Summary:

- Tesla, Inc. kick-started the year with major price reductions and beat estimates in Q4 2022; we’re taking the cup half-empty approach and maintaining our sell rating on the stock.

- We believe the 6-20% price slashes will likely boost demand but simultaneously take a bite out of Tesla’s margins in the near term.

- We believe the price cuts on Model 3 and Model Y vehicles are a sign that Tesla’s back is against the wall amid the macroeconomic headwinds and intensifying competition.

- We see more downside ahead for Tesla in the near term as we expect per-car margins to be pressured by the price cuts and increased cost of batteries.

Justin Sullivan

We continue to be bearish on Tesla, Inc. (NASDAQ:TSLA) after the company dropped a bomb that it would slash prices up to 20% for its Model 3 and Model Y vehicles. We believe the price drop was a sign that Tesla’s back is up against a wall amid rising inflationary pressures and spiking interest rates.

We’re seeing Tesla through a cup-half-empty lens – we expect the price drop to eat away at Tesla’s margins as the cost of goods is still on the rise, especially the costs of batteries. We don’t expect the heightened demand from the lower prices and potential eligibility for tax incentives under the Inflation Reduction Act (IRA) to offset the weaker margins in the near term.

We downgraded Tesla stock late last year, arguing that the company faces pressure from its shrinking electric vehicle (“EV”) market share and expecting its revenue growth to be lackluster due to macroeconomic headwinds. We maintain our sell-rating now, as we believe Tesla’s decision to cut prices might boost demand and retain its EV market share but will the same time only further pressure revenue and gross profit margins.

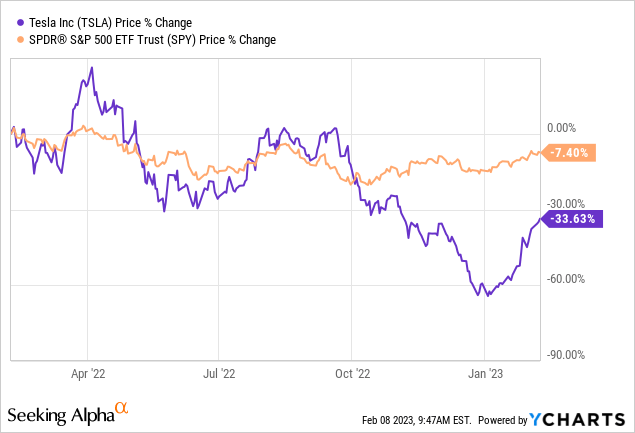

Tesla stock is down nearly 34% over the past year, significantly underperforming the S&P 500 Index (SP500), declining 7% during the same period. The following graph outlines Tesla’s performance compared to that of the S&P 500 Index.

YCharts

Tesla stock is hovering around its two-year low. While the company’s Q4 2022 earnings results beat expectations, we’re still not too optimistic, as the fourth quarter does not show the full effect of the price cuts on margins. We’re bullish on Tesla in the long run, given its position in the EV space. Yet, we believe the company is in a tough spot in 2023 on two fronts: its struggle to maintain market share amid intensifying competition and the macroeconomic headwinds pressuring consumer spending and manufacturing costs. We recommend investors exit the stock, as we see more downside ahead due to weaker margins after price cuts. We believe investors looking to jump into the EV space should wait for a better entry point toward 2024.

Price cuts to eat away at margins

Tesla’s vehicles are finally getting cheaper after a rise in ASP last year- while this is good news for consumers, we believe it’s bad news for investors. Tesla started the year with price cuts in China, the U.S., and Europe by as much as 20%. While we believe the price cuts will expand Tesla’s addressable market and likely boost vehicle sales in the near term, we believe the price cuts come at the expense of the company’s margins and status as a high-end EV maker.

1. Weighing on margins

With prospects of a recession intensifying amid inflationary pressures and rising interest rates, we’re not too shocked that Tesla’s trying to boost demand by slashing prices. Tesla first reduced prices in Asia and saw a positive response from the Chinese market. Tesla’s EV registrations in China reached 12,654 in the second week of January, a 500% increase compared to 2,110 the week prior. We expect to see increased demand in the U.S. and Europe, especially as customers in the U.S. can qualify for a tax credit of up to $7,500.

However, it’s important to note that Tesla isn’t the only one cutting prices, although it’s the one making the headlines. XPeng Inc. (XPEV), which competes in Tesla’s same price range, also cut prices last week, followed by Huawei-backed Aito. While this all looks great at face value, we believe it will reflect poorly on Tesla’s margins in the near term. We’re concerned about Tesla’s gross margins in the 1H23; gross margin is the amount of money Tesla has left after subtracting all costs. Given the lower per-car price and the higher cost of production, we expect Tesla’s gross margins to be weaker post-price cuts.

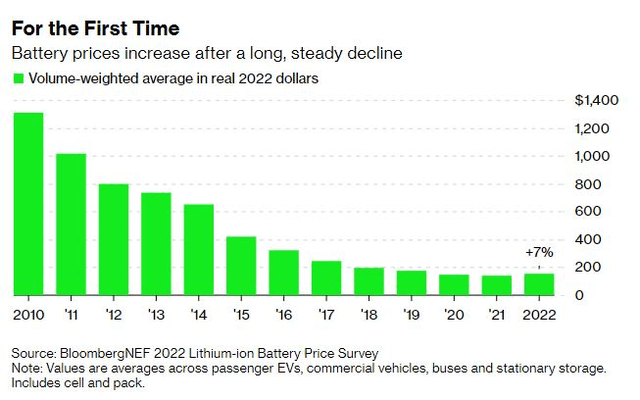

Tesla still faces increased costs of raw materials to manufacture its EVs. Falling battery prices were one of the most consistent trends until last year, when BloombergNEF’s annual lithium-ion battery price survey showed a 7% increase in average pack prices, reaching $151/kWh. The following graph illustrates the battery price increase in 2022.

We believe the increased cost of batteries translates to more expensive EVs for automakers, and Tesla is not feeling the churn alone. Competition in the EV space also feels the pressure of rising costs with limited ability to raise the costs of vehicles, including Rivian (RIVN) and General Motors (GM). We believe the price cuts will negatively impact Tesla’s economics, even if demand does heat up.

2. Status as a high-end EV maker

Our bearish sentiment on Tesla stock is partly based on our belief that the price cuts were Tesla’s last resort to retain and gain slipping market share and boost demand as EV startups and other automakers broaden their EV offerings. Our previous note analyzing Tesla discussed the company losing market share to competition with more attractive pricing, as the company’s EV market share in the U.S. shrank from 79% two years ago to 65% in 3Q22. Consistent with our expectations, Tesla has succumbed to the macroeconomic environment and slashed prices to target the demand south of the $50,000 to $55,000 price range.

Tesla bulls interpret the price cuts as positive, expecting the lowered prices to secure volume growth and put competition in a tough spot to keep up with Tesla’s pricing power. The bullish sentiment is further reinforced by the company’s 4Q22 earnings results reporting a 37% increase in revenue and CEO Elon Musk’s promises of increased demand post-price cuts.

However, we believe the aggressive discounting comes at the price of the company’s image as a high-end luxury EV supplier. We believe Tesla’s cornered, because the price cuts have reversed the EV maker’s market strategy for the past two years when demand exceeded supply. We believe Tesla feels pressure to cut prices as it sees supply outweighs demand.

In FY2021, Tesla’s deliveries outweighed production for Model 3/Y by 0.6%, while FY2022 reported a 4% gap between production and deliveries, with production exceeding delivery. While we believe demand post-price cuts will likely allow demand to exceed supply in FY2023, we believe it will negatively impact Tesla’s automotive gross margins and put a dent in profitability. Tesla’s automotive gross margin has already dropped sequentially, from 27.9% last quarter to 25.9% this quarter. Hence, we recommend investors exit TSLA stock at current levels.

Valuation

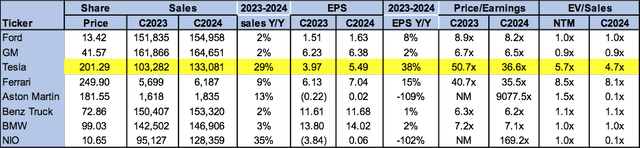

Tesla stock is relatively expensive, despite the major selloff last year. The stock is trading at 4.7x EV/C2024 Sales versus the peer group average of 2.1x. We recommend that investors wait for the valuation to get compressed and reflect the company’s current earnings more accurately rather than factoring in future growth and earnings.

The following table outlines Tesla’s valuation in comparison to the peer group.

Word on Wall Street

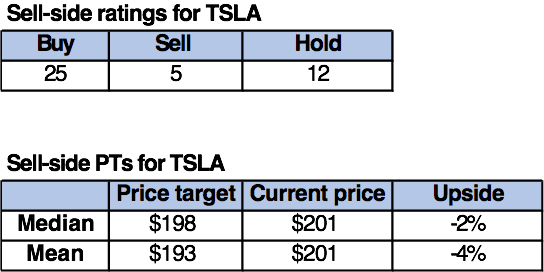

Wall Street is bullish on Tesla, for the most part. Of the 42 analysts covering the stock, 25 are buy-rated, 12 are hold-rated, and the remaining are sell-rated. We expect Wall Street’s bullish sentiment is the result of Tesla’s leading position within the EV market, combined with the recent price cuts that expanded the company’s addressable market. The stock is currently priced at $201 per share. The median sell-side price target is $198, while the mean is $193.

The following tables illustrate Tesla’s sell-side ratings and price targets.

TechStockPros

What to do with the stock

We continue to be bearish on Tesla after the company cut prices on Model 3 and Model Y. We believe Tesla is in defense mode as its EV market share shrinks. We further believe Tesla is prioritizing volume at the expense of margins to boost demand. We expect the lower prices will pressure Tesla’s margins and earnings as the company faces the high costs of raw materials.

Tesla stock slipped under $200 per share in early November and is now trading nearly 48% lower than its 52-week-high of around $384. We believe investors should wait on the sidelines to see how the price cuts impact Tesla’s earnings toward the second half of the year, namely after Q2 2023, and see how competition react to Tesla’s more affordable models. In the near term, we recommend investors exit Tesla, Inc. stock at current levels as we expect TSLA stock will dip further due to weaker margins in 1H23.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.