Summary:

- Meta’s stock crashed to about $88 during the recent capitulation like panic selling.

- Meta’s fall from the top was remarkable, as it erased more than $750 billion in market value from peak to trough.

- However, Meta remains the dominant social networking monopolistic-style company that should continuously attract more ad dollars as we advance.

- Once the transitory slowdown concludes, Meta should see a substantial increase in revenues, driving its stock price much higher in the coming years.

Teera Konakan/Moment via Getty Images

Meta Platforms (NASDAQ:META) has had one of the most epic rebounds, appreciating by a staggering 62% off its multi-year low in early November. I pounded the table on Meta’s stock as capitulation and panic selling brought shares down to an absurdly low level. However, despite appreciating considerably from its lows, Meta is still cheap relative to its long-term growth and profitability potential. Furthermore, despite the recent rebound, Meta is still about 63% below its ATH and could have another significant technical breakout soon. Also, Meta will report earnings on February 1, and we probably won’t see a miss this time. Despite transitory near-term challenges, Meta should become more efficient and increasingly profitable as it advances. Therefore, the company’s stock price should appreciate considerably in the intermediate and long term.

No, Facebook Isn’t Dead

I often hear that Meta isn’t a top company because fewer people use Facebook now. Moreover, I hear claims that Facebook is “dead,” or worse, like the new MySpace. However, while Facebook may not be the most popular social media platform among teenagers, it’s far from dead. Sooner or later, almost everyone ends up on Facebook.

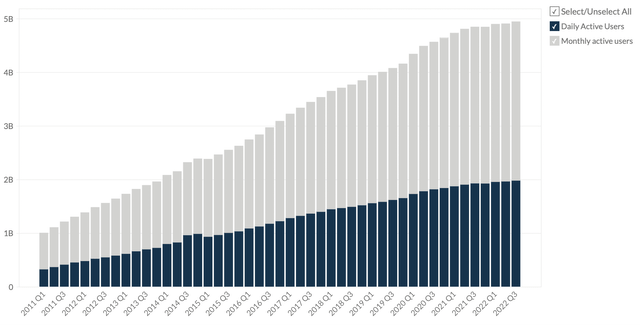

Facebook: Active Daily and Monthly Users

Facebook users (Businessquant.com )

At the end of the last quarter (Q3 2022), Facebook had a staggering 1.98 billion active daily users. In addition, the company reported 2.96 billion active monthly users in Q3. These are extraordinary numbers, illustrating that a significant portion of the global internet-using population utilizes Facebook, nearly 2 billion people daily.

What is The Facebook Alternative?

When discussing social media platforms, there are few alternatives to Facebook. In my view, Instagram is an exciting supplement to Facebook, but it’s not a viable alternative. Nevertheless, if people spend only some of their free internet time on Facebook, they must spend it elsewhere. Instagram has around 2 billion monthly active users, and more than 500 million people use the site daily. Also, I’m sure that most people reading this article know that Meta owns Instagram. Meta also owns Messenger and WhatsApp, making it an essential social media monopoly in the West.

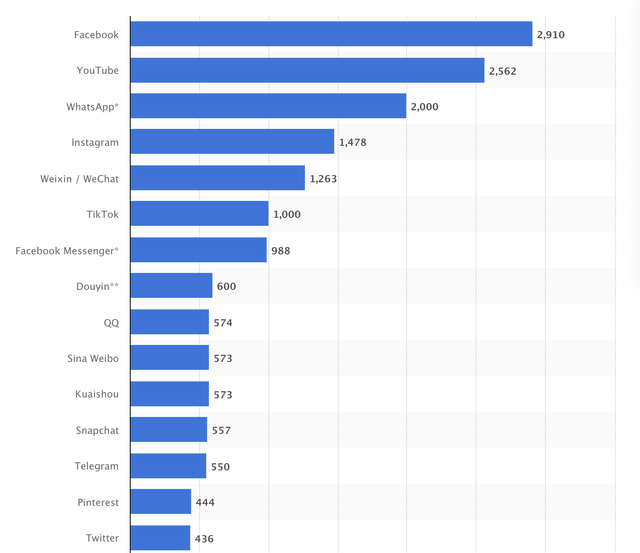

Most Popular Social Media Platforms “MAUs” (January 2022)

Most popular social networks (Statista )

Facebook, WhatsApp, Instagram, and Messenger are now billion-plus user platforms. These extraordinary user numbers provide Meta with an incredible advantage consisting of massive amounts of precious data for its advertising businesses. Meta advertises to more than 2.11 billion people globally and has more than 3 million active advertisers across its platforms. Therefore, despite the transitory slowdown in ad spending, Meta’s customers should continue advertising on Meta’s platforms, as there are few “alternatives.” Meta is a social networking monopoly. Thus, sales growth and profitability should accelerate in future years.

Technically – It’s Not So Simple

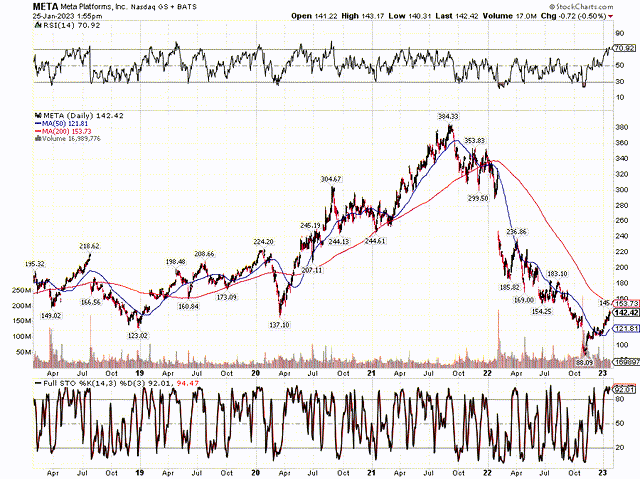

META (StockCharts.com)

Meta’s stock collapsed in one of the most epic destructions of wealth stories of all time. Meta’s valuation was more than $1 trillion during its peak in 2021. As Meta’s stock dropped by approximately 75% from its peak, more than $750 billion worth of Facebook’s market cap got wiped out in slightly more than a year. I don’t know if there has ever been a more significant market cap collapse, but perhaps not.

However, the stock likely hit a long-term bottom as it dipped to the $88 range low not seen since 2014). Since then, Meta’s stock has appreciated by approximately 60%. Nevertheless, Meta is well below its recent highs and is likely to move much higher long term.

Meta could use a pullback in the near term, as the stock’s RSI recently went above 70, indicating significant short-term overbought technical conditions. Thus, we could see a pre-earnings pullback, leading to a buying opportunity. Also, if Meta misses on earnings, the stock could get a temporary post-earnings setback. Therefore, Meta could become a strong buy at lower levels soon.

That Entire Metaverse Thing Should Pay Off

Meta Platforms has a leading position in the infrastructure building of the Metaverse. The Metaverse has the potential to become the “internet 2.0”. This Metaverse concept may be familiar to many people in specific ways, and it involves, at its core, providing a more immersive user experience. Some can call it a virtual life parallel to your real-world one. Some call it the ultimate escape from reality. Various augmented and virtual reality breakthroughs are occurring that should continue to shape and mold the Metaverse over the next several years. Several leading companies involved in building the Metaverse and the infrastructure in the space include Meta, Microsoft (MSFT), Nvidia (NVDA), Apple (AAPL), and other prominent tech companies.

Meta – Becoming More Efficient

Google, Microsoft, Amazon, and Meta recently laid off about 50,000 employees. Meta cut around 11,000 spaces, decreasing its job force by roughly 15%. A considerable 15% reduction in its workforce implies that Meta intends to lower costs, improve margins, and deliver higher profitability in the coming years.

Significant Growth and Profitability Prospects

Meta’s dominance in social networking ad revenues is unparalleled and remarkable, as the company should report revenues of around $120 billion for 2022. While the consensus estimate is only around $116 billion for this year, I believe in Meta’s money-making-machine potential. Meta could blow away depressed consensus revenue and EPS estimates as we advance.

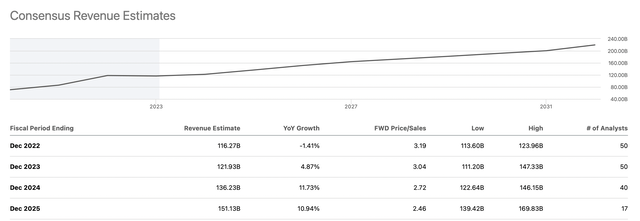

Consensus Estimates May Be Light

Revenue estimates (SeekingAlpha.com )

The consensus estimated revenue growth is only 5% this year and around 10-12% after that. However, Meta has had much higher growth numbers in recent years. Furthermore, as Meta comes out of this transitory downturn, its revenues could increase more than expected. Meta could attain 10-15% (or higher) annual revenue growth in future years. Moreover, Meta’s revenues could come in at about $136 billion this year (below higher-end estimates), surpassing the consensus analysts’ estimate of around $122 billion. Likewise, Meta can continue outperforming revenues and earnings estimates in the coming years.

The Bottom Line – Meta Is Still Too Cheap To Ignore

Love it or hate it, Meta is a unique, market-leading, monopolistic-style social networking and media giant. Meta’s market cap got decimated (unfairly, in my view) due to various transitory elements. Meta remains a top internet juggernaut that became extremely undervalued recently. Moreover, despite the stock’s recent 60% epic comeback, Meta remains cheap, and its share price will likely travel much higher as we advance.

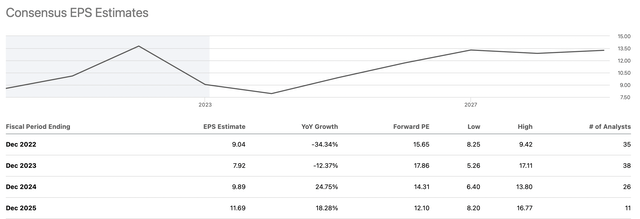

Rock Bottom EPS Estimates

EPS estimates (SeekingAlpha.com )

We know that Meta is going through an earnings recession, and the earnings dip was telegraphed for the long term. However, this year’s earnings dip will not be as massive as consensus estimates envision. What if Meta makes more money instead? What if Meta earns more money YoY in 2023, surprising the rock-bottom consensus estimates? I suspect Meta can report much higher than is currently stated. Higher-end 2023 EPS estimates go up to $15-$17. However, the company could report $10-$12. This dynamic implies that Meta is trading at only 12-14 this year’s EPS potential. Moreover, Meta could earn approximately $13-$14 in EPS next year, implying that Meta may be trading at a forward P/E ratio of about 10.

Where I see Meta’s stock going in several years:

| Year | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 |

| Revenue (Bs) | $136 | $147 | $168 | $190 | $212 | $238 | $264 | $291 |

| Revenue growth | 13% | 8% | 14% | 13% | 12% | 12% | 11% | 10% |

| EPS | $11 | $13.50 | $16.47 | $20.42 | $25 | $30 | $38 | $46 |

| EPS growth | 22% | 23% | 22% | 24% | 23% | 22% | 21% | 20% |

| Forward P/E | 10.4 | 14 | 16 | 17 | 18 | 17 | 16 | 15 |

| Stock price | $140 | $230 | $326 | $425 | $540 | $646 | $736 | $820 |

Source: The Financial Prophet

Risks To Meta

While I am bullish on Meta’s future, some analysts aren’t. There is skepticism about the Metaverse project, and some investors must be convinced that the risk is worth the gamble. Meta has invested tens of billions into the concept and has a lot of burnt cash to answer for. Moreover, there is a concern that Meta will continue burning money on the Metaverse without recouping its investment in the long run. There are also concerns associated with sustainable growth in its ad business and other risk factors like competition and regulatory issues. Therefore, Meta’s revenue growth could be slower, and its profitability may be less than projected. Investors should consider these and other risks before committing to a Meta investment.

Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am long a diversified portfolio with hedges.

Are You Getting The Returns You Want?

- Invest alongside the Financial Prophet’s All-Weather Portfolio (2022 17% return), and achieve optimal results in any market.

- Our Daily Prophet Report provides crucial information before the opening bell rings each morning.

- Implement our Covered Call Dividend Plan and earn an extra 40-60% on some of your investments.

All-Weather Portfolio vs. The S&P 500

Don’t Wait! Unlock Your Own Financial Prophet!

Take advantage of the 2-week free trial and receive this limited-time 20% discount with your subscription. Sign up now, and start beating the market for less than $1 a day!