Summary:

- Textron’s stock soared 12% after beating Q2 earnings estimates and increasing EPS guidance.

- Wall Street is excited about Textron’s $6.4 billion order backlog and positive outlook for the aviation business segment.

- However, an intrinsic valuation will find that the upside might already be priced in.

Wirestock

Thesis

Textron Inc. (NYSE:TXT)’s stock price got a 12% boost last week after beating earnings estimates and upping guidance. The market is excited about rebounding demand in the high-margin aviation business segment, which accounts for about 40% of company revenue. However, based on a DCF analysis, Textron’s current stock price seems to already reflect this positive upside. Hence, I rate it a hold. I do not recommend dumping the stock, however, in light of the recent strong momentum, and Textron’s strategic position in the aircraft market, where demand could possibly exceed expectations while operating margins continue to grow.

Textron Overview: 6 Companies in 1

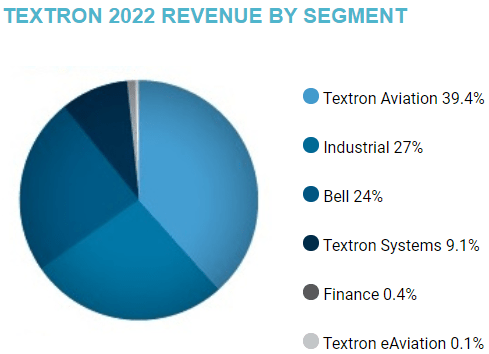

Textron is an international conglomerate that produces well-known products such as Bell helicopters, Cessna aircraft, and E-Z-GO golf cars. The company, headquartered in Rhode Island, has 34,000 employees with plants and offices in 25 countries. The company is made up of six business units with Aviation, Industrial, and Bell accounting for 90% of sales in 2022.

Textron 2022 Sales by Segment (Textron 2022 Financial Highlights)

78% of sales derived from commercial customers in 2022 and 22% from U.S. government agencies. Geographically, nearly 70% of sales were generated from U.S.-based customers, 11% from Europe and the remainder other international accounts.

Aviation – The aviation division includes major aircraft brands such as Cessna and Beechcraft. Cessna specializes in high-end business jets, among other planes, whereas Beechcraft sells piston-engine and turboprop planes. Textron also sells trainer and combat aircraft to the military. The AT-6 light attack jet was certified by the US Air Force last year, enabling international sales of the aircraft. Cessna secured a 30%+ share of the North American business jet market in 2022, followed by Bombardier Inc. with about 20% and Gulfstream at nearly 15%, according to a ReportLinker assessment.

Industrial – Textron builds and sells a range of vehicles and equipment for industrial and recreational applications, including E-Z-Go golf carts, all-terrain vehicles, snowmobiles, and airport ground support equipment.

Bell – One of the world’s most recognized helicopter brands, the Bell unit sells products to the military and for commercial use. Bell had about $3bln in revenue last year in a global market sized at $56bln. Airbus SE, the industry leader, posted over $7bln in helicopter sales in 2022.

Textron’s Systems division produces a variety of electronic systems including weapons systems and other technologies. Textron’s eAviation division consists of Pipistrel, an electric aircraft builder, while the finance division provides financing solutions for purchasers of Textron products, primarily aircraft and helicopters.

Outlook

The near and medium-term trends look positive for Textron, largely due to an expected rebound in demand for aircraft, accompanied by a robust backlog – especially with respect to private planes. The near-term outlook is buttressed by the fact Textron finished 2022 with a backlog of $6.4 billion overall, up almost 60% from prior year.

Citibank analyst Jason Gursky in new research coverage earlier this month said they are bullish because of “increased adoption of private travel post-pandemic and tight supply throughout the industry that has stretched lead times to more than two years.”

Confirming this sentiment are studies published by market research firms, Reportlinker, Industry Research, and Precision Business Insights, who project the aerospace and plane manufacturing industries to grow by 6% to 9% from 2023 to 2027.

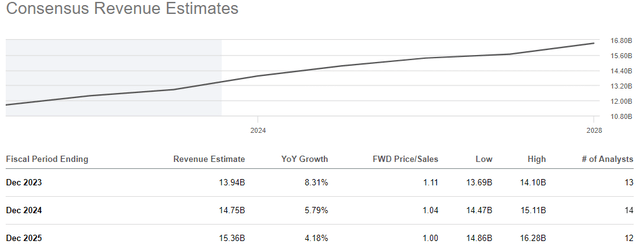

Analyst consensus estimates have Textron sales growing by 8.3%, 5.8%, and 4.2%, respectively, in the next three years, rising to $15.36 billion by 2025.

Textron Revenue Estimates (Seeking Alpha)

Performance

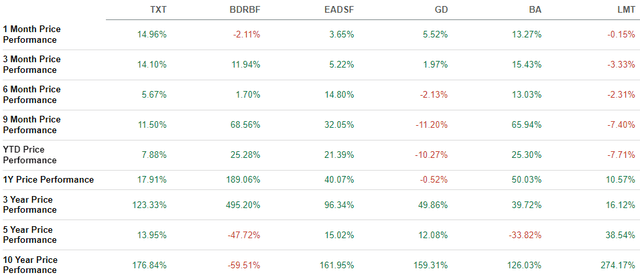

Textron’s stock rose over 12% since the company announced beating the average EPS target last week. The stock is now up almost 15% over the past 30 days and 17% in twelve months. The sector and S&P 500 1-year price performance are both around 12-13%. Some top rivals, however, have performed much better in the past 12 months, including Bombardier (+190%) and Airbus (+40%).

Textron Price Performance vs. Peers (Seeking Alpha)

Q223 Non-GAAP EPS of $1.46 beat expectations by $0.26, while revenue of $3.4bln was up 8.6% year-over-year, and in line with consensus estimates. The company also reaffirmed full year manufacturing cash flow, before pension contributions, of $900mln to $1bln for 2023. In addition, Textron increased EPS guidance to a range of $5.20 to $5.30, up from $5.00 to $5.20.

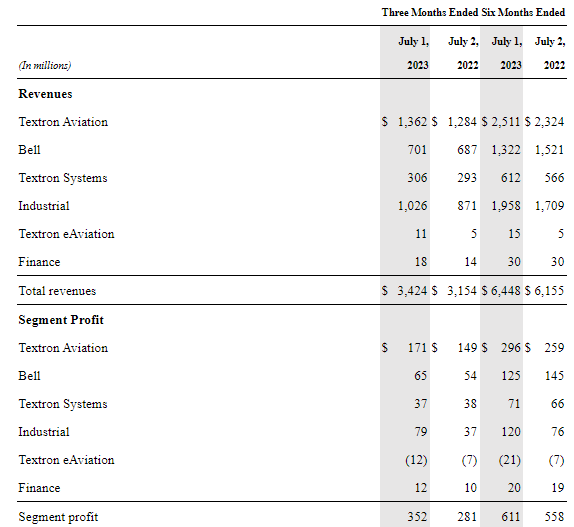

In the first six months of 2023, Aviation accounted for 39% of sales, Industrial 30%, and Bell 21%. Systems made up 9% of sales and Finance and eAviation combined represented 5 percent of revenue.

Textron Q223 Results by Segment (Q223 SEC Filing)

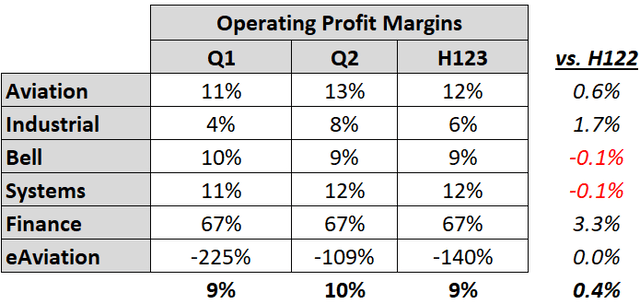

Textron recorded an operating profit margin of 10% in Q2, after recording 9% in Q1, and are tracking to hit 9% annual guidance target. According to company guidance, Textron is hoping the aviation business segment can finish the year at a 12-13% operating margin. Textron’s valuation hinges on operating margin more than any other factor. It is interesting to see the Industrial segment margin rise by 4% from Q1, finishing the first half of the year at a 6 percent average, up 1.7% from H122.

Textron Operating Profit Margins (Company Financials)

Valuation

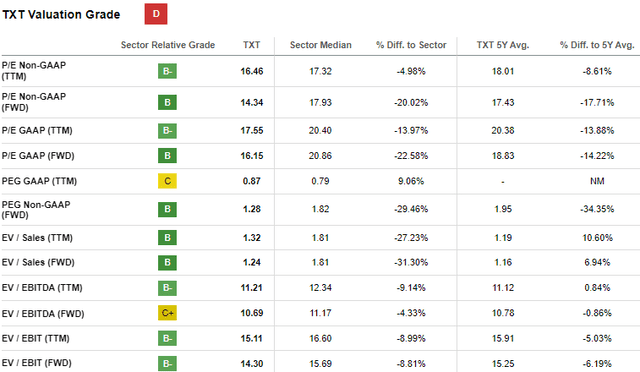

Frum a multiples perspective, the stock looks undervalued, trading at 17.5x earnings, almost 14 percent below the sector median and the company’s 5-year average. Textron’s EV/EBITDA and EV/EBIT ratios are both about 9% below the sector median.

Textron Valuation Grade (Seeking Alpha)

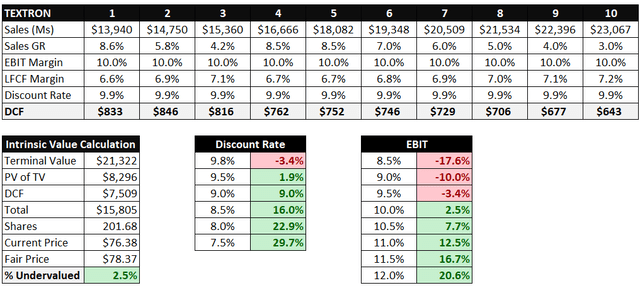

However, from an intrinsic value perspective, the stock looks fairly priced at $76.38/share, only 2.5% below my target price of $78.37. Below is a summary of assumptions behind key DCF model inputs.

Revenue – I plugged in analyst estimates for years 1-3 and used the industry research to come up with 8.5% for years 4 and 5. I then gradually lowered the figure to the long-term growth rate of the economy.

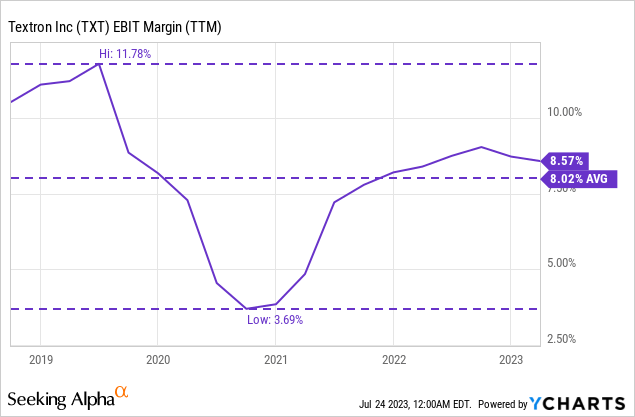

EBIT – Operating profit margin was the most decisive data point in the valuation, a figure I could not find myself able to push beyond 10% on average over ten years. The company was clear on 9% for year 1, while its five-year historical average is 8%, and the sector median is 9.7%. Not to mention the operating margins of the aforementioned two near peers were below 8%.

If one believes the operating margin used herein is too low, I’ve provided a sensitivity table that shows the stock would be undervalued by as much as 20% if you pushed the EBIT margin to as high as a 12 percent 10-year average.

Summary of DCF Analysis of Textron (MH Analytics)

Risks

Aviation Forecast – One risk is that my projections of EBIT margin might be overly optimistic, the potential downside of which is illustrated in the sensitivity table within the DCF analysis summary above. The assumption is based on growth in aviation revenue driving the sales mix toward more profitable products, thereby raising the blended EBIT margin. But if the demand in the aviation market does not meet expectations, the investor might be hurt by holding onto the stock too long.

U.S. Government Contracts – The company also faces risk by having more than 20% of its contracts with U.S. government agencies, given the funding of many programs relies on congressional appropriations which change from election to election. Plus, Textron in many cases is contractually obliged to continue to provide services even if the government is unable to make timely payments. Textron has said any long delays could have a material adverse effect on the company’s liquidity.

Supply Chain/Labor Woes – Another risk is related to Textron’s struggle with supply chain and labor issues, which have hurt the bottom line. In the Q2 earnings call, the company said aviation segment profits could have been even higher, but were hindered by “unfavorable manufacturing performance largely related to supply chain and labor inefficiencies.” Textron vowed to continue to “fight” its way through the ongoing supply chain challenges through the course of the year.

Conclusion

Textron’s long-term prospects look bright with a robust order backlog and climbing demand for private planes and business jets. However, a DCF calculation reveals that the bright forecast may already be priced-in. The stock is still a long-term hold, in my opinion, however, given the ongoing momentum. In addition, the company is well-positioned to benefit if the private and business jet markets grow beyond current analyst and researcher estimates.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.