Summary:

- Teladoc Health, Inc. has experienced a post-Covid hangover, with the shares losing more than 90% since peaking early in 2021.

- Despite the decline, the company is generating substantial free cash flow.

- Can Teladoc Health and its stock regain some traction in 2024? An analysis follows in the paragraphs below.

Solskin

Few businesses and stocks benefited more from the Covid Pandemic than did Teladoc Health, Inc. (NYSE:TDOC). Unfortunately, after peaking early in 2021, the shares have been largely in a freefall since, giving up over 90% of their peak value. However, the company is producing significant free cash flow. Can the shares start to turn around in 2024? An analysis follows below.

Obviously, Telehealth services don’t have the same buzz or growth drivers as they did during the pandemic, when a good portion of the country was afraid to go outside without a mask on and plenty of sanitizer on hand. In addition, numerous competitors have entered or expanded into this market since the coronavirus hit our shores four years ago.

However, Teladoc has built up a substantial membership base and is generating positive cash flow. The company’s primary business is providing telemedicine services, which it connects customers with doctors and healthcare professionals via video or phone. Approximately 90 million members can access these services. Teladoc Health also provides health care plans to companies and individuals. Let’s take a look at recent results.

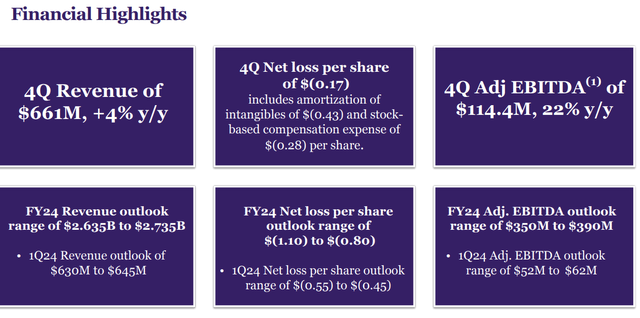

Teladoc Health posted its Q4 numbers on February 20th. The company delivered a GAAP loss of 17 cents a share, which was seven cents above the consensus. Revenues grew 3.6% on a year-over-year basis to $660.5 million, roughly $10 million light of expectations.

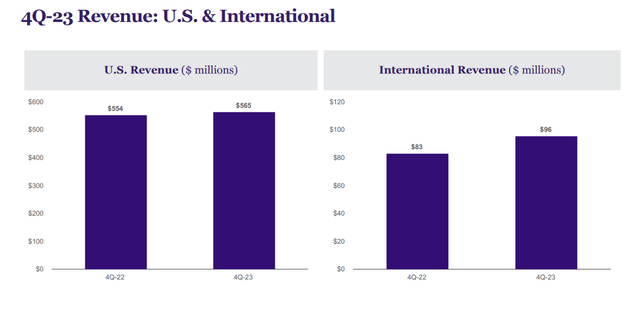

February 2024 Company Presentation

Revenues from access fees rose four percent from the same period a year ago to $573.9 million, while sales from other services grew three percent to $86.6 million. Adjusted EBITDA grew 22% over Q4 2022 to $114.4 million. International sales rose nicely during the quarter, but still make up a relatively paltry share of overall revenues.

February 2024 Company Presentation

In addition to revenue being lower than expected for the quarter, management disappointed investors with its initial guidance for FY2024. The company is projecting sales of $2.635 billion to $2.735 billion for this fiscal year. The consensus was expecting $2.77 billion in sales in FY2024 at the time. At its midpoint, that would be three percent growth over FY2023. Leadership also sees a net loss (GAAP) of 80 cents to $1.10 a share in FY2024. This would be an improvement from the $1.43 a share loss in FY2023. Management cited dwindling Covid cases, a challenging macroeconomic environment, and increasing competition for its tepid forward sales guidance.

Analyst Reaction:

Not surprisingly, Q4 results and FY2024 guidance were not received well by Wall Street. Since the news hit the wires, 10 analyst firms including Wells Fargo, Citigroup and Evercore ISI have reissued/assigned Hold/Neutral. Price targets proffered range from $17 to $21 a share. Oppenheimer ($26 price target) and Piper Sandler ($25 price target, down from $30 previously) maintained their Buy ratings on TDOC while Cantor Fitzgerald initiated the shares as a new Overweight with a $22 price target. The current analyst firm consensus has Teladoc losing $1.03 a share (GAAP) in FY2024 with losses narrowing to 70 cents a share in FY2025. Both years are projected to see low single-digit sales growth.

Nor have investors been kind to the equity since fourth quarter results cross the wires, taking the stock down some 25% in trading action since. Insiders have not stepped up to the plate and bought the dip in the shares. In fact, several insiders have sold just over $2.7 million worth of equity collectively since the company’s latest earnings report.

Balance Sheet & Cash Flow:

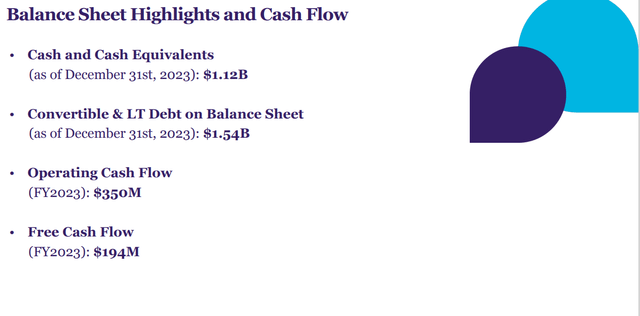

February 2024 Company Presentation

If there is a silver lining around the company at the moment, it is around its balance sheet and ability to produce cash flow. The company ended its fiscal 2023 with a bit over $1.1 billion in cash and marketable securities on its balance sheet. The company does have just under $1.54 billion in senior convertible debt on its ledger as well. Teladoc’s net interest expense for FY2023 was a bit over $22 million.

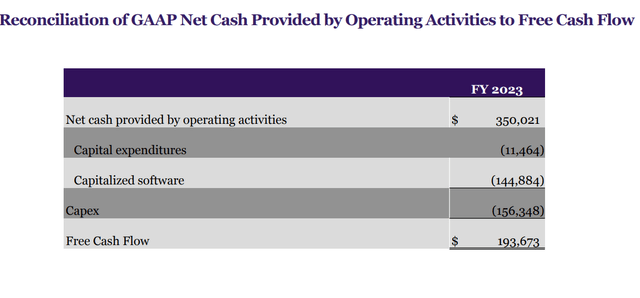

The most impressive part of the company’s 2023 story was it managed to produce nearly $195 million in free cash flow during the year. With a market cap of just over $2.5 billion, the equates to a free cash flow yield in the high single digits.

Management has guided to free cash flow of between $210 million to $240 million in FY2024, aided in part by actions it expects to save $85 million in annual run-rate costs. Leadership has stated it plans to use cash on hand and free cash flow to potentially do “tuck-in” acquisitions, potential stock buybacks and to pay down debt (Teladoc has a convertible bond due in 2025). The stock also sells for a bit less than one times revenues.

February 2024 Company Presentation

Conclusion:

Outside of Teladoc Health, Inc. free cash flow and balance sheet strength, it is hard to get too excited about this story given its tepid growth prospects. Outside of another pandemic or some unprofitable competitors exiting the market, it is hard to envision growth accelerating significantly in the foreseeable future. Therefore, it is best to remain on the Teladoc Health, Inc. stock sidelines on what is currently a busted growth story.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Live Chat on The Biotech Forum has been dominated by discussion of lucrative buy-write or covered call opportunities on selected biotech stocks over the past several months. To see what I and the other season biotech investors are targeting as trading ideas real-time, just join our community at The Biotech Forum by clicking HERE.