Summary:

- Tesla, Inc.’s scarcity value should last, as it continues to lead the world’s transition to renewable energy.

- Tesla’s production capacity and consumer demand remain strong, especially in China.

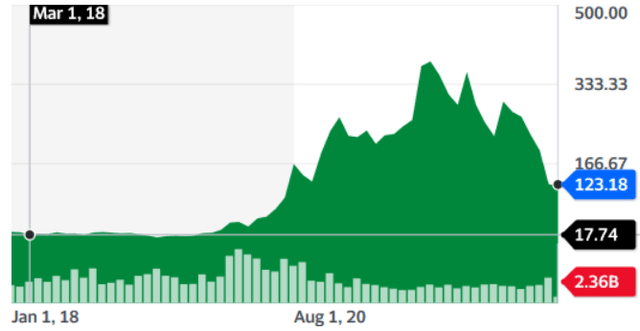

- In spite of various uncertainties, investors might want to closely follow Tesla and seize buying opportunities around $100-$110.

Spencer Platt

Tesla, Inc. (NASDAQ:TSLA) generates revenue from two segments: automotive, and energy generation and storage. Its automotive offerings include Model 3, Model Y, Model S, Model X, and its future Electric Vehicles including Cybertruck, 2023 New Tesla Roadster, and Tesla Semi. Its energy generation and storage products include Solar Roof, Solar Panel, Powerwall, and Megapack. Tesla’s founder is Elon Musk, the most talked-about entrepreneur in the world. He also has co-founded/founded/acquired the following companies.

- Zip2, sold to Compaq for $307MM in 1999

- X.com, later known as PayPal, and bought by eBay for $1.5B in 2002

- Space Exploration Technologies (SpaceX), founded in 2002

- The Boring Company, founded in 2016

- Neuralink, founded in 2016

- SolarCity, acquired into Tesla Energy in 2016

- Twitter, purchased in 2022

TSLA has been a legend for several years, and only became concerning in the last 12 months (52-week high price $403, and 52-week low $108) driven by numerous issues resulted from Elon Musk’s recent acquisition of Twitter and the overall economic environment hit in terms of demand, production, and supply chain.

We do not know how long it may take Elon Musk to get a new Twitter CEO onboard, and how much dedication Elon Musk will have for Tesla while taking care of his other businesses. We would just focus on the knowns to discuss a couple of things investors are currently worried about.

Tesla’s Scarcity Value

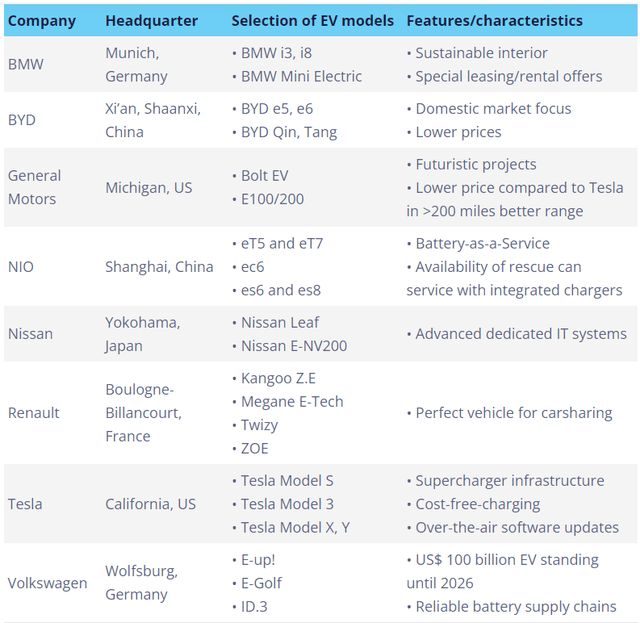

Admittedly, Tesla is not dominating the electric vehicle (“EV”) space anymore, as the whole industry is going electric. According to TridensTechnology.com, Tesla now has many rivals.

However, I am still positive about Tesla’s scarcity value. Tesla is leading the world’s transition to sustainable energy, and it has been pushing the boundaries of technology in many ways. Elon Musk himself has been able to prove his exceptional innovation blood in his other businesses. I think technologies such as Full-Self Driving (FSD), Humanoid AI automaton (Optimus), and AIaaS (Dojo) will enable Tesla to continue its mission.

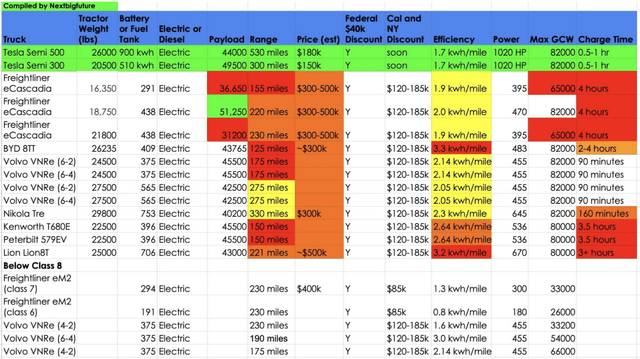

Its upcoming models also appear exciting. For example, according to Teslarati.com, “Tesla Semi outperforms both diesel and electric truck competition, according to a new specification analysis” (see the following figure). Its first 100 vehicles will go to PepsiCo (PEP) before mass production in 2023.

I think Tesla will continue to lead this space by bringing in more renewable energy products and solutions to consumers and enterprises. Its scarcity value will last, considering both Tesla’s leading position and Elon Musk’s relentless drive in disruptive technology.

Tesla’s Production Capacity and Consumer Demand

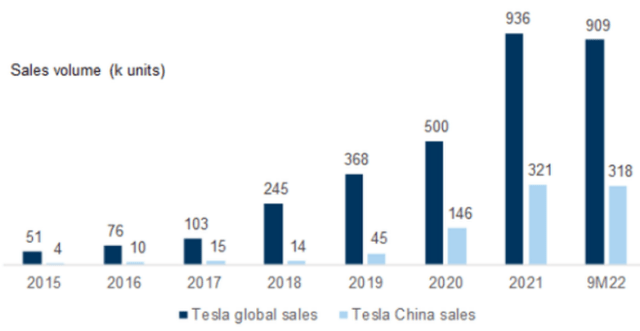

Tesla continued to miss Wall Street expectation on delivery in Q4-22, although it hit a new watermark of 405,278 for quarterly results. Its FY22 vehicle deliveries grew 40% YoY to 1.31 million, while production grew 47% YoY to 1.37 million.

To be honest I would never bother about this miss for a company achieving 40% volume growth in this macro environment. Tesla owns factories across the U.S., China, and EU, and five factories are in production. Its demand is stronger than supply, but landing fairly close with supply. This is pretty positive, and even more if we dive into China market specifically (given it now accounts for over one third of Tesla’s global sales).

In my opinion, Tesla’s growth from China for both production and sales perspectives will materially help with Tesla’s performance in 2023. According to InsideEVs, Tesla’s Shanghai Gigafactory delivered 100,291 electric vehicles in November, +90% YoY. Assuming this growth momentum to continue, I would have less worry about Tesla’s production capacity in 2023. In terms of demand, admittedly Tesla faces some competition from a few Chinese and Global players, especially BYD Auto in China.

However, there are two things that could alleviate some of the concerns. First, China has a much stronger push in EV transition (e.g., traffic restriction for all gasoline cars but not EVs in many cities, registration limitations for all gasoline cars via lottery or over $10k auction price). A $30ish thousand Tesla Model 3 (after price cut) is undoubtedly a sought-after option for many households in China.

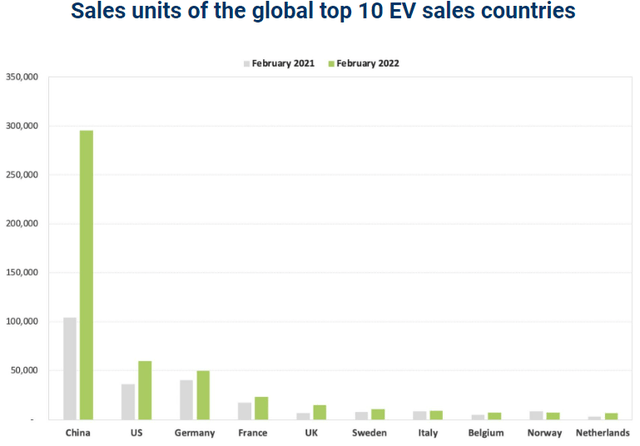

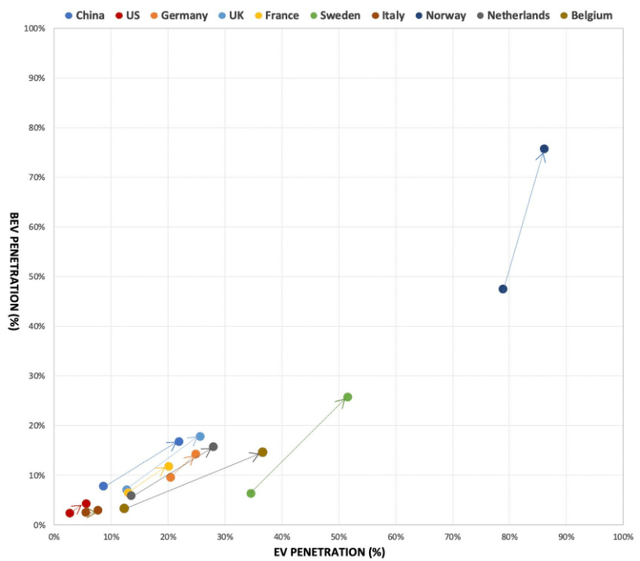

Second, competition from top-selling Chinese brands may not necessarily be a threat to Tesla, considering different brands serve different segments of customers. The Chinese market is big enough for multiple brands to co-exist. As shown in the following figures, EV Sales in China almost tripled in 2022 vs 2021, and BEV (battery electric vehicle) penetration in China is below 20% in 2022 (doubled vs 2021) as compared to 70%-80% in Norway.

e-vehicleinfo.com e-vehicleinfo.com

Conclusion

Despite uncertainties around Elon Musk’s dedication as Tesla’s CEO, potentially more Tesla shares being sold, and Twitter’s CEO search, I expect Tesla to deliver strong performance in 2023. Investors might want to closely follow Tesla and seize buying opportunities around $100-$110.

In my next article, I will focus on Tesla’s profitability outlook, as well as its intrinsic value and multiple-based valuation.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.