Summary:

- Walmart surprised investors with a sizable earnings beat.

- The company had previously guided for a double-digit decline in earnings but instead delivered modest growth.

- The company’s stores are being seen as a place for value amidst a difficult economy.

- I continue to see the potential for the company to conduct share buybacks over the long term.

Sundry Photography

Walmart (NYSE:WMT) stock soared after releasing third quarter earnings that handily beat both guidance and consensus estimates. The company had initially guided for year over year declines in profits but ended up delivering a modest increase as the brand’s value perception helped generate a surprising beat on the top-line. Meanwhile, Sam’s Club continues to deliver double-digit comp sales and remains a shining star for the company. While I don’t see a high likelihood for exponential moves in the stock price from here, the stock can still deliver market-beating returns as it benefits from the consolidation of retail.

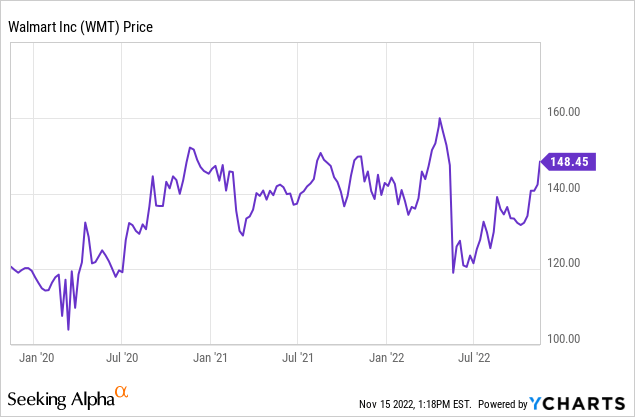

WMT Stock Price

Amidst inflation and recession risks, WMT stock is still trading fairly close to 52-week highs.

Data by YCharts

I last covered WMT in August where I rated the stock a buy based on the long term catalyst to increase leverage. WMT’s solid results amidst a difficult environment help support what continues to be a premium valuation.

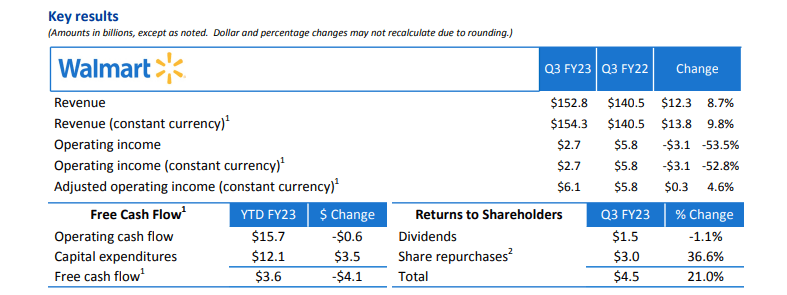

WMT Stock Key Metrics

In the third quarter, WMT delivered adjusted earnings of $1.50 per share, representing 3.4% YOY growth – far above the guidance for 10% declines as well as the $1.32 consensus estimate. Crucial to that beat was the surprising 8.7% revenue growth (management had previously guided for 5% growth). On the conference call, management cited increased traffic from high income households as being a driver of that beat. It seems that Walmart has great brand power for “value” and that is paying off in the current environment.

2022 Q3 Press Release

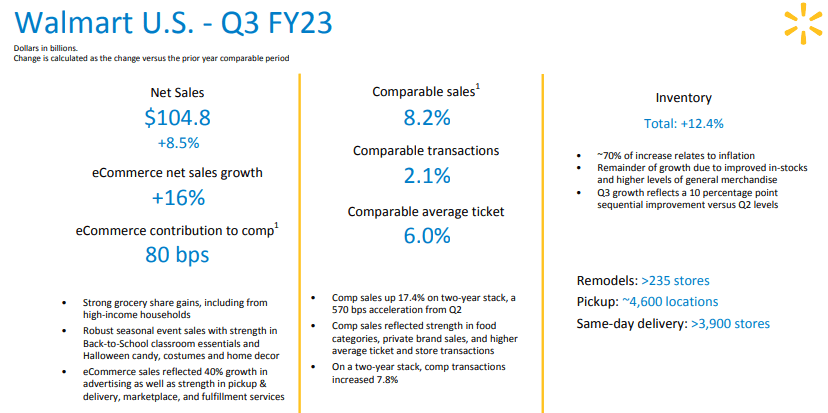

In its Walmart U.S. operations, WMT delivered 8.5% net sales growth, bolstered by 8.2% comparable sales growth. Operating income grew by 4.8% as WMT has generally been able to pass through inflationary costs to consumers. Inventory rose by 12.4%, with 20% of the increase being due to inflation and much of it being due to strategic positioning ahead of the holiday season. In the prior quarter, management had expected the process of working through inventory to pressure near term results. Not only has the company made great progress in right-sizing inventory (management expects the bulk of the work to be done by the next quarter), but strength in foot traffic has helped the company grow amidst the process.

2022 Q3 Presentation

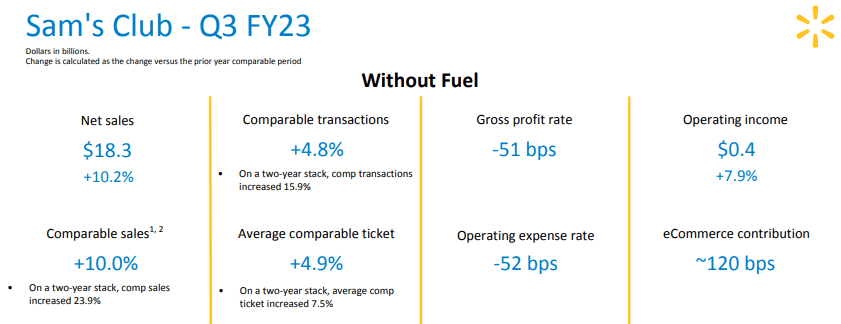

The Sam’s Club segment continues to grow incessantly, generating 10% comparable sales growth. Management noted that the segment has generated double-digit comp sales for three straight years. Operating income grew by 18.3% and I expect operating income to continue to outpace revenue growth for years to come.

2022 Q3 Presentation

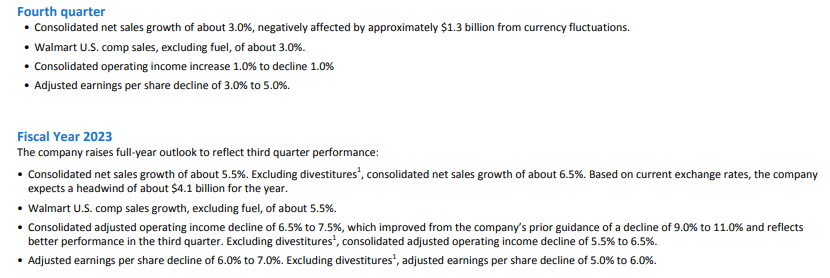

Looking ahead, WMT expects the fourth quarter to see about 3% net sales growth and for adjusted EPS to decline by up to 5%. That guidance represents a sizable sentiment boost after management had previously guided for double-digit declines this quarter.

2022 Q3 Presentation

WMT ended the quarter with $11.6 billion of cash versus $46.2 billion of debt for a $34.6 billion net debt position – up from $22.3 billion in the year prior. Net debt has risen largely due to the company continuing its aggressive return of cash to shareholders amidst difficult market conditions. The company repurchased $3 billion of stock and paid out $1.5 billion of dividends in the quarter – total cash returned to shareholders grew by 21% YOY. I note that WMT also has $16.3 billion in long term assets which includes various equity investments such as their stake in the Chinese e-commerce company JD.com (JD). In the quarter, WMT announced a new $20 billion share repurchase program to replace its existing authorization which had $1.9 billion remaining.

Is WMT Stock A Buy, Sell, Or Hold?

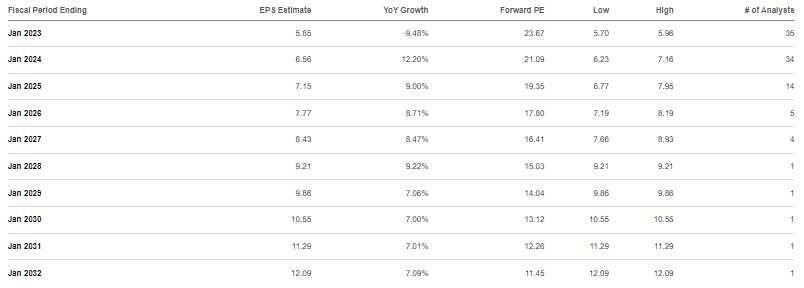

WMT might not look obviously cheap here, with the stock trading at 24x forward earnings. This is a company that is expected to grow earnings at a high single digit growth rate over the next decade, implying a 3x price to earnings growth ratio (‘PEG ratio’).

Seeking Alpha

As I stated in my prior report, I could see leverage rising to as much as 3x debt to EBITDA, implying $60 billion in incremental debt capacity and a 12% boost to earnings per share (assuming it is used for buybacks). Perhaps the most compelling driver for the stock is the investor confidence in forward growth. WMT is benefiting from the intersection of various secular growth drivers. Its big-box concepts continue to consolidate retail as consumers may prefer to do all their shopping in one place. WMT is also benefiting from its low-cost focus as evidenced by the persistent growth in groceries. The Sam’s Club division may have significant potential for operating leverage. Sam’s Club currently generates a 2.6% operating margin. If the company could increase gross margins by just 100 basis points, then that could lead to as much as 40% growth in Sam’s Club operating profits. That investment thesis is very similar to what is seen at Costco (COST) – I would be pleasantly surprised to see WMT spin-off Sam’s Club as I would expect the stock to trade at very rich multiples.

What are the key risks here? Valuation in my opinion is the biggest risk. WMT trades at a 3x PEG ratio which is very rich, especially considering that growth stocks have crashed. That valuation is supported mainly by sentiment – based on the projected growth rate the stock may deliver double-digit returns at best and that is assuming stable multiples. In contrast, Target (TGT) is trading at a 1.5x PEG ratio based on forward estimates (albeit, assuming a robust recovery in earnings) – anecdotally I find the Target shopping experience to be far superior to that of Walmart. Competition may be a risk – not only from TGT but also from COST. I am of the view that competing on price can only go so far – the shopping experience may inevitably show its worth over the long term, which may stunt growth prospects. Again – these are quite anecdotal and WMT continues to show strong numbers. The best takeaway may be that at these valuations, such anecdotal fears become more important. Nonetheless, on account of the strength in Sam’s Club and the company’s continued ability to take market share, I rate the stock a buy though note that investors may find more compelling investment options in growth sectors.

Disclosure: I/we have a beneficial long position in the shares of COST either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am long all positions in the Best of Breed Growth Stocks portfolio.

Growth stocks have crashed. The time to buy is when there is blood on the streets, when no one else wants to buy. I have provided for Best of Breed Growth Stocks subscribers the 2022 Tech Stock Crash List, the list of names I am buying amidst the tech crash.

Get access to Best of Breed Growth Stocks:

- My portfolio of the highest quality growth stocks.

- My best 6-8 investment reports monthly.

- My top picks in the beaten down tech sector.

- My investing strategy for the current market.

- and much more

Subscribe to Best of Breed Growth Stocks today!