Tesla: Pricing Power At A Fair Value

Summary:

- The current Tesla, Inc. share price is trading near the intrinsic value of the company.

- Existing margins are solid and indicate stable product lines with pricing power.

- Core technologies are transferable to additional product lines.

Tesla Risks and Returns Justin Sullivan

The Value of Software

Tesla, Inc. (NASDAQ:TSLA) is not just a car company; it is a technology company. This has been a hot topic of debate, especially since it makes 95% of revenue from selling cars. We need to pull Tesla’s revenue streams apart a little bit to understand why its core offering is software. The Tesla motor’s carbon fiber wrap impresses the mechanical engineer in me, but the software in the Tesla is the game changer.

I am lucky enough to be a beta tester for Full Self Driving (“FSD”). My Model 3 received FSD Beta in September of 2022, and it is amazing. A few days after I got the upgrade, I let it take me and my son from his soccer game all the way home with no input from me. Although a necessary 3 lane change in 100 meters was less than comfortable, stop lights, signs, and almost everything else was handled well by the system. My background in machine learning and data science gives me a deep appreciation of what the team has accomplished. Still, this is Seeking Alpha, and we should focus on the numbers, more specifically the numbers with dollar signs in front of them.

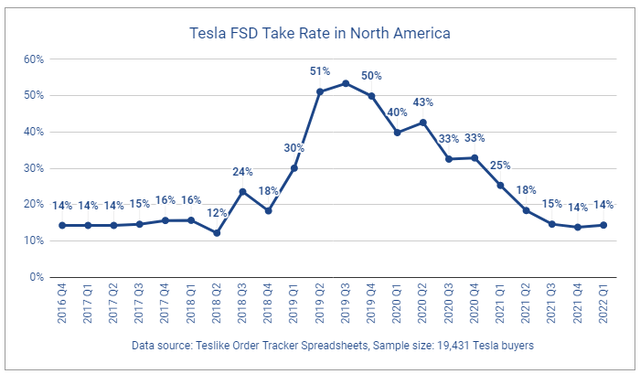

Tesla has increased the cost of its Full Self Driving capability from $6,000 in 2019 to $15,000; not bad pricing power for software in beta that isn’t really fully self-driving yet. The take rate on the FSD add-on is now around 14%, however, I believe that shows a purposeful reversion caused by Tesla pricing policies. The chart below shows the FSD take rate since late 2016.

The company began raising prices on the FSD option in Quarter 3 of 2019 and continued until the most recent price increase to $15k at the end of 2022. The take rate is now back down to the level it started at. I don’t believe the increase in price is Tesla giving up, as other authors have argued. I have experienced a massive increase in capabilities and functionality moving from Enhanced Autopilot to FSD. Tesla also has multiple options for leveraging this technology in other products, as can be seen from the application of the FSD algorithms to their humanoid robot, Optimus. The team applied the same Artificial Intelligence techniques used in FSD to create the bot in under a year.

Tesla products are cool for sure, however, cool products do not make a successful company. Only solid business fundamentals can do that.

Long-Term Growth Prospects

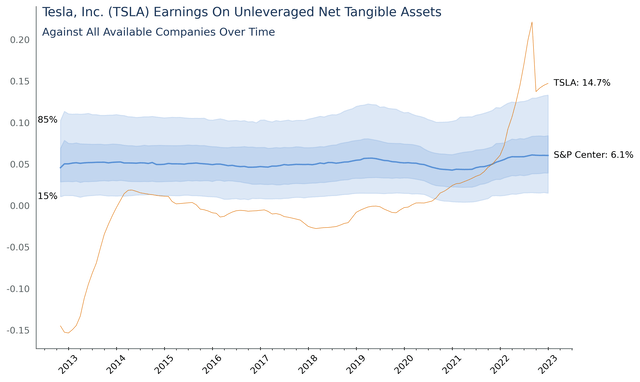

The following chart shows Tesla compared with the rest of the companies in the S&P 500 (SP500) for context regarding earnings on unleveraged net tangible assets. The blue shaded area here shows the distribution of all other companies in the S&P 500 since 2013. Tesla is way up at the top, above the 85th percentile.

Authors Image from Financial Modeling Prep Data

Warren Buffett uses unleveraged net tangible assets to decide what he calls the long-term economic prospects of a business. His logic is simple, increasing earnings without major capital requirements is a better business to be in. It takes money to make money, but you want it to take as little money as possible.

At a Return on Unleveraged Net Tangible Assets of 14.7% Tesla is well above the rest of the S&P 500, which is centered around 6.1%. The recent massive increase shown in the chart above demonstrated pricing power during an economic shock. Other SA authors have pointed out the Tesla has the ability to capitalize on more segments of the value chain than other car companies such as Ford (F) or General Motors (GM). I see this as a positive for the overall business model and demonstrates the pricing power of the product lines rather than a negative on margins. GM and Ford were left watching the dealerships soak up most of the increased margins.

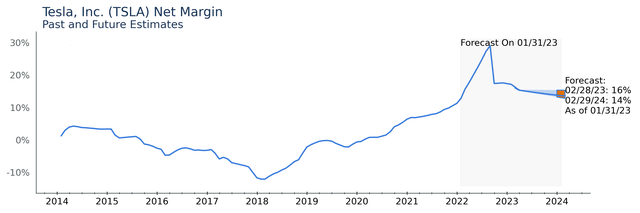

The chart below shows that Tesla does forecast a decrease in margins until at least February of 2024. The decrease in margins expected reaches a level that normalizes back to long-term trends and still maintains a very healthy 14%.

Authors Image from Financial Modeling Prep Data

It is important to understand that this margin prediction is not based on my opinion. It is the result of analyst forecasts from major brokerage houses for both earnings and revenue.

Risk Reward Forecast

Here we explore risk and reward for TSLA stock over the next two annual earnings cycles.

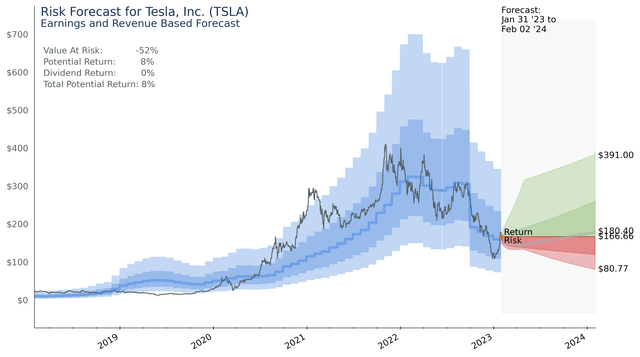

The below chart is a prediction of value at risk and potential return of holding Tesla stock. As shown by the blue intrinsic value region in the chart below, Tesla is in the center of its intrinsic value region. The large drop at the end of the 3erd Quarter of 2022 is the result of the decrease in margins shown in the chart above.

Authors Image from Financial Modeling Prep Data

Tesla now has a value at risk of 52%, while potential returns are only 8%. This 8% is based on the long-term intrinsic value that Tesla has traded at. Long term, the company has solid fundamentals, so as a buy and hold you can do well. The range of predicted values in 2024 is very large, so over the near term Tesla is a momentum and sentiment play. I can’t predict how well a near-term trade will turn out, but the odds are in favor of the long momentum position.

For an explanation of the risk return forecast, look at this article on Visa (V). It also provides a link to a video of the long-term performance of that estimate.

The algorithms do a pretty good job of predicting long-term price movement, but price will go outside the blue bands. Those bands are only there to show you where the price should be 90% of the time. This forecast, and forecasts for other stocks as well, tend to lag price when it goes down and lead when it goes up. This makes it useful to figure out risk in a stock, but it is less reliable for market timing. I am unaware of any market timing schemes that stand up to robust analysis.

Conclusion

Tesla, Inc. offers amazing products that have the potential to change the world. The potential and existing value of these products were only briefly explored in this article. The company is using core technologies to explore new markets which may lead to exceptional returns for shareholders. Tesla, Inc. is currently fairly valued based on long-term trading trends and high trading ranges around intrinsic company value. However, Tesla stock is only suitable for those willing to hold on through extreme share price volatility.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Content is not a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments. All content in this article and website is information of a general nature and does not address the circumstances of any individual or entity. You alone assume the sole responsibility of evaluating the merits and risks before making any decisions.