Summary:

- The reopening of China, coupled with Tesla, Inc.’s decision to cut its prices to reach its goals, made it possible for the company to end 2022 on a high note.

- Beijing’s decision to focus on achieving its economic goals has all the chances to revive Tesla’s growth story and help the company to have another record year.

- As for the long term, the bifurcation of the global system could negatively affect Tesla’s business due to the fragility of its supply chains that rely on undisrupted globalization.

jetcityimage

The latest appreciation of Tesla, Inc.’s (NASDAQ:TSLA) stock in large part was possible thanks to Beijing’s decision to drop the idea of sticking with the zero-Covid policy. Instead, the government prioritized the country’s growth with the help of various stimulus packages aimed at improving consumer confidence after a disastrous performance of the economy in 2022 due to lockdowns. The reopening of China coupled with Tesla’s decision to cut its prices to reach its production and sales goals made it possible for the company to end 2022 on a high note. This convinced the market that the growth story is far from over. Thanks to this, we could see 2023 becoming another record year for the company that could help lift Tesla’s stock from the current levels until greater geopolitical concerns begin to greatly affect the business later this decade.

Ending 2022 On A High Note

More than a year ago, I wrote a piece on Tesla in which I argued that the company’s long-term success depends mostly on the growth story of China and its electric vehicle (“EV”) market. This view has been mostly reiterated in my latest Tesla article published a month ago here at Seeking Alpha and proved by the latest earnings results, which highlighted Tesla’s exposure to Beijing’s policy and how politics plays a crucial role in deciding how successful the company will be.

Let’s not forget that Beijing’s decision to implement strict movement restrictions in the first half of 2022 made Elon Musk admit that Tesla’s factories were gigantic money furnaces and also exposed the fragility of the company’s supply chains. The moment Beijing decided to abandon its zero-Covid policy and instead focused on growing the economy at the end of 2022, after Xi Jinping has been reelected for an unprecedented third term as the general secretary of the CCP, Tesla’s business once again began to prosper around the globe. Tesla’s 47% Y/Y increase in produced vehicles and 40% Y/Y increase in delivered vehicles in FY22 that made the company’s stock recently rebound in large was possible thanks to Beijing’s domestic policy pivot.

Tesla’s Stock Performance (Seeking Alpha)

Since Tesla’s FY22 numbers are out and Beijing’s domestic goals for 2023 are set it, makes sense to value the company to figure out whether its stock is an attractive investment in the current environment. We can then try and analyze the potential drivers for growth along with the risks that could negatively affect the growth story.

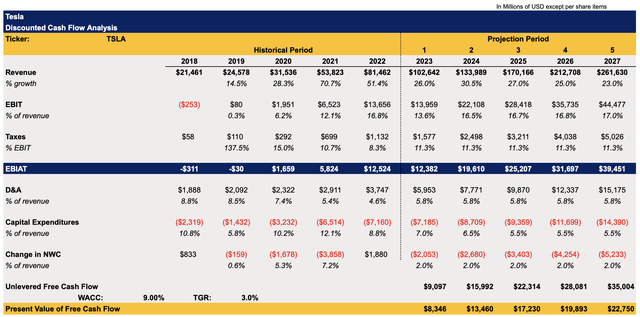

The discounted cash flow (“DCF”) model below shows a potential growth trajectory of Tesla for the following years. The revenue growth rate in the model is mostly in-line with the Street estimates for the next couple of years, after which it slowly cools down as the business matures. EBIT as a percentage of revenue is also mostly in-line with the estimates and is largely lower in comparison to the historical period due to rising competition that already has forced Tesla to cut prices to continue to fund its growth. The tax rate assumption is the average of the previous three years that stays flat mostly due to various government subsidies and incentives that are likely to offset a potential tax hike in the future.

The D&A as a percentage of revenue in the following years is the average of the previous three years. The change in NWC stands at 2% of revenues, while capital expenditures for the next two years are mostly in-line with Tesla’s predictions for the next two years. In the following years, CapEx as a percentage of revenue slowly decreases.

The WACC in the model stands at 9%, while the terminal growth rate is 3%.

Tesla’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

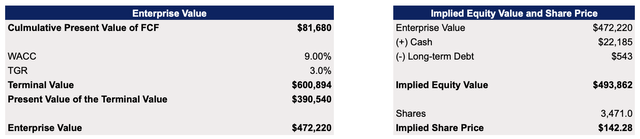

This DCF model shows Tesla’s enterprise value to be $472 billion, while its fair value is $142.28 per share, below the current market price of ~$170 per share at the time of this writing. This could indicate at first that the company is overvalued.

Tesla’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

However, the fact that my DCF model shows that Tesla trades above its fair value doesn’t mean that the stock can’t grow higher or that the business can’t exceed expectations and deliver a greater growth rate than expected. That’s why there’s more to Tesla’s story than a simple valuation model, as assumptions could change at any time as the sentiment changes.

The Revival Of The Growth Story Is Upon Us

Let’s not forget the fact that Tesla wasn’t a value play in recent years. The bull run that started in 2020 and lasted throughout a good part of 2021 showed that during times of expansionary monetary policy Tesla’s stock can grow at an aggressive rate and trade at over 100 times its earnings. During times of contractionary monetary policy, its stock experiences decline, but doesn’t trade in-line with its fundamentals. Even today, Tesla’s stock trades at over 40 times its earnings despite already being significantly overvalued solely based on the fundamentals, while its peers are mostly trading at single-digit P/E ratios. That’s why it would be a mistake to figure out the investment attractiveness of the company’s stock by looking solely at its fundamentals.

At the same time, the reopening of China could help Tesla keep its business momentum, outperform the expectations in 2023, and make the stock recoup some losses from 2022 in the following quarters. The fact that the IMF has improved the global outlook for 2023 due to China’s reopening and urged the country to stay on its current course at a time when there’s an indication that the U.S. can avoid a recession shows the immense power that Beijing has over the global economy – and Tesla in particular.

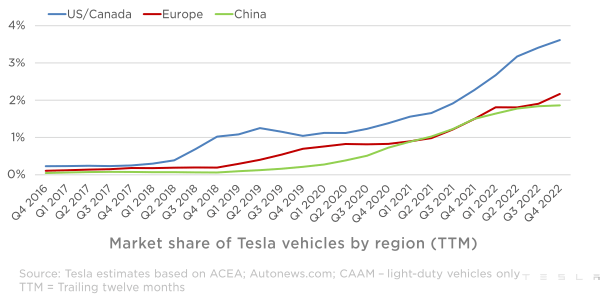

The graph below clearly illustrates that once zero-Covid restrictions in China were lifted, Tesla experienced an increase in market share in Europe and the United States as supply chain disruptions were minimized, and at the same time managed to keep its share in China despite the ever-increasing competition there.

Tesla’s Market Share By Region (Tesla’s Latest Presentation)

Don’t Get Too Excited Too Soon

If you think that the arguments presented above are highlighting an optimistic bullish case, then you’re not wrong. There’s an actual case to be made that 2023 could very likely become another year of record growth for Tesla as Beijing’s domestic pivot coupled with more governmental incentives and potential growth of the global economy could continue to support the company’s growth story in the following quarters. This could help Tesla’s stock recoup some of the 2022 losses and outperform the street estimates which could lead to the improvement of assumptions in my model and a greater valuation. However, beyond 2023, the picture looks less rosy.

In the comment section of my latest article on Tesla – which was published at the end of 2022 and highlighted the fragility of the company’s supply chains – there was a lot of critique about the notion that we’re witnessing the collapse of globalization. However, if you look at the data then, you’ll see that since 2011 there has been an uptick in protectionist policies around the globe that hampered free trade and the free flow of goods.

Tesla dodged a bullet back in 2018 when the Trump administration began its trade war against China that forced the latter to retaliate. It significantly increased tariffs on American-made cars which are active to this day by opening its Gigafactory in Shanghai. Without having a production facility in China, Tesla wouldn’t have been able to grow its business at the current double-digit rate, and probably would’ve been trading at more conservative multiples.

At the same time, even though Tesla managed to open production facilities in each of its major markets right on time as the risk of a potential U.S.-EU trade war is also looming, the company nevertheless is unlikely to be able to sustain various geopolitical shocks at once. The company’s performance in the first half of 2022 showed how fragile its supply chains are and highlighted how its business model heavily relies on the idea of undisrupted globalization.

While such an idea is likely to help the company retain its momentum in 2023 due to China’s reopening and Beijing’s decision to return to the pre-Covid foreign policy, it’s unlikely to be the case in the following years, as the Sino-American competition is likely to lead to a greater bifurcation of a global system over the long-term.

The U.S. is already talking about implementing additional restrictions on Chinese companies and activating a screening tool to ensure that Beijing complies with the sanctions against Russia. China, on its part, is looking on establishing its own trading blocs without involving the United States to protect its own regional interests. All of this shows that decoupling is in full force right now and the world is likely to look extremely different and less rosy a decade from now.

Being greatly exposed to the American, Chinese, and European consumer markets and having supply chains interconnected between those markets makes Tesla an extremely vulnerable target for various potential geopolitical disruptions. While Tesla managed to avoid the Chinese tariffs a few years ago by diversifying its production and was able to report record results in 2022 thanks to Beijing’s domestic policy pivot, there’s no guarantee that it would always be able to mitigate downsides of various geopolitical shocks This is due to the complexity and interconnectivity of its supply chains.

The Bottom Line

The reopening of China is likely to have a positive impact on the global economy in 2023, and could help avoid major recessions in the Western world. If that’s the case, then Tesla is likely to have another record year in which it has all the chances to outperform the expectations that would lead to an increase in its valuation. This makes me more bullish about Tesla, Inc. stock in the short to near term, as the revival of the growth story could lead to the toleration of higher multiples by the market and an appreciation of the TSLA share price from the current levels.

As for the long-term, the bifurcation of a global system is more than likely to harm Tesla, Inc. due to the complexity and interconnectivity of its supply chains. These are more than likely to suffer another major disruption in case globalization continues to collapse.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Bohdan Kucheriavyi and/or BlackSquare Capital is/are not a financial/investment advisor, broker, or dealer. He’s/It’s/They’re solely sharing personal experience and opinion; therefore, all strategies, tips, suggestions, and recommendations shared are solely for informational purposes. There are risks associated with investing in securities. Investing in stocks, bonds, options, exchange-traded funds, mutual funds, and money market funds involves the risk of loss. Loss of principal is possible. Some high-risk investments may use leverage, which will accentuate gains & losses. Foreign investing involves special risks, including greater volatility and political, economic, and currency risks and differences in accounting methods. A security’s or a firm’s past investment performance is not a guarantee or predictor of future investment performance.

Brave New World Awaits You

The world is in disarray and it’s time to build a portfolio that will weather all the systemic shocks that will come your way. BlackSquare Capital offers you exactly that! No matter whether you are a beginner or a professional investor, this service aims at giving you all the necessary tools and ideas to either build from scratch or expand your own portfolio to tackle the current unpredictability of the markets and minimize the downside that comes with volatility and uncertainty. Sign up for a free 14-day trial today and see if it’s worth it for you!