehicles for R1T or R1S. Legacy automakers like Toyota, Ford, GM, and others cannot provide this level of discount as it will cost them tens of billions of dollars and will dramatically impact their profitability and ability to give dividends. The higher delivery volumes of legacy automakers make it difficult to cut prices significantly. Rivian has a good cash buffer and low delivery volumes, which allows the company to give these discounts in the next few quarters.

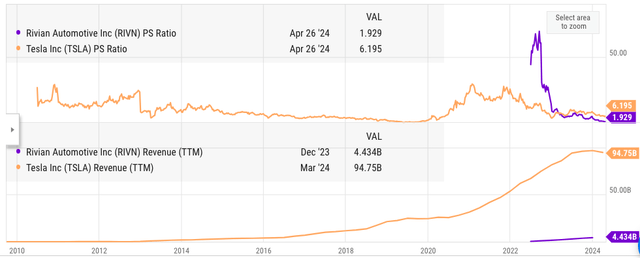

Tesla (TSLA) is the 800-pound gorilla for the EV industry. It has shown CAGR revenue growth of 50% in the past 10 years and intends to sell 20 million cars annually by 2030. This increase in production capacity will continue to be a major headwind for the EV industry. However, there is likely going to be more than one winner in the EV race. Rivian’s products have received good reviews, and it has a strong partnership with Amazon (AMZN). Rivian stock is trading at PS ratio of 1.9 compared to over 6 for Tesla, which shows that the valuation is reasonable if the company can deliver on margin improvement and revenue growth.

In the eye of the storm

The EV industry will face a tough situation for the next 2 to 3 years. While the vehicles are priced at a premium to combustion-engine equivalents, the supply has increased massively. The higher interest rates have also subdued demand for new cars. This is causing a mismatch in the demand-supply balance. On top of this, the Chinese automakers are able to launch very good products at lower costs. The lower labor costs and subsidies are helping the Chinese automakers grab a big chunk of the market share. It is difficult to see how this situation will be resolved, especially as geopolitical tensions are rising between China and Western countries.

Financial Times

Figure: Increase in vehicle exports from China. Source: Financial Times

China has already managed to build overwhelming dominance in several industries, such as solar panel manufacturing. It is highly likely that their market share will continue to rise over the next few quarters in the EV industry due to cost advantage within the region. The European auto industry has traditionally received strong backing from their governments, as they create massive jobs and contribute to the overall economic growth. However, there is already immense thought given to the possible tsunami of Chinese car imports heading to Europe in the near term.

The US market might be insulated for the short term, but we are already seeing steps taken by many Chinese automakers to find a route to US market. BYD plans a new electric vehicle plant in Mexico from where a majority of car imports reach the US market. BYD has also announced price cuts for its small hatchback called Seagull, which is now being sold for less than $10,000. While this car is not a direct threat to Rivian, there will be pricing headwinds for the entire EV industry.

Quarterly earnings can give greater clarity

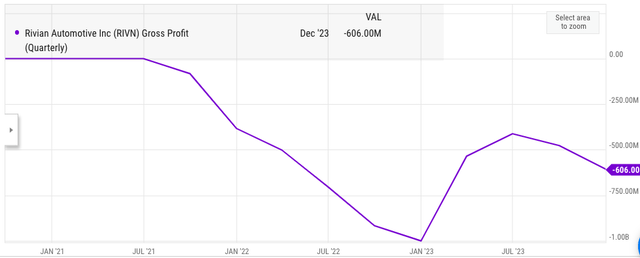

Rivian’s management had earlier announced that they would like to reach positive gross profit level by the end of 2024. This is a very important milestone for the company because if it reduces the cash burn rate, there would be greater optimism towards the long-term viability of the company. Rivian announced in February 2024 that they will be reducing their workforce by 10%. Another announcement a few days back mentioned another 1% cut in the workforce. These layoffs might start reflecting in the gross margin from the next quarter.

Figure: Rivian’s gross profit trajectory in the last few quarters. Source: Ycharts

The management will likely announce the impact of these layoffs in the upcoming quarterly earnings, which should improve the long-term margin projection for the company. Rivian has a number of advantages compared to legacy automakers and even Tesla, which should allow the company to navigate the current storm in the EV industry.

Advantages with Rivian

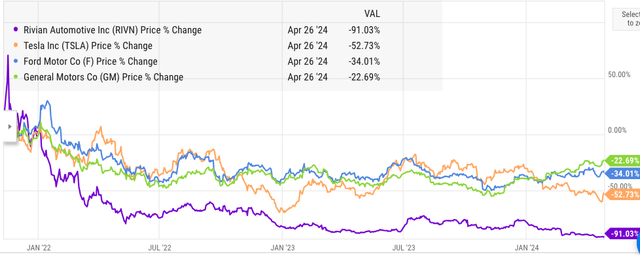

There has been significant correction in almost all auto stocks since the peak in 2021. Since its IPO, Rivian has lost 90% of its value. During the same time period, Tesla has lost close to 50%. Ford (F) and GM (GM) stock have also seen a price drop of 35% and 23% respectively since Rivian’s launch.

Figure: Price movement in Rivian since its launch. Source: Ycharts

Despite the challenges, Rivian has a few advantages that should help the company in the next few quarters. The company has $9.4 billion in cash reserves at the end of 2023. The cash reserves were $12 billion at the end of 2022. Hence, at the current burn rate, the company can easily survive till the end of 2026. The management has also promised to reach gross margin positive level by the end of 2024. This should reduce the burn rate of cash.

The total deliveries in 2023 were 50,000. Hence, Rivian could easily afford to give an additional $10,000 to $15,000 discount on purchases to customers for the short term in order to lift the demand. Even if Rivian decides to give $10,000 discount for the next 100,000 vehicles sold, it would cost the company an incremental $1 billion. There is enough cash buffer to absorb these losses. On the other hand, legacy auto players cannot afford to give this level of discount as their vehicle shipments are much larger, and they have less wiggle room on margins due to dividends. If legacy automakers were to give a similar price discount on all cars, it would cost them tens of billions of dollars, which is unlikely to happen.

Hedging against Tesla

An ideal hedge for Tesla stock would be in the EV industry. There are a few Chinese EV makers, but they suffer from geopolitical disadvantage. Legacy automakers like Ford and GM cannot be used for this purpose, as their EV ramp-up is taking longer than expected. Their revenue growth projections are also much lower than EV companies. Rivian stock can prove to be a good hedge against Tesla. While Tesla has a better product pipeline and stronger financials, it is also controlled by Musk and investors have to tolerate certain shenanigans from Tesla’s management. A couple of tweets from Musk can cause new headwinds for the stock and make it more volatile. Rivian’s management has shown greater restraint while also delivering good growth in key metrics.

Tesla also has had a roller coaster ride in the last few years. However, strong products and an improving supply chain have helped the company improve its revenue base and margins. Over the last ten years, the ttm revenue of Tesla increased from $2 billion to $96 billion, which equates to CAGR growth of 47%. Musk has announced that he would like a similar growth trajectory till 2030 by which time Tesla hopes to reach 20 million annual car sales. This is a tall order, but it will also cause overcapacity in the system and put pressure on other automakers.

Figure: PS ratio and revenue growth of Tesla and Rivian. Source: Ycharts

Rivian’s PS ratio is 1.9 while Tesla has a PS ratio of 6.2. When Tesla was showing a revenue base equal to Rivian’s $5 billion in 2016, the PS ratio was still high at 6. While Rivian does not get the attention similar to Tesla, it has good products and has a very strong backing from Amazon. Investors can look at Rivian stock as a hedge against Tesla and still gain the possible growth of investing in an EV stock. The stock price has reached very reasonable levels compared to during the IPO, and Rivian’s growth runway is also clearer.

Investor Takeaway

The entire EV industry will face headwinds in the next few quarters as they show overcapacity and moderate demand. This will force all the companies to give higher discounts to attract customers. Rivian has the cash buffer to give good discounts and its vehicle delivery rate is also quite low which allows bigger discounts. Even if the company gave $10,000 discount on every vehicle for next 100,000 deliveries, it would cost the company an incremental $1 billion in loss compared to $9.4 billion in cash reserves.

Wall Street is betting that the company can improve its deliveries, and it might give the company greater leeway in terms of margins compared to traditional automakers.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.