Summary:

- Recently, Alphabet (hereafter referred to as “Google”) stock dipped 2.5% on a day when the NASDAQ-100 fell a mere 0.18%.

- GOOG most likely tumbled because of news that the Department of Justice (“DOJ”) was suing the company.

- The lawsuit will attempt to get Google to unwind part of its advertising business.

- The DOJ has a poor track record with anti-trust lawsuits seeking to break up companies.

- A large settlement is possible, but Google will likely remain intact as a business after the dust settles.

Justin Sullivan

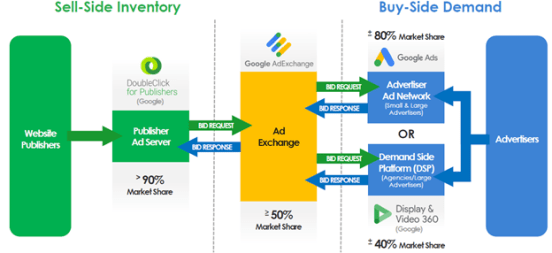

On Wednesday, Google (NASDAQ:GOOG) slipped 2.5%, when the NASDAQ-100 only fell 0.18% on the same day. The stock’s move coincided with news that the Department of Justice (“DOJ”) was suing the company for anti-competitive practices, specifically in its advertising business. According to the DOJ, Google has a market share of up to 90% in some parts of its ad-tech business. This in itself does not constitute anti-competitive behavior, but the DOJ thinks it has evidence that, when combined with Google’s large market share, makes a strong case for anti-trust violations.

Google’s market shares as alleged by the DOJ (The Department of Justice)

It seems likely that the DOJ’s lawsuit was the cause of Google’s selloff on Wednesday. There was no other material news from the company at that time, and the company’s earnings are still almost a week away.

There are some legitimate reasons for Google shareholders to worry about the company being sued. Sometimes, these lawsuits can be quite costly to tech companies. For example, Google recently got sued for $4 billion and lost its appeal-it will quite likely be forced to pay the amount out. There are countless examples of Google and other big tech companies being sued for large amounts of money, sometimes successfully.

However, the big thing with the Google lawsuit is that it’s seeking much more than a mere monetary reward: it wants to unwind part of Google’s business. The complaint does list “damages pursuant to 15 USC section 15a,” which presumably means damages similar to ones Google has taken in the past. However, the more threatening part of the complaint is the request to unwind the entire Google Ad Manager suite, including both DFP and AdX. These businesses are crucial components of Google’s ad business, and the loss of them would cut in on the company’s economic moat.

As far as monetary compensation goes, investors may need to accept that there’ll be a payout in the future. It won’t be any time soon-the DOJ’s 2020 lawsuit isn’t going to trial until 2023-but it might happen eventually. If you’re uncomfortable with a $5 billion settlement in a few years’ time, then maybe GOOG isn’t the stock for you. On the other hand, the attempt to force Google to unwind its ad businesses shouldn’t deter anybody from investing in GOOG. As I will demonstrate shortly, the DOJ has a very poor track record when it comes to breaking up businesses. It may force Google to pay out some money, but its attempt to break up the ad business looks unlikely to succeed. For this reason, I remain bullish on the stock, despite the various headwinds it faces.

What Google is Being Accused Of

Because this article deals with a specific risk to Google’s business, it helps to understand that risk in detail. So, we need to look at the accusations being made about Google, as these accusations are related to the risk. Also, because the accusations have to do with the claim that Google is a monopoly, understanding that claim will also help us understand Google’s competitive position.

According to the DOJ, Google is involved in the following anti-competitive activities:

-

Acquiring competitors to consolidate market share.

-

Forcing publishers to adopt its advertising tools.

-

Impeding auction competition.

-

Manipulating auctions.

The first of these practices is pretty easy to understand. Google has bought many ad platforms over the years, most notably YouTube. This has resulted in Google gaining market share, but it has not given it control of the entire market-Google’s share has been estimated at 29%. Large, but no majority.

The three following points are interrelated. Basically, the DOJ is saying that Google forces publishers to use its ad platform by giving publishers that use non-Google platforms lower bids. This sounds similar to what Alibaba (BABA) was accused of doing with its “choose one of two” policy, which the Chinese government ended up banning. The lawyers at Lexology agree with the complaint, saying that Google does give publishers lower bids if they work with other ad networks.

How do these claims hold up?

Well, Google’s overall advertising market share isn’t as high as the complaint would have you believe. Most online statistics platforms estimate it as being somewhere between 25% and 30%, the 29% I cited above being one example.

The claim about Google Ads having an 80% market share doesn’t look credible. In this space, Google is up against Meta Platforms (META), Amazon (AMZN), Microsoft’s (MSFT) LinkedIn, and Twitter. Meta’s ad revenue (around $100 billion per year) is about half of Google’s (a little over $200 billion), how could Google control 80% of a market where just one competitor makes about half of its revenue? If the digital ad space was only Meta and Google, then Google would have a 66% share, and Meta would have 34%. That’s already a lot less than 80% for Google. However, we also need to consider the other companies listed above: once you take them into account, it becomes a major stretch to say that Google’s ad market share is over 50%.

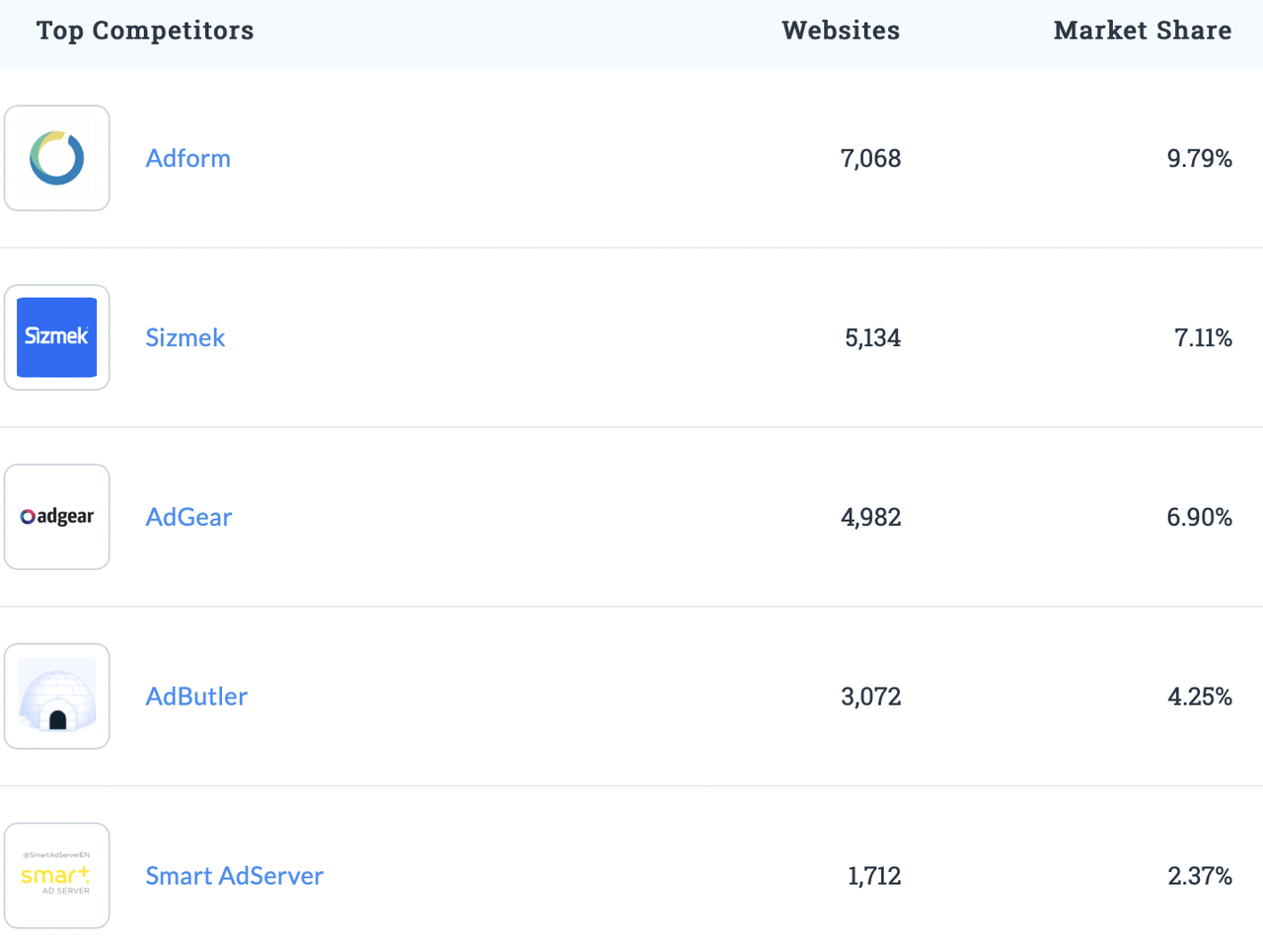

The claim about Doubleclick having a majority market share in publisher ad servers is more plausible. The independent third party platform Datanyze claims that it has a 56.25% market share. That’s lower than the DOJ’s estimate but nevertheless a majority share. The claim is corroborated by looking at a list of Google’s competitors in the space-these definitely are not household names:

Google doubleclick market share (Datanyze)

As the above data shows, Google’s ad market share is not as high as the DOJ claims it is. However, there are segments of the market where Google’s share is above 50%. It’s possible, then, that the DOJ could force Google to unwind small portions of its ad business, but most components should remain intact. It’s also worth noting that lawsuits alleging similar things about other tech companies haven’t had a great track record. For example, in the 1990s, the Federal Trade Commission (“FTC”) sued Microsoft, alleging that it had violated the Sherman Antitrust Act. The FTC initially won on a few of its claims, but parts of the lawsuit were eventually overturned by the D.C. Court of Appeals. Microsoft was not broken up.

Valuation

Having looked at Google’s biggest current risk and its competitive position, we can now turn to its valuation. Whatever you think of the DOJ’s claim that Google is a “monopoly,” the officials at the Department certainly aren’t saying anything controversial when they claim that the company enjoys high market share. Some of the market share figures they throw out are a bit of a stretch, but basically they’re correct that Google is dominant in its market.

So, what’s the valuation of this market-dominant company?

According to Seeking Alpha Quant, Google trades at:

-

19.7 times earnings.

-

4.55 times sales.

-

5 times book value.

-

13.6 times operating cash flow.

These are pretty modest multiples by big tech standards. In fact, the earnings and operating cash flow multiples are below those of the S&P 500! They’re also lower than those of Apple (AAPL) and Microsoft.

We can also value Google using discounted cash flows. A full discounted cash flow model, complete with a modelled cash flow statement, would be a bit of a “reach” here. Given the lawsuit and other risks, it’s hard to say where revenue and earnings will fall in the future-legal settlements create cash outflows. However, we could figure conservatively and simply discount the company’s $4.76 in free cash flow per share with no growth assumptions. The results of that calculation are:

-

At the current 10-year treasury yield (3.5%) with no risk premium: $136.

-

With a 4% risk premium added to the treasury yield: $62.63.

The average of these is about $99, suggesting that Google is about fairly valued under no growth assumptions. This in itself doesn’t make the stock a buy, but remember that the company recently reduced its costs. We may see a return to positive free cash flow growth in the next 12 months.

The Bottom Line

The bottom line on the DOJ’s Google lawsuit is that it just confirms what bulls have always said about the stock:

That it’s a rock solid tech company with a dominant market position, that deserves a premium price. The whole reason the DOJ is upset at Google is because it’s the dominant player in its industry, and they’re right about that. However, Google today does not have the premium price tag you’d associate with a dominant player; it’s actually one of the cheaper big tech names out there. So, it looks like a bargain.

As for the lawsuit itself: obviously, a multiple billion dollar monetary settlement will sting. However, the actual outcome of this lawsuit is still years away, and as far as “breaking up the company” goes, the DOJ is only seeking to unwind a small part of the ad business. Most of Google’s business will remain intact in a worst case scenario.

So, I’m content to keep holding Google. Sure, there are risks to the bullish thesis on the stock-legal risk, in particular. But there is a great opportunity as well. I’m buying the DOJ lawsuit, and I’ll probably be buying if the stock dips after earnings, too.

Disclosure: I/we have a beneficial long position in the shares of GOOG, META, AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.