Summary:

- 2023 will likely be a key year for airlines, testing which ones are most on track to return to the post-COVID “normal”.

- A key variable I’m watching is when each different airline resumes dividend payments, which I’m watching across 10 airlines in America, Europe, and Asia.

- Of these 10, Singapore Airlines, the world’s largest airline by market cap, was first to resume its dividend, but I find it way too expensive at 20x estimated 2025 EBIT.

- Southwest Airlines is a much more localized carrier that is re-starting its dividend in 2023, and seems much better valued at 5x 2024 estimated EBIT.

IlkerErgun/iStock via Getty Images

2022 was a year when airline travel started to feel like it was returning to normal, but 2023 is the year where I’m watching airline stocks to see if any of them will return to being normal investments. As much as I romanticize airlines because of my love of traveling on them, I usually avoid them as investments because the fierce competition between them tends to be great for customers and terrible for shareholders. On the rare occasion I do add an airline investment to my portfolio, it’s usually in the form of a higher-yielding bond or dividend stock where I can clearly see the premium I am earning for taking the risk of that one airline over both its competition and industry-wide risks like COVID-19. In this article, I aim to outline my global outlook for the airline industry through a selection of 10 airline stocks across three major regions, and highlight what I’m watching to decide whether to make any investments in airlines this year. I will first list these 10 stocks, share my dashboard of the numbers I’m watching for each, and then look more closely at the names within each region before sharing my conclusions at the end. All 10 of these airlines halted their dividends during the COVID-19 pandemic, and so far only two of them have re-started dividend payments, so watching out for the next dividend of each of these 10 will be the finishing touch on my outlook.

One thing I find exciting about the airline industry is that the coverage area of each airline stock can be drawn on a map, and one measure of diversification of an airline stock or bond portfolio is how many non-competing routes those airlines cover. I chose to organize my dashboard of airline stocks across each of three regions (Americas, Europe, and Asia-Pacific) by selecting some of the largest airlines within each region with as little overlap as possible. I define “overlap” both in terms of routes, but also in terms of market segment (e.g. “budget” versus “full service”). The three regions and 10 airlines I have chosen for this article are as follows

- Americas

- Europe

- Deutsche Lufthansa (OTCQX:DLAKY)

- Ryanair Holdings (RYAAY)

- Türk Hava Yollari Anonim Ortakligi (OTCPK:TKHVY), aka Turkish Airlines

- Asia-Pacific

- Singapore Airlines (OTCPK:SINGY)

- China Southern (ZNH)

- Japan’s ANA Holdings (OTCPK:ALNPY)

- Australia’s Qantas Airways Limited (OTCPK:QABSY)

Key Airline Metrics Entering 2023

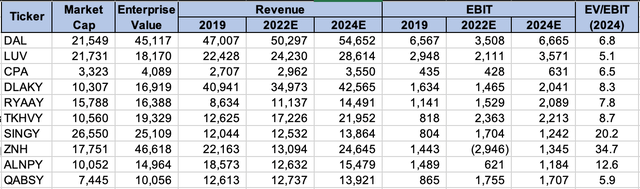

For the above 10 airlines, below is the dashboard of key metrics I’m watching to see which airlines are most “on track” to returning to pre-COVID (2019) levels of revenue and profitability. The estimates for 2022 and 2024 are the median estimates according to Tikr.com as of my download on 2 January 2023. Even before looking at the dividend, I compared these revenue and EBIT numbers to each respective airline’s enterprise value to get an idea of which are relatively cheap or expensive, and I have that ratio for the 2024 EBIT estimate on the right hand column.

Now we will look at some region-specific information.

Region #1: The Americas

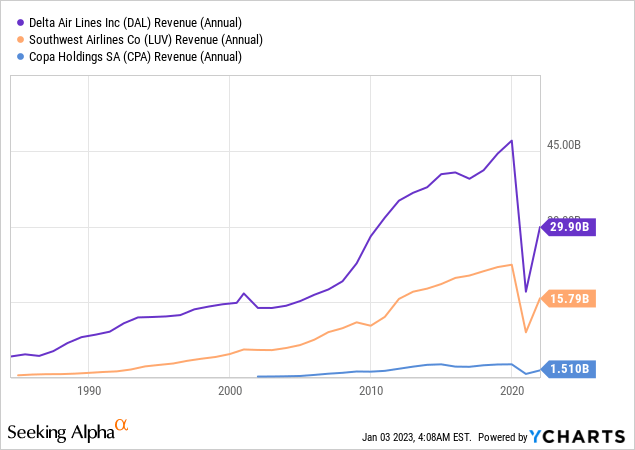

I start with the Americas region because it is likely the most familiar to the Seeking Alpha audience, but also because these three stocks have the highest quality data both on Seeking Alpha and on YCharts. One quick way to see how devastating the COVID-19 pandemic was on the airline industry is to run a quick chart of annual revenues of DAL and LUV going all the way back to the mid 1980s. We see there was a little bit of a dip in revenues, possibly even a “minor depression” right after 9/11, but nothing even close to what hit the airline industry in 2020. All three of these airlines use the calendar year as their fiscal year, so the below chart ends in 2021, and we need to look at the above table to see that the median analyst consensus for 2022 revenues for each of these three airlines is slightly above the previous all-time highs of 2019. DAL is currently scheduled to report on January 10th, LUV on January 26th, and CPA on February 10th for those wanting to set calendar reminders to check the actual numbers versus these estimates.

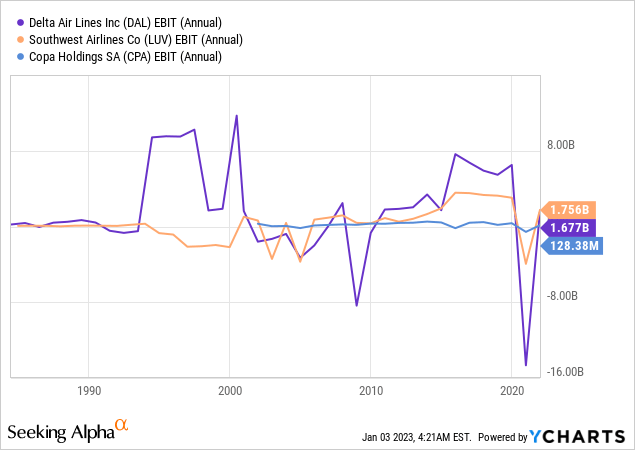

This next chart shows why I usually don’t like airlines as an investment: despite the steady revenue growth of all three airlines in the above chart, the profits earned on those revenues, as measured by earnings before interest and tax (EBIT), show anything but steady growth. 2019 seems to have been the end of a multi-year “plateau” in the EBIT of all three airlines, and none of the three airlines are expected to recover their EBIT quite to 2019 levels. Analysts only expect DAL to return to its 2019 EBIT level by 2024, while they are more optimistic about LUV and CPA significantly surpassing their pre-COVID plateaus.

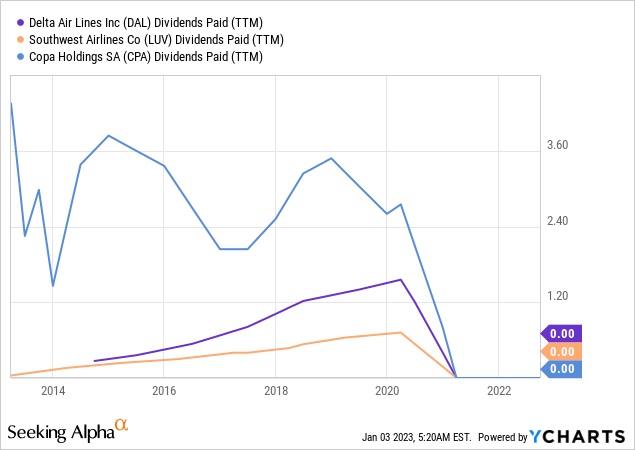

When we look at the dividend histories of these three stocks before they were all halted by the pandemic, we see that it was DAL and LUV who steadily increased their dividends almost every year in the 2010s, while CPA’s dividend payment record was far more erratic. LUV is the first of these three airlines to resume its dividend, by announcing on December 6th that its next $0.18/share dividend will go ex on January 9th, implying a dividend yield just above 2%.

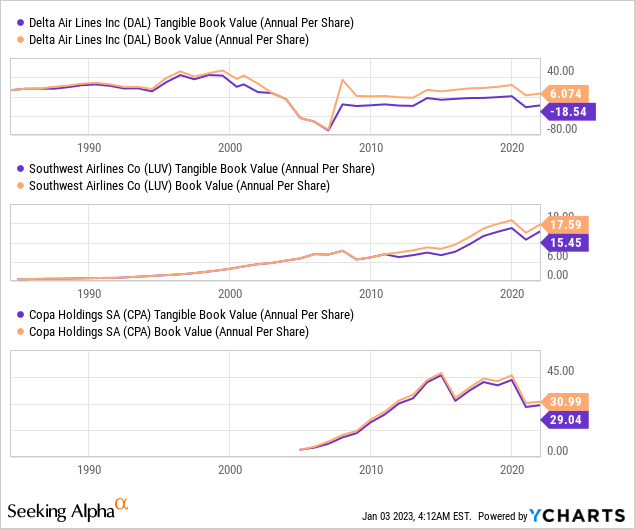

Of these three airlines, LUV also seems to have been the best at turning any profits not distributed as dividends into growth of tangible book value. Book value growth is another key metric I look at with dividend stocks to make sure that dividend growth is not coming at the expense of real business growth.

When watching these airlines, two additional data points I’d put on my dashboard are the yields on the LUV 2.625% 2/10/2030 bonds versus the DAL 3.75% 10/28/2029 bonds, which are currently 5.6% and 6.7% respectively. This implies that the bond market sees DAL as a riskier bet, though 6.7% per year, roughly 2.7 percentage points over the 7-year US treasury, looks like a good rate of return for someone wanting to get paid now to take that risk, rather than waiting for DAL to resume its dividend. The LUV bond, on the other hand, only makes sense for investors who believe that LUV’s dividend growth rate will slow to significantly less than about 4% per year, far slower than it was before COVID.

So while I’ll be watching the earnings reports of all three of these airlines, LUV is the one that seems best positioned in the Americas region to provide a safe return to investors. This is probably because it focuses on many point to point domestic routes which are likely less expensive to run and face less competition, and so are more profitable than competing for flights to Paris or Peru.

Region #2: Europe

The three airlines I selected in Europe might very roughly be considered parallels of the three American ones I picked:

- DLAKY, like DAL, is one of the “legacy full service” carriers that does both long haul international and domestic routes, and has grown through acquisition.

- RYAAY, like LUV, is a low cost point to point carrier.

- TKHVY is much bigger than CPA, but is similar in that it is much faster growing and serves many emerging air markets further south and east.

I moved back to Europe a little over a year ago, and unlike in the US, I am far more likely to travel around here by train than by short-haul flight. I see this as good preparation for one of the medium-term risks to airlines operating over European airspace: the expansion of bans on short-haul flights like the one just approved in France last month. This could potentially be quite limiting for some of RYAAY’s more profitable continental routes, but despite that, analysts still expect RYAAY to be significantly more profitable post-COVID than DLAKY.

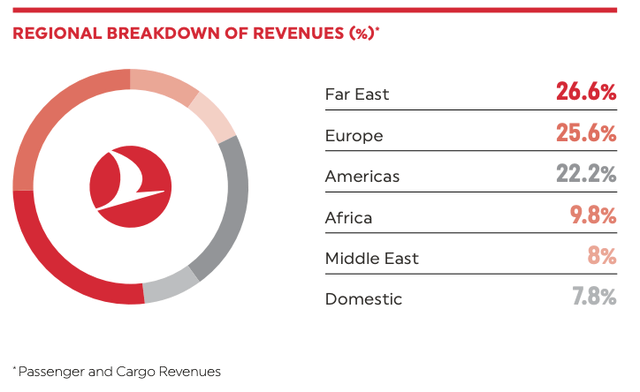

Given that all three of these airlines trade at similar multiples to 2024 EBIT consensus, and none have yet resumed their post-COVID dividends, I would put any money in this region on TKHVY, as they have the most exposure to emerging growth routes in Africa and Asia. As this next chart from page 22 of TKHVY’s 2021 annual report shows, Turkish Airlines’ revenue breakdown looks as balanced as any globally well-diversified portfolio.

Turkish Airlines 2021 Annual Report

Region #3: Asia-Pacific

Last but not least, we look at four airlines in the world’s most populous region: Asia-Pacific. This was the region with by far the strictest COVID lockdowns and travel restrictions, as seen in Australia as well as in China. China’s strict and extended lockdowns through 2022 explain why ZNH is the only one of these 10 airlines still expected to lose money in 2022, and also only one of two airlines still expected to make less in revenue in profits in 2024 than in 2019. The other slow-to-recover airline on this list is ALNPY, which makes sense seeing that Japan eased COVID restrictions only a little earlier in 2022, and has a much slower growing economy than China’s.

On the bright side, Singapore dropped quarantine requirements for vaccinated travelers on April 1st 2022 (which happens to be the first day of SINGY’s fiscal year), and restrictions were further eased later in 2022. For this reason, I see SINGY’s next annual report for the fiscal year ending March 31st 2023 as the best first full-year view on how the Asia-Pacific airline market is doing post-COVID. Singapore airlines happens to be the world’s most valuable airline by market cap, and it just paid a S$0.10/share dividend last month for the first time since 2019, but unfortunately I see it as way too expensive relative to less risky assets I can buy in Singapore.

It is a convenient coincidence that QABSY’s 2019 and 2022 estimated revenue and EBIT numbers happen to be very close to SINGY’s, but analysts expect QABSY’s EBIT to grow much faster than SINGY’s by 2024, and QABSY trades at less than half the enterprise value of SINGY. If I had to buy an airline in the far east, my current pick for now would probably be QABSY just based on these projections and valuation, and the catalyst would be QABSY resuming an annual dividend in the A$0.15-A$0.25/share range, which would be around a 2.5-4% dividend yield.

Conclusion

Investors interested in airline stocks should start setting reminders in their calendars for key annual reports and dividend announcements this year. On January 26th, I’ll be looking out for LUV’s 2022 earnings announcement and then will see around March whether they continue their $0.18/quarter dividend. Turkish Airlines will probably report their 2022 numbers a little later in Q1, but their last dividend announcement was in March 2013, so I’ll read the annual report without holding my breath for the dividend. For the airlines of the far East, only QABSY seems well valued enough to buy for the expectation of the dividend resuming, and I’d look for that in 2023Q3, given that Qantas’s fiscal year ends in June.

If I were to buy LUV shares at the current price around $33.67, I would pair it by selling a 40-strike covered call expiring January 19th 2024 for a premium of around $3/share. That option premium would still leave me with significant upside while providing a healthy supplement to my dividend, and a scheduled sell date timed for long-term capital gains treatment.

More likely though, I’ll continue flying on these airlines and reading about how different regions are recovering post-COVID, and making more of my investments where dividend growth is more certain.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Most of my portfolio is in non-US stocks because many foreign markets tend to be faster growing, less competitive, and often more cheaply valued. Join my journey around the world as I share my experience as a long-term expat in search of the best international stock opportunities with a free trial to The Expat Portfolio.