Summary:

- Lithium prices are seeing massive declines, which is expected to benefit Tesla, Inc.

- Tesla’s recent deal with Piedmont Lithium should amplify the company’s benefits.

- Further, Tesla, relative to its competitor, is likely to benefit from its early transition to LFP batteries.

jetcityimage/iStock Editorial via Getty Images

Introduction

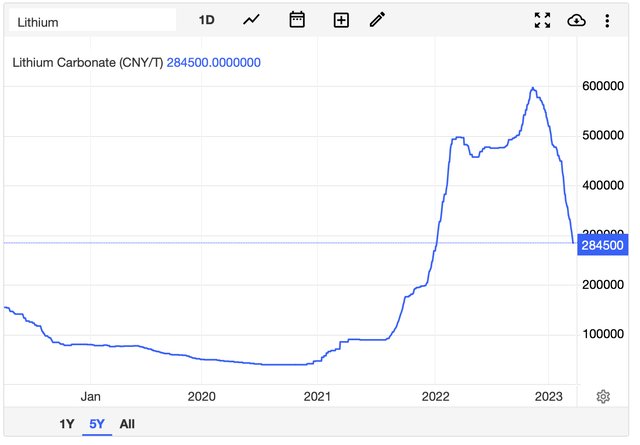

Lithium prices are falling. In fact, they are not just falling – the commodity seems as if the price is falling off a cliff after a record rise in prices during the past year. Most electric vehicle (“EV”) makers will likely benefit from this phenomenon, as lithium is one of the most crucial commodities in building batteries.

Of all automakers, Tesla, Inc. (NASDAQ:TSLA), in my opinion, will benefit the most from falling lithium prices for two major reasons. First, Tesla is the biggest producer of electric vehicles in the Western world and naturally consumes the most lithium. Second, unlike its closest competitors, Tesla’s primary battery is LFP (Lithium Iron Phosphate), providing disproportionate gain for Tesla. Therefore, I believe Tesla is a buy.

Lithium Prices and Tesla

After a period of a bull run for lithium prices, the price of the commodity is finally falling back down to Earth. As the image below shows, recently, lithium prices have been going down as fast as it had been rising, providing absolute benefit for Tesla.

As it is widely known, battery costs are significant portions of the cost of an entirely electric vehicle, which creates a strong correlation between lithium prices and Tesla costs. But, beyond this obvious reasoning, Tesla’s recent contract with the lithium provider, Piedmont Lithium Inc. (PLL), creates an even better environment for Tesla as the prices decline. In 2023, Tesla signed a floating price contract to receive 125,000 metric tonnes of SC6, highly concentrated lithium ore, from the second half of 2023 to the end of 2025, averaging about 40,000 per year. Bloomberg estimates that Tesla used about 42,000 metric tonnes of lithium in 2022; thus, the current deal with Piedmont Lithium is sizeable.

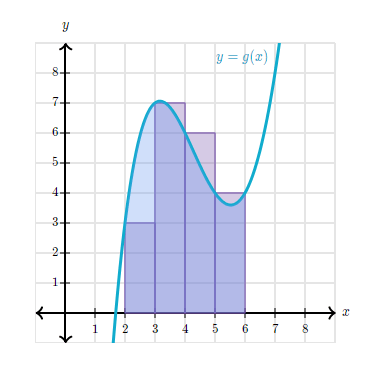

I believe this to be beneficial because the declining lithium prices today will almost instantaneously be reflected in the commodity price that Tesla pays. For example, if the deal was a set price for a number of years, which is the norm, Tesla will be paying for higher lithium prices in a price-decline environment. In mathematics, Riemann Sums explains this phenomenon: while a set price is good for companies like Tesla in times of price increase, it is less beneficial in times of price decrease. As the chart below shows, if areas of rectangles of boxes represented prices paid in set price deals and areas under the curve represent floating price deals, it clearly shows that floating price benefits Tesla in times of Lithium price decline.

Khan Academy

Long-term Lithium Prices

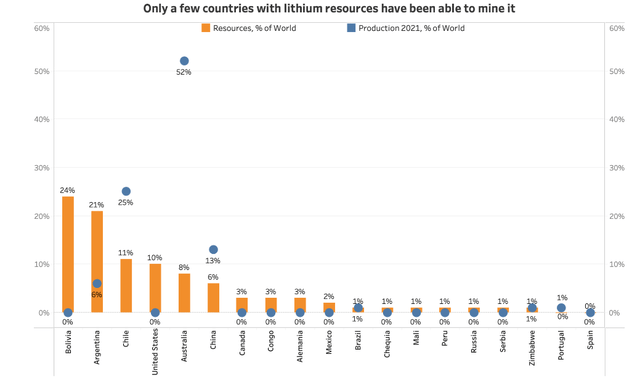

Although I view the deal with Piedmont Lithium to be positive today, one point of concern is that the price of lithium must not increase dramatically in the future for Tesla to fully reap the benefits, and I believe the lithium prices, in the long-term, will continue to trend downwards. Apart from Bank of America Corporation’s (BAC) view of continually lower lithium prices in 2023 as supply grows by 38%, the long-term supply is expected to grow exponentially. The World Economic Forum estimates that about 60% of the global lithium is in South America; however, as the image below shows, South American countries such as Bolivia and Argentina have massive lithium deposits, but they have yet to maximize their capacity. Argentina is expected to boost output from 6% of global supply to 16% by 2030. Further, Bolivia’s lithium mines are being developed with an initial production volume of 16,000 metric tonnes to come online in 2023. Therefore, with the view that lithium is the new gold, supply growth will likely continue to accelerate, creating favorable market conditions.

LFP and NMC Battery

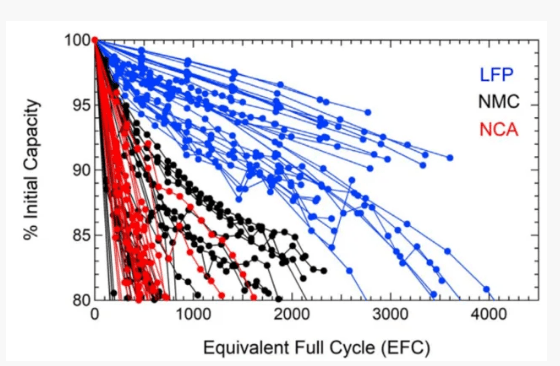

Falling lithium prices do benefit Tesla in absolute terms, but it also benefits Tesla relatively compared to its competitor. Tesla made its 4680 batteries the standard for Model 3 and Model Ys, and 4680 batteries are known as LFP batteries made of lithium, iron, and phosphate instead of expensive and often controversial nickel and cobalt. I will not go into details about the battery’s pros and cons, as it was announced in 2020, but I would like to establish that Tesla’s main batteries, in the current market, have a significant advantage compared to Volkswagen (OTCPK:VWAPY), the second-biggest EV manufacturer in the western world, who currently uses NMC 811, Lithium Nickel Manganese Cobalt Oxide, battery. Because of these differences, I expect Tesla to be an outsized beneficiary from the decline in lithium prices compared to Volkswagen.

First, as commodity prices are normalizing, battery price inflationary pressure is expected to ease, but Tesla will likely benefit more. NMC 811 battery uses 80% nickel and 10% cobalt and manganese. Thus, focusing on Nickel, year-to-date, nickel prices fell about 24.4% while lithium prices fell about 40% year-to-date. Nickel, a more expensive commodity for the electric vehicle battery, fell much less than lithium. Further, LFP batteries, due to their composition, are expected to be about 30% cheaper to produce than NMC 811 batteries, providing an additional benefit factor.

Further, although unrelated to lithium prices, as the image below shows, on average, LFP batteries have much longer life cycles compared to NMC batteries.

Engineering.com

As such, Volkswagen is just switching to LFP batteries starting in 2023; thus, bringing the new battery type for most of its production vehicles will be a multi-year process. Therefore, I believe it is reasonable to argue that the falling lithium prices will benefit Tesla more than Volkswagen, its closest competitor.

Risk to Thesis

Some investors may point out that the reason behind the falling lithium prices is the slowdown in the demand for electric cars. While this is true to some extent in certain markets, I do not believe the decline in lithium prices is necessarily correlated to Tesla’s electric vehicle demand.

A major reason for the dramatic decline in lithium prices is in fact a demand problem, but not in the U.S. markets: it is primarily contained in the Chinese markets. Starting in 2023, the Chinese government stopped providing subsidies to electric vehicle sales, and because China is the biggest electric vehicle market in the world, it had a profound effect on the global lithium market. For example, the Chinese battery manufacturer, CATL, started giving discounts on its batteries.

The demand problem in China, fortunately, is not affecting Tesla heavily. Tesla, in reaction to the end of government subsidy, has reduced the price of its vehicles by 6-13.5% from 2022, which has led to positive results. January and February data show that Tesla’s China sales have increased sequentially by about 18.4% and 12.6% from December to January and January to December, respectively. The February numbers also represent about a 32% year-over-year increase. I believe this is the result of Tesla’s unique position in the market as a luxury player. China’s GDP per capita is about $12,500, which means that only the wealthy individuals in the country can afford Teslas, affecting their demand for EVs less despite a ceased government subsidy.

Overall, the demand slowdown in China led to a lithium price decline benefiting Tesla; however, it has not affected Tesla in a significant way due to its unique positioning in the market.

Summary

Lithium prices are falling, and Tesla, Inc. is expected to benefit. The company, with its floating price deal signed in 2023, will likely see lower commodity prices reflected in its purchase price fairly quickly. Further, with new lithium supplies coming online, the pricing environment will likely continue to be favorable for Tesla. Finally, Tesla, relative to its competitor, is likely to benefit from its early transition to LFP batteries. Therefore, I believe Tesla, Inc. is a buy.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.