Summary:

- Tesla faces challenges with slower EV demand and increased competition in China.

- Elon Musk promises to launch a robotaxi service, but regulatory approval may not anytime soon even assuming Tesla has the Level 5 technology.

- ARK Invest projects Tesla’s value to reach $2,000 in 2027 with the launch of the robotaxi service.

- The stock isn’t exactly cheap after falling more than 50%, but investing in Elon Musk is likely to pay off, especially if Tesla does successfully launch robotaxis.

3alexd/iStock via Getty Images

Tesla (NASDAQ:TSLA) has faced a tough year with slower EV demand in the U.S. and higher competition in China. The big hope for shareholders is that Elon Musk will fulfill the promise to turn a fleet of Tesla’s into robotaxis allowing the company to earn large fees. My investment thesis is generally Bullish on the stock, but the robotaxi catalyst could still be far away.

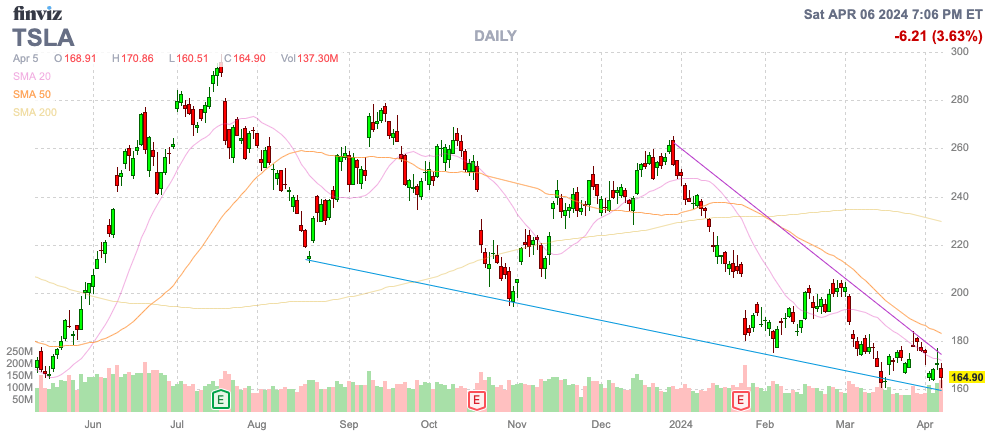

Source: Finviz

Robotaxi Launch

Elon Musk has promised Tesla would launch a robotaxi service going way back to 2016. The EV company currently offers FSD (full-self driving) software offering up to a Level 2 service, but a true robotaxi service would involve Level 5 where a driver doesn’t exist and the vehicle completely controls the driving functions.

After a drama filled day, Musk announced on X that Tesla would unveil the robotaxi business on August 8, or roughly 4 months from now. Though, the CEO didn’t actually list the year, but the assumption is clearly this year.

Tesla has already hosted multiple robotaxi events, so investors probably shouldn’t get too excited about this news. Cruise Automation, owned by General Motors (GM) recently shut down their robotaxi business offering services in multiple cities. The company had their license restricted in San Francisco after an accident caused by a human driver and a pedestrian involved the robotaxi service dragging a woman knocked into the Cruise vehicle.

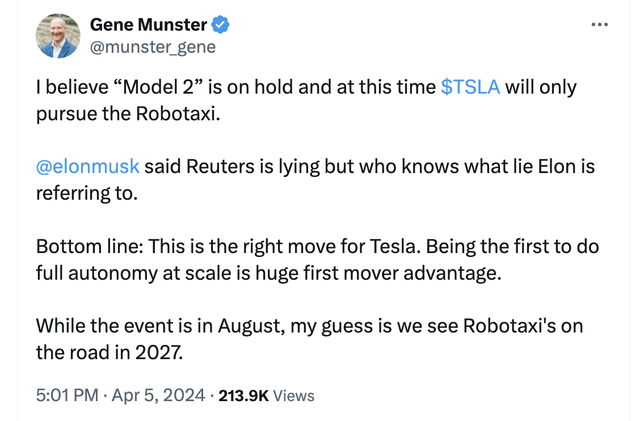

As Gene Munster from Deepwater Asset Management discusses, even if Tesla has the technology for a full Level 5 robotaxi, the service isn’t likely to obtain regulatory approval until 2027. The biggest obstacle could very well be state approvals, not technology.

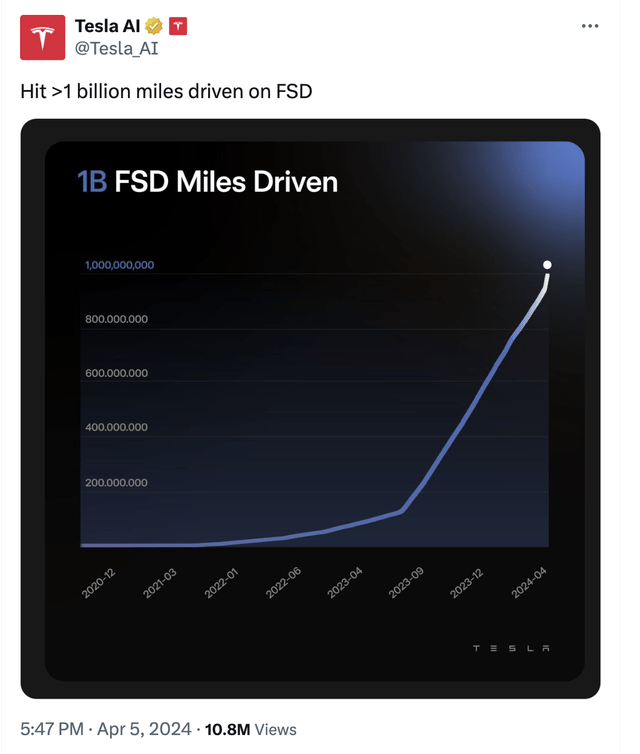

While Tesla has long discussed full autonomy, the FSD service is only Level 2 due to the requirements for driver supervision. The company announced the FSD service has now driven 1 billion miles with a huge uptick in the last year and a hockey stick move after recently offering 1-month free trial.

FSD costs $12/K or a customs can start a subscription for $199/month and appears highly over valued considering the service is only Level 2. The problem with these FSD miles is that regulators won’t count them as autonomous for testing purposes because drivers are supposed to keep hands and eyes on the car.

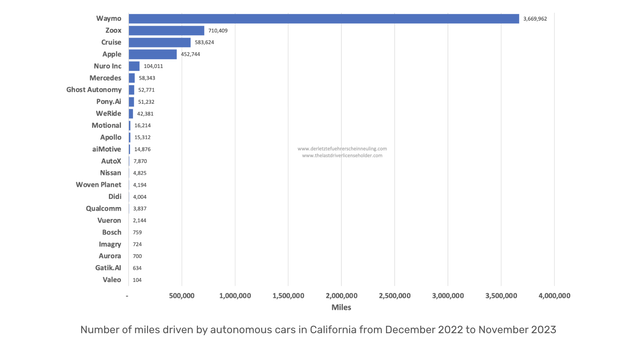

The FSD miles definitely help Tesla build the platform and update the service, but a robotaxi service will require regulatory approvals for a license to not have a driver in the vehicle and each city/state has their own regulations. According to the California DMV, Tesla has 0 recorded test miles while Waymo had 3.7 million last year.

Source: The Last Driver License Holder

Big Investment Projections

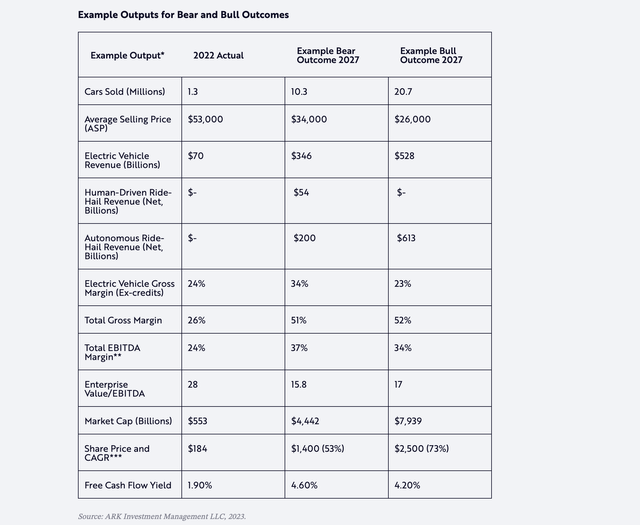

ARK Invest (ARKK) bought into the robotaxi concept and projected Tesla could have a $2,000 expected value in 2027 based on the launch of the service. The key is taking the EV company from an EV manufacturer to an autonomous service provider.

Tesla was projected to half the vehicle ASP to only $26,000 while dramatically boosting the units sold from only 1.3 million in 2022 to 20.7 million in 2027. EV revenues would still surge from $70 billion to $528 billion during the period, but the company would more than double revenues with a robotaxi business producing $613 billion in revenues alone.

The model suggested Tesla had a 63% chance of starting robotaxi service in 2024 or 2025. ARK Invest gave very little odds to the service starting after 2025.

The whole value is derived from turning a fleet of cheaper cars estimated to cost $25K to manufacture into money earning robotaxis. A lot of the market drama on Friday was whether Tesla still plans to produce the Model 2.

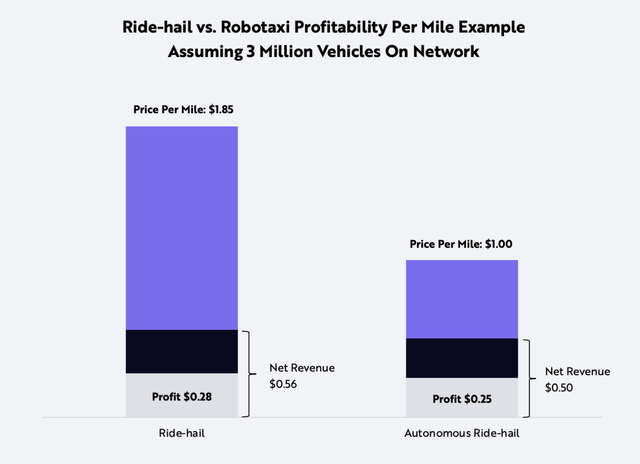

The pre-Covid models had goals of Tesla reducing the trip costs from ride-hail services like Uber (UBER) by 50% to ~$1 per mile. The amount of trips would increase with the lower cost and reduced need to own a vehicle with robotaxis.

A big part of the costs of ride-hailing services is the driver. A holy grail of the sector is removing this cost from the structure while Tesla has actually projected the ability to produce a vehicle with extra AV technology at a very low cost while a lot of fears were the vehicle cost would skyrocket.

Under Ark Invest’s model, Tesla would generate ~$0.50 in revenue per mile and generate a profit of $0.25. A lot of the financial details would have to be worked out based on the timing of the service and the ability of the EV company to produce the low costing EVs with robotaxi service capable of operating up to 90K miles a year and 1 million lifetime miles. In addition, big questions surround whether Tesla is still focused on selling the cars to asset owners that join the robotaxi service. Tesla would collect revenues from purchases of the FSD service at $12K now and share in the platform revenues presumably 50/50 based on the above model.

If anything, ride-hailing costs have only risen in the last 4 years. According to a AAA study, ride-hailing services costs $2+ per mile in major cities while owning a car only costs around $1 per mile.

Investors should definitely tune into the robotaxi unveiling event on August 8 with open ears. The stock is intriguing having fallen nearly 60% from the highs from over 2 years ago. Musk always has something in the works that could add value to Tesla and his determined leadership could help push past some of the regulations that hit Cruise’s service.

With the slowdown in the EV market, the stock isn’t exactly cheap now at 40x 2025 EPS targets of $4 and over 4x sales targets. Robotaxis are definitely the holy grail for the auto sector and Musk seems more determined than others making Tesla appealing from this angle, though the business isn’t likely to launch anytime soon.

Takeaway

The key investor takeaway is that investors don’t usually fare well investing against Elon Musk. Tesla launching a robotaxi service could provide the next big leg up for the stock with ARK Invest projecting upside to $2,000 from the current price of only $165, over an 1,100% gain. The problem is that Musk has long promised full-self driving services and Tesla has yet to deliver anything close. Not to mention, the EV company appears to have done nothing to allow regulators to license a robotaxi service in any state.

The stock is intriguing on the big dip here, but investors need to understand the full launch of the robotaxi service is highly unlikely for several more years. Buy Tesla, but don’t buy the stock for AVs.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.