Summary:

- Salesforce is facing challenges to growing revenues in the current uncertain economic environment.

- However, its platform enables customers to develop and scale apps rapidly, while saving on costs as well as streamlining operations to become more efficient.

- The company is adopting a new sales approach together with cost-saving measures in order to boost profitability.

- Looking deeper, it is the re-platforming project that should be more beneficial to margins, while its platform investments are also capital-light.

- Despite all these strengths, I opt for caution and have a neutral position on the stock in view of the current challenges I evoke.

JHVEPhoto

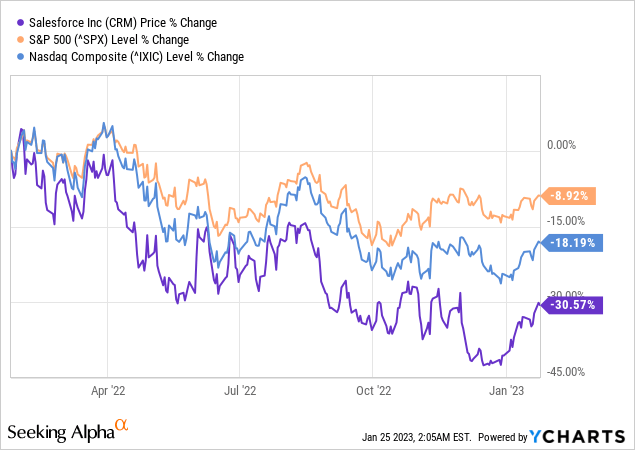

Whether it is the S&P 500 or the tech-heavy Nasdaq Composite, Salesforce (NYSE:CRM) has underperformed both by a large margin as seen by the deep blue chart below. However, the company has outperformed both of these indices by at least 8% on a year-to-date basis.

Part of the reason is that Bret Taylor who was the co-CEO for about one year left, causing a 5% drop in the share price. In these circumstances, job cuts together with activist investor Elliott Management accumulating a stake of one multibillion-dollar and also showing support for Marc Benioff, the other co-CEO are positives for the online CRM company.

However, the objective of this thesis is to go one step further and show that it is the company’s platform that symbolizes strength, both for margins and the way capital is spent. In this respect, I provide some insights into its platform strategy as well as how the acquisition of Slack, a company with an instant messaging program has helped.

The Platform Narrative and Slack

Contrary to what most of us believe, Salesforce not only sells CRM or customer relationships management software but also its platform, in the form of platform-as-a-service. The reason is simply that when users log in through the portal to create marketing or customer relationship applications, it all implies they are also using Salesforce’s platform. More recently, low code object creator tools allow users to directly create apps from spreadsheets, where a lot of corporate data still resides.

This all means that users can themselves create automated workflows, which can process data rapidly (in real-time), for example, to streamline IT operations, thereby saving customers time and money. Moreover, by moving their data to the Salesforce platform, users do not have to invest in time-consuming software installations or provisioning of servers, which respectively suffer from higher expenses due to wage inflation and supply chain-led higher equipment costs.

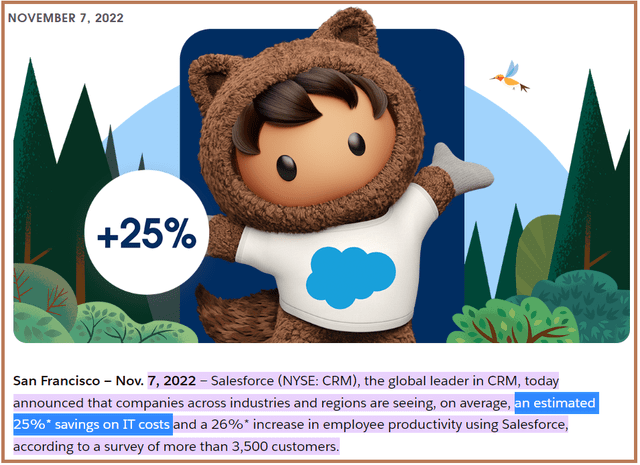

Thus, using Salesforce’s platform available on a ready-to-use basis can lower IT costs by 25% according to a study conducted in 2022, involving ten countries including the United States.

The 25% Cost Savings (www.salesforce.com)

This is significant and does not take into consideration potential savings when testing and deploying applications at scale as well as intangible benefits like customer satisfaction.

Now, the platform strategy helps to explain the acquisition of slack for $27.7 billion in 2021. This sounds like a colossal amount of money but considering that Salesforce makes use of the Slack instant messaging app helps to keep its customers within its cloud platform ecosystem, instead of having to share data through Zoom (ZM), Cisco’s (NASDAQ:CSCO) WebEx or Microsoft’s (NASDAQ:MSFT) Teams. There is also Slack’s analytics now integrated within salesforce to obtain actionable insights.

These data-driven insights are crucial for increasing employee efficiency in the current economy as corporations look for ways to cut costs and improve performance at the same time.

Challenges, Stock Volatility Risks, and the New Sales Approach

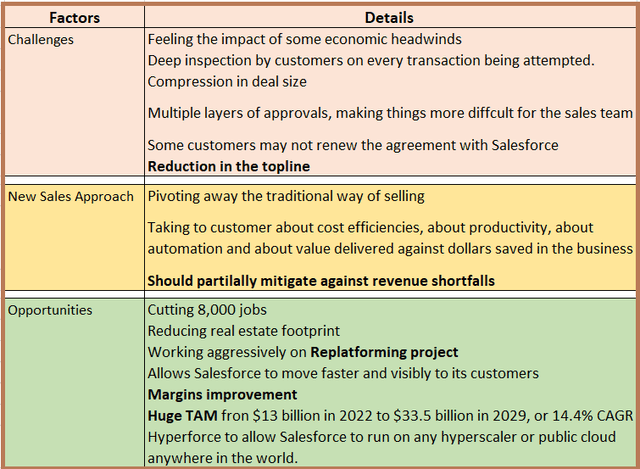

However, despite the appeal of its products to foster efficiency-at-a-lower TCO (total cost of ownership), an important requirement for a high-inflation business environment with lots of uncertainty, Salesforce has been facing challenges from the second quarter of fiscal 2023, which persisted in the third one. Hence, customers are asking more questions before committing funds to projects and deal sizes are also getting compressed and delayed by several layers of approval. Some major customers like Veeva (VEEV) have announced their intention not to renew their agreements that are due for renewal in 2025 as pictured below.

Table Built using data from (www.seekingalpha.com)

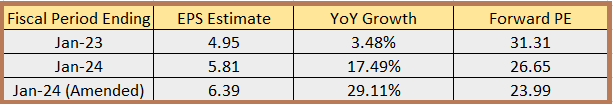

To address the issue, the company has adopted a new sales approach (as pictured above) and which should help it to somewhat mitigate the headwinds. Still, analysts are forecasting only 3.48% of YoY growth for fiscal 2023 which ended in January or the lowest in ten years.

This implies that Salesforce’s share price may be under pressure when financial results are announced at the beginning of February, as this is a company that has gained its reputation by constantly innovating and growing at double-digit figures.

However, there is also the bottom-line to consider.

Margin Improvement Opportunities, with Cost-Cutting and Re-Platforming

Prioritizing profitability, the company has announced job cuts and will fire around 10% of its workforce globally which is equivalent to around 8,000 jobs. It will also reduce its real estate footprint as a large portion remains underutilized. Together, these two measures should bring around $3 billion to $5 billion of savings whose mid-point represents less than 1% of the fiscal year’s 2022 overall sales of $26.5 billion.

However, this could just be the start as there could also be further cuts under the impetus of activist investors, but much more as part of the re-platforming project (above table).

In this case, the company is working towards “aggressively consolidating” the infrastructure part of these Salesforce acquisitions which are (at least partially) running on different platforms, into a single one. This exercise has a good chance of being rapidly executed as it is being led by Steve Fisher, who rejoined Salesforce from FD Technologies in July 2021 and was instrumental in building its initial platform and could result in significant gross margin gains as it should result in fewer infrastructure engineers to support operations.

Now, this type of project which involves merging several platforms fall under IT integration and according to the Gartner 2019 Business Application Integration Survey, it can improve associated revenue by 10% and financial postings or margins by 20%. Now, this survey may have been done four years ago, but, it is still relevant today, especially in view of higher labor costs.

Valuations and the Capital-Light Platform Investment

Adopting a more moderated stance since Salesforce’s platforms are already partially integrated and assuming margins gains of only 10% for the fiscal year 2024 ending in January next year, I obtain higher earnings per share of $6.39 (5.81×1.1) compared to the initial estimate of $5.81. Now, since earning is the denominator of the price-to-earnings multiple, this translates into a lower forward P/E of 23.99x (26.65 x 0.9).

Table Built using data from (www,seekingalpha.com)

This is less than Salesforce’s forward P/E (GAAP) of 24.46x, signifying that Salesforce may even be undervalued, but, this depends on the re-platforming project being brought to completion. To this end, this project would be put into question in case the company disposes of some of the previous acquisitions like Tableau, Slack, or Mulesoft, under pressure from activist investors.

However, this would not make much sense as they should be valued much less than the initial prices. Along the same lines, as seen with Athenahealth five years back and SAP SE (SAP) more recently, Elliott’s strategy is not necessarily to aggressively push for cost-cutting, but more to accelerate strategic actions that have already been planned, and, in extreme cases lobby for changes in the CEO position itself. Also, selling parts of Salesforce is not in shareholders’ interest as it would reduce its huge TAM or total addressable market, which is expected to increase from $13 billion in 2022 to $33.5 billion in 2029, or 14.4% CAGR.

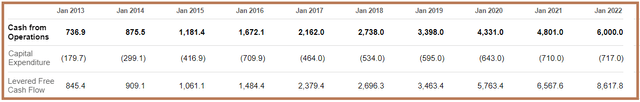

Furthermore, with a platform-based business that can run both in private data centers and on any public cloud anywhere in the world (through Hyperforce), the online CRM pioneer can rapidly make new functionalities available to users globally, and in an asset-light fashion. This is evidenced in the table below by the annual revenues increasing rapidly while Salesforce scaled up while consuming relatively less Capex. This in turn implies a high level of FCF as seen in the table below.

Table Built using data from (www.seekingalpha.com)

This means that the company has a financially sustainable business model which is appropriately positioned between enterprises supplying services and individuals or businesses demanding services and willing to pay for them.

Conclusion

Therefore, while there are challenges on the revenue growth front, Salesforce can increase margins through cost efficiencies and re-platforming. In this respect, the platform approach, which enables rapid deployment of apps or new functionalities without necessarily investing heavily in new IT infrastructures is also synonymous with a capital-light growth strategy for the company.

Moreover, activist investors’ interest in the CRM company is also positive, but, with business appetite no longer the same as in 2021-2022, expect volatility when financial results for the fourth quarter and full year are released in early February. Also, with its higher valuations with respect to the IT sector, the stock could suffer if the Fed continues to be aggressive prompting investors to turn to more value names. Finally, this is the reason why I have a neutral position on the stock despite platform strengths.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This is an investment thesis and is intended for informational purposes. Investors are kindly requested to do additional research before investing.