Should Investors Consider Paying The Apple Premium?

Summary:

- As yields continue to rise and Apple keeps trading at elevated multiples, it becomes increasingly questionable whether this premium is justified.

- We believe that Apple has not yet achieved mature growth and that years of top-line growth, margin expansion and market share lie ahead.

- A revaluation of risk premiums could negatively affect Apple’s current valuation and push the company more toward its historical average.

- While there may be better opportunities in the equity and bond markets, we still think Apple is a better choice versus staying overweight cash.

ozgurdonmaz/iStock Unreleased via Getty Images

Investment Thesis

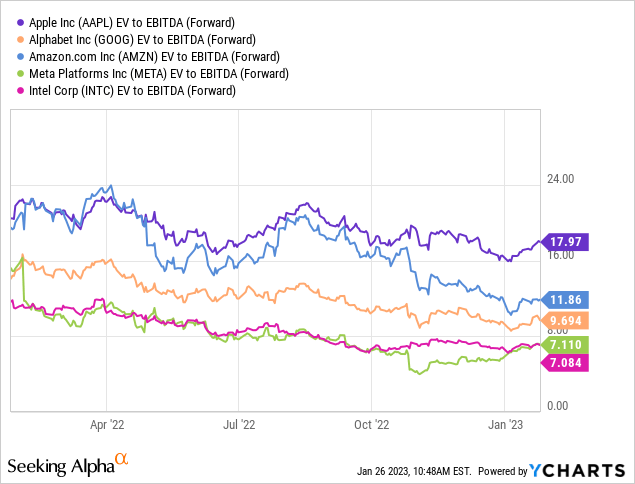

Apple (NASDAQ:AAPL) held up relatively well in 2022 last year, trading on par with the S&P 500 (SPY) for most of the year and outperforming the Nasdaq-100 (QQQ), unlike most other tech giants. Although it is the favorite stock of Warren Buffett’s Berkshire Hathaway (BRK.A) (BRK.B), it still seems to trade at a premium compared to the sector and its peers (and we’re not talking about their products).

Yes, Apple seems to stand out like a sore thumb, trading at a 17.97x forward EV/EBITDA ratio, making it one of the last FAANG companies standing. But even at these multiples, we will outline in this article why investors might justify “paying the Apple premium.” We will take a unique look at some determinants, such as:

- Overlooked fundamental parameters

- Margin of safety & longevity

- Macro risks & technological advances

- Valuation, DCF & yield spreads

The Evolution Hasn’t Finished Yet

The first crucial aspect of understanding Apple, and perhaps the most fundamental, is its huge moat. Even for a company worth $3T at its peak, it cannot be underestimated. A discounted cash flow model, even if we create one, cannot compensate for the qualitative aspect of the company.

As Warren Buffett says, a decision to buy a company could be made here by some math on the back of a napkin. Things like ecosystem or true long-term brand loyalty are almost impossible to quantify rationally. We only know that Apple will exist with a certain degree of trust for the next 5-10 years, which cannot be said of many companies in this environment.

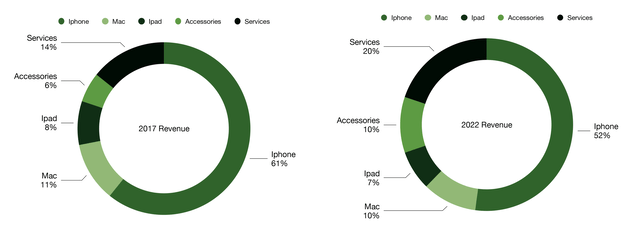

Over the past 5 years, between 2017 and 2022, we have also seen quite a shift in Apple’s revenues. In 2017, sales of iPhones dominated the product mix, accounting for 61% of total revenue. By 2022, that’s down to 52%, while services grew from 14% to a stunning 20%. This shift away from dependence on its iPhone sales is not only good in terms of diversification, but also from the perspective of gross margin leverage.

We expect this positive shift to continue for the next 5-10 years.

Author’s Visuals (SEC Data)

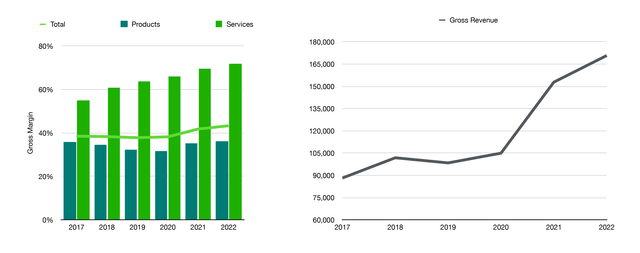

Many analysts therefore like to point to Apple’s dependence on sales of iPhones, but sometimes forget to consider that this is not the category with the highest margins either. The average margin in 2022 for products is 36.3%, while services are 71.7%.

The shift away from product-based revenue is itself already contributing to higher margins, while we like to point out that Apple actually has double leverage on its gross margin. Because when Apple shifts to service-based revenue, it simultaneously increases its gross margin in that service category, providing double leverage. In a sense, it has always been relatively easy to predict natural demand for iPhones based on historical trends and hardware adoption rates.

Yet, those analysts also often fall into the trap of underestimating the type and amount of new innovative products Apple brings to market and the level of adoption within the ecosystem itself. The idea that “Apple can’t keep growing like this” has been around for more than 10 years, and yet the company has managed to more than double revenues since then.

AirPods didn’t exist before 2016 and became a $20BN+ market in a fraction of the time. From just 1 addition to the ecosystem.

Author’s Visuals (SEC Data)

As a pragmatic business thought experiment, imagine you were a stock analyst throughout Apple’s history since the 1980s. In the 1990s, no analyst would have predicted or counted the massive success of the iPod in 2001, by Apple, which was considered a PC manufacturer. Similarly, those analysts would never have predicted the massive success of the iPhone in 2007, becoming the company’s main engine.

Therefore, looking 10 years into the future at Apple, we must rationalize that it is quite possible that the business model has changed so much, that iPhones become a smaller part of the revenue streams, like PCs/Macs throughout history. The “next big thing” may already be around the corner somewhere, without us realizing it.

Inflation & Price (In)Elasticity

Another important point often overlooked is Apple’s price elasticity and high resistance to inflation. If we look at the base model of the iPhone, we see that in 2010 the price was only $199 for the base model, and $299 for the 32gb model. When the iPhone 4 was introduced, the 3G was even available for $99. Talk about inflation resistance.

Compared to before, the price for a base model 14, it is now $799. That amounts to a 25% price increase per year. It is almost like the story with Coca-Cola (KO): you are the original and leading brand, have a huge order volume and a product that is actually indispensable.

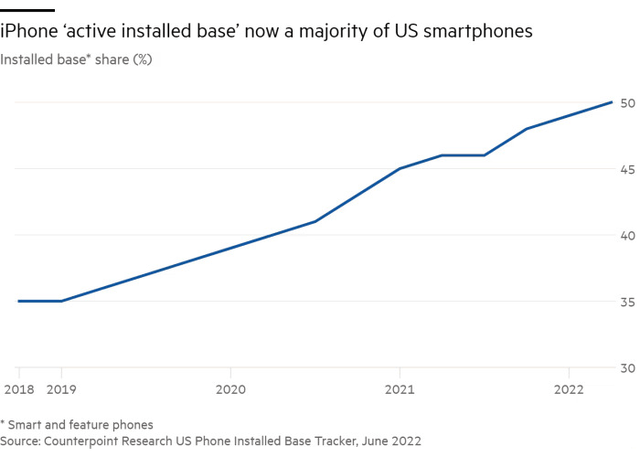

Counterpoint Research

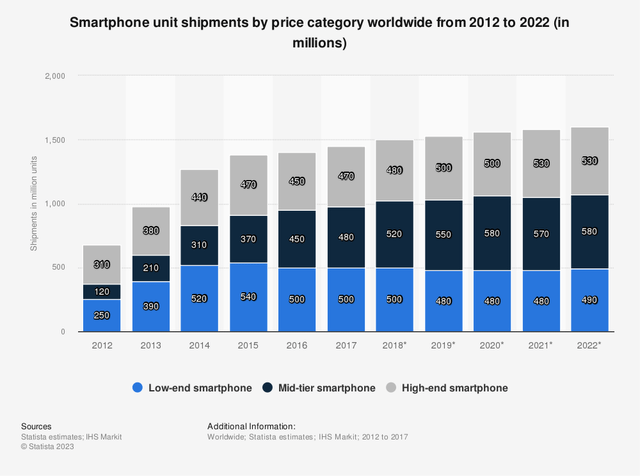

Another trend, which we definitely see, is the global transition to mid- and high-end smartphones as living standards continue to rise, especially in developing countries. In our opinion, there is still a lot of potential for Apple to gain market share and expand margins even further.

To the surprise of most people, the average global smartphone price is still only about $317. We think people would be surprised how many people would still buy an iPhone even if it cost, say, more than $3,000. The value added is exceptionally high and will only increase as Apple adds more features, such as implementing AI.

If you really looked at the value of an iPhone, you could think of it as a function of the time spent on the phone per year. The average hourly wage in the U.S. was about $29.32, according to the most recent data. People reportedly spend an average of 3 hours and 15 minutes a day on their phones.

So if you were to view the usefulness of an iPhone as a function of time rather than purchase price, you could argue that people spend $34,781 a year on their phones. A $1,000 phone may sound expensive to some, but if you compare it to how valuable time is, it’s still nothing compared to the utility people get from it.

Statista

This is also evident in the data, with Apple finally exceeding a huge benchmark, namely an active installed base of over 50% in the US alone. We see that over time, globally, the best OS will simply win, almost regardless of pricing. There are also still great opportunities in emerging markets:

We continue to perform incredibly well in emerging markets with very strong double-digit growth in India, Southeast Asia and Latin America. We set September quarter records for iPhone revenue in the vast majority of markets we track, and our performance was particularly impressive in several large emerging markets, with India setting a new all-time revenue record and Thailand, Vietnam, Indonesia and Mexico more than doubling year-over-year. (Q4 Transcript)

And speaking of inelastic demand, unit costs work particularly well for Apple. With 240 million phones a year, and if they can add enough software value, each $100 price increase could generate an additional $24BN to the bottom line, if demand remains rather inelastic, as has been seen in the past.

Counterpoint Research

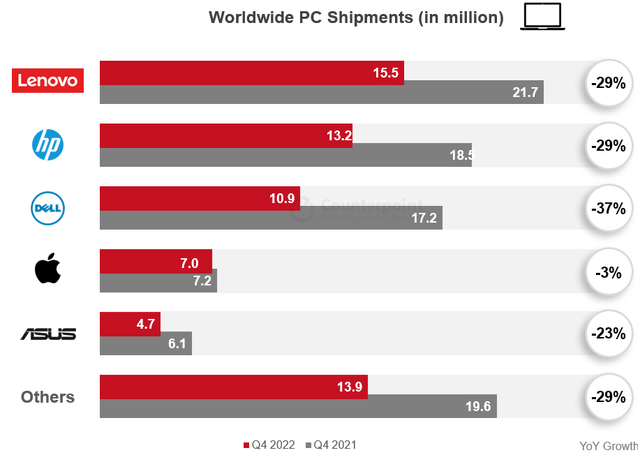

We also think Apple is not getting all that much credit for their part in the PC market anymore, as analysts often focus on iPhone sales, which make up most of their current revenue.

But like their iPhone sales, their PC/Mac sales are extremely resilient. All other major PC vendors already had a tough year in 2022, compared to 2021, except Apple, which saw only a slight consolidation in the segment. Or call it, the strength of Apple’s ecosystem.

Counterpoint Research

For innovation, Apple is usually not the first thing that pops into people’s minds when asked about AI. Certainly not at a time when impressive new models like ChatGPT, LaMDA (GOOG) (GOOGL) and AI with Amazon AWS (AMZN) are regularly hitting the market.

Apple’s strategy is a bit different, with device-driven AI. It is extremely focused on data security, which we believe will play the most critical role in the future with AI. Their new range of Macs with M1 and M2 chipsets is designed to accelerate machine learning, with their M1 chipset containing a 16.8% neural engine, which should prove extremely useful in the future.

The Valuation

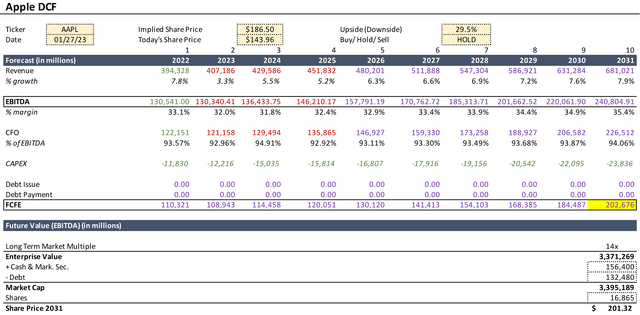

Our DCF will elaborate a bit on why we think Apple is near that buying range, but why we are still a bit wait-and-see at the moment and assign a hold rating. First, we have modeled that 2023 to 2025 will be some more difficult years as growth slows in almost all developed countries around the world and all monetary authorities tighten monetary policy sharply.

After 2025, we think Apple will return to high single-digit sales growth. The most important factor, which we have already discussed, we believe is margin expansion as Apple continues to move toward software-based revenues. We think EBITDA margins could be just over 35% by 2030, if not more.

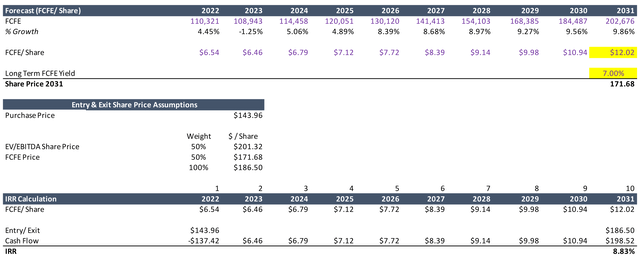

Author’s DCF

Cash flow from operating activities is in the same range, in our view, assuming average historical margins and with a trough to 2031. In terms of investments, we have taken into account higher investments from 2025, as we believe there may be risks related to geopolitical factors.

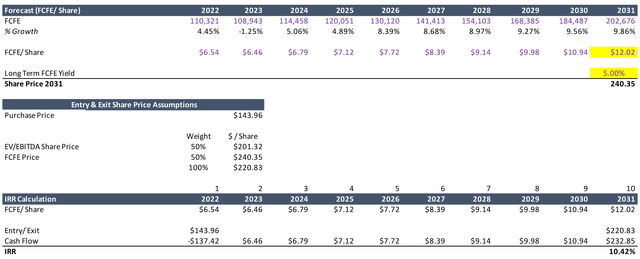

One of these could be the “reshoring” of production, or the relocation of production to another geography, which could lead to higher capital expenditures. Based on both FCFE and EV/EBITDA calculations, we believe Apple could yield a share price of $220.83 in 2031, or an IRR of 10.43%.

Author’s DCF

That sounds like a decent return and perhaps should get a buy rating. But that’s when we use an FCFE yield of 5% for the stock. If we used a higher yield, such as 7%, we would only get an IRR of 8.83% or a stock price of $186.50.

If the United States were to enter an era of higher yields, as the Fed expects, we think it would be best to remain cautious and perhaps look for an investment that provides a higher yield or take the risk-free rate.

Author’s DCF

A Story Of Yields

Finally, we believe that yields and risk-free interest rates, as well as the repricing of risk premiums, may play a crucial role in future equity investments. We refer to one of Buffett’s wise statements:

It’s insane to risk what you have for something you don’t need.

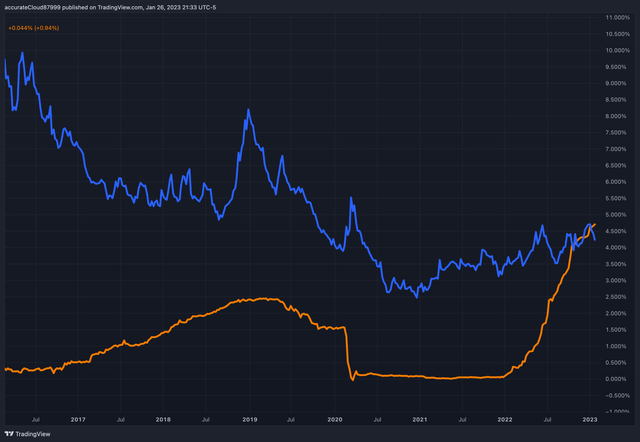

If we currently look at what the earnings yield on Apple stock is, compared to what the yield is on a risk-free government treasuries, it’s seemingly at a crossroad, and the spread between them has been as close as it’s ever been in recent history.

Looking at Apple’s combined earnings and dividend yield, currently at 4.88%, it is eerily close to the three-month Treasury bond yield, currently at 4.70%. That means Apple could still be worthwhile, although the risk should be justified by the growth.

And we think that unless you predict revenue growth of more than 10%, that premium may not be worth it at the moment and investors are better off playing it safe, averting a potential loss of principal and opting for short-term Treasury bonds until the uncertainties are removed.

Tradingview

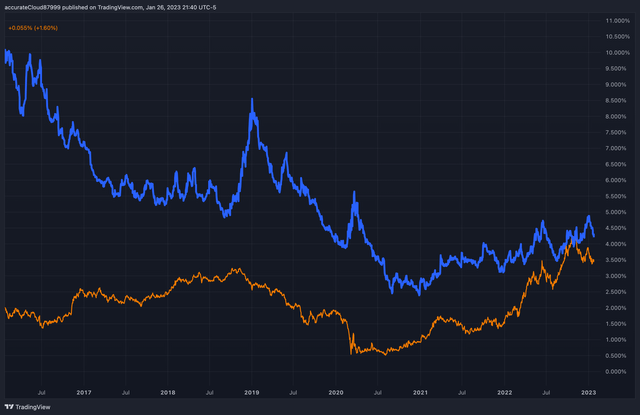

There is, of course, a possibility that Apple will fall in price enough to justify this as well. We believe that a spread premium of about 2% is justifiable in terms of risk. We think this is even more important if we look at it from a long-term perspective, where the 10-year yield seems dangerously close to Apple’s earnings yield.

If interest rates remain higher and the risk premium is revalued, we do not think Apple should be trading at a 23x forward P/E as it is now, as we saw the company trade below 10x P/E in 2014, for example, when we were even in a low interest rate environment with QE as a tailwind.

Tradingview

Sometimes it is just not yet warranted to take the excess risk. Especially if you value your sleep at night.

A bird in the hand, is worth two in the bush. (Aesop, 600 BC)

The Bottom Line

Is paying the Apple premium worth it? We think it is at least better than holding cash. On the other hand, we think there are better alternatives at the moment, as investors may have to start weighing taking the risk-free rate, and being sure of no principal loss by buying short-term treasuries.

Waiting for valuations to fall, or for interest rates to go lower, seems to be the idea here. On the other hand, it is no wonder that Apple is the favorite of Warren Buffett’s Berkshire Hathaway, because it is a solid company, with tremendous brand loyalty, that is likely to continue to generate revenue over the long term and is able to pass inflationary pressures onto its customers.

On a relative basis, however, we think Apple will remain at least a little more expensive than its competitors because we believe it offers tremendous security. Moreover, it has a history of good performance and good management, with growing profit margins. It also exercises great capital discipline, buying back its own shares en masse with excess cash.

It’s much better to buy a wonderful company at a fair price than a fair company at a wonderful price. Apple is getting close to that fair price, but in our opinion it is not there yet.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.