Summary:

- In this note, we shall analyze Walmart’s better-than-expected Q3 results.

- Furthermore, I will share my fair value and expected return estimates for Walmart.

- At ~22.5x forward P/E, I rate Walmart “Neutral” at $148.50 per share.

Justin Sullivan

Introduction

Despite a challenging macroeconomic environment (rising interest rates, persistent inflation, and softening consumer demand), Walmart (NYSE:WMT) reported a stunning set of numbers for Q3 FY2023 on 15th November 2022, with significant beats on both revenue ($152.8B vs. est. $146.8B) and earnings (adj. EPS: $1.50 vs. est. $1.32). Amid high inflation, consumer spending patterns are shifting away from consumer discretionary to food and consumables. On the one hand, this change is pressuring Walmart’s margins; however, on the other hand, Walmart’s value proposition is shining in this environment. According to its Q3 results, Walmart seems to be gaining market share as consumers (hurting from high prices) are trading down. Anecdotally, a Whole Foods shopper is now going to Walmart. The likelihood of a recession in 2023 is growing rapidly, and Walmart could continue to benefit from the trade-down trend among consumers. In this note, we will discuss Walmart’s Q3 earnings report.

Before we do that, I would like to share some background here. So, back in early August, I published a report comparing Walmart and Costco (COST): Walmart Vs. Costco Stock: Which Is The Better Buy?

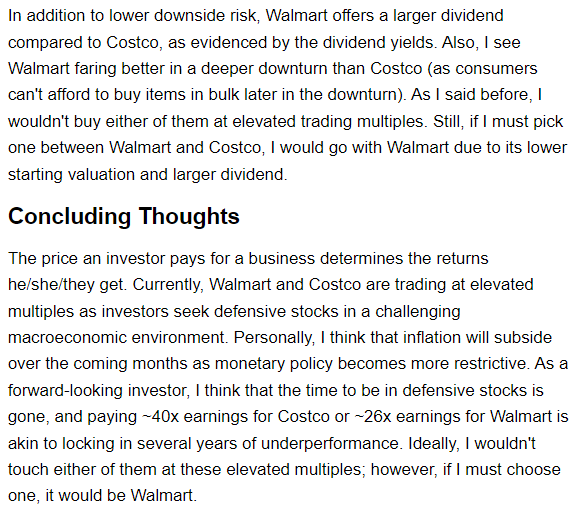

While I rated both Walmart and Costco as “Hold” in this report, I said that if I had to pick one, I would buy Walmart due to its lower valuation, larger dividend, and market positioning (recession beneficiary). Here’s an excerpt from my previous note:

Author (Walmart Vs. Costco Stock: Which Is The Better Buy?)

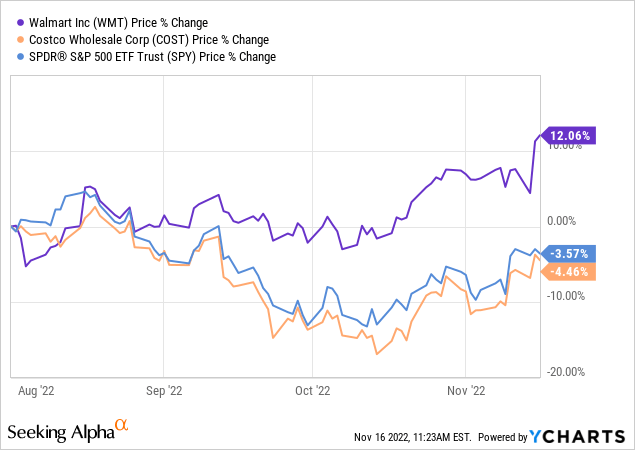

Since that call, Walmart is up ~12%, Costco is down ~4.5%, and S&P500 is down ~3.6%. Clearly, Walmart’s stock is doing quite well.

As an analyst, I like to test my investment ratings against stock outcomes, and Walmart is piquing my interest right now due to the significant outperformance I passed up on by rating Walmart a “hold” back in early August. Today, I will be analyzing Walmart’s latest quarterly report and re-evaluating its valuation to see if Walmart’s stock is a buy/sell/hold at current levels.

Analyzing Walmart’s Q3 Results: Did Walmart beat earnings expectations?

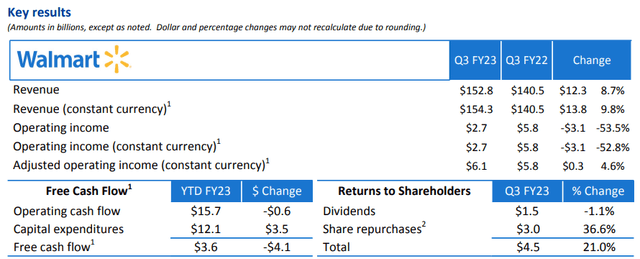

Heading into its Q3 FY2023 report, Walmart was projected to record sales growth of 3% y/y and an adj. EPS decline of 9-11% y/y. The actual results differed materially, and in relation to these estimates, Walmart had an absolutely stunning quarter. In Q3, Walmart’s revenue came in at $152.8B (up 8.7% y/y), and adj. EPS came in at $1.50 (up 3.4% y/y).

Walmart Q3 FY2023 Earning Release

Walmart Q3 FY2023 Earning Release

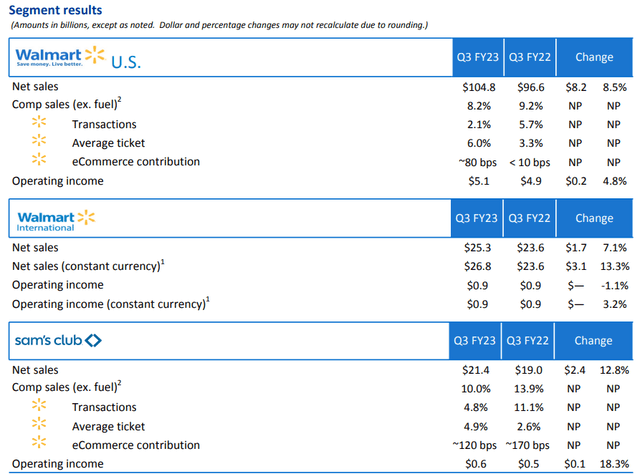

According to Walmart’s management, these strong results were powered by robust performance across all of its business segments – Walmart US, Walmart International, and Sam’s Club. Throughout this year, we have been facing high inflation across most goods, and aggressive monetary tightening is causing a softening in consumer demand.

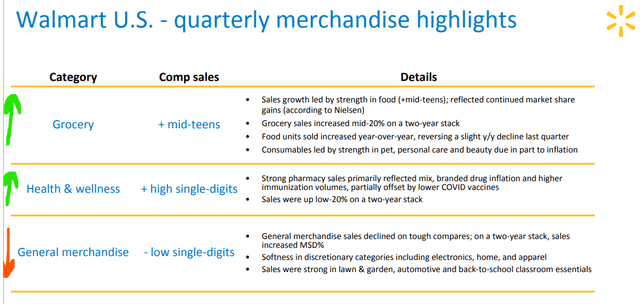

Walmart Q3 FY2023 Earnings Presentation

However, with food and consumables getting more expensive, consumers are cutting back on discretionary spending. As the leading grocery chain in the US, Walmart is a direct beneficiary of this change in consumer spending patterns. As noted by its management on the Q3 earnings call, more and more customers are choosing Walmart in this difficult economic environment. Walmart is winning market share, and its focus on everyday value is attracting consumers (even higher-income households – annual income >$100K). In a recession, consumers tend to trade down, and Walmart is obviously benefitting from this trend.

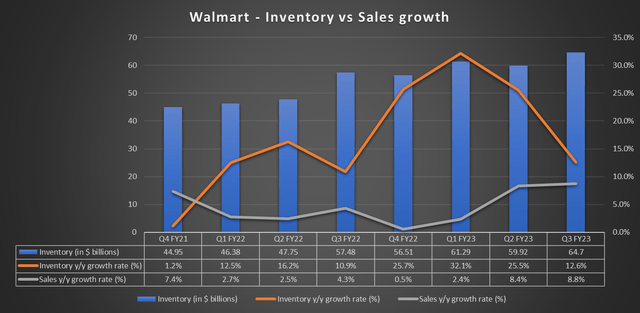

As you may know, Walmart has been facing margin compression due to excess inventory since the start of this year. According to Walmart’s management, they have made significant progress in right-sizing the inventory across categories and feel comfortable going into the holiday season. Remember, in previous quarters, Walmart’s management has been edgy about inventory and has discussed margin pressures due to the promotional environment.

Author

Heading into Q4 FY2023, Walmart is carrying an inventory of ~$64.7B, which is a record high. However, the alarming trend in inventory growth has been reversed, and in Q3, Walmart’s inventory growth of 12.6% represents a sharp deceleration from Q2 and Q1 growth rates. In my view, Walmart’s excess inventory issues are now firmly in the rearview mirror.

With inflation showing signs of cooling down (last week’s CPI and this week’s PPI prints were both lower-than-expected), Walmart may see stronger margins next year. While it is too early to declare a victory over inflation, the lag effect of the FED’s monetary policy actions makes me believe that inflation will collapse over the coming months. The real threat here is a recession (or stagflation), not inflation. In my opinion, Walmart’s value proposition shines during a period of an economic slump, and consumers should continue to flock to Walmart. The long-term focused evolution to a scaled omnichannel retail company is progressing well, as evidenced by strong growth in e-commerce (16% y/y) and global advertising (30%+ y/y) businesses.

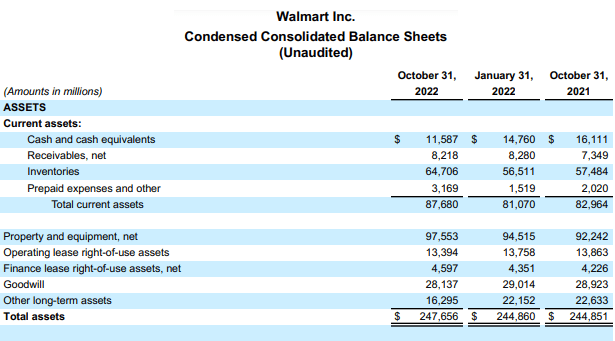

Before we look into Walmart’s guidance, I would like to share an update on Walmart’s financial health. In August, I highlighted that Walmart’s debt levels are rising, and its balance sheet is getting weaker. Well, that negative trend is still intact, as Walmart is returning more capital to its shareholders than it is producing at this moment in time. While YTD operating cash flows ($15.7B) are down only by $600M, Walmart’s increased capital expenditures are weighing heavily on free cash flows, which are down more than 50% in 2022.

Walmart Q3 FY2023 Earning Release Walmart Q3 FY2023 Earning Release

As you may have read, Walmart announced an additional $20B stock buyback authorization with its Q3 report. A big chunk of capital being returned to shareholders via dividends and share buybacks is being raised in the form of new debt, and with this new stock buyback program, I now expect that Walmart will need to raise an additional ~$10-15B in long-term debt. An increasing debt load is not an immediate cause for concern, but Walmart’s balance sheet leverage is growing, and the funds are being used to repurchase stock close to all-time highs. So far in 2022, Walmart’s book value has dropped by an astounding ~$10B, and if I were invested in Walmart, I would keep a keen eye on Walmart’s debt levels and capital return program.

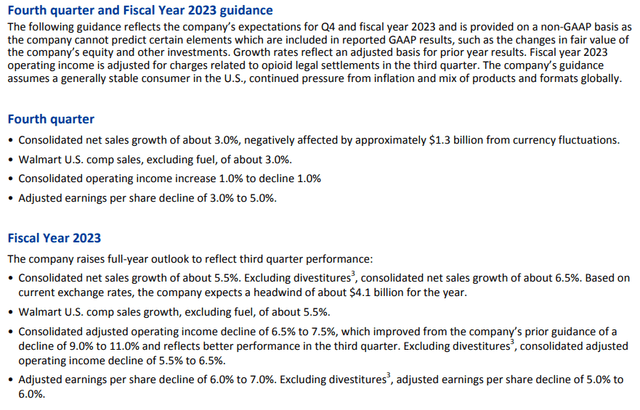

What is Walmart’s outlook?

Considering the strength of Q3 numbers, I would have expected Walmart’s management to raise guidance for Q4. However, Walmart’s management is still being very conservative due to macro uncertainty and chose to maintain the Q4 net sales guide at ~3% y/y. That said, Walmart’s management has raised the outlook for Q4 earnings and operating income, which is a big positive.

Walmart Q3 FY2023 Earning Release

With all of this information in mind, let’s try to find the fair value and expected return of Walmart.

What is the target price now for Walmart stock?

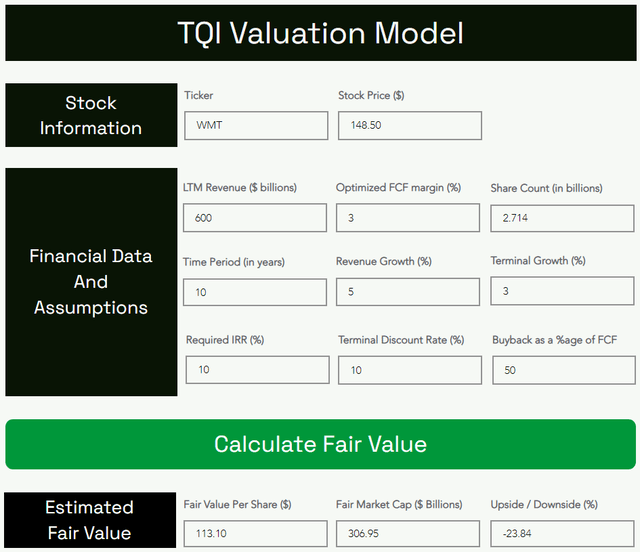

Walmart is rapidly evolving into a robust omnichannel retail outfit, and I expect to see mid-single-digit growth in its revenues from current levels throughout the next decade. While newer businesses like business advertising, e-commerce, Walmart+, and financial services will command higher margins than Walmart’s core business, I am embedding a margin of safety in my valuation by assigning an optimized FCF margin of just 3%. The remaining assumptions are fairly straightforward but let me know if you have any questions through the comments section below.

Assuming a discount rate (required IRR) of 10%, Walmart’s fair value is only $113 per share. Hence, I think it is pretty overvalued at this time. The market has overcrowded the defensive stock trade amid rising fears of an impending recession, and Walmart is trading at a hefty premium, like most other high-quality defensive names.

TQI Valuation Model (Author’s website: https://TQIG.org) TQI Valuation Model (Author’s website: https://TQIG.org)

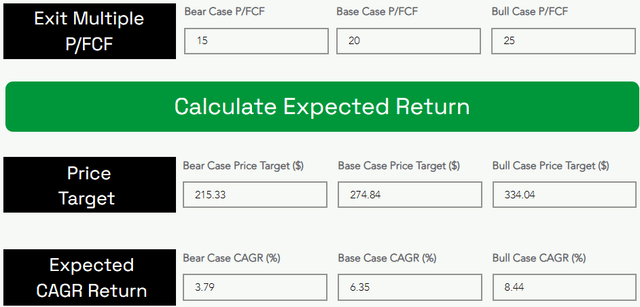

Over the next five years, an investor could expect to generate a 6.35% CAGR return from Walmart’s stock. If we add on the ~1.5% dividend yield, the total CAGR return rises to ~8%. Now, I think ~8% is an acceptable level of return for most investors looking to guard against a recession by putting capital to work in defensive stocks right now. Personally, I have a higher investment hurdle rate (15%), and Walmart clearly falls short of it. Hence, I am not a buyer here.

Final Thoughts

Walmart’s evolution to a scaled omnichannel retail company is progressing nicely, and the retail behemoth could get over its excess inventory troubles by the end of Q4. Heading into next year, Walmart’s management is taking a cautious view of consumer demand for goods as the probability of a recession is rising rapidly, and food inflation is proving to be sticky. While inflation may have peaked already, bringing prices down is going to be challenging (even for Walmart). And hence, consumer discretionary spending may remain under pressure. However, this is an environment where Walmart’s value proposition shines, as evidenced by strong Q3 FY2023 results, where I see clear benefits of trade-down from customers. In a recession, more and more people are going to shop at discount retailers like Walmart and Dollar General (DG).

The business cycle is turning, and a classic recession playbook would suggest owning defensive names like Walmart. Considering Walmart’s strong Q3 numbers and improving business fundamentals, I continue to see it as one of the best defensive stocks in the market. However, so does the market! Walmart is now trading at ~22.5x forward PE, which is a premium to S&P500, and with mid-single-digit sales growth, it is hard to justify a long-term investment (5+ years) in Walmart at the current valuation.

As an investor, I like to look at businesses (and stocks) 3-5 years out, and macro is unlikely to dominate the investment narrative as much as it is doing right now. For investors looking to defend against a potential recession in 2023, Walmart is a fine medium-term investment for the next 1-2 years. The expected return on such an investment is low-mid single digits, and personally, I would just rather buy the 2-yr treasury bond (yield: ~4.5%).

Walmart’s Q3 results turned out to be far better than expected, or, I should say, less worse than feared. However, the risk/reward for long-term investors is not favorable. Hence, I continue to rate Walmart “Neutral” at current levels.

Key Takeaway: I rate Walmart “Neutral” at $148.50

Thanks for reading, and happy investing. Please share your thoughts, questions, or concerns in the comments section below.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Are you looking to upgrade your investing operations?

Your investing journey is unique, and so are your investment goals and risk tolerance levels. This is precisely why we designed our marketplace service – "The Quantamental Investor" – to help you build a robust investing operation that can fulfill (and exceed) your long-term financial goals.

TQI’s core idea is to generate wealth sustainably through tailored portfolio strategies that meet investor needs across different investor lifecycle stages. Each of our five model portfolios comes with thoroughly vetted investment ideas, embedded risk management, and specialized financial engineering for alpha generation.