Summary:

- Warner Bros. Discovery has the necessary media assets to compete head-to-head with Disney and Netflix for the streaming crown.

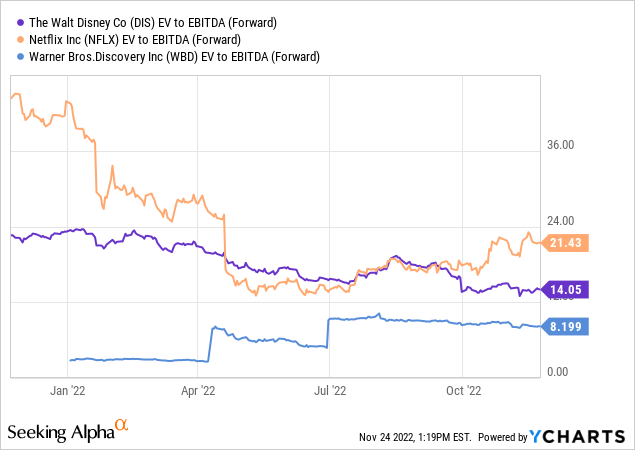

- The strongest argument in favor of Warner Bros. Discovery outperforming Netflix and Disney in the coming decade is the starting valuation.

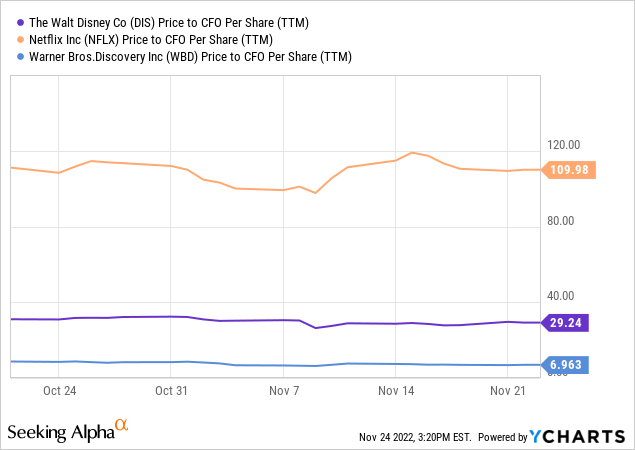

- Trading with a forward EV/EBITDA of ~8x and with a price/cash flow multiple of ~7x WBD shares are quite cheap, especially when compared with Netflix and Disney.

Jon Kopaloff

Even though Warner Bros. Discovery (NASDAQ:WBD) delivered another disappointing quarter, and Netflix (NASDAQ:NFLX) is back to growing global subscribers, the valuation difference between the two companies is such that it is extremely likely that Warner Bros. Discovery will outperform Netflix by a wide margin in the coming decade.

Valuation is a large part of why we believe WBD will outperform, but not the only reason. It also has the assets and the scale to compete head to head with both Netflix and Disney (DIS) for the streaming crown. Disney is already closing the gap in terms of streaming subscribers quite quickly with Netflix, and we would not be surprised if the new iteration of HBO Max sees growth accelerate.

WBD is also much better diversified with cash generating businesses, even if some of them are legacy businesses with negative growth. These businesses are still generating a lot of cash that will help the company deleverage and invest in its future.

While Netflix has a powerful brand, at the end of the day what people really care about most when choosing which platform to sign-up for are the shows and films available. This is the key advantage that both Disney and Warner Bros. Discovery have over Netflix. Now all they have to do is close the gap in terms of UX/UI of the platform and do a decent job marketing it to potential customers.

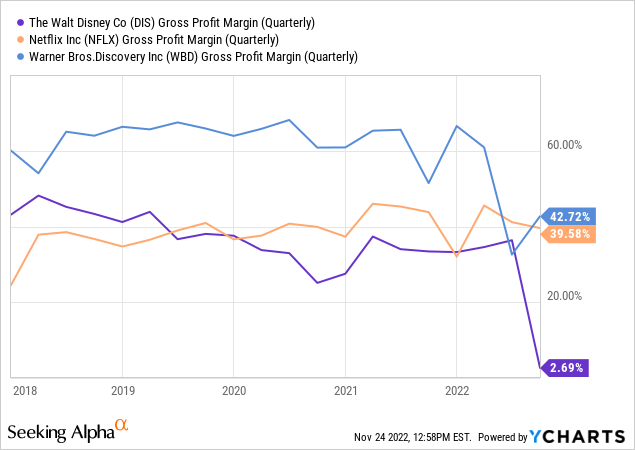

Profit margins

Warner Bros. Discovery back when it was only Discovery had excellent gross profit margins, much better that those of Netflix and Disney. After the merger its gross profit margin went down, but as the company cancels underperforming shows and films we expect margins to trend up again.

Growth

The big attraction to Netflix for investors has been its unbelievable growth. Netflix’s growth, however, is quickly decelerating and trailing that of its main competitors. In Q3 Disney+ added 12.1 million subscribers, Warner Bros. Discovery added 2.8 million, and Netflix came in last adding only 2.4 million.

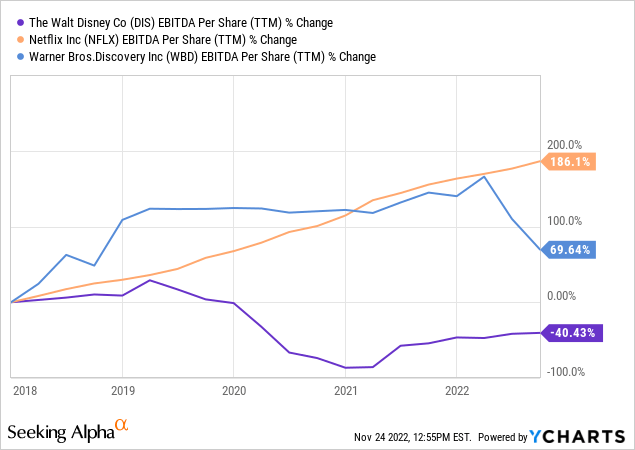

Another type of growth worth analyzing is per share profitability. To that end we created a graph showing the growth in EBITDA per share for the last five years for each company. Netflix has performed the best in this respect, but there are reasons to believe this is about to change.

Warner Bros. Discovery is spending money on restructurings and operating efficiencies that are temporarily depressing EBITDA, but that should result in synergies of more than $3.5 billion. That is why we believe EBITDA will start growing again soon for WBD in a very significant manner. Disney should also see its EBITDA improve as the economy continues to re-open and its theme parks, theatrical releases, and cruises return to normal operating conditions.

People love shows and characters more than they love their streaming platforms

It might sound obvious but people sign-up to streaming services for the content. The UX/UI interface might make the overall experience better/worse, but as long as the platform is not completely unstable, making watching shows a real pain, it is likely that users will actually decide which platform to subscribe to depending on which has more shows that they like.

All this to say, based on the IP that Warner Bros. Discovery has, it should be able to compete head to head with Netflix. Just to name a few, WBD has assets such as Friends, Sex and the City, The Big Bang Theory, Game of Thrones, etc. It also has some of the best movie studios and creative talent.

Warner Bros. Discovery Investor Presentation

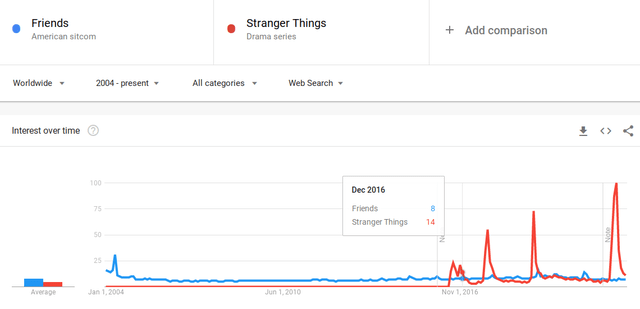

Some might argue that shows like Friends are old, and that Netflix is putting out new content constantly. Let’s compare this old show against the Netflix star Stranger Things using Google Trends. Stranger Things has big peaks when new seasons are released, but in between seasons its popularity is very close to that of Friends. With some franchises there is also a possibility to create new content, such as what HBO has done with Game of Thrones and the spin-off House of the Dragon. Expect similar moves with Harry Potter, Batman, Wonder Woman, etc.

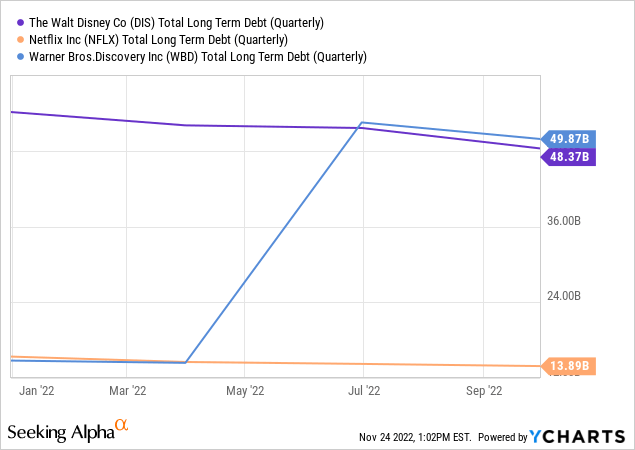

Balance sheets

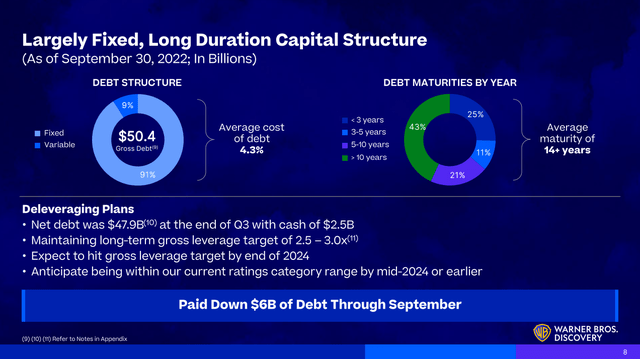

One big advantage that Netflix has is its lower debt levels. It has roughly $14 billion in gross debt, while Disney and Warner Bros. Discovery have close to $50 billion.

Fortunately WBD has secured mostly fixed debt with a long average maturity of more than 14 years. This reduces the refinancing risk, especially in this environment of higher interest rates. The company is also paying back debt quickly, and anticipates to be within its credit ratings category by mid 2024 or earlier. Leverage should come down significantly if WBD meets its goal of ~$12 billion in adjusted EBITDA for 2023.

Warner Bros. Discovery Investor Presentation

Valuation

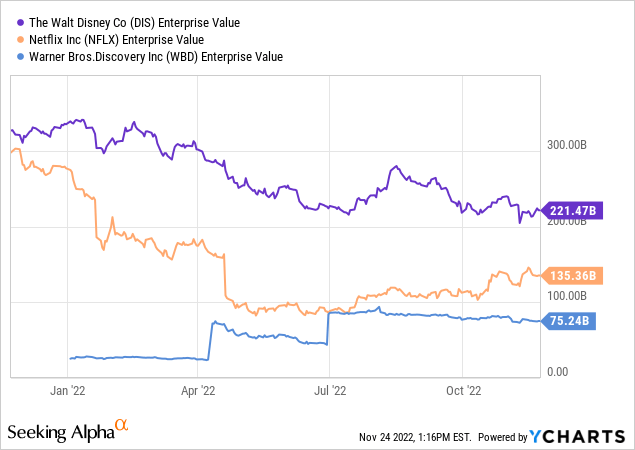

By far the strongest argument in favor of Warner Bros. Discovery outperforming Netflix in the coming decade is the starting valuation. To give an idea of the size of each business, quarterly revenues for Disney are ~$20 billion, for Warner Bros. Discovery they are ~$10 billion, and for Netflix they are ~$8 billion. Despite WBD being a larger business than Netflix, it trades with a significantly lower enterprise value.

Looking at the forward EV/EBITDA, Netflix’s multiple is more than twice as expensive as that of Warner Bros. Discovery.

In terms of price/ cash flow, the difference is even more significant, with WBD trading at only ~7x cash flows, and Netflix in the triple digits. This tells us a lot about the quality of the earnings, and the real cash generating power of the businesses.

Going forward we would expect EV/EBITDA multiple expansion for WBD, and multiple contraction for Netflix, which is the main reason why we expect WBD to significantly outperform Netflix over the coming decade. Drivers for WBD’s multiple expansion include calming the market by repaying debt and improving the balance sheet and restoring its free cash flow generation, which has been affected by restructuring costs. As for Netflix, the driver’s for a multiple contraction include an extremely stretched initial valuation, and the likelihood that growth will continue to be disappointing as streaming competition intensifies and more quality content gets pulled away from Netflix and into other platforms. As for Disney, we think it is slightly undervalued, but not as significantly as WBD.

Risks

Despite the low valuation, an investment in Warner Bros. Discovery still carries significant risks. For one thing its streaming operations are not yet profitable. It is expecting peak EBITDA losses for the segment in 2022, to break even in the US by 2024, and +$1 billion EBITDA for the global DTC segment in 2025. It estimates that it will need roughly 130 million global subscribers by 2025 to meet this goal, compared to the ~94.9 million it has currently. Then there is the significant amount of long-term debt, which as we already discussed is mostly fixed and has a long average duration, but it still adds risk to the equation. Another important risk is the company’s exposure to the advertising market, which proved to be a significant headwind in the most recent quarter.

Conclusion

We believe Warner Bros. Discovery has the necessary assets to compete head to head with Netflix and Disney for the streaming crown. Based on the starting valuations, with Netflix overvalued and WBD significantly undervalued, it is very likely that Warner Bros. Discovery shares will outperform Netflix’s in the coming decade. There are important risks to consider with WBD, including its significant amount of long-term debt, and its exposure to the advertising market, but these risks are mitigated by the company’s cash flow generation capabilities, expected synergies, and valuable IP assets.

Disclosure: I/we have a beneficial long position in the shares of WBD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling shares, you should do your own research and reach your own conclusion, or consult a financial advisor. Investing includes risks, including loss of principal.