Summary:

- Tesla mania is over and the bottom is still a long way off.

- Tesla’s fair value is far below the current price.

- The perception toward the Tesla brand is changing in my opinion.

Justin Sullivan

It was not so long ago since my last article where I explained my reasons for why Tesla (NASDAQ:TSLA) around $220 was to be avoided at all costs, yet in such a short time the stock has lost about 50%. Everything I argued previously I still think so, but I realized that I made a mistake: I was too positive in my valuation. Tesla is still highly overvalued despite the overall 70% collapse.

Herd mentality

The last few years of expansionary monetary policy literally doped the stock market, which gave confidence to anyone who decided to invest in it. No skills mattered, and at times in 2020 and 2021 it was enough to pick a random tech stock to have over the course of a few months a very good profit. Companies that had been losing money for years suddenly became the opportunities of a lifetime, and companies belonging to an “innovative” sector were so promising that people even invested in them with leverage. This general overconfidence was the driving factor in stock markets until the end of 2021, when the Fed decided to fight inflation with a severe tight monetary policy.

From that point on, all those companies that were worth little or nothing have lost much of their value, but in my opinion there’s still a long way to the bottom. But where did all hope go for those companies that would write our future? Wasn’t Tesla supposed to grow indefinitely driven by its charismatic CEO?

In my opinion the truth is that these companies were never that promising, and Tesla is not exempt from this reasoning. Herd mentality has ruled the day, as has FOMO. As of today, these companies are bumping up against harsh reality, as the expected future cash flows did not justify the 2021 prices.

As far as I am concerned, I think Tesla was the most egregious case of all, as it had become virtually impossible to discuss it without being insulted, a very strong signal that a stock is subject to heavy speculation. Generally, the argument of the average Tesla investor was/is based on the fact that electric cars will be the future, and therefore Tesla will also be the future, but without considering that Tesla is not the only company to sell them but simply one of the first to do so. This is basically the same reasoning that caused the tech company bubble in the early 2000s: The Internet is the future and all tech companies will be the future. Basically, it’s true that the Internet was the future, but how many tech companies from the 2000s are still around today?

By this I’m not saying that Tesla will fail, but that investing in it because electric cars are the future is completely wrong, especially considering the industry in which it operates. Most of Tesla’s revenues come from selling cars, a historically very competitive industry. This does not mean that one should never invest in Tesla, but that one should buy it when it’s undervalued and not at any price “because it is destined to be the future.”

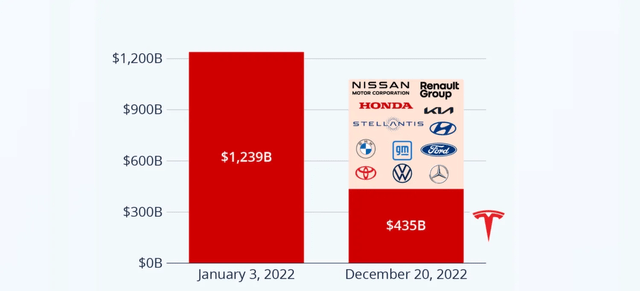

It’s true that in recent years Tesla seems not to have felt the brunt of the competition, but how long can this last? Is it really possible that automakers with decades of experience can develop electric cars that are less attractive than Tesla’s? In my opinion it’s unlikely, and the sharply declining market share is evidence of this. New affordable electric vehicles are increasingly becoming a reality, and the options on the market are becoming more and more. In spite of everything, however, Tesla remains by far the most important car company in the world despite the sharp slump it has suffered. At least according to market capitalization.

Fred Lambert, electrek.co

In any case, in an environment of rising interest rates potentially followed by a recession, I do not see how a car company that sells cars at a minimum price of $43,990 can do well. What’s more, when compared to other automakers, in my view Tesla’s value is visibly out of scale and it’s not reasonable to believe that this is sustainable. How can a single automaker be worth nearly as much as all the other automakers combined? It is simply absurd.

The first slowdowns in demand already are visible and are coming from the United States and especially China, the largest market for electric cars. In the former case there was a $7,500 discount and 10,000 free Supercharger miles for those who bought a Model X or Model S by the end of the year, while in the case of China the prices of the Model 3 and Model Y were reduced by up to 9% in addition to a subsidy for insurance costs. Chinese automakers are becoming increasingly competitive and Tesla must necessarily reduce prices if it wants to compete, thereby reducing its profit margins per car sold. In my opinion, this is a sign that Tesla’s competitive advantage is slowly disappearing due to excessive competition in the industry.

Doubts on Elon Musk

One of the reasons why everyone started believing in Tesla was because of the charisma of its leader Elon Musk, one of the most well-known controversial figures in the world. At the peak of the speculative bubble, it literally took only one tweet to see Tesla’s price per share skyrocket.

At first, I believed that Tesla’s CEO was its greatest asset. However, to date there are a few situations that are leading me to disprove my initial opinion. There are three reasons mainly.

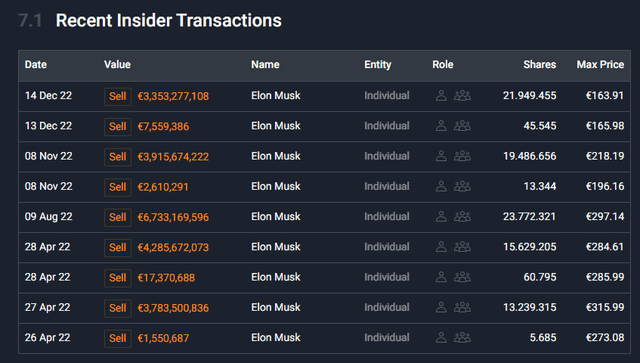

He’s selling his stake in Tesla

Musk has been selling his stock for months now, and this is certainly a factor to consider.

simplywall.st

Confidence toward a CEO also is seen in his or her operations toward the company he or she runs, and seeing that there are only sales and no purchases certainly is not encouraging. By this I do not mean that the CEO of a company cannot sell any stock, but selling so many in such a short time creates legitimate doubts for shareholders. This attitude on his part was one of the causes that led Tesla to plummet almost 50% in just a few weeks. He recently stated that he will not sell any more shares before 2024. We will see if that is the case. He had already stated in April 2022 that he would stop selling shares to finance his deal to acquire Twitter.

The market capitalization goal does not convince me

Reading the Q3 2022 earnings call transcript, I was quite puzzled by Musk’s words regarding market capitalization targets. In my opinion they’re not only quite unrealistic but also out of context:

And several years ago, I said, I think on our earnings call, that I thought it was possible for Tesla to be worth more than Apple (AAPL), which was then the highest-cap company, I think, in the market. At that time, I think it was around $700 billion. And I said it required an incredible execution, at least some luck, and we didn’t only achieve that.

Tesla went, in fact, or passed Apple’s market cap at the time. And now, we have the opinion that we can far exceed Apple’s current market cap. In fact, I see a potential path with Tesla worth more than Apple and Saudi Aramco combined. So now that doesn’t mean it will happen or that will be easy.

In fact, I think it will be very difficult. It will require a lot of work, some very creative new products, manage expansion, and always luck. But for the first time, I am seeing – I see a way for Tesla to be – let’s say, roughly twice the value of Saudi Aramco (ARMCO). And I think that’s – I haven’t quite seen that yet.

My view is that market capitalization targets are not very meaningful because they’re not relevant from a long-term perspective since the latter depends mainly on how much the company can earn. Earnings and free cash flow are the only thing that matters, market capitalization is a consequence. Moreover, comparing Tesla to Apple and Saudi Aramco based on market capitalization is completely out of context since the comparison does not hold up at all. Let me give you a table to make you understand what I mean.

| Market Cap (millions $) | FCF LTM (millions $) | MC/FCF | |

| Tesla | $ 384,677 | $ 8,912 | 43.16 |

| Apple | $ 2,066,941 | $ 111,443 | 18.55 |

| Saudi Aramco | $ 1,878,061 | $ 147,808 | 12.71 |

Based on this data, do you see a potential scenario where Tesla could be worth as much as Apple and Saudi Aramco combined? What I see is that Tesla with a market cap/FCF of 43.16 is still too overvalued and getting back to even being worth $1 trillion within 10 years would already be a huge success given the industry it operates in. In the long run what matters is the free cash flow generated, so I do not understand the point of the market cap goal other than to exalt Tesla fans.

Twitter purchase creates havoc for Tesla

Tesla shareholders frowned upon the Twitter acquisition as it adds additional commitments to their CEO, who in addition to these two companies must also manage Space X. Moreover, it should be considered that the Twitter acquisition was financed by Musk by selling Tesla stock, a further negative signal to shareholders. I do not doubt that Musk can handle this as best he can, but the concerns are more than justified. Compared to last year, his attitude toward Tesla is changing and shareholders are noticing it.

How much is Tesla worth?

In my previous article I already calculated my fair value for Tesla, however, I believe that almost three months later an update is necessary. Previously, I had calculated a fair value of about $110 in the most likely scenario. To date I believe I have been far too positive. It’s true that my price target was reached a few days ago, but I did not expect such a sudden change in sentiment. My impression is that the perception of the Tesla brand is changing, and certainly strong competition does not help.

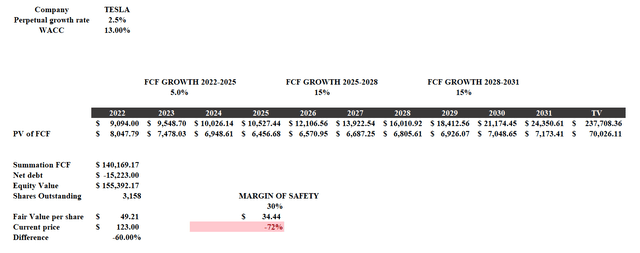

The new fair value will still be calculated through discounted cash flow, but obviously the inputs will change.

- The WACC will be equal to the cost of equity since Tesla has negative net debt. The latter, will be calculated with a beta of 1.91, Country Market Risk Premium of 4.20%, Risk Free Rate of 4% and additional risks due to competition of 1%. The result is 13%, quite high but in my opinion justified. Investing in Tesla is risky and it’s reasonable to require a return above the market average.

- The 2022 free cash flow represents an estimate by TIKR Terminal analysts. From 2022 to 2025, I have considered only 5% growth because I expect an impending economic slowdown, where companies that are highly susceptible to the business cycle such as Tesla will be the main losers. How many people can buy an expensive car during a recession?

- From 2025 to 2031, the growth rate of free cash flow will be 15% according to my estimates. This also is too positive an estimate in my opinion and I am ready to revise it downward in the future.

- Net debt and shares outstanding were obtained through TIKR Terminal.

Discounted cash flow

In light of all these considerations, Tesla’s fair value is only $49.21 per share. Weighing on the valuation was the very high but, in my opinion, unavoidable discount rate. Certainly, the growth rates entered are not in line with those of the past, but one must also consider that this model estimates constant and increasing free cash flow, which is virtually impossible in the automotive industry. In short, the actual growth may be higher than what is entered, but I doubt that Tesla can have such constancy in generating cash by operating in the automotive sector.

Overall, I regard Tesla as the epitome of the speculative bubble born after the massive stimulus injected within the economy. Like all bubbles, sooner or later they burst, and that is what is happening now to Tesla. Although I consider $50 to be a reasonable price, I personally would not invest in it at that price anyway, as I believe there are far better opportunities currently in the market. Tesla mania is over and it’s unlikely to be a tweet that will save the day.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Not a financial advice, just my opinion.