Summary:

- Recent reports mention that the FED is likely to launch an antitrust lawsuit against the takeover of Activision Blizzard by Microsoft.

- I think a lot of misconceptions are playing a role with the regulatory scrutiny.

- The acquisition of Activision will give Microsoft access to a lot a couple of high-growth opportunities.

- Cloud gaming and growth of the gaming sector are strong growth drivers for Microsoft’s gaming division.

- Recent weakness in the gaming industry could have an effect on revenue in 2023, but the long-term growth thesis is very much intact.

Chris Cook/iStock Editorial via Getty Images

Investment thesis

Microsoft (NASDAQ:MSFT) is my highest conviction stock, and I wrote about this in my initial coverage of Microsoft stock, which I wrote over a month ago. Within that article, I explained why Microsoft is my largest personal holding and I discussed a few of its largest growth drivers. This time, I will take a more in-depth look into its growth opportunity in gaming as Microsoft is one of the largest players in the gaming industry through its Xbox platform.

The Activision (ATVI) deal is still pending and is seeing a lot of scrutiny from regulators in both the UK and the US. The question remains whether the acquisition will be given the green light by regulators. Microsoft remains confident that the deal will be permitted to go on and is cooperating with regulators to make sure that misconceptions are taken away. The Activision deal, when approved, will open Microsoft up to several growth opportunities which are the mobile gaming market and a strong position in the cloud gaming market.

General gaming market growth will be a tailwind for Microsoft no matter the outcome of the Activision acquisition. The market is expected to grow at a CAGR above 13% until 2028 and will be a growth driver for Microsoft as it already has a strong position in the gaming industry through its Xbox platform. Microsoft continues to expand its cloud gaming offering through its Xbox game pass and looks well-positioned to benefit from a fast-growing cloud gaming market with its expertise in cloud computing.

Near-term there seems to be some weakness in the gaming market as consumer spending is slowing down and the industry is early cyclical. Weakness is witnessed within other gaming companies such as Nvidia (NVDA) and Sony (SONY), but Microsoft kept growing over the latest quarter, although at a slower pace. Despite the near-term weakness, I remain to believe that the long-term growth trend is still very much intact and will be a growth driver for Microsoft.

Despite a small increase in valuation and a 10% increase in share price ever since my previous article, I still believe the current valuation is close to fair value and the stock remains a strong buy on the strong growth potential and incredible financials.

Sector growth

As Microsoft is one of the biggest players in the gaming industry, it is to no one’s surprise that this is also a big opportunity when growth for the gaming industry is expected to be above 13% CAGR for the next six years. According to Business Fortune Insights, the gaming market is expected to grow at a CAGR of 13.2% until 2028. The total market size will come in at $545.98 billion by then. In the console market, Microsoft currently holds a market share of 20% and is expected to improve this to 27% by 2026. This general growth of the market and increase in market share will allow Microsoft to see strong growth over the next decade within its gaming division. I believe the gaming division will grow to be a larger part of Microsoft as it is one of the faster-growing industries in which Microsoft is active, only trailing cloud computing growth. If we look at Microsoft’s third quarter results, we can see that revenue generated by the gaming division was a little over $3.5 billion and this represented approximately 7% of total revenue for the quarter. There is a lot of upside for the gaming division, by innovation and cloud gaming execution, without the Activision acquisition.

Activision Blizzard acquisition

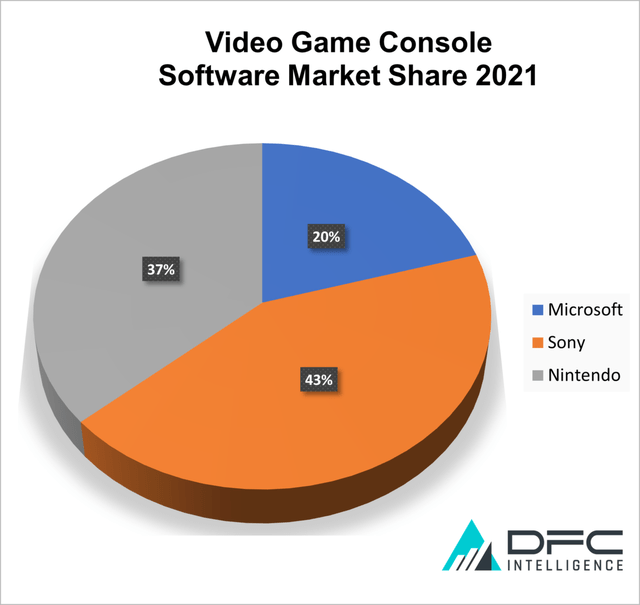

At the start of the year, Microsoft announced its acquisition of Activision Blizzard. Yet, the acquisition still is not completed as regulators in the US, Europe, UK, and China continue to review the purchase. As a result, Microsoft is still awaiting regulatory approval. Most recently, Politico reported that they expect the FED to file an antitrust lawsuit to block the $69 billion acquisition. This seems to be building on a large number of misconceptions as the largest part of Activision’s revenue is thanks to mobile gaming in which Microsoft currently has little to no exposure. Of course, there are worries, mainly from Sony, that Microsoft is going to make blockbuster console games such as Call of Duty an Xbox exclusive and therefore making the PlayStation console from Sony less attractive to a large number of console gamers. Yet, Microsoft promised that it will not make it an Xbox exclusive as this is not their motivation to buy Activision. For that reason, I do not see how this would give Microsoft any sort of an unfair boost in the video game market as it would not even be the largest player, remaining behind Japanese Sony and Chinese Tencent. This is what Microsoft spokesman David Cuddy said about this:

Microsoft is prepared to address the concerns of regulators, including the FTC, and Sony to ensure the deal closes with confidence. We’ll still trail Sony and Tencent in the market after the deal closes, and together Activision and Xbox will benefit gamers and developers and make the industry more competitive.

I believe Microsoft will be having a hard time getting the acquisition through as many regulators are afraid of the sheer strength of Microsoft across different industries. Maybe the direct unfair position in the gaming industry will not be the problem (as there seems to be none), but the strength of Microsoft, which allows it to make $70 billion acquisitions without any issues, is the biggest fear of regulators as it allows Microsoft to expand into any industry it wants by buying the largest players.

Microsoft seems to be willing to cooperate with regulators to get the deal through and I remain confident they will, but the chance remains that the FED, or any other regulator, will file an antitrust lawsuit which will end the chances of the acquisition. I do not believe that a rejection of the acquisition will be a game-changer for Microsoft within its gaming segment. Even more, I don’t even know whether I believe Activision Blizzard is worth the price tag for Microsoft. Microsoft already has a strong position in the gaming industry and without Activision still has plenty of growth opportunities. So, what would the Activision acquisition bring to the table for Microsoft? Well, there are three main benefits of owning Activision, and these are getting access to its large customer base, owning a strong game development company to create more Xbox exclusives for subscription services, and if offers an inside into the fast-growing and dominant mobile gaming industry.

The acquisition of Activision will give Microsoft access to the 40 million monthly active users playing Activision games and pull them towards its gaming platforms and subscriptions by offering Microsoft exclusive games or exclusive extras. Xbox is investing heavily in its cloud gaming service which it launched in 2020. Later in this article, I will go into more detail regarding the cloud gaming opportunity, but the acquisition allows Microsoft to include Activision games in its cloud gaming library without having to pay additional fees. In addition to this, and ideally, Microsoft would want to make current and future games an Xbox exclusive just as Sony does with its games produced by Sony Studios like Spiderman: Miles Morales or The Last of Us.

Right now, there is a split in gamers since you can either be a PlayStation gamer or an Xbox gamer (or PC). Both are great platforms, but Sony has the upper hand as Microsoft made some wrong choices in the past. Cloud gaming offers a new sort of gaming and allows gamers to switch consoles since console hardware will not be crucial to be owned in the future as you will be able to play your games on any device. Catching a larger amount of the gaming audience through better service, a larger game library with blockbuster titles, and superior technology and innovation will give you the upper hand and can get Microsoft on top of Sony. The Activision acquisition can play an important role in gaining this advantage.

Finally, the acquisition will gain Microsoft a strong position in the mobile gaming industry in which it now has little to no exposure. The fastest-growing segment within the gaming industry is mobile gaming. According to Straits Research, the mobile gaming market is expected to grow at a 12.3% CAGR until 2030 and will reach a market size of $338 billion from $119 billion today. The Indian gaming market is the fastest growing of all and Call of Duty and Candy Crush, two games owned by Activision, are among the top 10 most-played games in India. The Indian market is home to over 430 million gamers and is growing by 35-40% a year, with mobile gaming accounting for 90% of this growth.

Xbox + Activision games (Microsoft)

Cloud gaming

Microsoft is not focused on platform gaming, but on cloud gaming. Microsoft wants to enable people to play games anywhere and on any device. Microsoft is building on this with its Xbox Game Pass, which is a monthly subscription enabling you to play every selected game for free on supported devices. These differ from Xbox hardware to PC and mobile devices.

Cloud gaming enables users to play their favorite games without owning the necessary hardware like the Xbox. Instead, the games are being played in one of the many powerful cloud servers of Google (GOOGL), Microsoft, or AWS (AMZN). This is then streamed to your device of choice. This enables users to play their games where and whenever they want without needing the hardware. This allows you to play the most intense graphical games on your simple smartphone. Microsoft offers this cloud gaming service through its Xbox Game Pass Ultimate. Microsoft owns the cloud servers’ software and hardware to realize this on a huge scale, and owns the gaming platform with Xbox, which positions them perfectly. When using a cloud gaming subscription from Microsoft, you will not need to buy your own games as it comes with a game library with games you can play for free whenever and wherever you want. Therefore, the Activision acquisition is valuable for the cloud gaming opportunity as Activision is a great video game builder and produced many blockbusters in the past that it can involve in its cloud gaming platform. There is a good chance that Microsoft will continue to keep games such as Call of Duty available on PlayStation, but for cloud gaming, it will only be available on Xbox. Microsoft is in a great position to benefit from the shift from traditional console gaming to cloud gaming thanks to its technical expertise in the cloud and already popular gaming platform. The cloud gaming market is expected to grow at a 42.5% CAGR until 2028 and reach a market size of $13.3 billion.

Risks and valuation

The main risk seems to be regulatory scrutiny over its acquisition of Activision which could result in a blow-up of the deal. This would make the growth case more difficult for Microsoft but would leave it with a large amount of cash to make multiple smaller acquisitions in the industry. Yet, it would be a blow for Microsoft if the acquisition would not be completed. As I mentioned before in this article, I do believe Microsoft can still grow its business driven by other growth factors.

Also, we have seen so far this year that the gaming market is seeing negative numbers as reflected by the financial results of Nvidia and Sony. Sony mentioned that it saw less activity on its PlayStation platform and less spending by consumers. Nvidia saw a drop of over 50% in gaming revenue. The gaming market is early cyclical and might very well have bottomed already, but there is a significant chance that more downside is still to come as consumers lower their spending on discretionary goods. As a result, gaming growth may slow down for Microsoft and even turn negative in the short term, but as a long-term investor, this is absolutely nothing to worry about as the long-term growth will remain very much intact for the gaming industry.

Microsoft is currently valued at a forward P/E of close to 26 and is therefore still 11% undervalued compared to its 5-year average. Analysts are projecting growth to slow this year but expect growth to speed up again the three years after with close to 20% growth per year. I think this is a fair estimate by analysts and I agree with their growth outlook for Microsoft. I believe Microsoft is close to fair value right now.

Conclusion

Scrutiny over the Activision acquisition remains a difficult one to judge as it seems less likely every week that the acquisition will be approved. Microsoft continues to do everything in its power to cooperate with the regulators, but the question will be whether it is enough. The acquisition will open a lot of new doors for Microsoft, but I don’t believe it is a make-it-or-break-it situation as Microsoft already has a strong position and plenty of other opportunities in the gaming market. Growth in the gaming segment will not depend on just this acquisition. Cloud gaming is a large future opportunity on which Microsoft is acting well so far. The general growth of the gaming market will be an additional driver of growth as Microsoft already holds a strong market position through its Xbox platform.

In my previous article, I already stated that Microsoft was my highest conviction opportunity on the market today and my position did not change. I remain to be buy rated on Microsoft despite the recent increase in share price. The current valuation is still attractive when considering the strong market position, incredible balance sheet and cash generating, and future growth potential.

I rate Microsoft a Strong Buy and believe gaming will be a growth driver going forward, despite near-term industry weakness. Buy this incredible company on current weakness.

Disclosure: I/we have a beneficial long position in the shares of MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.