Summary:

- Snowflake Inc. is down 31% in 2024 due to slowing growth and leadership changes, but recent improvements in the chart picture suggest the stock has bottomed out.

- Snowflake’s sales trajectory remains strong with annual growth rates exceeding 30%, generating substantial free cash flow and raising product sales forecast.

- Despite challenges, Snowflake’s technical indicators are bullish, sales multiple is low compared to peers, and potential for re-rating to $230 intrinsic value.

pingingz

Snowflake Inc. (NYSE:SNOW) is down 31% in 2024 as the cloud-based data warehousing and analytics platform amid slowing growth and a changed in leadership earlier this year.

Snowflake’s Chief Executive Officer stepped down after leading the cloud company for five years and was replaced by another executive with artificial intelligence experience. These developments have led to growing selling pressure for Snowflake, but the chart picture has improved lately and it looks as if the stock has already bottomed out.

With investor sentiment improving and Snowflake generating substantial free cash flow from its data platform, I think that SNOW is poised to re-rate even higher.

Sales Trajectory And Free Cash Flow Upscaling

Snowflake is a data cloud vendor with a specialization in data warehousing, storage, analytics, scalability and integration. Snowflake’s customers can use the platform to store complex data in an encrypted way, analyze their data and integrate it with other business intelligence tools.

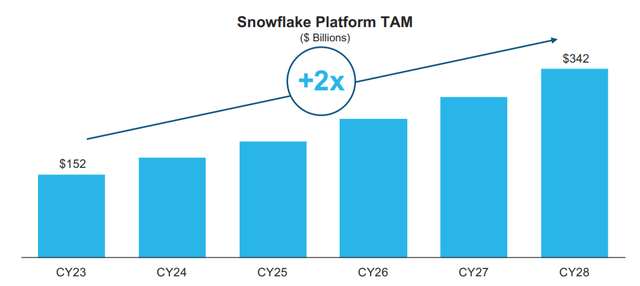

Snowflake has been quite successful in recent years and its present annual sales growth rates exceeds 30%. The market for Snowflake’s cloud computing platform is growing fast, creating a long-term monetization opportunity for the company.

Snowflake Platform TAM (Snowflake Inc)

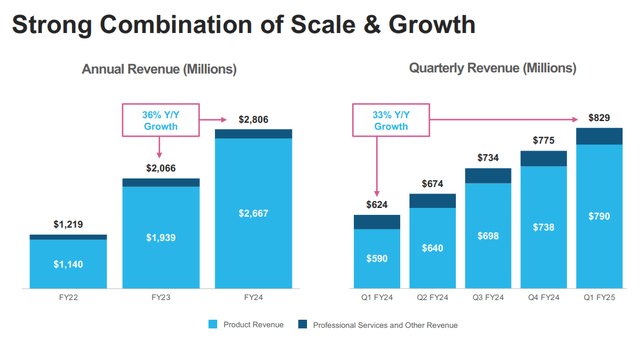

The data cloud platform produced 33% YoY sales growth in 1Q24 and generated product sales of $829 million, the highest amount Snowflake ever recorded. Though sales growth has fallen as of late and the company’s leadership changes have weighed on sentiment, Snowflake’s trajectory still looks rather good to me.

Strong Combination Of Scale & Growth (Snowflake Inc)

Though sales growth is slowing, Snowflake raised its product sales forecast from 22% to 24% and now anticipated to rake in $3.3 billion in sales this year. While this growth is down from the 38% realized growth rate last year, Snowflake is seeing encouraging cash flow upside.

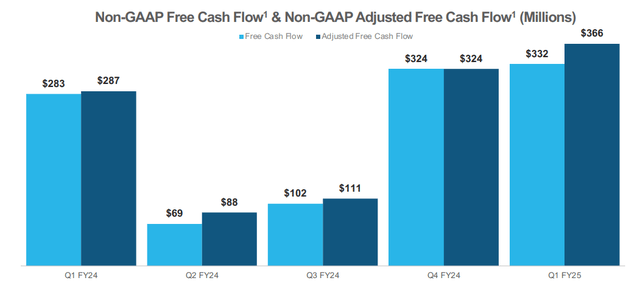

In 1Q24, Snowflake’s adjusted free cash flow totaled $366 million, reflecting a YoY growth rate of 38%, so free cash flow is growing at a slightly higher rate than the company’s product sales. The FCF-margin totaled a whopping 44% compared against a 46% FCF-margin last year.

Adjusted Free Cash Flow (Snowflake Inc)

Technical Analysis

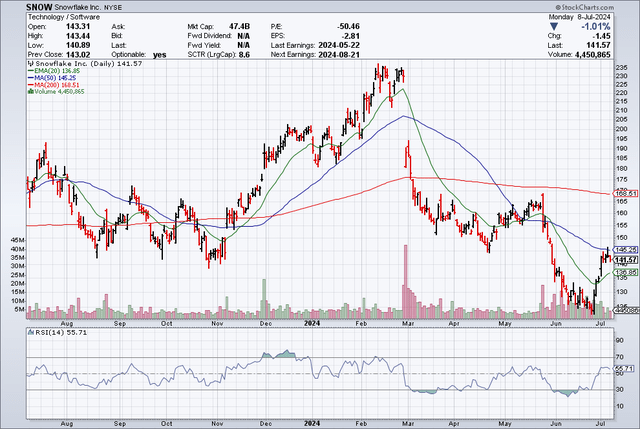

Snowflake’s chart deteriorated in quality in February when the data cloud company surprised the market with the announcement that its Chief Executive Officer would step down. The company did appoint a new executive with specific AI experience in his place, however, in order to steer the company towards an AI-centric future.

In May, sentiment further deteriorated when Snowflake reported weaker-than-anticipated earnings for the last quarter. With that said, though, the chart picture has turned noticeably more bullish as of late and Snowflake’s technical indicators are flashing bullish signals. For instance, Snowflake recaptured the 20-day moving average line in July and is about to re-test its 50-day moving average line.

If this test succeeds and Snowflake breaks through the 50-day moving average line, which presently runs at $145.25, Snowflake’s stock has immediate upside to $168.51 which is where the 200-day moving average sits.

Moving Averages (Stoc)

Snowflake’s Sales Multiple

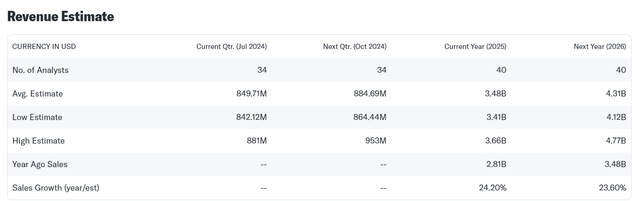

If you look at Snowflake’s price chart, there seems to be the perception that its growth is slowing down quite a bit, but this is not what the company’s earnings results tell and not what consensus sales estimates indicate. This year Snowflake has guided for 24% sales growth while the Street estimate for next year in anchored around the same rate. Snowflake is thus valued at a sales multiple of 10.9x.

For a fast growing cloud company, this is not a high multiple. Cloudflare Inc. (NET) is selling for 13.7x next year’s sales. CrowdStrike Holdings Inc. (CRWD) has a sales multiple of 18.8x and ServiceNow Inc. (NOW) is valued at 11.8x next year’s sales. All of these cloud computing companies are selling for much higher sales multiples and since Snowflake resolved its CEO succession issue, I anticipate for the stock to return to its February sales multiple of 18.0x which is where the stock sold for before the Chief Executive Officer issue started to seriously hurt Snowflake’s stock.

With an 18x sales multiple, based on next year’s estimates sales, Snowflake has an implied intrinsic value of $230. This, in my view, is a fair that would be more in tune with the higher sales multiples we see in the cloud data market and also account for the fact that Snowflake has moved on from its overhyped CEO replacement situation.

Revenue Estimate (Yahoo Finance)

Why The Investment Thesis Might Not Pan Out For Investors

Snowflake is growing its sales presently at slightly more than 30% per annum. The forecast for the financial year 2025 is bullish and the data company still anticipates to see 24% product sales growth. Though Snowflake is delivering tangible results in terms of its free cash flow, Snowflake is not making any money on a GAAP basis and investors are increasingly turning their attention to earnings.

Should Snowflake fail in steering its business towards GAAP profitability, if not operating income profitability, then a Snowflake re-rating might not happen after all.

My Conclusion

Snowflake is a high-growth cloud data company that is still growing quite fast and that has made a bit of headlines after the company lost its Chief Executive Officer. But things are not looking as dire as investors think and the stock appears to have already bottomed out.

The recapture of the 20-day moving average is a very bullish short-term signal and a retake of the 50-day moving average would brighten up Snowflake’s chart picture by a lot.

Snowflake raised its guidance for product sales from $3.25 billion to $3.30 billion in the last quarter which equates to 24% YoY growth (as opposed to 22% prior to earnings release). Though it is true that Snowflake as of now is not profitable on a GAAP basis, the company produces quite a bit of free cash flow.

Snowflake’s business overall appears to be in good shape and with the stock still selling substantially below the February $230 level, I think investors can capitalize on a potentially lucrative rebound opportunity. Buy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in SNOW over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.