Summary:

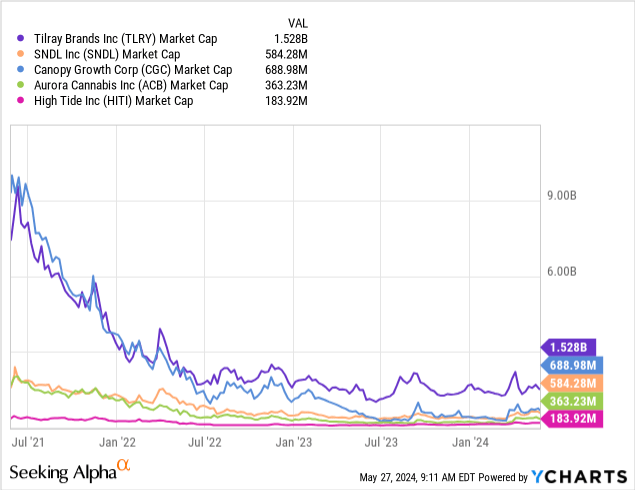

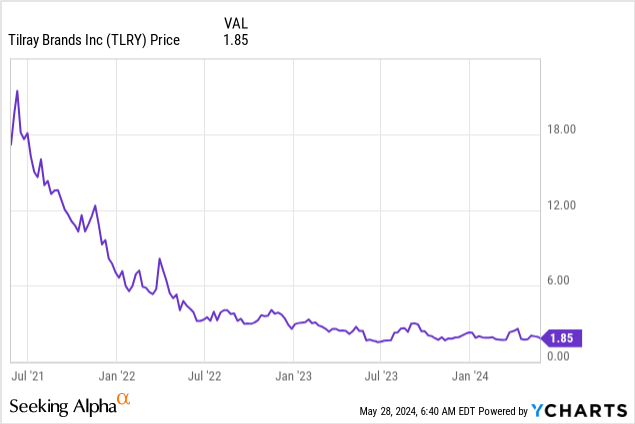

- Tilray’s stock has dropped 20% since the start of 2024, losing nearly 90% of its valuation over the last 3 years.

- Despite the decline, Tilray’s market cap of $1.53 billion is still higher than its competitors Canopy Growth and Aurora Cannabis.

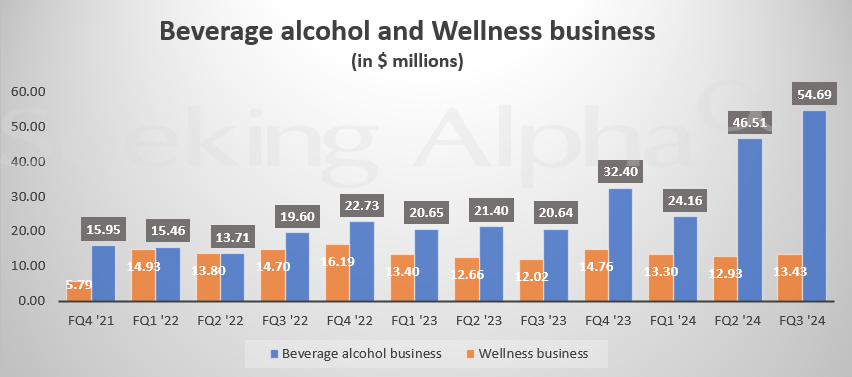

- Tilray’s investment pitch is focused on its diversified business footprint, with beverage alcohol sales offsetting the decline in its cannabis distribution segment.

Nastasic

Tilray Brands (NASDAQ:TLRY) has dipped 20% since the start of 2024, maintaining a downtrend that has seen the largest Canadian cannabis company by market cap lose nearly 90% of its valuation over the last 3 years. There might be a reversal at some point, but TLRY’s current market cap of $1.53 billion is still far above its competitors and greater than the aggregate market cap of Canopy Growth (CGC) and Aurora Cannabis (ACB). TLRY’s investment pitch is hinged on its diversified business footprint with its growing beverage alcohol sales helping to offset the continued dip of its cannabis distribution segment.

The cannabis company recorded a total fiscal 2024 third-quarter revenue of $188.3 million, up 29.3% over its year-ago comp but missing consensus by $10.03 million. This third quarter ended February 29, 2024. Beverage-alcohol net revenue was up a remarkable 165% year-over-year to $54.7 million, the largest driver of growth, and is on track to become TLRY’s largest revenue segment. This came as distribution net revenue dipped by 13.15% year-over-year to $56.8 million and cannabis net revenue grew by 33% over the same time frame to $63.4 million. Critically, TLRY generated a net loss of $92.7 million during the third quarter with continued cash burn seeing its total cash, cash equivalents, and marketable securities dip to $225.86 million from $448.52 million in the May 2023 quarter.

Seeking Alpha

Dilution, Liquidity, Balance Sheet, And Free Cash Flow

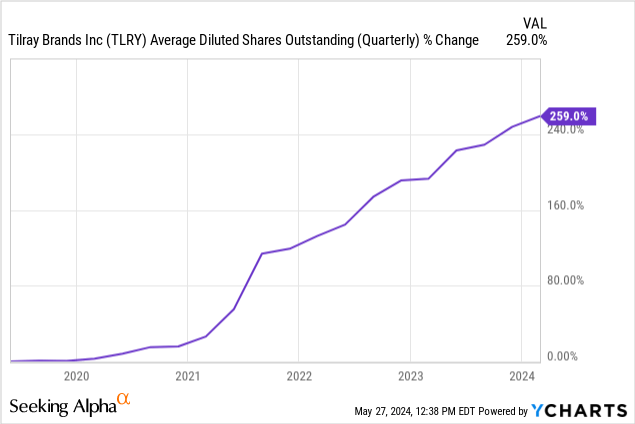

TLRY’s cash burn has been significant with the cannabis company heavily reliant on intense dilution to plug the gaps. TLRY’s diluted weighted average number of common shares ended the third quarter at 754,439,331. This was up a material 259% over the last five years, with dilution running at around 51.8% per year. The dilution has been a perpetual feature of TLRY and is set to continue with the recent filing for the sale of up to $250 million in shares through an at-the-market equity program.

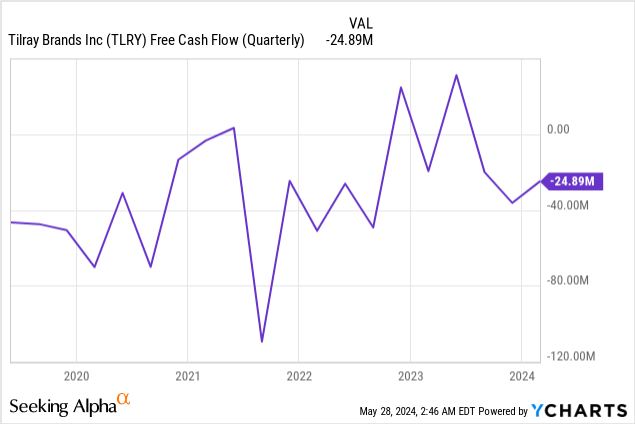

This will heap more selling pressure on the commons, with TLRY’s quarterly free cash burn currently running at roughly $12.5 million versus its trailing 12-month cash burn as of the end of the third quarter. Free cash burn for the third quarter was $24.89 million. TLRY’s cash burn profile has broadly improved versus its pre-pandemic levels on the back of management’s efforts to push through cost savings. The company expanded on these efforts on its third-quarter earnings call, with $15.6 million in annualized cost savings realized during the third quarter from the continued integration of HEXO.

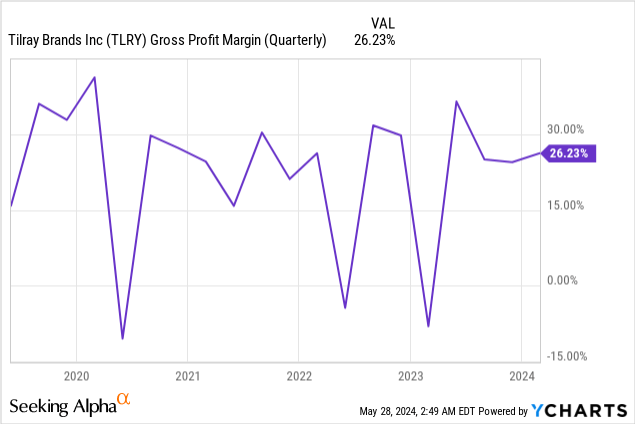

TLRY plans to close its outdoor grow Cayuga facility and move cultivation to existing production lines as a core part of the streamlining of its Canadian operations. The company anticipates being able to take more costs out of its business by selling its Masson growing facility in Quebec and its Belleville beverage facility in Ontario inherited from Truss. This is expected to drive roughly $70 million to $85 million to Canadian cash flow and improve net income by $5 million to $7 million annually. The company’s third-quarter gross profit was $49.4 million with gross profit margins have remained relatively constant on a 5-year view at 26.23%. Bears would be right to highlight that TLRY’s balance sheet held a large total debt balance of $481.6 million at the end of the third quarter, down post-period end following a $19.8 million debt-for-equity swap deal.

Multiple, Reclassification, And Possible Near-Term Returns

TLRY is now swapping hands for a 1.85x multiple to trailing 12-month sales, a material drop from 18x roughly a year ago. This steep drop comes as the US looks set to push through the reclassification of cannabis from a Schedule I to the lower-risk Schedule III category. The US Department of Justice has officially proposed to shift cannabis to Schedule III, a milestone for the industry that would see a wider range of financial services for cannabis firms opened up. It would also allow cannabis operators to take standard tax deductions, which are currently prohibited for businesses that generate revenue from Schedule I drugs.

The main benefit for TLRY from US reclassification will be the opening up of the specter of broader US federal legalization. I expect the company’s Canadian cannabis operations to continue to drive near-term losses, albeit at a reduced scale following TLRY’s measures to save costs. The company at its current sales multiple is trading below its prior highs, but I’d be apprehensive about taking a position with the market cap still sitting above close peers. The beverage-alcohol business is TLRY’s bright spot from a growth perspective but I’d expect the company to continue its history of intense dilution in the absence of profits and positive free cash flow.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.