Summary:

- Thermo Fisher Scientific is a leading research and development company and provider of laboratory products and services headquartered in Waltham.

- On August 23, Reuters announced that Novo Nordisk has entered into a partnership agreement with Thermo Fisher Scientific, under which it will be responsible for filling the Wegovy injection pens.

- Moreover, Thermo Fisher Scientific’s Non-GAAP P/E [TTM] is 24.35x, which is 32.17% higher than the sector average and 1.1% lower than the average over the past five years.

- At the beginning of July 2023, Thermo Fisher Scientific’s total debt was about $34.02 billion, down $2.32 billion from 2021.

- We initiate our coverage of Thermo Fisher Scientific with a “hold” rating for the next 12 months.

sanjeri

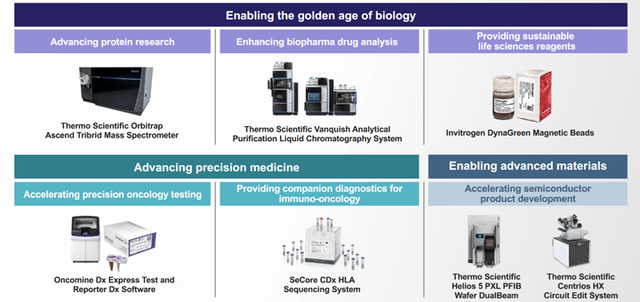

Thermo Fisher Scientific (NYSE:TMO) is a leading research and development company and provider of laboratory products and services headquartered in Waltham. The company has long been a key player in developing and commercialization of laboratory equipment, reagents, analytical instrumentation, and diagnostic systems utilized for research purposes, the discovery of new drugs and vaccines, the diagnosis of diseases, and more.

Thanks to active R&D and M&A policies, the company has a diverse range of products, including mass spectrometers, chromatography systems, electron microscopes, and DNA sequencing systems, which, due to the advanced technologies used in them, are in high demand from clinical diagnostic laboratories, research institutes, pharmaceutical companies, and hospitals.

The emerging trend of population aging in the European Union, Japan, and China inevitably entails an urgent need not only for developing more effective medicines but also contributes to an increase in the volume of laboratory tests required for a more accurate diagnosis. We believe Thermo Fisher Scientific is well-positioned to capitalize on current demographic trends, thanks to its diverse portfolio of diagnostic products.

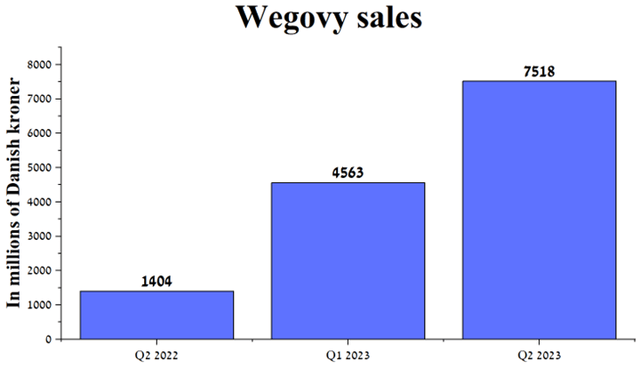

Moreover, on August 23, Reuters announced that Novo Nordisk has entered into a partnership agreement with Thermo Fisher Scientific, under which it will be responsible for filling the Wegovy injection pens. Wegovy (semaglutide) is the Danish company’s blockbuster drug for chronic weight control in adults with obesity, which has seen rapid growth in demand since FDA approval in 2021. Sales of this medicine amounted to DKK 7.52 billion, an increase of 435.5% compared to the previous year. Given the production problems at the Catalent plant, demand for Thermo Fisher Scientific’s services will only increase, thereby helping to improve its financial position in the post-COVID-19 era.

Author’s elaboration, based on quarterly securities reports

Despite the decline in revenue of the Life Sciences Solutions segment of the company relative to the previous year, caused primarily by a decrease in sales of reagents, instruments, and diagnostic tests after the end of the acute stage of COVID-19, for the past six years, its management has been increasing dividend payments, gaining favor among conservative investors.

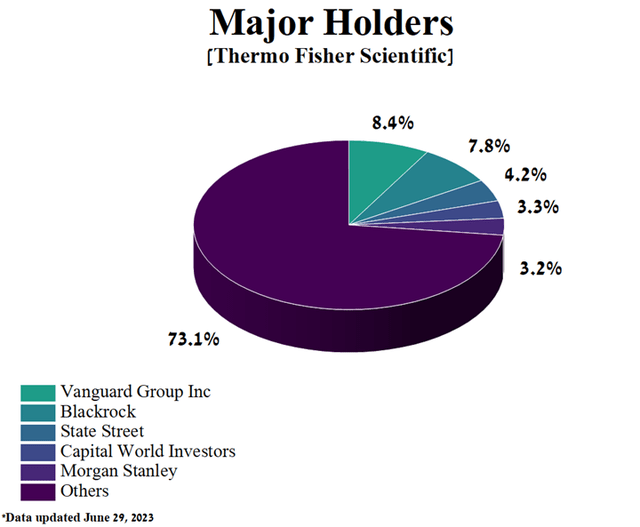

Additionally, Thermo Fisher Scientific has notable backing from prominent financial giants, including Morgan Stanley, Vanguard Group, BlackRock, State Street, and Capital World Investors, who collectively hold a substantial 26.94% stake in the company. Despite growing competition in the global mass spectrometry market, their unwavering support reflects a strong belief in Thermo Fisher Scientific’s bright prospects.

Author’s elaboration, based on Yahoo Finance

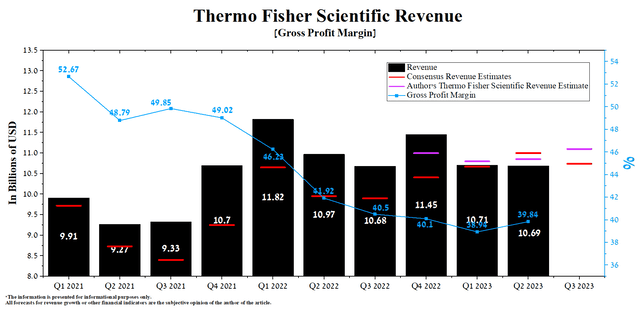

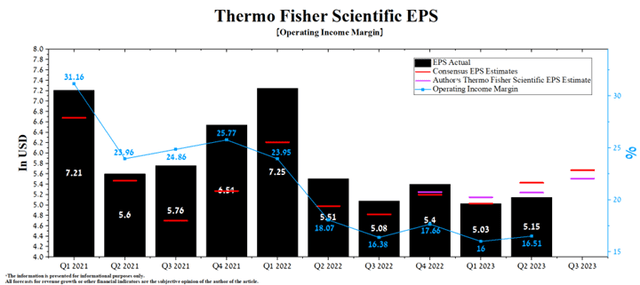

The financial report for the second quarter of 2023 showed mixed results. On the one hand, Thermo Fisher Scientific’s revenue and EPS failed to exceed analysts’ expectations, but on the other hand, sales of its Analytical Instruments segment continued to grow year over year due to increased demand for electron microscopes.

Thermo Fisher Scientific is expected to release its third-quarter 2023 financial report at the end of October 2023, which we estimate should surprise investors due to an increase in the volume of COVID-19 tests and growth in sales of mass spectrometers, mainly used for research purposes.

According to Seeking Alpha, the company’s revenue for the third quarter of 2023 is expected to be $10.5-$11.27 billion, up 0.6% year-over-year and 2.4% below analysts’ expectations for the previous quarter. At the same time, according to our model, Thermo Fisher Scientific’s total revenue will be within this range and amount to $11.1 billion. The leader in the healthcare sector’s quarterly revenue growth will be driven by continued high demand for laboratory and transplant diagnostic products.

Author’s elaboration, based on Seeking Alpha

At the same time, we forecast that the operating income margin will reach 17.4% by 2023, and by 2024, it will rise to 19.4%, thanks to an increase in the number of clinical trials, growth in sales of analytical systems, and a decrease in the cost of components and raw materials for the production of medical equipment and reagents.

According to Seeking Alpha, Thermo Fisher Scientific’s third-quarter EPS is expected to be $5.45-$5.86, up 4.4% from the consensus estimate for the second quarter of 2023. Simultaneously, according to our model, the company’s EPS will be $5.51, slightly higher compared to the previous quarter.

Moreover, Thermo Fisher Scientific’s Non-GAAP P/E [TTM] is 24.35x, which is 32.17% higher than the sector average and 1.1% lower than the average over the past five years. In comparison, the P/E Non-GAAP [FWD] is 22.44x, which is one of the factors indicating a slight overvaluation of the company during a period of slower economic recovery in China, which is emerging as a world leader in scientific research.

Author’s elaboration, based on Seeking Alpha

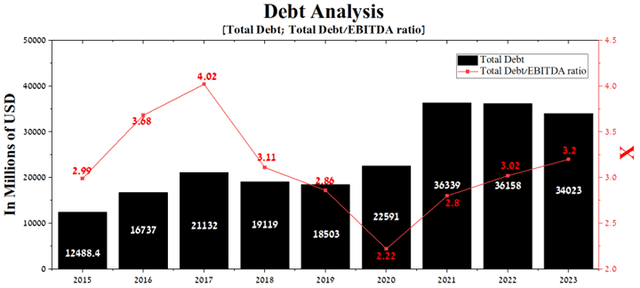

At the beginning of July 2023, Thermo Fisher Scientific’s total debt was about $34.02 billion, down $2.32 billion from 2021. On the other hand, the company’s slow EBITDA growth rate in recent quarters has led to an increase in the total debt/EBITDA ratio from 2.8x to 3.2x.

Author’s elaboration, based on Seeking Alpha

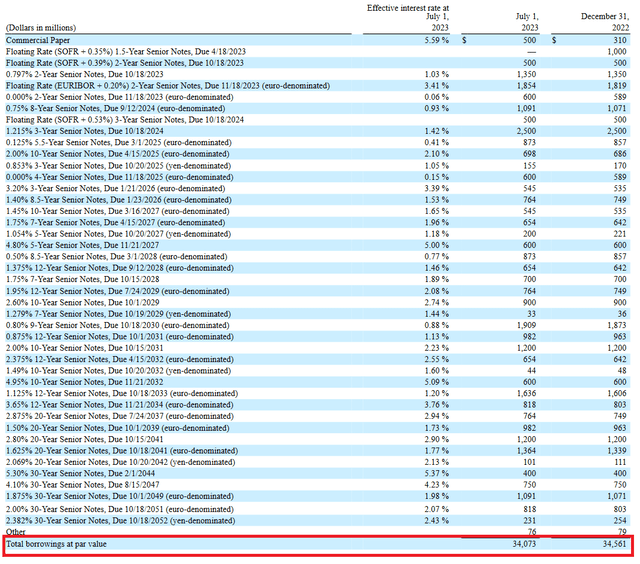

Given Thermo Fisher Scientific’s stable cash flow and expanding portfolio of blood-test systems, diagnostic tests, and medical devices, we do not expect the company to have significant difficulty repaying its senior notes.

Author’s elaboration, based on 10-Q

As a result, the company’s management will continue to pursue a policy of increasing dividend payments despite the continued challenging macroeconomic environment in the world caused by rising hydrocarbon prices.

Conclusion

Thermo Fisher Scientific is a leading research and development company and provider of laboratory products and services headquartered in Waltham.

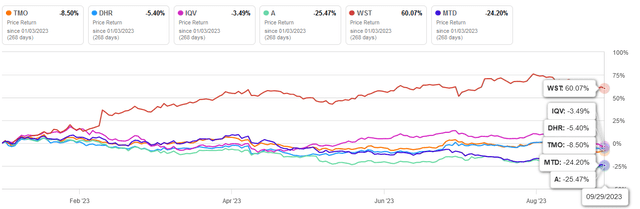

The decline in sales of reagents, instruments, and diagnostic tests after the completion of the acute stage of COVID-19 negatively affects the company’s revenue growth rate year-on-year. As a result, Thermo Fisher Scientific’s share price has fallen more than 8% since the start of 2023, underperforming Danaher (DHR), its main competitor in the healthcare sector.

Author’s elaboration, based on Seeking Alpha

Even though the company is actively expanding its portfolio of analytical instruments and entering into partnership agreements with leaders in the pharmaceutical industry, we believe that the price level at which the risk/reward profile will be attractive is $478-$480 per share.

We initiate our coverage of Thermo Fisher Scientific with a “hold” rating for the next 12 months.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article may not take into account all the risks and catalysts for the stocks described in it. Any part of this analytical article is provided for informational purposes only, and does not constitute an individual investment recommendation, investment idea, advice, offer to buy or sell securities, or other financial instruments. The completeness and accuracy of the information in the analytical article are not guaranteed. If any fundamental criteria or events change in the future, I do not assume any obligation to update this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.