Tesla Could Be Forced To Buy A Lithium Miner

Summary:

- With General Motors potentially buying a stake in Lithium Americas, will other carmakers follow its lead?

- Vertical integration could cut costs and secure supply for auto companies.

- Tesla has more than enough money to be bold lest they be left behind.

- Competition is increasing. The window that Tesla has to act will narrow as other car companies begin investing into lithium miners.

- This is a long fight. Most carmakers are entering the electric market. Act now or get left behind.

jetcityimage

In this article we will explore reasons why Tesla (NASDAQ:TSLA) could get in bed with lithium suppliers in time given the recent move by General Motors (GM) buying into Lithium Americas (LAC).

Lithium Musical Chairs – The Music Just Started

Remember the game musical chairs we played as kids? Well, General Motors just started up the music by marrying into the Lithium Americas Thacker Pass project, thus removing Thacker Pass from the future lithium supply chain for anyone else for quite some time.

What does the LAC/GM pair up bring? First, exclusive rights to GM for all of stage one production of 40k for 10 years, expandable to 15 years. Second, GM has rights to obtain the phase 2 expansion rights which would bring an additional 40k tonnes of production, bringing the total to 80k tonnes of lithium. Hence, for all practical purposes GM just took Thacker Pass out of the lithium supply chain. As other projects pair up, the future supply chain is bound to become very constrained.

Ponderings

For years, some of us have pondered why car producers like General Motors, Tesla, Ford (F) and other big boys have not taken a step to secure critical lithium supply by buying a stake in lithium-mining companies. After all, if you are making electric cars which require lithium, it would make sense to vertically integrate to some extent. We have seen mining companies take positions in other lithium miners or lithium technology plays such as Rio Tinto (RIO) taking a 4.9% stake in Nano One (OTCPK:NNOMF) but again, carmakers have avoided investing in the supply of lithium. Instead, they have pleaded with the industry to open more lithium mines though it takes on average 10+ years to get a mine from concept to pulling pay dirt out of the ground. Carmakers were lax and content to diddle around hoping the industry would sort things out.

That all changed when General Motors announced it was taking a large position (10-20% depending on future share prices) in Lithium Americas. While this is great news for LAC and clay-based lithium, the bigger news is this was the first salvo in the great electric car wars. In this article, we will look at Tesla and who they could potentially buy into in order to remain cutting edge.

The Great Electric Lithium War

In the past I pondered “Why buy into an electric carmaker when you can simply buy the element that they all require: Lithium.” Thus, it does not matter what carmakers win the great electric war.

Yet, with TSLA trading at sub $200 dollars, I have been buying Tesla stock because the stock is, frankly, cheap. Factor in Tesla may be achieving lower cost of goods via owning a stake (or even owning an entire lithium miner) and owning Tesla makes sense. If Tesla follows GM’s example, Tesla might increase or maintain its competitive advantage. This makes me bullish on Tesla and lithium in general.

Pondering The Electric Future

Looking towards the future, the first thing we need to do is look at demand for lithium. We can see many projects in the works that will require the element and thus we can follow the money somewhat. Do note the figures below concerning how much Volkswagen, Ford, and Mercedes-Benz are throwing at electric vehicles. Consider these hints of who might start buying into lithium mining companies next.

Follow the Demand

Following the money, you will note hundreds of billions flowing into lithium investments and the associated support infrastructure. Ponder a few names and the impact it has: Volkswagen $180 billion going into lithium, Ford (F) $50 billion, Mercedes-Benz $44 billion, GM $7 billion (for just Michigan), $1.4+ billion over five years for Ontario per Honda,. $1 billion in Mexico via GM, $717 million for Tesla to expand Austin Gigafactory, and Tesla to build a Gigafactory in Mexico. This is just an inkling of total increasing demand. All of the above automotive projects will need lithium and with General Motors taking all of Thacker Pass off the table we can assume we will see more automotive deals in the works where other lithium miners are married off.

Tesla Needs To Buy Into A Lithium Mine

While the idea of Tesla buying into a lithium mine might come as something new to some investors, Tesla has been toying with the idea for quite some time. In 2015, Tesla was in talks to acquire Simbol Materials for $325 million until the bankers advising Simbol went loco and tried to pitch that the company was worth $2.5 billion. Needless to say, that did not pan out.

Tesla was rumored to have approached Cypress Development [now Century Lithium (OTCQX:CYDVF)] but a deal was never consummated. Meanwhile, Tesla thought it could simply sign supply agreements, and why not? It has worked in the past, but now suppliers are altering the terms and things are becoming much more costly for the carmaker. An example would be Piedmont Lithium (PLL) raising costs for Tesla. Which brings us back to if Tesla wants to help keep costs down and guarantee supply, it has to get into the lithium game. We see two primary contenders. Remember, the most logical choices would be:

1. U.S. or Canadian based lithium plays for optimal IRA credits.

2. Mining companies close to Giga Factories to reduce logistical expenses of moving lithium (assuming that future plans include processing the raw lithium into a form Tesla wants… be it lithium carbonate or lithium hydroxide.)

3. The projects need to be further along in the process of pulling pay dirt from the ground as opposed to simply in the discovery phase. (Bonus points for a pre-feasibility study or a definite feasibility study).

4. Should be near obtaining required local and if required, Federal permits.

5. We will ignore the rumor that Tesla bought 10,000 acres somewhere. It has been speculated this is on land in Clayton Valley, but if that were true they have a water issue since no additional water rights are available. Hence, we will ignore it. This self-inflicted criteria cuts out many of the promising but speculative lithium prospectors. This is not to say they could not be targeted, but we need projects that are closer to production by 2026-27. This leaves us with two primary contenders in the United States.

Two Potential Lithium Choices For Tesla

Century Lithium

Our first choice is Century Lithium (OTCQX:CYDVF) – It was rumored that Tesla was in talks with Cypress Development (now called Century Lithium) back in 2020. It might would make sense for Tesla to revisit that relationship. Century Lithium has water rights in Clayton Valley (only one of three companies that does). Acre feet available to them are 1,770 feet which could be adequate for annual production of 27,400 tonnes of lithium. A DFS is due in Q2 but I’ll say Mr. Murphy strikes and it slips to Q3. The company is in the process of obtaining local and federal permits as the project is on BLM land.

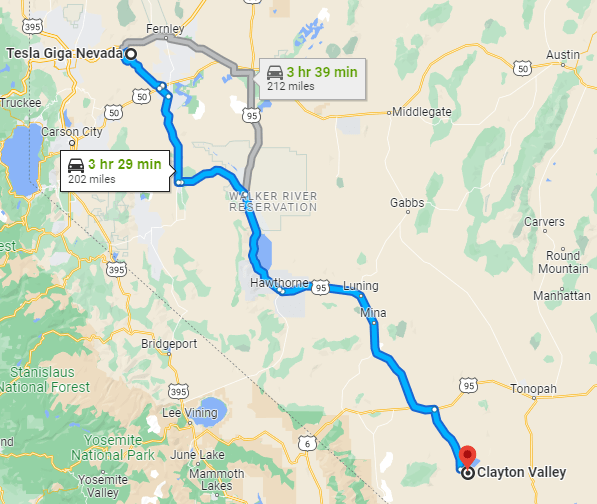

Century Lithium is located in Nevada and 202 miles (325 km) by car from Tesla’s Nevada Giga factory. Century is also in talks with the government for loans much like many lithium companies. Looking at the proximity to Tesla, we see by car the mine would be 202 miles away.

Tesla Nevada to Century Lithium (Google Maps)

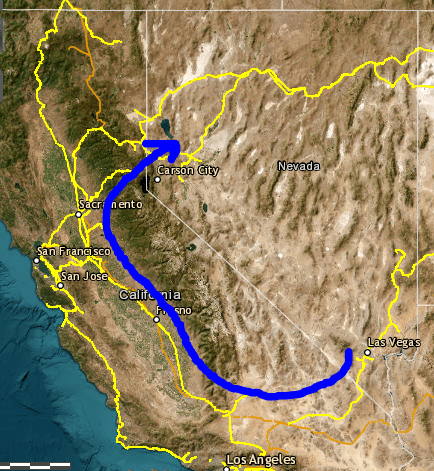

Looking below at rail, they could load and ship through from Los Angeles and take it north to the Reno area (noted in blue). How efficient this might be or the cost is unknown, but typically rail is a very efficient means of moving material due to low rolling friction.

Los Vegas to Reno (Acwr.com)

Standard Lithium

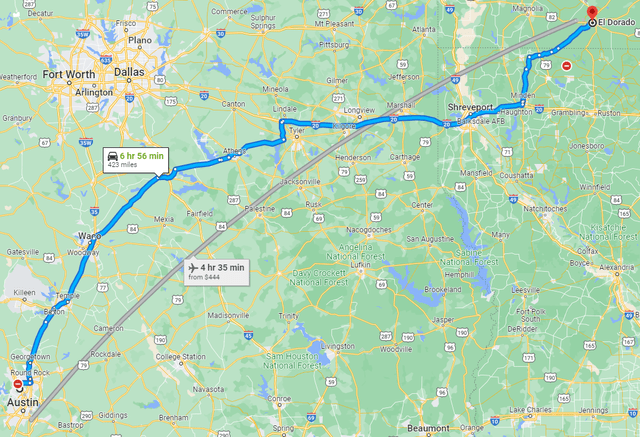

Our second choice is Standard Lithium (SLI) based out of Arkansas. Standard is on existing private land in a potential partnership with Lanxess. Standard Lithium is 423 miles by car from the Austin, TX Giga factory. As an interesting side note the patented DLE process that Standard Lithium sports was designed by a company that Koch now owns. The same Koch that invested $100 million into Standard.

Austin, TX to Standard Lithium in Arkansas (Google Maps)

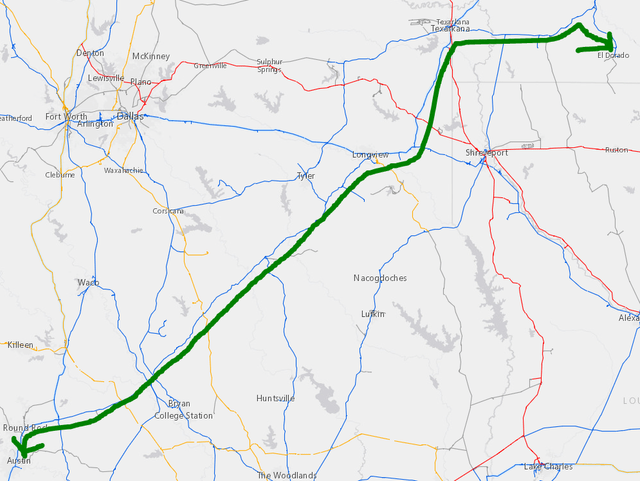

Looking at rail we see it is a simple route. Very efficient.

El Dorado, AR to Austin, TX (Arcgis)

Risk

The risk to Tesla or any car maker is frankly waiting too long and the music stops. All the lithium “chairs” could be taken and supply very hard to obtain. Meanwhile the competition might have secured dedicated exclusive supply and discounts, (much like GM has achieved with Thacker Pass). From a capital standpoint the risk is low as most car makers can use credit lines or simply issue stock to pay for transaction.

Get In Lithium and Tesla Before Government Loans

I fully expect to see Lithium Americas, Century Lithium, and Standard Lithium to receive and benefit from government loans. Share prices could react quite favorably and it would make the cost of buying in much more expensive for Tesla for the latter two. Hence, Tesla should move quickly on securing its piece of the lithium pie. With the synergy of Tesla and lithium miners apparent from a cost savings perspective, I see no reason not to own both if we take a long term view. Where will electric cars be at five or 10 years? The answer is electric ownership will be much higher, especially with world governments making inroads to ban ICE engines by 2030 and/or 2035 in some countries. This bodes well for lithium mining stocks and also Tesla. Hence Standard Lithium, Century Lithium and Tesla are all buys for the patient investor.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Disclosure: I/we have a beneficial long position in the shares of TSLA, NNOMF, CYDVF, SLI, RIO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: We own Century Lithium as LCE on the Canadian exchange as well.

We own LAC long options and common stock.