Summary:

- Toyota Motor Corporation and Tesla, Inc. are the two giants in the automotive industry but differ significantly in business strategy and valuation.

- Toyota’s main strength is its low-cost, high-quality manufacturing, while Tesla’s main strengths are its strong brand, attractive designs, and battery and autonomous driving technologies. Toyota is evolutionary, while Tesla is revolutionary.

- We share which company we would invest in right now, although at this point, there is an argument to just watch from the sidelines.

Justin Sullivan

As the two giants in the automotive industry, Tesla, Inc. (NASDAQ:TSLA) and Toyota Motor Corporation (OTCPK:TOYOF, NYSE:TM) couldn’t be more different. Toyota is the biggest by revenue, while Tesla is the largest by market cap. Toyota is a traditional company focused on quality and continuous improvement, while Tesla is an industry disruptor favoring revolutionary changes. Importantly for investors, one is the poster child of growth investing, while the other is a classic value opportunity.

Toyota has a more traditional business model, with a strong focus on production efficiency and cost control. Tesla has a more vertically integrated business model, with a focus on innovation and control over the entire value chain from design to production to sales. Toyota’s strength is its low-cost/high-quality manufacturing. Tesla’s competitive advantage rests in the desirability of its products and strong brand, as well as in the progress it has made reducing battery costs and the AI capabilities powering its self-driving technology.

Despite these strengths, both companies have their weaknesses. Toyota’s reliance on internal combustion engines makes it vulnerable to shifts in consumer preferences and government regulations, while Tesla’s high valuation and aggressive expansion plans bring its own set of risks.

Technology

Tesla has made significant improvements to the cost, performance, and durability of its lithium-ion batteries through proprietary designs and manufacturing processes. Still, we are concerned that we have not heard much about some of the advances promised during the 2020 battery day, where the company presented its plan to halve the cost per kWh. If Tesla manages to deliver on these promises, it could increase its competitive moat substantially. Then there is Tesla’s self-driving technology, which is still in the early stages of development and faces regulatory and technical challenges, but that could potentially improve safety, performance, and convenience. It will be interesting to see what news come out of its investor day event for 2023, where it will discuss among other things a new vehicle platform.

While Toyota has developed a range of technologies such as hybrid electric systems that are designed to improve fuel efficiency and reduce the environmental impact of its vehicles, we are still concerned its approach is too evolutionary, instead of revolutionary. Toyota risks being disrupted if consumer preferences for electric vehicles (“EVs”) accelerate before the company is able to replicate its hybrid success with EVs. We are in particular not convinced that fuel-cell technology is worth investing significant resources into, and believe the company should be considerably more aggressive with its EV strategy. In fact Toyota is in the process of revamping its EV strategy, which might help it better compete with Tesla. This will certainly be interesting to watch, as Toyota has gained a reputation as a laggard when it comes to full electric vehicles, so it has a lot to prove.

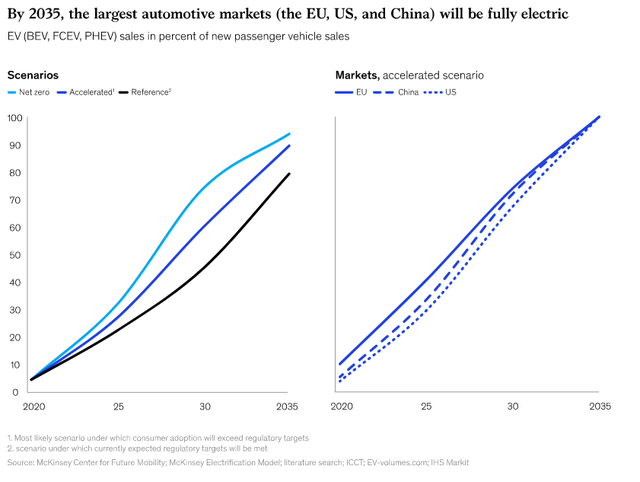

Why The Automotive Future is Electric

Everything is pointing to an inflection point in the future toward electric vehicles. We believe people will be surprised at the acceleration in EV sales as prices go below those of conventional cars. The main reason we believe EV prices will actually beat those of internal combustion engine (“ICE”) vehicles is that battery costs still have the potential to decrease significantly through the combination of economies of scale and technological innovations that are yet to be brought to the production lines. When combined with government incentives, a lower total cost of ownership, and the convenience of not having to visit the gas station, we believe EVs will be the default option for many consumers. We are not the only ones to believe this, for example, McKinsey put out a research paper where they forecast that by 2035 the largest automotive markets will be dominated by electric vehicles.

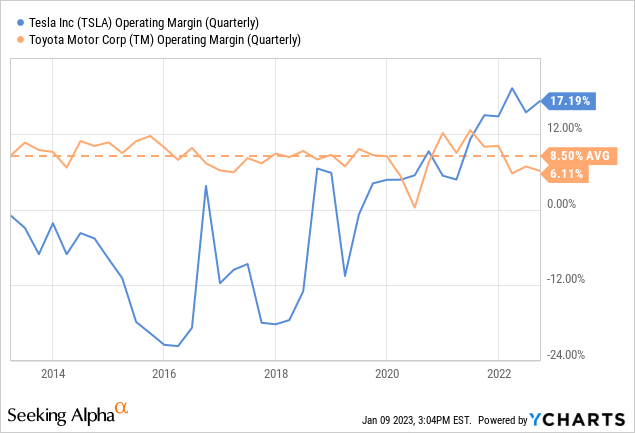

Financials

Toyota has a solid operating margin for a car manufacturer, but it has been declining recently. Meanwhile, Tesla’s operating margin has improved dramatically, and is now close to Ferrari’s (RACE) ~24% margin, which is incredible considering Ferrari is one of the strongest luxury car brands.

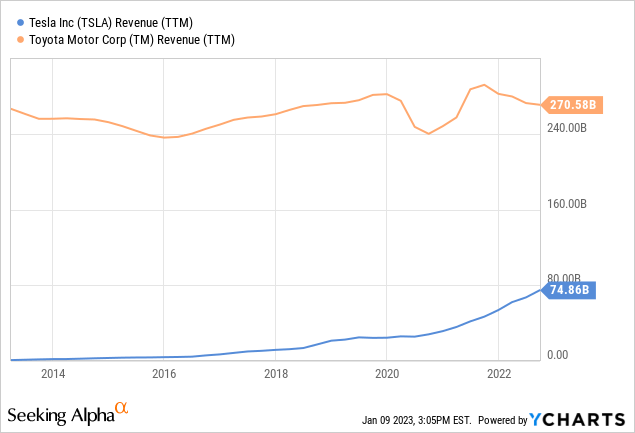

Toyota remains a much larger company when measured by revenue, with trailing twelve months revenue of ~$270 billion to Tesla’s ~$74 billion. This could, however, quickly turn around if the world moves from ICE to EVs in just a few years. In the graph below, it is clear that Tesla is closing the gap at a fast pace.

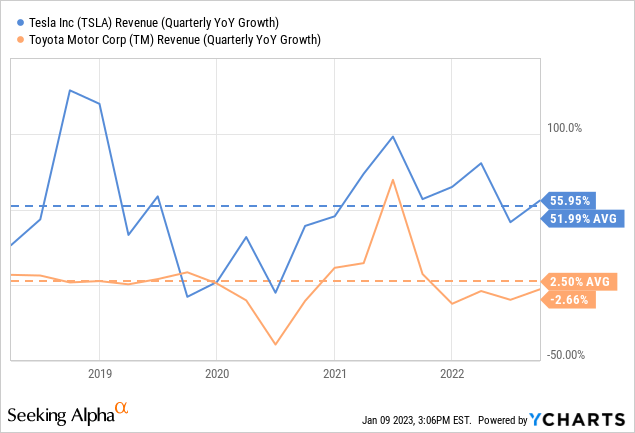

Growth

In the last five years, Tesla has grown revenue at a jaw-dropping ~51% average, while Toyota has barely had any growth at all, with average quarterly year-over-year growth of only ~2.5%. This is clearly one of the reasons many investors are willing to pay up for Tesla shares, and why Toyota is trading at such a low valuation. We mentioned earlier that Tesla could be the poster child for growth investing, its valuation being highly dependent on far-into-the-future earnings. Its ability to reach said growth depends on expansion capacity, which brings risks but which we believe is achievable based on their track record.

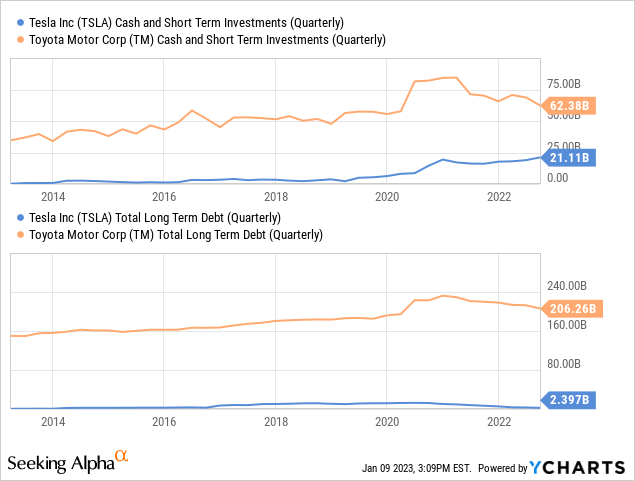

Balance Sheets

With ~$62 billion in cash and short-term investments, Toyota at least has the financial resources to finance a catch-up strategy in EVs. Tesla has a good cushion as well, with ~$21 billion. It is important to note, however, that Tesla carries very little long-term debt, while Toyota has a massive $206 billion in total long-term debt. This could make Toyota more risk-adverse, and less likely to go all-in with a non-proven EV strategy.

Valuation

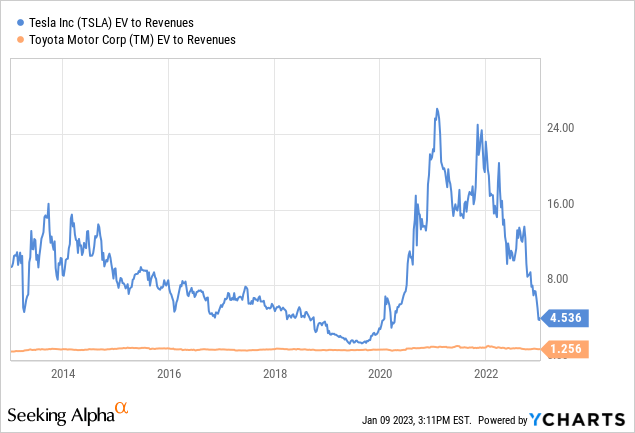

What makes things interesting is the valuation, otherwise Tesla would be the clear winner with a cleaner balance sheet, better profit margins, and higher growth. Tesla is currently trading with an EV/Revenues multiple of ~4.5x, which is much higher than Toyota’s ~1.2x.

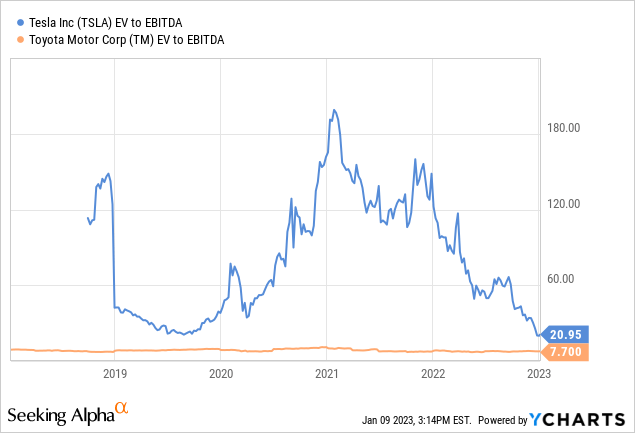

Similarly, Toyota is trading with a very modest EV/EBITDA multiple of only ~7.7x, compared to Tesla’s ~20x. Still, this is a relatively low multiple for Tesla compared to where it has traded historically.

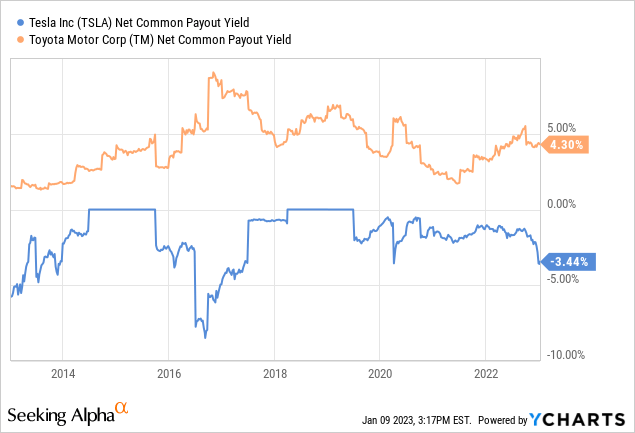

Something we like about Toyota is that it pays a generous dividend and repurchases its shares, which gives it a high net common payout yield. As a reminder, the net common payout yield is the percent a company has sent back to its shareholders through share repurchases and dividends based on a company’s market cap. In Tesla’s case, it appears negative because it does not pay a dividend, and it is likely issuing shares instead of buying them back.

Based on the net present value of our estimated future earnings for Tesla, we believe shares are trading close to fair value, while shares of Toyota are trading about one-third below our fair value estimate. Still, we believe there is significant uncertainty in both cases as the automotive industry is quickly changing.

The Verdict

Despite considering ourselves value investors, if we had to choose one of these two companies to invest in, we would go with Tesla. We believe the automotive future is electric, and are concerned that Toyota might turn out to be a value trap or a melting ice cube.

Risks

There are several other companies that could potentially emerge as leaders in the automotive market in the future. For example, some analysts believe that companies in China, such as BYD Company Limited (OTCPK:BYDDF) and NIO Inc. (NIO), could become major players in the electric vehicle market due to their strong domestic demand and government support. Companies like Rivian Automotive, Inc. (RIVN) and Lucid Group, Inc. (LCID) could also surprise and rise to the top.

In addition, tech companies like Google (GOOGL) and Apple (AAPL) are rumored to be developing self-driving vehicles, which could potentially shake up the industry if they are successful. It is difficult to predict which company will dominate the automotive market in the future, it might not even be Tesla or Toyota.

Conclusion

Toyota and Tesla represent two different investment strategies: growth versus value. Both companies have their strengths and weaknesses, and the decision of which one to invest in ultimately depends on the investor’s view of the future. We believe the future is electric, and for that reason we would choose Tesla over Toyota, despite believing Toyota’s valuation looks more attractive. Tesla has enormous potential due to its impressive growth, but the valuation has very little in terms of margin of safety. If we had to choose only one we would go with Tesla, but at the moment we prefer watching from the sidelines.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling shares, you should do your own research and reach your own conclusion, or consult a financial advisor. Investing includes risks, including loss of principal.