Summary:

- Royal Caribbean Cruises had strong Q2 on top and bottom lines, with company and analysts forecasting positive EPS growth for 2024.

- Company has lots of debt, however interest expense has declined and debt-to-equity better than key peers.

- Macro factors of travel demand will be a tailwind, though there is mixed sentiment over Fed interest rate decisions and recession potential.

- This sector is known to be prone to recessions and pandemics, but also fluctuations in consumer discretionary spending.

- Company began paying dividend again this month after several years of no dividends, a major plus for dividend investors.

Alan Morris

Bulls Chasing After Cruise Ships

As peak summer travel season winds down, I thought it would be fitting to cover the travel and tourism sector so in today’s article I’m exploring a stock I’ve never covered before, Royal Caribbean Cruises (NYSE:RCL).

To summarize from its SA profile, the Miami-based company operates worldwide and has 65 ships under brands like Royal Caribbean Intl, Celebrity Cruises, and Silversea Cruises.

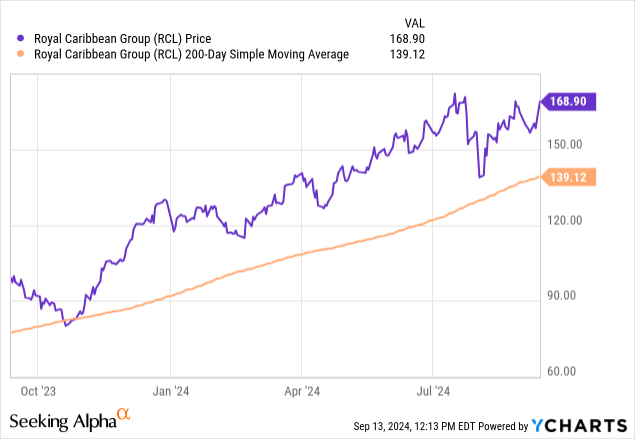

For starters, let’s see where this stock is today as of this article writing. It is trading about +21% above its 200-day simple moving average.

Further, momentum data on SA shows that RCL has been outperforming the S&P500 index for the entire year so far.

Along with the buy ratings from SA analysts and Wall Street, and the strong buy from the SA quant system, what this evidence tells me is that the market is very bullish on this stock.

Is it justified and does it still present a buy opportunity, hold, or time to sell off?

That’s what we’ll explore further. In the next section, let’s talk about the fact that this company is back to being a dividend payer after several years.

A Return to Dividend Payouts

Barron’s in their late July article reported:

Royal Caribbean is paying a quarterly dividend again. That leaves just a handful of companies that haven’t restarted shareholder payments after suspending dividends during the Covid-19 pandemic.

We can see from SA dividend data that the last time RCL paid one was March 2020, and now they’ll be paying out $0.40/share with an ex-date coming up soon on Sept. 20th.

That is certainly something to think about for dividend-income investors, and since the pandemic travel slowdown is a few years behind us we want to think about the future sustainability and potential dividend growth of this stock a year from now, so next we will talk about recent earnings performance and future potential.

Strong Earnings in Q2 & Future Growth Expected

From SA income statement data we can see the company achieved top-line revenue YoY growth in the quarter ending June, but also what appears to be significant YoY earnings growth on the bottom line, driving their basic EPS up to $3.32 from $1.79 a year prior in June 2023.

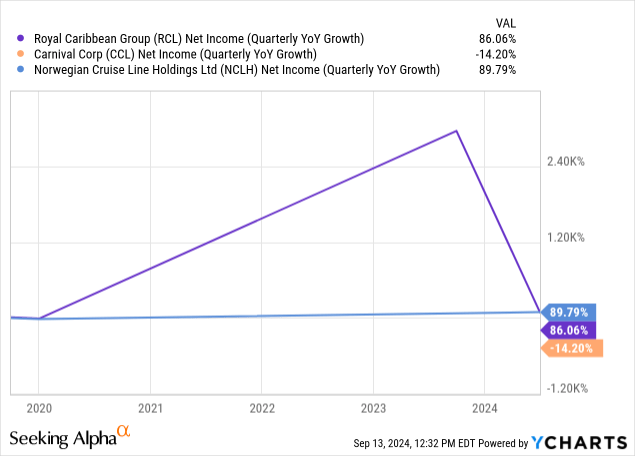

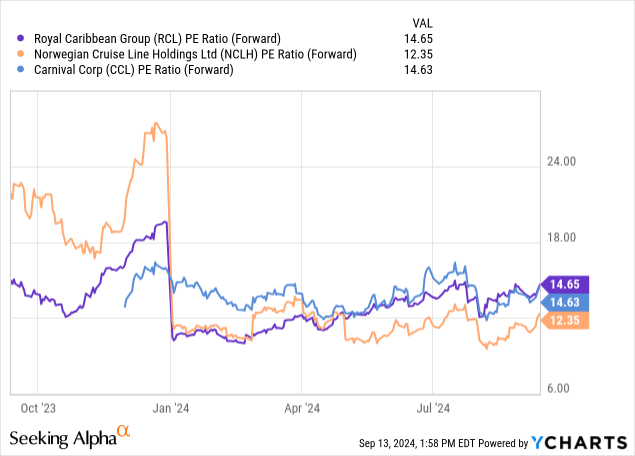

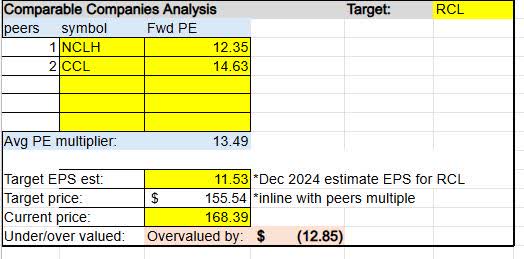

Fact is, this company does not have a lot of comparable peers (large cruise lines) trading on the US market, so I picked two key peers, Carnival (CCL) and Norwegian Cruise Line (NCLH). In fact, Wikipedia lists these three as the top three cruise companies.

What we can see is that RCL’s quarterly net income growth of 86% is in line with its peer Norwegian, while Carnival has lagged behind with a decline.

Here is what the company highlighted in their Q2 earnings release as performance drivers:

Strong demand for the company’s vacation experiences, including onboard spend, led to stronger revenue in the second quarter and a further improvement in yield and earnings expectations for the balance of the year.

Looking ahead, they also said “the company continues to be in a record booked position for 2024 sailings.”

Also looking ahead, on a positive note, the company’s infographic shows they have raised their 2024 EPS guidance:

RCL – guidance (RCL)

We also know that analyst estimates are calling a fiscal ending Dec. 2024 EPS of $11.53, a +70% YoY growth, with 19 upward revisions and 0 downward ones.

In order for me to justify these estimates, I am looking for evidence of continued demand growth for cruising, which will drive top-line revenue. That evidence of demand is certainly there right now.

For instance, Reuters wrote in a July article:

The global cruise industry expects to carry 10% more passengers by 2028 than the 31.7 million who took cruise holidays in 2023, when the sector surpassed pre-pandemic levels, but sees some routes exposed to protests over overtourism.

Further, a June study by J.P. Morgan said the following:

Looking ahead, J.P. Morgan Research estimates the cruise industry will capture ~3.8% of the $1.9T global vacation market by 2028.

While Baby Boomers once formed the core consumer base for the cruise industry, an increasing number of younger travelers and first-time passengers are now coming on board.

So, there is data showing cruise demand will continue. However, next let’s talk about some risks that could and have impacted the travel sector: the risk of a recession and further global pandemics, but also the role of AI.

The Macro Impact: Recessions, Pandemics, and AI.

What we know from the last few decades is that the travel sector can take a huge hit during recessions and pandemics when demand for travel drops.

According to a June 2021 study by Science Direct discussing the cruise industry:

This industry faced the Spanish, Asian, and Hong Kong flus of the 20th century. In the 21st century, the cruise industry has needed to cope with the consequences of the 2001 terrorist attacks on 9/11, the 2002 SARS epidemic, the 2008 global financial crisis, the H1N1 2009 Influenza pandemic, and the unprecedented worldwide COVID-19 crisis.

As far as recession risk, a senior investment strategy director for US Bank (USB), Rob Haworth, had the following to say on this topic a few days ago in the bank’s Sept. 4th article:

Modest, steady economic activity continues to be the path we appear to be on at this point, and there don’t seem to be signs of serious recession risk, says Haworth. Nevertheless, a big question that may drive the markets and the pace of Fed rate cuts is whether consumers can continue spending at a sufficient pace to keep the economy growing.

While those points may be good for the top-line at a cruise company, when it comes to earnings there is also the challenge of driving down costs and improving productivity, I think. There is evidence that artificial intelligence (AI) will have an impact in that regard.

In a June 2024 study by global consulting firm McKinsey & Co, the AI topic was addressed:

For travel companies, the task now is to rethink how they interact with customers, develop products and services, and manage operations in the age of AI. According to estimates by McKinsey Digital, companies that holistically address digital and analytics opportunities have the potential to see an earnings improvement of up to 25 percent.

So, what I gather from the above is that a cruise company like RCL could likely see continued strong consumer demand but also new opportunities presented by AI that could help the bottom line as well, which I think will drive investor confidence in buying more shares if future earnings come in strong.

On a micro level, next let’s talk about the risk of debt levels and liquidity at this company.

Liquidity & Cashflow Strength with Declining Interest Expenses

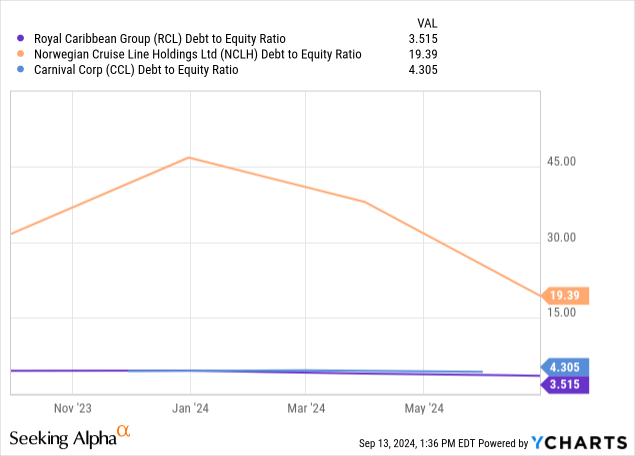

When it comes to debt-to-equity ratio, the good news for RCL is that it has the lowest ratio compared to its 2 peers, Norwegian and Carnival, as the YChart below shows:

Although the debt-to-equity is better than peers, with $19.4B of long-term debt on its balance sheet as of June 2024, my question as an analyst would be what the company’s strategy is to reduce it.

Here is what CFO Naftali Holtz said in the Q2 release:

Our accelerated performance and commitment to strengthening the balance sheet have allowed us to reduce both leverage and cost of capital, consistent with our goal of achieving investment grade metrics, and we continue to expect our leverage to be below 3.5x by year end. Our strong balance sheet allows us to expand capital allocation and reinstate a quarterly dividend, further supporting our goal of creating long-term shareholder value.

In terms of liquidity, the same Q2 release said:

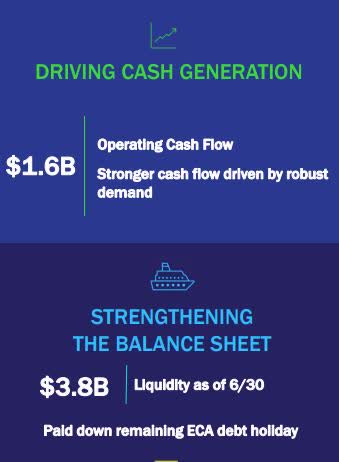

As of June 30, 2024, the Group’s liquidity position was $3.8 billion, which includes cash and cash equivalents and undrawn revolving credit facility capacity.

In addition, besides liquidity strength the firm boasted of $1.6B in operating cashflow, driven by demand strength:

RCL – operating cashflow (Q2 presentation)

Because having a company that operates huge cruise ships is obviously very capital-intensive, and can carry a lot of debt financing as we see in the data, my other question would be what impact this has to interest expenses since they can impact the net income.

The good news for RCL as we see in the income statement is there has been a downward trend in the interest expenses from its peak in the quarter ending Dec. 2022, having dropped to $298MM in the quarter ending Jun 2024:

In addition, if the Fed begins cutting its target rate and continues doing so into 2025, that could translate into lower interest rates across the board and for new debt that RCL has to take on in the future.

However, at this time there seems to be mixed sentiment on those rate cuts happening, with today’s CME FedWatch tracker showing just a 53% probability a rate cut will happen at the Fed’s Sept 18th meeting next week, while a few days ago it was over 80%.

Future debt costs are certainly something to consider with owning a company like this, and this sector overall.

Signs of Overvaluation are Expected

I see a mixed valuation picture: while the price-to-book (P/B) ratio is well above its overall sector average, the forward P/E ratio is below average compared to the overall sector.

Comparing, however, to the 2 key peers in the cruise industry I selected earlier, RCL’s forward P/E is mostly in line with them:

Plugging that data into my comparable companies analysis below, you can see that RCL comes in overvalued by nearly $13/share right now. A price in line with the peer average fwd P/E multiple would put it closer to $155.50/share.

RCL – comparable companies analysis (author spreadsheet)

I think what is driving the high premium on Royal Caribbean is a stellar Q2 performance and positive guidance from the company and analysts on future EPS, so it is not necessarily unjustified.

As a quick note, although the peers data in SA shows other comparables I could use, such as Hilton (HLT) and Marriott (MAR), personally I think cruise lines are such a unique subsector of travel that I would avoid comparing them to hotel companies which are not necessarily the same type of business, despite being in the overall tourism segment.

Impression: Hold On and Buy Next Dip

To bring this discussion back into port, in today’s research discussion we determined the following positive points about Royal Caribbean:

Strong Q2 on YoY top and bottom-line growth, both company and analysts are expecting positive future EPS guidance, signs of declining interest costs and lower debt-to-equity than some peers, strong liquidity and cashflow, and a return to paying dividends again which is great news for dividend investors. In addition, on a macro level, travel demand continues to grow since its pandemic-era low point while new AI-driven innovations could reduce costs.

Areas of concern to me are that this is a very debt-laden type of business and cost of interest still remains high, as well as being an industry very prone to impacts from recessions and pandemics, not to mention the seasonal swings in travel, and a mixed outlook when it comes to both a potential recession as well as Fed rate cuts.

Though being a cruise passenger may be fun, in my opinion being a cruise investor could be a different story, and for those reasons it would not be one of my favorite sectors to invest in on a longer-term basis.

At this time, my clinical impression is neutral so I will call it a hold, despite there being justification for the overvaluation I think if I were to hold a cruise stock long term I will wait for the next dip to pick up a few shares at a cheaper price and now that they are offering a dividend.

There was a nice price dip this summer, as you can see in the chart below, but I consider a fair price to be up to $155/share which would put it in line with the peer average fwd P/E multiple.

If there is an overall market dip that could drive this stock down to the $140-$155 range again, that spells a great dip buying opportunity, and then riding the rebound since the evidence shows this stock has lots of support from the bulls right now which will push the stock back up again when the market rebounds.

RCL – price dip (YCharts/SA)

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.