Summary:

- Valneva SE is a French biotechnology company specializing in developing and commercializing vaccines.

- We expect approval of two attractive vaccine candidates targeting Chikungunya and Lyme disease by 2024-2025.

- The company has a relatively cheap valuation, enterprise value of ~$700M, and a strong balance sheet with ~$255M cash on hand (runway until ’24-’25).

- We expect Valneva’s COVID-19 portfolio revenue to decline significantly in 2023-2024, but now the key focus is on the other two lead pipeline candidates.

- We initiate with a buy rating moving into 2023.

FatCamera/E+ via Getty Images

Background

Valneva SE (NASDAQ:VALN) is a biotechnology company that specializes in the development and commercialization of vaccines. The company was founded in 2013 and is headquartered in Saint-Herblain, France.

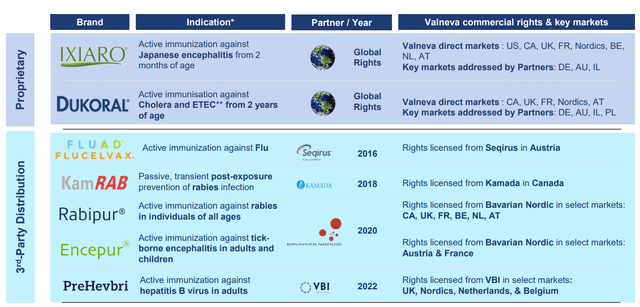

Valneva’s focus is on the development of innovative vaccines for the prevention of infectious diseases. The company’s portfolio includes a range of vaccines for diseases such as Lyme disease, cholera, and Japanese encephalitis, as well as a COVID-19 vaccine candidate. In addition to its vaccine development programs, Valneva has a strong presence in the European market, with commercial operations in France, Germany, and the United Kingdom. The company has collaborations with leading global health organizations, such as the World Health Organization (WHO) and the European Centre for Disease Prevention and Control [ECDC], to support its mission of developing innovative vaccines for the global community.

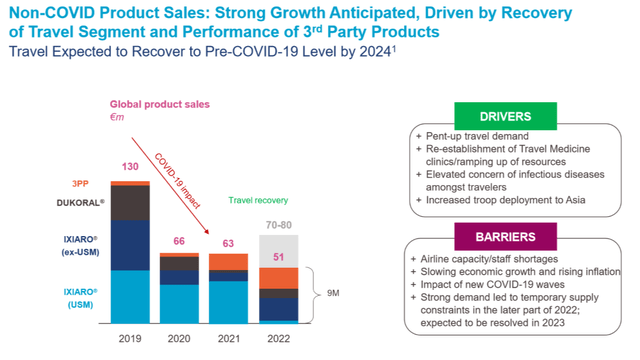

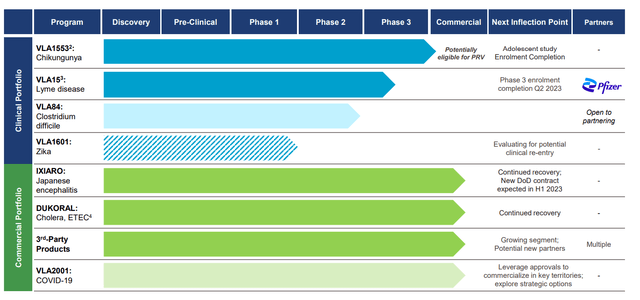

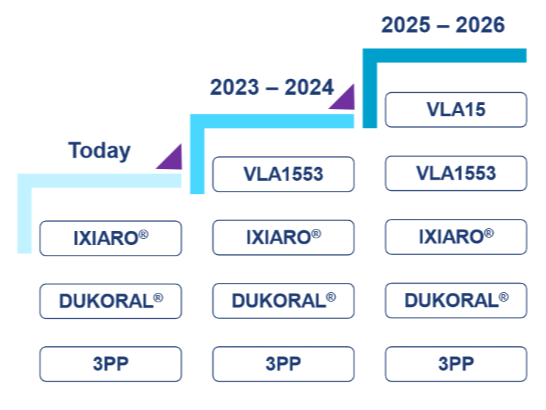

Currently, the company has 4 commercial portfolios, IXIARO targeting Japanese encephalitis, DUKORAL targeting cholera, and VLA2001 targeting COVID-19. We expect the sales of this candidate to recover with the decline in COVID-19 cases and the rebound of air travel. For Valneva’s COVID-19 pipeline, the company is expected to receive around EUR340-360M in revenue; this is sizeable revenue that can be useful to fund the company’s late-stage clinical development; we expect COVID-19 related vaccine revenue to decline during 2023-2024 with a decline in demand for vaccination. We believe this may have led the stock to sell off ~63% during last year. We believe the stock is at an attractive valuation, and we believe the company is entering an inflection point during 2023, where investors will start looking at Valneva’s other clinical pipeline products.

Travel vaccine candidate’s revenue expected to rebound (Company)

We are most excited about the company’s Lyme disease and Chikungunya vaccine candidates that are expected to be approved within 1-year timeframe.

Valneva pipeline overview (Company) Current Commercial Portfolio of Valneva (Company source)

VLA1553 targeting a Chikungunya market

VLA1553 is a live attenuated, single-dose vaccine based on the La Reunion strain of the East Central South Africa genotype, and it is attenuated by reverse genetics, 60aa deletion within the non-structural nsP3 protein.

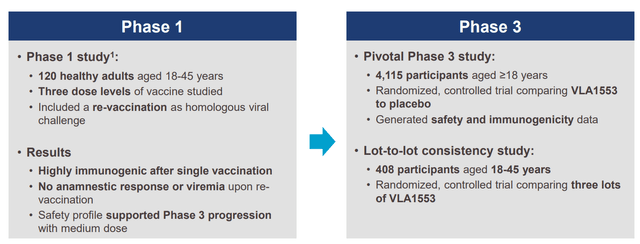

VLA1553 clinical trial (Company)

The pivotal Phase 3 trial met all primary endpoints. The trial showed a) 99% zero response (SRR rate), b) SRR was maintained even after 12 months of treatment, c) showed compelling efficacy even in the elderly patient population (>65 yr), similar to patients who are under 65 years old, and d) 100% seroconversion after 14 days and it sustained to month 12 in a preceding trial. Besides the impressive efficacy shown, VLA1553 was generally well tolerated amongst 3,082 patients treated, which is enough for us to build comfort on the candidate’s safety. The most common side effects were mild to moderate levels of headache, fatigue, and myalgia, which doesn’t concern us considering the positive risk-reward of vaccination. 2% of the participants experienced serious adverse events (i.e., fever). There are two additional ongoing trials: an antibody persistence trial and an adolescent trial in Brazil.

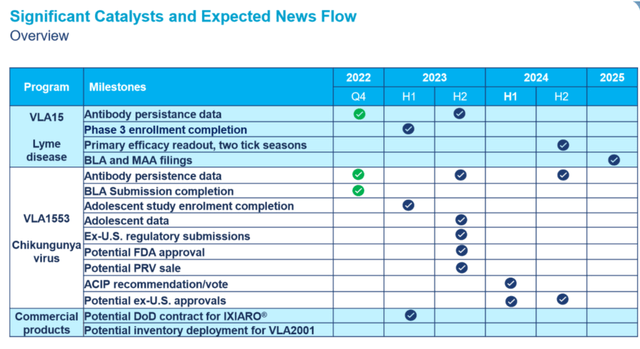

Based on these positive results, the company filed a rolling submission of BLA last December. The FDA granted priority review, fast track, and breakthrough designation. EMA granted PRIME designation in 2020. We expect VLA1553 to be approved in 2023 without a problem.

Chikungunya is a viral illness that is transmitted to people by the bite of infected mosquitoes, primarily the Aedes aegypti and Aedes albopictus mosquitoes. The disease was first identified in Tanzania in 1952, and since then, it has spread to many parts of the world, including Africa, Asia, Europe, and the Americas.

The symptoms of chikungunya usually begin 3-7 days after being bitten by an infected mosquito and can include:

- High fever

- Joint pain (especially in the hands and feet)

- Headache

- Muscle pain

- Rash

- Nausea

The joint pain associated with chikungunya can be severe and debilitating, and it can last for several weeks or even months. The other symptoms of the disease typically resolve within a few days to a week, but in some cases, the joint pain may persist for a longer period of time.

There is no specific treatment for chikungunya, and the disease is typically managed through supportive care, such as pain and fever management. Preventing mosquito bites and controlling mosquito populations are the most effective ways to prevent the spread of chikungunya. Vaccination against chikungunya is currently not available.

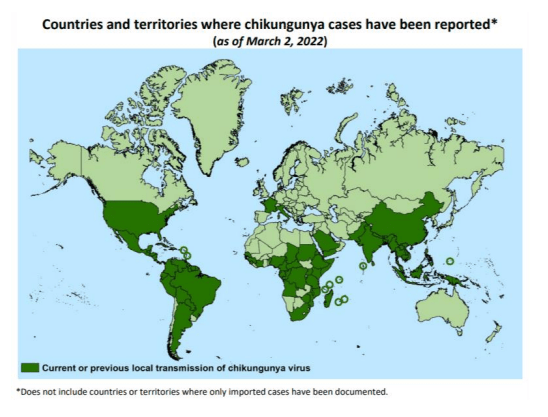

Chikungunya geographical prevalence (Company)

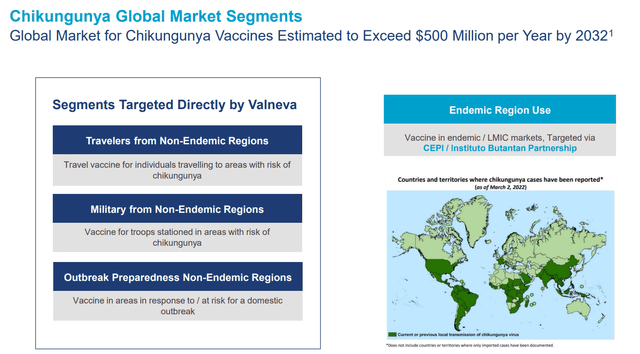

The company plans to position VLA1553 on travelers/military/outbreak preparedness in the US, EU, and Canada and plans to market the product for endemic uses through partnering with CEPI and Instituto Butantan through technology transfer.

Market opportunity for Chikungunya (Company IR deck)

Although a smaller market size (39.9 million Total estimated cases in the Americas) than Lyme disease, we believe Chikungunya indication could be a ~$100M market opportunity (the company claims $500M, but we exercised caution as Valneva is marketing the product in-house). Valneva has an internal marketing team in US and EU and plans to rely on distributors in other regions, such as Asia and Australia.

VLA15 targeting the Lyme disease market

VLA15 is the only Lyme disease vaccine currently being developed or approved. We believe anti-OspA is a validated target that the GSK’s (GSK) previously marketed vaccine LYMErix targeted. LYMErix was voluntarily withdrawn from the US market in 2002. GSK generated first-year sales of USD40M, but revenue plummeted due to low demand driven by ”vaccine victims” suing the company regarding safety concerns. FDA’s investigation ensued but found insufficient evidence to support the causal relationship between the adverse event and the drug.

Last June, the company signed an exclusive worldwide partnership with Pfizer (PFE) and received a $95M equity investment from Pfizer. Pfizer is expected to lead commercialization and late-stage development (Valneva is responsible for 40% and Pfizer 60%). In return, Valneva received a $130M upfront payment, $35M developmental milestone payments, and a further $143M commercialization, and around $100M of cumulative sales milestones are expected with commercialization.

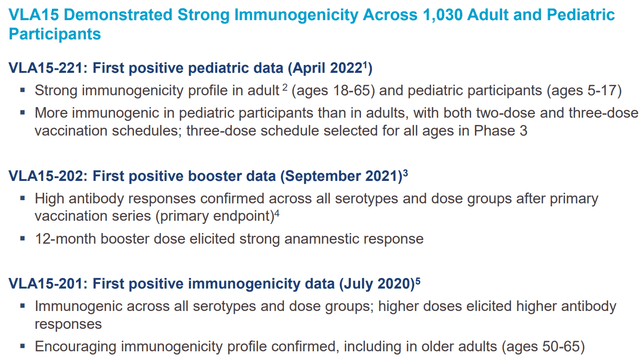

VLA15’s three phase 2 results were compelling (immunogenicity shown across 1,030 adult and pediatric populations). The three phase 2 data studied patients of age 5-65, and no vaccine-related serious adverse events have been shown so far.

Lyme disease phase 2 data key readout summary (Company source)

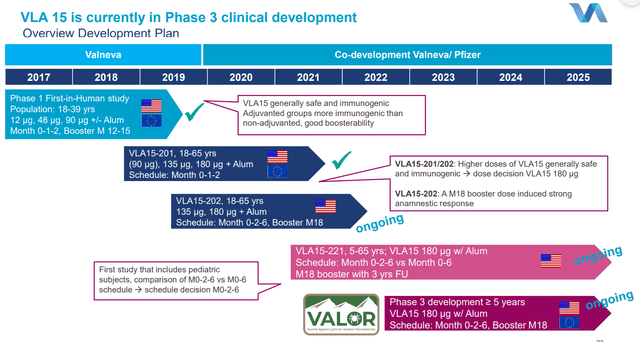

Phase 3 trial is expected to include the pediatric patient population as well, which we believe will well position the candidate as Lyme disease is contracted through outdoor activities.

Clinical development status (Company source)

Based on the positive phase 2 data, Valneva embarked on a phase 3 trial (currently ongoing). We expect data readout by 2H of 2023 (with expected enrollment completion by 2Q 2023), and we expect FDA and EMA approval by 2025

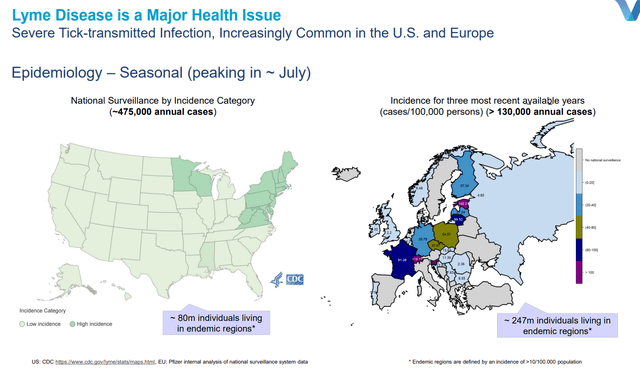

Lyme disease could be an attractive >$500M indication

Lyme disease is an infectious disease caused by the bacterium Borrelia burgdorferi. It is transmitted to people through the bite of infected black-legged ticks, also known as deer ticks.

Lyme disease is most commonly found in North America and Europe, although cases have also been reported in Asia, Africa, and Australia.

The disease is typically contracted in the summer months when people spend more time outdoors in areas where infected ticks are common.

The symptoms of Lyme disease can vary widely but often include:

- A bull’s-eye-shaped rash around the bite site

- Flu-like symptoms, such as fever, fatigue, and muscle aches

- Joint pain and swelling

- Headache

- Stiff neck

If left untreated, the bacterium can spread to other parts of the body and cause more serious symptoms, such as heart problems, nerve damage, and joint pain. Lyme disease is typically treated with antibiotics, but early diagnosis and treatment are crucial to a successful outcome.

Preventing tick bites is the most effective way to prevent Lyme disease. This can be done by taking steps such as wearing protective clothing, using insect repellent, and avoiding areas with high grass and leaf litter. Regular tick checks after spending time outdoors are also recommended.

Unlike other travelers’ diseases, the fact that Lyme disease is more prevalent in high-income nations should be a net positive for VLA15’s commercial prospect.

Prevalence of Lyme disease (Company source)

The key catalysts for Valneva during 2022-2025

Valneva Catalyst Calendar (Company)

As shown above, 2023 is a year with various high stake clinical catalysts on VLA15 and VLA1553, which we believe could move the stock meaningfully.

Furthermore, we expect the company to reach sustainable growth and cash flow generation throughout 2023-2026 with the approval of additional clinical candidates.

Valneva’s 2023-2026 trajectory (Company)

Risks

Clinical and regulatory risk remains as there are multiple ongoing clinical trials. Capital raise risk remains as the company is yet cashflow positive, and COVID-19-related revenue is expected to decline moving forward. Commercial and competitive risk remains with new upcoming approvals.

Conclusion

We initiate coverage on Valneva with a buy rating because we believe the stock is currently undervalued, with the market hype around Valneva’s COVID-19 portfolio now cleared out. We view Valneva’s Chikungunya and Lyme disease vaccine candidates favorably as they address markets without any approved vaccines. Specifically, the partnership with Pfizer, a sophisticated big pharmaceutical giant, enhances our confidence in the commercial success of the Lyme disease vaccine. The expected high-stakes clinical catalysts in 2023 are likely to shift investor focus beyond Valneva’s COVID-19 portfolio, leading to potential upward trends in the stock over the next 12-24 months. Additionally, we find Valneva’s strong balance sheet, with approximately $255M in cash reserves, reassuring, providing the company with around 1-2 years of cash runway.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Biotechvalley Insights (BTVI) is not a registered investment advisor, and articles are not targeted toward retail investors. The content is for informational purposes only; you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained in our articles or comments constitutes a solicitation, recommendation, endorsement, or offer by Biotechvalley Insights or any third-party service provider to buy or sell any securities or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction.

The research and reports made available by BTVI reflect and express the opinion of the applicable BTVI entity as of the time of the report only. Reports are based on generally-available information, field research, inferences, and deductions through the applicable due diligence and analytical process. BTVI may use resources from brokerage reports, corporate IR, and KOL/expert interviews that may have a conflict of interest with the company/assets that BTVI covers. To the best of the applicable BTVI's ability and belief, all information contained herein is accurate and reliable, is not material non-public information, and has been obtained from public sources that the applicable BTVI entity believes to be accurate and reliable. However, such information is presented “as is” without warranty of any kind, whether express or implied. With respect to their respective research reports, BTVI makes no representation, express or implied, as to the accuracy, timeliness, or completeness of any such information or with regard to the results to be obtained from its use. Further, any analysis/comment contains a very large measure of analysis and opinion. All expressions of opinion are subject to change without notice, and BTVI does not undertake to update or supplement any reports or any of the information, analysis, and opinion contained in them.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.