Summary:

- Wholesale shipment data from the China Passenger Car Association indicates that recent price cuts have spurred demand for Tesla’s EV products.

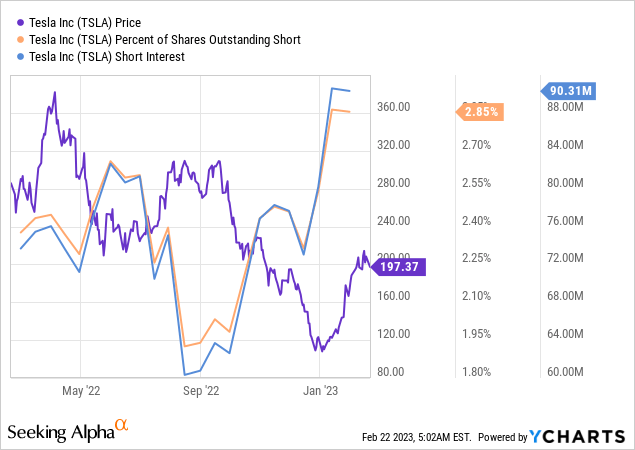

- Tesla’s two-month stock rally was likely supported by an unwinding of short positions.

- Tesla’s valuation is now stretched and sentiment overly bullish which is why I am selling.

jetcityimage

I made a risky and aggressive buy recommendation for shares of electric vehicle company Tesla (NASDAQ:TSLA) at the end of December — Tesla: Buy The Bloodbath — which is when Tesla was on track to post its worst monthly stock performance ever and sentiment was extremely bearish. As reasons to buy Tesla I cited a strong expected production rebound for the fourth-quarter and excessive short-selling that led to an unprecedented and undeserved draw-down in Tesla’s market cap.

Since the end of December, however, Tesla has risen about 65% and a profound shift in sentiment has taken place, in part because of very strong production numbers from the EV company for Q4’22. I believe the situation has now completely reversed and investors are overly bullish. Although I like to see TSLA stock as a long-term holding, the strong price increase suggests that this is no longer a time to be greedy, but to be fearful!

Sentiment change driven by solid production growth and impressive delivery numbers in a challenged market

The unprecedented sell-off in December didn’t make much sense to me because Tesla was seeing strong post-lockdown production momentum at its Shanghai Gigafactory which, in my opinion, was set to continue in FY 2023. Tesla’s production and delivery numbers for the fourth-quarter strongly confirmed my outlook at the start of January.

In Q4’22, Tesla produced 439,701 electric vehicles and the EV company had a delivery share of 92%, meaning Tesla delivered 405,278 EVs to customers. Tesla’s deliveries soared 18% quarter over quarter as Tesla successfully ramped up production, especially regarding Models 3 and Y, for which deliveries grew 19% quarter over quarter.

Tesla delivered a total of 1.31M electric vehicles in the entire year, showing 40% year over year growth in a year that was marked by factory shutdowns and supply chain challenges. Tesla said in FY 2022 that its longer term goal is to achieve 50% annual production growth rates.

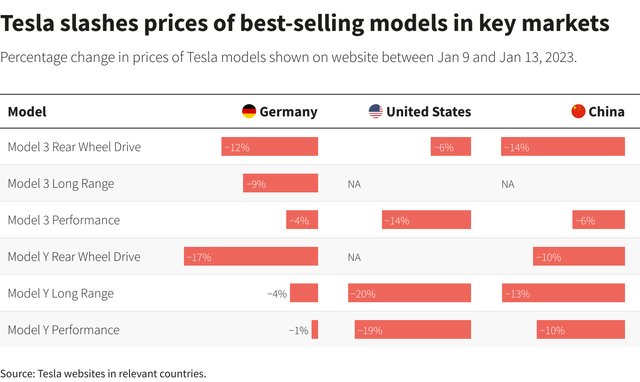

What is even more interesting that production/delivery numbers for FY 2022 is that Tesla has started off FY 2023 with solid delivery momentum as well. Shipments increased strongly in January, on a month over month basis, despite Tesla aggressively cutting prices in order to offset slowing consumer demand as well as growing competition in the EV market. Tesla said in January that it was going to cut prices for some of its most in-demand products in a bid to spur demand. Tesla’s EV prices in China have dropped up to 14% year over year in a strategic move that some worry could lead to a price war in the EV industry. A week ago it was reported that Tesla is again increasing prices for its Model Y in China.

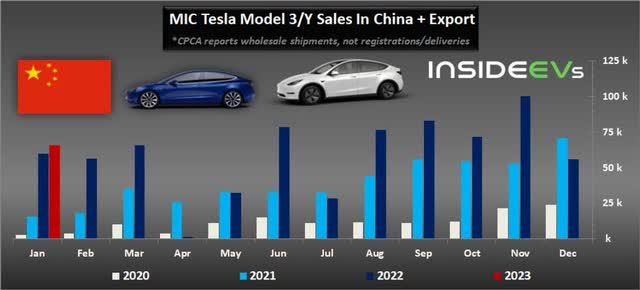

While the increase in Tesla product prices is old news, recent shipment data from the China Passenger Car Association shows that Tesla’s wholesale shipment volumes actually went up in January. Tesla sold 66,051 electric vehicles in China (including those vehicles prepared for export), showing an increase of 18% month over month. In December, when production already rebounded from previous lockdown restrictions, Tesla sold 55,796 electric vehicles in China.

Tesla’s production and delivery performance in January indicates that the price decreases did not hurt Tesla’s sales, but actually generated sales growth. The results are especially impressive when considering that the January sales period includes the Lunar New Year holidays which is when millions of people across China go home to their provinces and many factors shut their doors. Therefore, EV manufacturers tend to see declines in deliveries in January and February. NIO (NIO) and XPeng (XPEV) saw delivery declines of 12% and 60% on a year over year basis (source 1 and source 2) in January, so Tesla’s results are even more impressive than they first look.

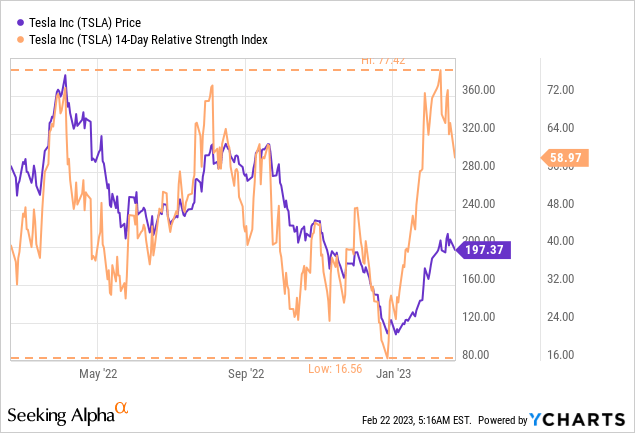

Sentiment for Tesla is now leaning very bullish. The RSI-index rebounded from a low of 16.6 in late December to 77.4 at its peak in February. The RSI is now 59.0 and shows that investors are quite optimistic about Tesla’s prospects.

Short position unwinding and Tesla’s valuation

In my last work on Tesla I indicated that the downward revaluation of Tesla’s shares in December was driven, at least partially, by short sellers. I believe the recent upward revaluation has been driven, also partially, by short sellers unwinding their profitable short positions in the EV company.

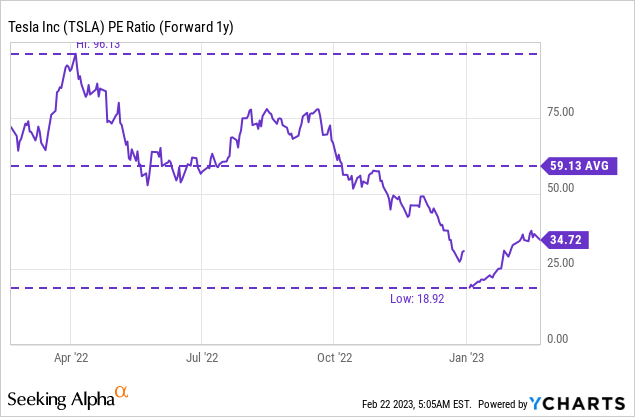

Tesla was valued at a P/E ratio of 20.4 X in December when I aggressively acquired the stock. Now, the P/E ratio has risen to 34.7 X. This means that Tesla is still valued 41% below its average 1-year P/E ratio.

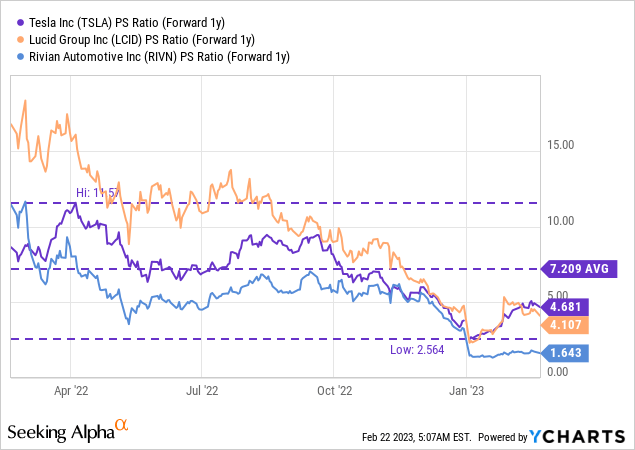

Based off of revenues, Tesla is currently valued at 4.7 X forward revenues (3.1 X back in December) and Tesla is now once again the most expensive EV stock when compared against Lucid Group (LCID) and Rivian Automotive (RIVN). Tesla, however, also has significantly higher production/delivery volumes, a much broader and more global production footprint and is free cash flow profitable… which are all things that Tesla’s rival can’t claim about themselves.

Risks with Tesla

Selling into the strength exposes me to the risk of not participating in a continued stock rally, especially if Tesla continues to perform well and ramps up deliveries, but it also helps me secure a very solid total return of close to 70% in just two months. I believe Tesla could achieve 40% delivery growth in FY 2023, possibly up to 50% if the Cybertruck launches early enough this year. A general reopening of the Chinese economy could also be a catalyst for Tesla to report continual production and delivery momentum for the Model 3 and Model Y.

A commercial risk for Tesla is the impact price cuts may have on margins. While Tesla may “buy” revenue growth by lowering its vehicle prices, the company’s gross margins may come under pressure going forward. Tesla’s automotive gross margin in Q4’22 was 25.9%, showing a decline of 4.70 PP year over year. A developing downtrend in margins may result in a lower valuation multiplier factor for Tesla’s shares.

Final thoughts

I believe that after a near-70% upside revaluation that has taken place in just about two months, investors should think about taking profits and selling into the strength. Frankly, I thought of Tesla as a long term holding when I bought the drop in December, but the strong price rally following the release of full-year production numbers challenges my assumption. While I believe the price cuts have not only not hurt Tesla’s sales in January, but actually spurred demand, Tesla’s negative sentiment overhang from December has completely been removed and investors are now much more bullish than two months ago. Since investors clearly are much more greedy than in December, I believe this is a good time to be more fearful and take profits!

Disclosure: I/we have a beneficial long position in the shares of NIO, XPENG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.