Summary:

- Tesla set new records for deliveries in Q4, but about half of the sales came from a backlog that is now depleted, and new orders declined dramatically.

- Tesla has slashed prices to revitalize growth. This will come at the expense of profit margins.

- Elon Musk issued a veiled profit warning in a Twitter chat, indicating he would prioritize growth over profits.

- With competition arriving in the EV sector, high margins with high growth rates are no longer possible.

jetcityimage

Signs of slowing Tesla growth

Cracks first started to appear in the Tesla, Inc. (NASDAQ:TSLA) China growth story in Q3. Deliveries were strong, but many of those orders were coming from a backlog that had been accumulated during factory shutdowns in Q2. Competition from BYD Company Limited (OTCPK:BYDDF) and others was eating into Tesla’s order books.

Prices were cut at the end of September, which gave sales a temporary boost, but by December it was clear that Shanghai production was running ahead of demand. The factory moved to a shorter workday (9.5 hrs per shift instead of 11.5 hrs) and shut down for eight days at the end of December.

At the same time, inventories were building in North America, customers were waiting for the New Year to place orders to take advantage of a proposed $7,500 tax credit that was expected in 2023. To offset this, Tesla offered a $3,750 price deduction at the beginning of Q4, and two weeks before the end of the quarter they offered $7,500 and 10,000 miles of free supercharging to buyers who took delivery by December 31st.

It was obvious that Tesla was struggling to find buyers for its factory production in China and North America. The picture in Europe was less clear, sales were strong, buyers were placing orders ahead of a subsidy cut in Germany. A new weight tax and partial imposition of VAT on electric cars in 2023 in Norway was bringing electric vehicle (“EV”) sales forward into 2022. A comparison of EV sales in Norway in January versus December shows a fall of more than 90% (that’s for all EVs, not Tesla).

However, Tesla finished the year with inventory in most of Europe. It is likely that Q4’s record sales depleted most of the order backlog in Europe.

Tesla’s deliveries in Q4 were a record for the company, but new orders were significantly lower than deliveries.

Elon Musk’s “profit warning”

Tesla CEO, Elon Musk participated in a Twitter Spaces chat on December 22nd, in which he gave what might be interpreted as a profit warning for 2023 and indicated that he was willing to fight for growth by lowering prices, even to the point where profit becomes negative. Here’s a link to the chat.

Firstly, he claims that we are in a recession and blames the Federal Reserve for pushing up interest rates, then he outlines possible strategies, then he puts forward a preferred strategy. I quote:

“Let’s grow as fast as we can without putting the company at risk, which would mean in that scenario profits would be low or negative during a recession, provided the cash position is OK. I think that’s still the right move in the long-term.”

Elon Musk really has no option. Tesla is ramping up two new factories at the worst possible time, and he cannot afford to continue operating those factories at low capacity.

Prices were slashed in January

In the USA, the IRS delivered a blow to Tesla early in January when the 5-seat Model Y failed to qualify for the $7,500 tax credit. Inventories in early January were at all-time highs. In China, sales continued to drop, with less than 2,500 Tesla cars newly insured in the first week, and inventory was still available in Europe even though no ships had arrived from China.

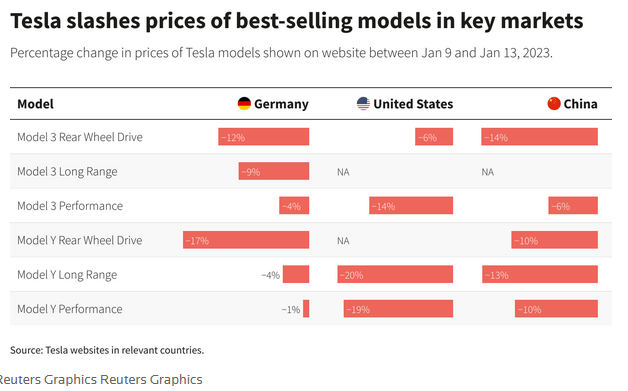

This prompted Musk to put his plan into action, first in China and then in the rest of the world. Prices have been slashed drastically, as shown in the table below:

Tesla – January 2021 price changes (Reuters)

Price cuts in Germany are typical of the cuts in all European countries. Prices in Japan, Australia, and other Far East countries were also cut.

The chart shows only the January changes in China. With the combined effect of the September and January cuts, prices for the SR versions of the Model 3 and Model Y are now lower by almost 25% versus the Q3 prices. Based on the China revenue as quoted in the Q-10 reports, average selling prices are very close to the prices of the SR versions, indicating that those versions account for almost all Chinese sales.

Tesla doesn’t publish detailed information on sales split out by trim level, so an accurate evaluation of the weighted average price cut is not possible. My own estimate is that Tesla has put in place an across-the-board price cut averaging 16%, including the January cuts and the September cuts in China.

Forecasting the effect on deliveries and profits

The cuts will of course increase sales, we have already seen weekly insured units in China grow to over 12,000 units in the second week of January. The Q4 earnings call provided another optimistic view, with Elon Musk claiming that new orders since the price cuts were double the rate of production (we don’t know whether that production rate included the Shanghai factory, which was shut down at the time).

It is too early to know whether that new order rate will be sustainable. Tesla still has inventory in the UK and Europe and is now offering low-interest financing in the UK and Germany, in addition to the lower prices. Leasing is popular in Europe and both the UK and Germany offer tax breaks for company cars that are EVs, those cars are mostly leased. However, price cuts don’t necessarily pass through to lease rates because the resale value also drops, hence the need to offer lower financing rates.

China data is delayed by the New Year holiday.

I have searched a lot of literature on the subject, but I have found no consensus on the price elasticity of car sales. Published figures range from 0.8 to 4, the lower figures likely refer to the price elasticity of automobiles in general, whereas the higher figure might refer to a price change in a single car or group of cars with no corresponding price change in other cars in the same class. The high figure would mean that a 15% drop in price would result in a 60% increase in sales.

However, here’s where I see the problem:

Tesla delivered 748,000 cars in the second half of 2022, but they also worked through an order backlog of about half of that. Net new orders placed were less than 400,000 cars for the two quarters combined.

To estimate the effect of the price changes, the baseline should be the new order rate, not the delivery rate. A 60% increase in new orders versus the second half of 2022 still leaves Tesla with no growth in deliveries. In fact, they need a 100% growth in new orders to achieve the same sales as Q4.

In the Q4 earnings call, Tesla guided to 1.8 million deliveries in 2023, which would be a 37% increase over 2022 but only an 11% increase over the rate of deliveries in Q4, 2022. With the price cuts, quarterly automotive revenue for 2023 will probably not exceed that of Q4,2022.

It is inevitable that profits will take a hit.

The rate of decline in margins in Q4,2022 was hidden by a one-time transfer of deferred revenue associated with Tesla’s “Full self-driving” package, and a higher than usual income from regulatory credits. If we back out the effect of those two items, we find that the average selling price per car (excluding leases) fell by 4.5% from $53,436 to $51,057 and gross margins, excluding the above items, fell by 3.9%. We can attribute that to the discounting and price cuts in China and the USA in Q4.

Some help will come in 2023, from the American taxpayer in the form of battery manufacturing credits from the misnamed “Inflation Reduction Act,” though the bulk of those credits actually accrues to Panasonic, maybe they will be generous and split the windfall with Tesla.

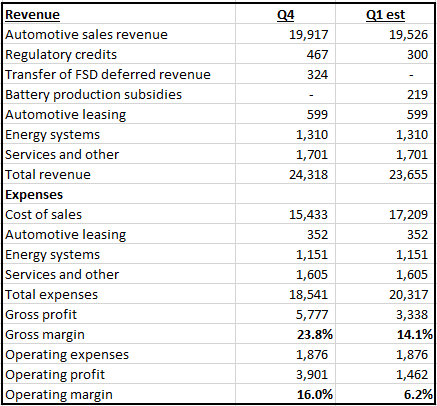

I have put together a pro forma calculation of operating margin for Q1, 2023 to show the possible effect of the price cuts:

Pro-forma calculation of operating margin (Calculated from Tesla financial statements)

I have used Tesla’s sales guidance of 450,000 cars per quarter and assumed 15,000 cars are subject to lease accounting. Profits are significantly reduced, operating margins fall to 6.2%.

Tesla falls from being the third most profitable automotive company (after Ferrari (RACE) and BMW (OTCPK:BMWYY)) to 24th place behind Ford (F), GM (GM), Stellantis (STLA), Volkswagen (OTCPK:VWAGY), and most of the other major automakers. Here’s a link to that data.

Those margins would be getting close to Musk’s statement:

“[P]rofits would be low or negative during a recession, provided the cash position is OK.”

But we aren’t yet in a recession, employment is reasonably strong, real interest rates are still negative, oil and commodity prices are rebounding, and the Federal Reserve is still raising rates to fight inflation. To be forced to cut prices this early in what might eventually turn out to be a recession is highly bearish for Tesla, but Musk seems determined to do whatever he can to boost sales “provided the cash position is OK.”

Tesla’s cash position

Tesla’s balance sheet gives the impression of a very strong cash position. But the published balance sheet is only a snapshot of a company’s financial position at a specific time. Tesla organizes its company around presenting the best possible picture at the quarter end. Deliveries are organized to minimize inventory (and therefore maximize cash) at the quarter-end. I have little doubt that payments for goods and services are also organized so that bills are paid shortly after the new quarter begins.

Tesla’s Q4 balance sheet included a mystery investment of $4.368 billion with no details and no indication during the earnings call as to what that investment might be. The wording on the balance sheet was changed from “cash, cash equivalents and marketable securities” to “cash, cash equivalents, and investments” which seems to imply that the mystery investment is not a marketable security and by implication, not easily converted to cash.

Tesla ended Q4 with $16.924 billion in cash, cash equivalents, and restricted cash according to the cash flow statement.

Accounts payable were $15.255 billion, averaging 72 days outstanding, mostly due for payment early in Q1.

In addition, there were $7.142 billion of accrued liabilities. Among those liabilities were items that would be due early in the quarter including taxes payable (mostly sales tax and VAT) and payroll, which in previous quarters have amounted to about $2 billion (we don’t see a breakdown until the Q-10 is published)

There is also $1,083 in customer deposits which need to be held in reserve.

The way Tesla organizes its business, most of the sales happen in the second and third quarters, and only about 10% of the incoming cash is received in the first quarter, but most of the bills are paid in the first month of the quarter. So, if you were to produce a balance sheet at the low point in the quarter you would see a cash position much lower than you see at the end of the quarter.

A declining cash position may have been a factor in the decision to drastically cut prices two weeks into the new quarter. Tesla may have been running short of cash.

Tesla cannot win a price war against the major automakers

Tesla’s price cuts will put pressure on the EV start-ups like Rivian (RIVN), Lucid (LCID), and Fisker (FSR), but even if those companies go out of business, the impact on the auto market will be negligible. The larger automakers are all expanding production and have an incentive to sell EVs, at a loss if necessary.

CAFE standards in the U.S. and China and emission regulations in Europe require auto manufacturers to lower their average fuel consumption across their sales fleet or face penalties. Selling EVs increases the corporate average fuel economy (and reduces tail-pipe emissions), particularly in Europe where EVs have been given a zero emissions rating. By selling EVs, automakers can reduce those regulatory penalties. For example, an EV sale in Europe can be worth $10,000 or more in fines avoidance.

Tesla has been reaping the rewards by selling emission credits of one form or another to automakers who have been late in developing their EV production. That situation will eventually change when other automakers are producing enough EVs to meet emission standards.

Once we reach the point where the supply of EVs catches up with demand then the large automakers can, if necessary, reduce their prices to below the cost of production and still be incentivized to sell EVs.

It would be a price war that Tesla cannot win.

In summary

- Tesla has been forced to lower its prices because of a slump in new orders at a time when it is trying to ramp up two new factories.

- Elon Musk blames a recession, but the recession hasn’t happened yet. A combination of forces, including poor quality control, horrible customer service, tired old models, and increasing competition is responsible for the lack of orders.

- Tesla’s price cuts will bring its operating margins below, those of competing automakers.

- Tesla does not have the cash to participate in a prolonged price war with other automakers without raising more cash or going into debt.

- Tesla’s share price has risen sharply since the price cuts were announced. The market has got this wrong. Tesla’s price cuts are not a bold move to boost sales, drive other manufacturers out of the electric car business and dominate the industry. They are making a desperate attempt to revive slumping sales at the expense of profits.

Because EV demand has exceeded supply for the past decade, Tesla has been able to sell cheaply made cars at luxury prices, while spending very little on customer service, marketing, and the development of new models. As more EVs have come to the market that situation is changing. Tesla is now having to give up its higher-than-normal profit margins and act like a normal auto supplier, running a capital-intensive, low-margin business in a competitive environment. Tesla, Inc.’s valuation needs to be adjusted to suit the new reality, and that valuation is a lot lower than the current share price.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Short position through short-selling of the stock, or purchase of put options or similar derivatives in TSLA over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.