Summary:

- Tilray reported strong revenue growth in FQ4, but most of it was not organic, mainly driven by acquisitions in the Beverage Alcohol sector.

- Despite acquisitions, non-beverage segments saw a decline in non-wholesale sales, raising concerns about the company’s ability to manage a far-flung business effectively.

- The company forecast limited organic growth for Tilray in FY25, making TLRY stock expensive, trading at 17x adjusted EBITDA and a history of missing financial targets.

skynesher/iStock via Getty Images

Tilray Brands Overview

Tilray Brands (NASDAQ:TLRY) constantly reports quarterly earnings where the Canadian cannabis provider appears to be reporting strong growth, but most of the growth isn’t organic. In addition, the company has now moved substantially away from the cannabis business, limiting the ability to benefit from the growing market opportunity. My investment thesis remains Bearish on the stock due to the constant inability to manage a far-flung business.

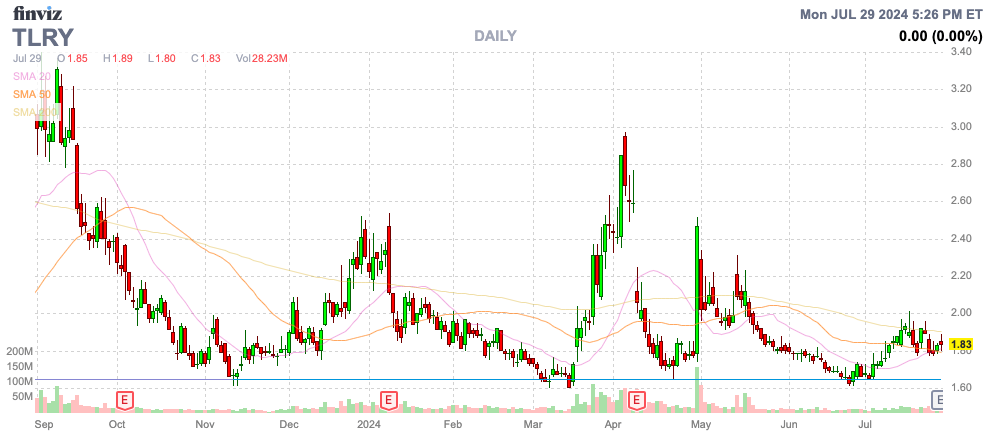

Source: Finviz

Tilray Q4 Results – More Of The Same

After the close, Tilray reported a quarter where reported revenue growth was strong at nearly 25%. The cannabis and alcohol company reported the following quarterly numbers:

While the numbers look impressive on the surface, with Tilray reporting FQ4’24 revenues of $230 million, the company really only produced substantial growth in the Beverage Alcohol sector from acquisitions. The revenue for the different segments compared to last FQ4 is as follows:

- Cannabis – $71.9 million versus $64.4 million, up 12%.

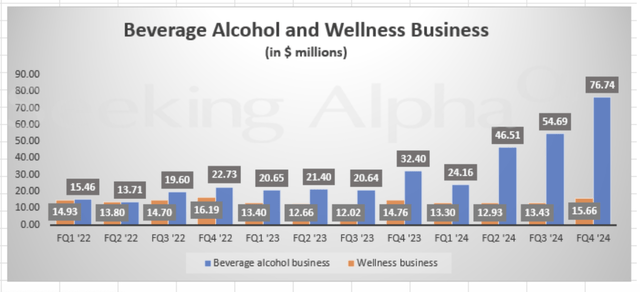

- Beverage Alcohol – $76.7 million versus $32.4 million, up 137%

- Distribution – $65.6 million versus $72.6 million, down 10%

- Wellness – $15.7 million versus $14.8 million, up 6%

First, the cannabis business grew almost entirely due to a big jump in wholesales revenues with a limited gross margin. Wholesales revenues were $13.0 million in the quarter, up from only $0.8 million last FQ4.

If one strips out these rather meaningless sales, Tilray actually reported a sales decline of $10.8 million in the non-beverage segments despite the acquisition of HEXO and Redecan in June 2023. The Cannabis, Distribution and Wellness categories only produced $1.4 million growth YoY.

Second, the Beverage Alcohol business surged due to the acquisition of craft beer brands from Anheuser-Busch (BUD) last October and Truss Beverages in August 2023. Revenues were up $22 million from FQ3, primarily due to the higher summer selling season for beer. Tilray had already targeted a $300 million business in the Beverage Alcohol space and peak sales in the May quarter only barely get the company above this target, suggesting annual sales probably aren’t far off the $250 million pro forma levels at acquisition time.

The good news is that adjusted EBITDA did rise to $29.5 million in the quarter, up from $21.5 million in the prior FQ4. Tilray had to pay substantial amounts in acquisitions in order to produce the higher sales and EBITDA.

No Reason For Excitement

The stock now has a market cap of $1.5 billion, while the company has a slight net debt position in the $65 million range. Tilray only produced $60.5 million in adjusted EBITDA last year.

The consensus estimates is for adjusted EBITDA of ~$87 million for FY25. The stock trades at 17x this target, with limited growth forecast by the company due to the inability to organically grow sales.

The consensus analyst estimates have revenues reaching $865 million in FY25, with the majority of the growth from the Beverage Alcohol business. Tilray is set to report substantially higher revenues from beverage acquisitions; hence, the Canadian cannabis company guided to FY25 revenues of $950 million to $1 billion for only mid-single-digit organic growth.

Quarterly sales were forecast to dip to $210 million in the next couple of quarters, prior to an additional dip in the February quarter to only $200 million. Any excitement over reporting strong growth in FQ4 will quickly disappear, with targeted organic growth in just the 5% range for FY25.

The target is confusing considering the FY24 pro-forma revenues were seen in the $850 million range after including the additional craft beer revenues. The other issue is that Tilray has constantly failed to grow the business organically and hit targets.

The Germany cannabis market is opening up, but other than that growth appears limited. Tilray needs to prove the ability to actually grow revenues profitably, and the business is now far more complicated to manage with the Beverage Alcohol business suddenly the largest segment. The company failed to produce organic growth when buying the Wellness business with the same promises.

Takeaway

The key investor takeaway is that Tilray appears in growth mode, but organic growth forecasts remain tepid. The stock just still appears expensive at 17x adjusted EBITDA for a company with a history of not hitting financial targets.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market to start Q3, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial.