Summary:

- Teladoc’s sales growth rate has slowed down in recent years, but its aggressive cost reduction program has fueled growth in adjusted EBITDA.

- The BetterHelp segment, which offers online therapy services, has strong potential for growth and could be a catalyst for Teladoc’s future growth.

- Teladoc’s adjusted EBITDA has been increasing, but the company has not yet achieved net income profitability. However, its valuation has become more rational, making it a potential long-term investment.

Solskin

Teladoc Health (NYSE:TDOC) is a growing healthcare delivery platform that enjoyed a lot of hype during the pandemic when Covid-19 restrictions fueled the company’s delivery of remote healthcare services.

The company enjoyed fast sales growth in the initial stages of the pandemic, but in recent years, Teladoc’s sales growth rate has fallen back to the low single digits.

However, Teladoc has driven an aggressive cost reduction program that has fueled its adjusted EBITDA growth quite substantially. The 2024 outlook implies growing EBITDA and the mental-health segment BetterHelp could be a catalyst for growth this year as well as in the future.

My Previous Rating

Slowing business momentum after Covid-19 was a major threat to the company and led to the stock falling into a sustained down-channel.

With that being said, management counteracted its challenging sales situation by driving hard cost cuts and developing BetterHelp, a provider of online therapy services, which Teladoc acquired in 2015. This segment has considerable potential in the future, in my view, and could be a primary driver of growth moving forward.

Catalyst For Growth In A Challenged Market

Teladoc has suffered a seriously slowdown in its business that centered on its technology-enabled healthcare delivery platform. This platform took off big time during the pandemic when Covid-19 restrictions forced patients to seek alternative pathways to communicate with their doctors.

The post-Covid normalization in the healthcare industry, however, has caused a drastic slowdown in Teladoc’s sales growth.

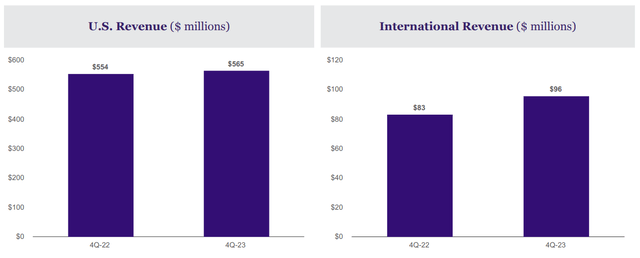

In the fourth quarter, Teladoc, for instance, only produced paltry 2% YoY growth for its U.S. sales. Internationally, the business looked a little bit better with Teladoc’s non-U.S. operations contributing $96 million to quarterly sales in 4Q-23, up 16% YoY.

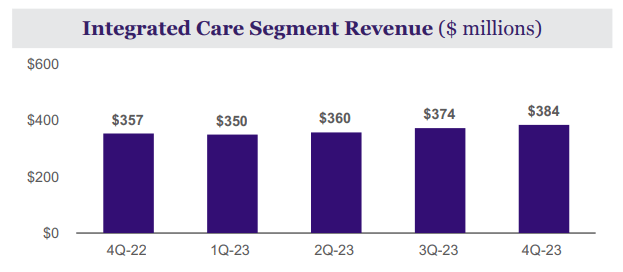

The majority of Teladoc’s sales come from its integrated care segment which captures paid access and visit fees from its users. Sales in this segment amounted to $384 million, up 8% YoY. This segment produced $56 million in adjusted EBITDA in 4Q-23, up 27% YoY.

Integrated Care Segment Revenue (Teladoc Health)

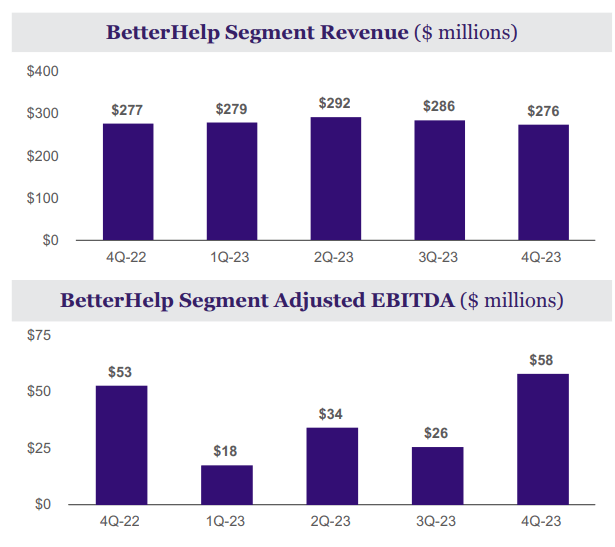

The BetterHelp segment, which offers patients therapy and wellness services via direct communication channels with mental health professionals, produced $276 million in sales in the fourth quarter and is seeing particularly strong adjusted EBITDA trends.

The company had 425K paying users in the BetterHelp segment in the fourth quarter and the healthcare delivery company managed to grow its segment EBITDA by $5 million to $58 million in 4Q-23, and it made an even larger EBITDA contribution than the integrated care segment.

Adjusted EBITDA By Segment (Teladoc Health)

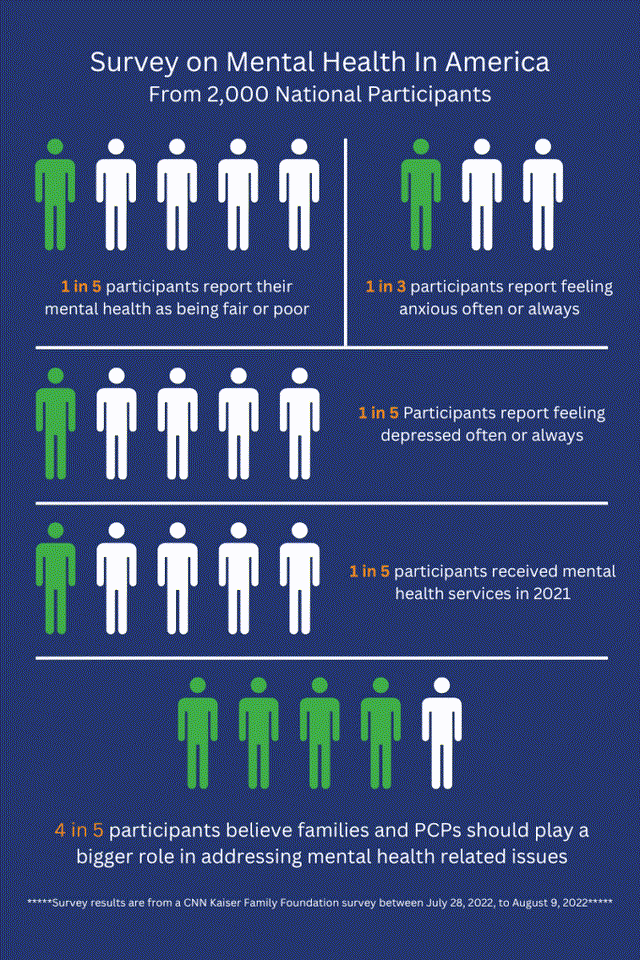

A substantial driver of the BetterHelp segment, for better or for worse, is the mental health crisis that affects the United States and which is set to drive demand for mental health counselling services.

A 2021 CNN and Kaiser Family Foundation survey revealed that 1 in 5 survey participants received mental health services that year. The mental health crisis in the U.S. (as well as in other Western countries) could be a secular demand driver for Teladoc and cause the BetterHelp segment’s EBITDA to experience long-term tailwinds moving forward.

Mental Health Survey (CNN Kaiser Family Foundation)

Adjusted EBITDA Trajectory

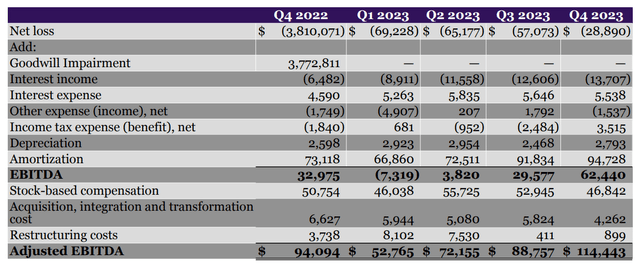

Though Teladoc has not yet been able to steer its business to net income profitability, the company has seen clear progress in terms of its adjusted EBITDA and its associated margins, primarily because management responded firmly to softer sales prospects in a post-COVID world by laying off staff and slashing costs.

The healthcare service delivery platform produced $28.9 million in net losses in 4Q-23, which was down substantially compared to last year, which is when impairments related to expensive prior acquisitions hurt Teladoc’s profit statement.

From an adjusted EBITDA angle, Teladoc’s financial trend is pointing upwards, with the healthcare delivery platform seeing 22% YoY EBITDA growth to $114.4 million in 4Q-23. I do think that Teladoc pays too much in stock-based compensation, however, considering that the business as such is not yet making a profit. In 2023, Teladoc paid its executives $202 million in SBC, which seems like a hefty sum when taking into account that the business itself is not yet profitable.

Adjusted EBITDA (Teladoc Health)

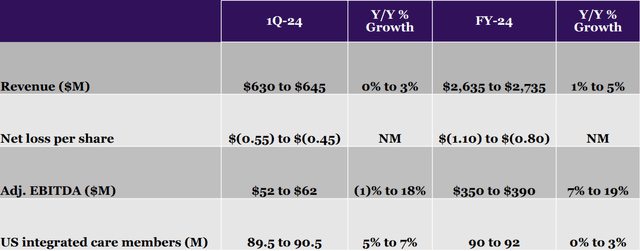

The guidance for 2024 implies that the company will remain EBITDA profitable this year. Teladoc sees an EBITDA margin of 13.8% and total sales growth ranging from 1-5% YoY.

Total Sales Growth (Teladoc Health)

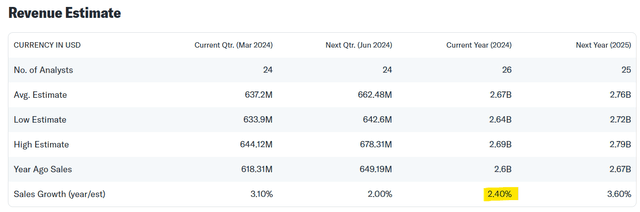

Teladoc’s Multiple

Teladoc’s sales growth estimates are not going to be impressive in the near future, primarily because the company’s fundamentals are under pressure simply because people can meet their physicians/therapists in person again after the pandemic. Consequently, the market models only 2% of sales growth this year and 4% next year. These growth rates are nothing to get excited about, but with long-term demand drivers (mental health crisis) and a much more compelling valuation multiple, I think the value proposition has improved for Teladoc, most certainly compared to my last review in December 2022.

Teladoc is presently valued at a P/S ratio of 0.9x sales, compared to a sales multiple of more than twice that in December 2022. The market models $2.67 billion in sales, while the company has a market value of only $2.4 billion.

At the peak of the pandemic hype, Teladoc grew into a market valuation of $45 billion. Obviously, this valuation was not sustainable, but with a present sales multiple of less than 1.0x and with improving EBITDA prospects, fueled by Teladoc’s BetterHelp mental health segment, Teladoc’s stock could be a promising long-term investment in the healthcare market.

Revenue Estimate (Teladoc Health)

Some Risks That Investors Might Want To Consider

Teladoc is not producing profits, and they may remain elusive if the company fails to grow both of its core businesses. Particularly, slowing, or even negative, sales growth in the integrated care segment might be a concern for investors moving forward.

Another concern is that the telehealth company is still spending a lot of money on stock-based compensation that, based on the stock’s performance, might not really be justified.

My Conclusion

Teladoc has obviously not been a particularly great investment since the pandemic with the company’s market valuation falling from $45 billion in 2021 to just $2.4 billion today.

With that said, the company’s BetterHelp segment, that offers mental health counselling services, is doing quite well and underpinning the company’s EBITDA upswing.

The valuation is now also much more rational, with investors paying less than 1.0x sales for the company’s healthcare delivery platform.

While more work needs to be done, particularly as far as the company’s net income situation and SBC expenses are concerned, I can see a contrarian investment case for Teladoc in the broader context of the U.S.’s mental health crisis and the positioning of BetterHelp. Hold.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in TDOC over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.