Summary:

- Walmart reported solid results for fiscal 2023 from a sales perspective – 7% comparable growth is no mean feat for a company with $600 billion in annual sales.

- Operationally, however, the company has been struggling for the past decade, and recent challenges have put further pressure on margins.

- In this article, I will make sense of WMT’s free cash flow, which has declined sharply in fiscal 2023, and discuss the impact of the rising interest environment.

- I will revisit my previous thesis, present an updated valuation, discuss recent analyst estimates, and share my expectations for fiscal 2024 and beyond.

Jessica McGowan/Getty Images News

Introduction

I published my first article on Walmart Inc. (NYSE:WMT) in May 2022, after the stock had sold off sharply due to lowered guidance and increasing pressure from inflation. I concluded that there was no point in rushing to buy WMT stock – after all, the stock was still trading at 19 times forward earnings.

However, since my article, the stock is actually up 10%, outperforming the S&P 500 (SPY) by a healthy margin. With fiscal 2023 earnings (ended January 31, 2023) on the table, I think it’s a good time to review whether I was too conservative in my assessment – or whether the market has gotten ahead of itself. I’ll elaborate on my expectations for Walmart stock earnings in 2023 (fiscal 2024) and beyond, taking into account the company’s performance in what was definitely not an easy year. I will revisit my earlier valuation and outline why I – in contrast to over 70% of analysts – do not see any upside potential for the stock.

How Did Walmart Perform In 2022?

While investors took flight on fears of rising inflationary pressures and weaker sales guidance following the announcement of FQ1 2023 earnings, the year actually didn’t turn out too badly – at least from a sales perspective. Sales growth of nearly 7% for the full year is definitely not a slouch for a retail giant with over $600 billion in annual sales. Walmart again posted healthy growth also on a comparable sales basis – 6.9% in Walmart’s domestic division and nearly 15% in its Sam’s Club division.

The main problem, if you will, was the change in product mix that began to emerge in early 2022. As inflation rears its ugly head, consumers are increasingly focused on everyday items, and so interest in discretionary product categories is declining. As a result, Walmart faced significant margin pressure, exacerbated by input cost inflation, higher transportation and logistics costs, and supply chain disruptions. As middlemen businesses, retailers typically operate on fairly narrow margins, making the current environment particularly challenging. Add to that the difficult comparison after a very strong fiscal 2021 and 2022 due to the pandemic – Walmart saw operating margin expansion of 10 and 50 basis points to 4.03% and 4.53%, respectively. In fiscal 2023, Walmart’s operating margin declined by a whopping 119 basis points year-over-year, resulting in operating income of just over $20 billion. Ten years ago, the company generated nearly $28 billion on $470 billion in sales, an operating margin of nearly 6%.

Things don’t look rosy from a free cash flow (FCF) perspective either, but of course it’s important to consider the significant challenges Walmart faces. Inflationary pressures are only part of the equation – a supply chain that is still not functioning optimally and, as a result, very high inventory levels – that result in significant inventory markdowns – are a much bigger problem. After all, Walmart reported additions to inventories of $11.8 billion in its fiscal 2022 cash flow statement – nearly six times the average of the last ten fiscal years (Figure 1). To be accurate, however, it should be added that the disproportionate increase in fiscal 2022 is also due to higher inventory costs and the impact of accelerated sell-through in the previous year.

Figure 1: Changes in inventories according to Walmart’s [WMT] full-year cash flow statements (own work, based on the company’s fiscal 2013 to fiscal 2022 10-Ks and the fiscal 2023 earnings release)![Changes in inventories according to Walmart’s [WMT] full-year cash flow statements](https://static.seekingalpha.com/uploads/2023/2/27/49694823-16775321344077284.png)

When normalizing working capital movements with a three-year moving average, and accounting for stock-based compensation expenses, we get a good idea of Walmart’s underlying FCF (Figure 2).

Figure 2: Walmart’s [WMT] free cash flow, normalized with respect to working capital movements and adjusted for stock-based compensation; year-over-year growth rates in percent (own work, based on the company’s fiscal 2011 to fiscal 2022 10-Ks and the fiscal 2023 earnings release)![Walmart’s [WMT] free cash flow, normalized with respect to working capital movements and adjusted for stock-based compensation; year-over-year growth rates in percent](https://static.seekingalpha.com/uploads/2023/2/27/49694823-16775321651994271.png)

The sharp decline in fiscal 2023 FCF is partly attributable to working capital effects. Figure 3 shows Walmart’s cash conversion cycle (CCC) as a combined metric that takes into account inventory days (ID), days sales outstanding (DSO) and days payables outstanding (DPO). Generally speaking, Walmart’s inventory management is very solid, and the rise in CCC will likely mean-revert to fiscal 2019 to fiscal 2021 levels as the company stabilizes its supply chain. At the same time, it is important to keep in mind that Walmart’s suppliers are constantly striving to lower their own DSO, which negatively impacts Walmart’s DPO – the only major working capital metric other than ID that allows the retailer to improve its free cash flow productivity. Consequently, inadequate management performance in this context would have a direct negative impact on free cash flow.

Figure 3: Walmart’s [WMT] cash conversion cycle (own work, based on the company’s fiscal 2012 to fiscal 2022 10-Ks and the fiscal 2023 earnings release)![Walmart’s [WMT] cash conversion cycle](https://static.seekingalpha.com/uploads/2023/2/27/49694823-1677532104352607.png)

Besides inventory-related issues, the deterioration in normalized free cash flow in fiscal 2023 was also due to higher capital expenditures. Walmart’s capex ratio (capital expenditures divided by normalized operating cash flow) increased to 63% from 42% in the prior year – about 20 percentage points higher than the ten-year average. No reversion to the mean is expected in fiscal 2024 – management has provided capex guidance for the high end of 2.5% to 3% of net sales, or more than $17 billion. This is broadly in line with the $16.9 billion invested in fiscal 2023 and well above the ten-year average of $11.9 billion. Walmart is investing heavily in its supply chain, automation and customer-facing initiatives. Although this will hurt near-term cash flow, I think these investments will eventually pay strong dividends.

The company definitely has the financial capacity to navigate this free cash flow trough – net debt (including operating leases discounted at 3% p.a.) was about $56 billion at the end of fiscal 2023, about 8% below the 10-year average. Walmart’s interest coverage is currently about six times pre-interest normalized FCF. This is broadly in line with the long-term average, in my view, although it is important to keep in mind that the metric is based on disproportionately weak cash flow in fiscal 2023.

Skeptical investors are now wondering – and rightly so – to what extent the rising interest rate environment will affect or has already affected Walmart’s ability to service its debt. Surprisingly little, I’d say, even though the company’s long-term debt due within a year has risen from 7.4% to 10.8% in fiscal 2023. In absolute terms, Walmart will likely refinance about $4.2 billion this year, but given the weighted average interest rate of 3.2% of these short-term maturities, the impact on the interest coverage ratio will be barely noticeable. Things looked a little different in fiscal 2022, as maturities in that year had a weighted average interest rate of only 1.7% – so the negative effect from refinancing on interest coverage was foreseeable.

Where Is Walmart Stock Heading In 2023, And What Is Its Long-Term Future

The retail industry is not really easy to predict, but large companies with a well-established and stable business model tend to be the exception. To gauge potential pleasant (and unpleasant) earnings surprises, I like to take a look at the one- and two-year analyst scorecards published by FAST Graphs. As expected, the company generally hits analysts’ forecasts very well on a one-year forward basis (Figure 4) – a mean deviation of -0.1% and a standard deviation of 6.9% over the last twelve years are really good, in my opinion. Of course, the pandemic-related jump in profits in fiscal 2022 was not predictable. On a two-year forward basis (Figure 5), of course, the forecasts are less accurate (-2.6% ± 12.8%), which underscores the importance of having a long-term horizon when investing, even for large blue-chip companies like Walmart.

Figure 4: One-year forward analyst scorecard of Walmart [WMT] (obtained with permission from www.fastgraphs.com)![One-year forward analyst scorecard of Walmart [WMT]](https://static.seekingalpha.com/uploads/2023/2/27/49694823-16775321973289928.png)

Figure 5: Two-year forward analyst scorecard of Walmart [WMT] (obtained with permission from www.fastgraphs.com)![Two-year forward analyst scorecard of Walmart [WMT]](https://static.seekingalpha.com/uploads/2023/2/27/49694823-1677532216535853.png)

I doubt we will see a nasty surprise in earnings – for fiscal 2024, the earnings per share estimate of -4% is rather unambitious, and over the last six months, analysts have become more cautious. Longer term, things should turn positive again from a margin perspective, but if you look at the share price performance over the last year, the market has largely priced in the improvements.

Admittedly, I think Walmart deserves a premium valuation because of its wide economic moat, which stems from its position as the leading grocery retailer in the U.S., its cost advantages and its excellent relationships with suppliers. It also competes extremely well with online retailers, due in large part to its highly efficient logistics network and the convenience factor of its store footprint (nearly 5,000 of its stores are located within 10 miles of 90% of the U.S. population).

WMT stock is currently trading at a blended price-to-earnings (P/E) ratio of 23, and it’s important to note that adjusted operating earnings growth has averaged “just” 6.3% over the past twenty years (Figure 6). Don’t get me wrong, I think this kind of earnings growth is really good for such a mature company in the retail business, but the corresponding valuation is definitely quite high.

Figure 6: Adjusted operating earnings based FAST Graphs plot for Walmart [WMT] stock (obtained with permission from www.fastgraphs.com)![Adjusted operating earnings based FAST Graphs plot for Walmart [WMT] stock](https://static.seekingalpha.com/uploads/2023/2/27/49694823-16775322586722867.png)

Normalized free cash flow growth has been de facto non-existent since fiscal 2013. Taking into account that free cash flow is set up to mean-revert in the coming years (expected to be around $21 billion by fiscal 2025), a compound annual growth rate (CAGR) of 4% to 5% would be a reasonable estimate for Walmart’s long-term performance in this regard. That puts the company’s forward free cash flow yield at 5% – not bad, but not cheap either. A simple discounted cash flow analysis suggests that the stock is currently fairly valued based on free cash flow of $17 billion (average of fiscal years 2021 to 2023), a cost of equity of 7.9% (a 4% risk premium on the current 30-year Treasury yield), and a terminal growth rate of 3.7% (Figure 7). This is certainly not an undemanding valuation, and the already substantial size of the company should also be considered. I think it will be difficult for a mature retailer like Walmart to grow its free cash flow by 3.7% on a sustained basis – after all, it’s a middle man’s business in a highly competitive industry. Growth in international markets is one factor that could support the current valuation over the long term, but management needs to rethink its international growth strategy, as the Walmart franchise has already failed in several countries. Strategic acquisitions would likely help in this context.

Figure 7: Discounted cash flow sensitivity analysis for Walmart [WMT] stock (own work)![Discounted cash flow sensitivity analysis for Walmart [WMT] stock](https://static.seekingalpha.com/uploads/2023/2/27/49694823-16775358743667707.png)

What Do Analysts Say About Walmart?

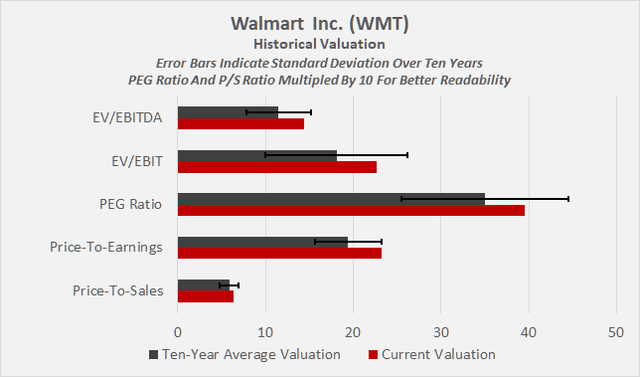

In the last 90 days, 29 of 41 analysts rated WMT stock as either a buy or strong buy. Their average price target for WMT stock is $161, which implies a potential upside of 13% from the closing price on February 24, 2023. Personally, I think this price target is overly ambitious, as it would imply a P/E ratio of nearly 26. In my view, the stock is currently somewhat overvalued – both from a free cash flow perspective (see above) and when comparing current valuation multiples with historical averages (Figure 8).

Figure 8: Historical valuation, taking valuation data from the most recent ten fiscal years into account (own work)

Given the valuation and lack of near-term catalysts, I can’t quite share the analysts’ enthusiasm. From a chart perspective, the stock is struggling – rightly, in my opinion – to break through resistance in the high $140 area. Granted, Walmart will overcome ongoing inventory issues, and free cash flow will recover sooner rather than later thanks to generally very solid working capital management, but as mentioned earlier, I think this is already priced into the stock. As is often the case, market participants leave little room for error, so news of a resurgence in inflation could lead to renewed uncertainty and thus pressure on WMT’s share price.

Conclusion – Is WMT Stock A Buy Or Sell After Q4 Earnings?

I think Walmart’s management responded appropriately in 2022 and was able to convince a large number of customers of its value proposition even in somewhat difficult times, further cementing its top position as the go-to one-stop shop. Inventory issues are understandable in the aftermath of the pandemic and will return to normal sooner rather than later as global trade rebalances, but mainly thanks to ongoing significant investments in automation initiatives and the supply chain. Investments in employees should also strengthen long-term fundamentals, especially since Walmart does not have the best reputation when it comes to employee treatment and wages.

I am not changing my original conclusion that Walmart is fundamentally a sound investment thanks to its top position, significant economies of scale, excellent supplier relationships, and sophisticated distribution and store networks. I acknowledge that this quality comes at a price, but the current valuation is definitely overstated, as it will be nearly impossible for Walmart to sustain growth at a rate that justifies a P/E ratio in the mid-20s.

I think the market came to its senses last year when the stock fell to $120 on fears of margin compression and continued inflationary pressures. It became clear fairly quickly that Walmart would overcome those challenges, and the market was quick to discount the improved future, so I think now is clearly not the time to buy Walmart stock. With no near-term upside catalysts and a mean-reversion in margins already priced into the stock (as seen, for example, in the FAST Graphs chart in Figure 6), I think it is prudent to wait for a better opportunity that could be triggered, for example, by a resurgence in inflation. As described in my previous article, I would only be interested in buying the stock at around $100 (or less), which would correspond to a forward P/E ratio of 16 to 17.

One final aspect is worth noting. With its recent dividend increase, Walmart has joined the hall of fame of dividend kings who are justifiably proud of increasing their dividends for 50 or more years in a row. It takes really solid management to navigate the many economic contractions and social and demand changes well enough to pay out a growing dividend even after such a long time. In 1973, the world was definitely a different place. However, Walmart’s current dividend and share price currently translate to a dividend yield of 1.6%, and with rather modest increases of $0.04 per year, I think it’s wrong to call WMT a dividend growth stock. Management has increased the dividend by this constant dollar amount since 2013, and if this trend continues, the stock’s yield on cost – if purchased today – will barely reach 3% in 50 (!) years. Figure 9 compares current Treasury bond yields to the projected yield on cost of WMT stock after a given holding period and considering a range of scenarios. From a dividend payout perspective (40% of normalized free cash flow over the last ten years), I see no reason not to return to stronger dividend growth in the future. However, management is playing it safe, as evidenced by the still unproblematic payout ratio of 60% in fiscal 2023, which was characterized by sharply declining normalized free cash flow.

Figure 9: Current Treasury yields compared to projected yields on cost for Walmart [WMT] stock (own work, based on Treasury yields as of February 27, 2023)![Current Treasury yields compared to projected yields on cost for Walmart [WMT] stock](https://static.seekingalpha.com/uploads/2023/2/27/49694823-1677532662883944.png)

Safety comes at a price, but not at any price. I believe that at $142, investors are willing to pay a significant premium for what I would broadly describe as “perceived” safety. While investments in the business and significantly declining inventory markdowns will help margin stabilization in fiscal 2024, the further shift in product mix toward lower-margin food and health products that may be necessary in the event of renewed rising inflation would certainly put downward pressure on the stock. Overall, I see no real upside potential for WMT stock and modest downside potential that could trap investors with a below-average dividend yield.

Thank you very much for taking the time to read my article. Do you agree or disagree with my conclusions? I’d appreciate your thoughts in the comments section below – Also, if there is anything you’d like me to improve or expand upon in future articles. In any case, please consult with a registered and experienced investment advisor before making or arranging any trades.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The contents of this article and my comments are for informational purposes only and may not be considered investment and/or tax advice. I am neither a licensed investment advisor nor a licensed tax advisor. Furthermore, I am not an expert on taxes and related laws – neither in relation to the U.S. nor other geographies/jurisdictions. It is not my intention to give financial and/or tax advice and I am in no way qualified to do so. I cannot be held responsible and accept no liability whatsoever for any errors, omissions, or for consequences resulting from the enclosed information. The writing reflects my personal opinion at the time of writing. If you intend to invest in the stocks or other investment vehicles mentioned in this article – or in any form of investment vehicle generally – please consult your licensed investment advisor. If uncertain about tax-related implications, please consult your licensed tax advisor.