Summary:

- Aerie Pharmaceuticals was one of my two favorite shorts as recently as August 2018.

- Since then, earnings data and developments have largely played out according to my thesis, and the stock is down as a result.

- In this article, I review the new data and update my trading position accordingly.

In June of this year, I explained why I was short Aerie Pharmaceuticals (NASDAQ:AERI), which at the time was trading around $70 per share, and in August, I compared my short of Radius Health (RDUS) to the situation developing at AERI. Indeed, given the lessons learned from my RDUS short, I deemed AERI one of my two “favorite” shorts at that time. (Note that Total Pharma Tracker subscribers had early access to both articles.)

Today, as shown in the chart below, AERI is trading just above $40, so I would like to re-visit the original thesis in light of recent developments and then re-evaluate my short position.

Financial Results

The biggest development since August has been the third-quarter earnings release, including the associated conference call and 10-Q.

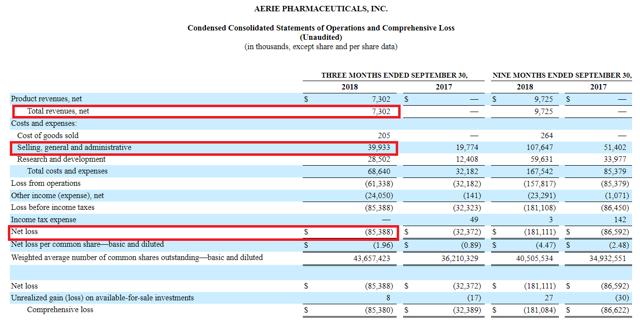

From them we learned that AERI had quarterly net sales of just over $7.3 million, with SG&A expenses of almost $40 million and a net loss of over $85 million. The net sales number kept the company on target for its guidance of $20-30 million in sales for calendar year 2018, which implies anywhere from $11 million to $21 million in sales for the fourth quarter (we’ll discuss this below).

Note that SG&A expenses are expected to be relatively constant going forward, so we can expect about $40-45 million in such expenses quarterly. Here’s an exchange from the conference call explaining this:

Elliot Wilbur

Okay, fair enough. And then just one final question for Rich. Looking at your SG&A levels, it’s been relatively steady the last couple of quarters. As we think about maybe some of the initial, Rhopressa launch costs tapering off, obviously you have more associated with Rocklatan in early 2019. So, maybe any reason to think that there would be sort of a kind of a large incremental one time step-up from, from current levels or is this kind of cruising speed and expense levels should be relatively, increase relatively modest rate going forward.

Rich Rubino

Yes sir. So, I certainly expect in the world of SG&A that will be consistent fourth quarter compared to third quarter. Obviously, we’ve got the commercial team fully in place and remember as we get into next year, with the Rocklatan launch, it’s the same team, but we may have some launch expenses, but just like they were last year earlier this year for Rhopressa, you’re talking about a relatively nominal amount, low single-digit millions. So, you’re not going to see a huge pop in preparation for the Rocklatan launch.

As an aside, this SG&A expense is quite comparable to that of RDUS, which is on the order of $48.5 million (and hence, is another reason to think the trajectories of the companies are indeed comparable – see my article linked above).

AERI will also continue spending on R&D, to support the launch of Rhopressa and Rocklatan in Europe and Japan, as well as developing the earlier-stage pipeline. Hence it will likely take quarterly net revenues of over $70 million for the company to turn profitable.

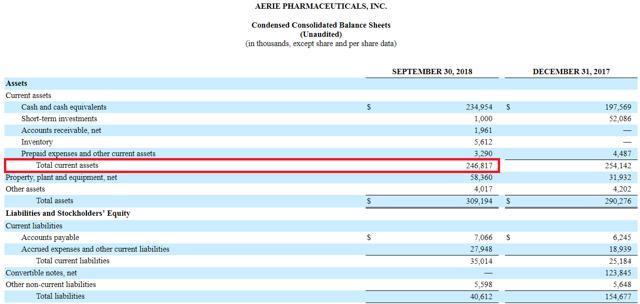

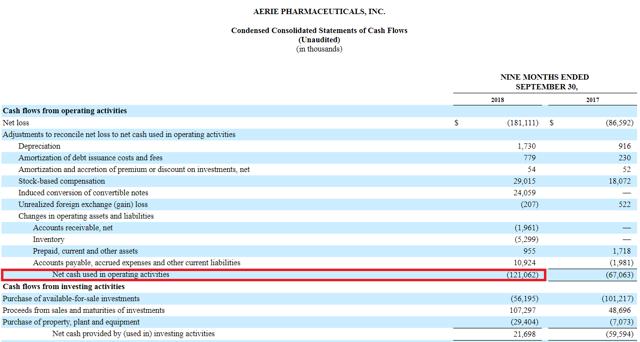

On the cash front, AERI ended the quarter with $246 million in current assets (and $211 million in net current assets), while average quarterly operating cash burn is on the order of $40 million, which suggests the company can easily go another year before having to raise cash again.

Uptake Rate and Competition with Vyzulta

Part of my short thesis is that AERI’s launch of Rhopressa, and soon Rocklatan, is contemporaneous with another new product, Vyzulta, produced by Bausch Health Companies (BHC). I also believe that Vyzulta’s safety profile is much more benign than Rhopressa’s (and Rocklatan’s when it becomes available for sale). This ultimately negatively impacts both product pricing and uptake rates, which makes the task of becoming profitable that much more difficult for AERI.

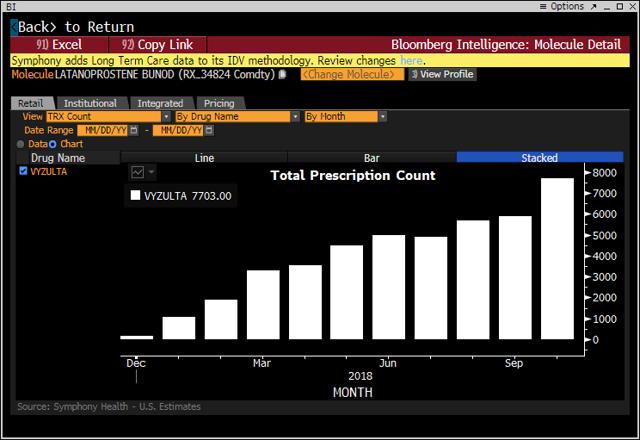

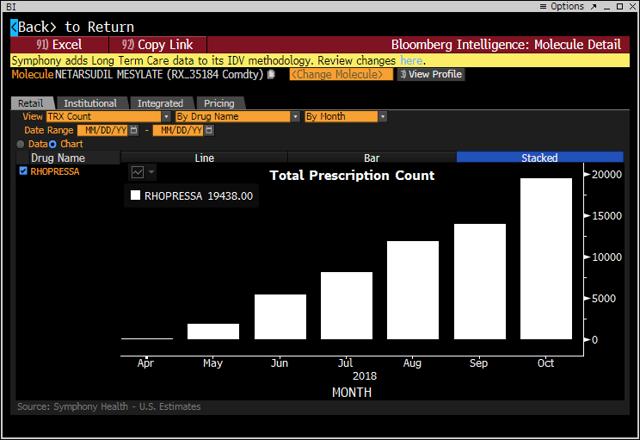

For reference, here are the sales levels through the end of October, as given by Bloomberg, for Vyzulta and Rhopressa.

Assessing the July, August and September histogram bars gives Rhopressa prescriptions of about (8,000+12,000+14,000) = approximately 34,000 prescriptions. Prescriptions are for 2 bottles, so the quarterly net sales of $7.3 million jibe with the company’s stated price of $122 per bottle, which is expected to drop to $100 per bottle by the end of the year. See this exchange from the conference call:

Now as a reminder, as we pick up coverage, particularly in tier two, we do have to pay rebates to the payers that bring our net revenue per bottle down. That net revenue was roughly $135 per bottle in Q2. It was $122 per bottle in Q3. As we pick up more coverage, it will ultimately level-off. As we approach the end of the year and that will get close to about $100 per bottle, which is consistent where we’ve always estimated the net prices to be.

Projecting from the graph above, we can estimate fourth-quarter prescriptions of about 75,000, which would mean $15 million in fourth-quarter net sales and $25 million for annual sales, thereby landing squarely in the middle of the company’s 2018 guidance of $20-30 million.

The problem is that AERI will need $40 million in quarterly sales to simply cover SG&A expenses, which means almost tripling fourth-quarter projected sales. That’s a tall order, as there will no doubt be a tapering in prescription growth rates over time. Also, only now is there six months of doctors’ experience with the drug, which is probably the minimum time frame for any worries about Rhopressa’s safety profile to emerge. The company downplays these concerns, but reading between the lines, it is no doubt an issue, though perhaps less than I originally thought based on dropout rates from clinical trials. Here’s what the company had to say on the matter, from the earnings call:

Adnan Butt

Shifting gears a bit, do you have any updated estimates on what adherence is like our discontinuations? Do they continue to stay low?

Rich RubinoYes. One of the things that we did talk to the doctors about is sort of how things are going and the like, you may remember that the discontinuation rates, they’re in that clinical trials where according to some kind of high, but obviously that was just a manufactured kind of a thing. What we noticed is that discontinuation rates are much lower than that now. We do still have them by the way. So there’s that – I want to make sure you understand that there are some folks were the IOP just doesn’t drop as much as they want to, we do have consistent with what we saw in the clinical trials and some folks who get hyperemia that’s persistent and especially if it’s combined with a low IOP drop, they’re just not willing to continue on the medication.

So we do get those. But the doctors are basically going to the patients and saying, stick with it. Let’s see. Let’s make sure that we understand how the drug is performing on you and the like and they appear to be quite happy. That’s why we see the kind of numbers that we’re putting up and that’s why we see the results in the marketplace. Like I said, we’ve got an awful lot of sales reps that are doing extremely well and it’s because the doctors are trying it and appear to be satisfied with it.

Adnan ButtVince, just a quick follow-up, is the main cause for discontinuation still hyperemia or is it another side effect?

Vince AnidoNo, it’s really not just, the hyperemia. I think it’s usually a combination of perhaps either the hyperemia or maybe some other adverse events, and the fact that 70% of these patients, Rhopressa just is the drug for them. It just doesn’t drop pressure enough or perhaps, they’ve already added it to something else and we just don’t see the incremental pressure drop that we’ve seen in other cases. And so, there’s hardly ever just one single item that doesn’t.

Rocklatan Launch

Since Rocklatan is a combination drug of Rhopressa with latanoprost, and most Rhopressa patients are already using latanoprost or equivalent, I’m not expecting a big bump in sales when (assuming it’s approved) Rocklatan is launched. It will be more convenient than having to take two separate drugs, but most patients will be those that could have used Rhopressa in any case. And the company suggests that pricing won’t be such as to favor one drug over the other, so that shouldn’t bump revenues either.

Here’s part of what AERI had to say on the matter, from the earnings call:

There is an extraordinary level of interest in Rocklatan, as once again that confirmed at AAO, there’s the interest we think stems from how well Rhopressa appears to be performing when it’s added to a prostaglandin. And so many have asked how doctors would prescribe Rhopressa versus Rocklatan and what we think the split is going to be.

Personally, I think it’s going to be very difficult to predict. I’ve mentioned that before. I think the doctors will follow their own path on a patient-by-patient basis. It’s clear to us however, the Rocklatan if and when approved, ultimately have a very significant potential in the marketplace. From a pricing perspective, we do expect to price Rocklatan fairly consistently with Rhopressa, which we believe will write in the market acceptance, including the necessary gains in market access.

Conclusion and Trading Position

Taking this data as a whole, I think my original thesis is bearing out and that the recent stock price reflects the market beginning to share that view. Going forward, I think it’s reasonable to expect 2019 US sales on the order of $100-110 million, and possibly $150 million in 2020. These numbers won’t result in profitability, and may not even cover cash burn depending on how aggressive the company is with R&D expenses. Future sales in Europe and Japan likely will have the same profitability problems unless AERI somehow secures favorable partnerships.

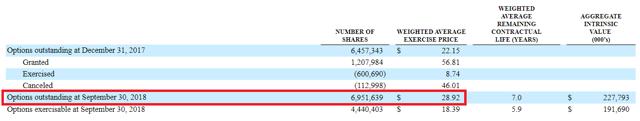

Nonetheless, if we’re optimistic, we can assign a P/S multiplier of eight times 2020 sales, which would give the company an estimated $1.2 billion valuation. It currently has 45.5 million shares outstanding, as well as 6.9 million options out, so on a fully diluted basis, a reasonable price target is on the order of $23 per share.

I am currently short “core” shares to approach that target, but I have covered some “trading” shares on the notion that there will be bounces in the stock price on the way to my ultimate target, and I’d like to leave portfolio room to trade these bounces too. See my article on RDUS linked to above for thoughts on better trading allocation.

A version of this article was previously released to subscribers of Total Pharma Tracker, a Marketplace service with whom I am now collaborating. Some of my work will be available to TPT subscribers either exclusively, or in advance. Please subscribe to TPT by clicking on this link – Total Pharma Tracker.

Disclosure: I am/we are short AERI. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I actively trade around core positions