Summary:

- We believe that Comcast’s tepid broadband net adds put pressure on the stock. Fixed wireless, with its aggressive pricing, took the net adds share. Fiber overbuilders also intensify the competition.

- Comcast’s spectrum split and DOCSIS 4.0 upgrades can help the company compete with FWA and fiber overbuilders in network performance and marketing claims.

- Further, affordable mobile plans, which we see as a unique value proposition for internet, should remain a growth engine. Millions of Xfinity internet users have not yet subscribed to mobile.

- After a 35% rally, the stock has an upside but does not provide a comfortable margin of safety. Still, Comcast consistently generates massive cash flows with relatively stable debt level.

- Risks remain if customers still see cheap internet prices as a top priority, and MNOs start being more aggressive in their mobile plans, which can slow down Comcast’s efforts to acquire new mobile subscribers.

hapabapa

Investment Thesis

Although we see short-term challenges, we believe Comcast (NASDAQ:CMCSA) can better compete with fiber and FWA with its network upgrades. Further, mobile has ample room for growth, as millions of Xfinity internet users have not yet subscribed to the mobile plan. While Comcast’s multiple is trading at a discount, we do not see any significant deterioration in fundamentals, as the company is generating massive cash and maintaining its debt levels. Nevertheless, after a 35% rally, the stock does not offer a comfortable margin of safety to serve as a cushion if our thesis turns out to be wrong.

What Moved the Stock?

Comcast is one of the largest broadcastings and cable companies worldwide, operating five business segments: cable; media; studios; and theme parks, part of NBCUniversal; and Sky, a British media and telecommunication company acquired in 2018.

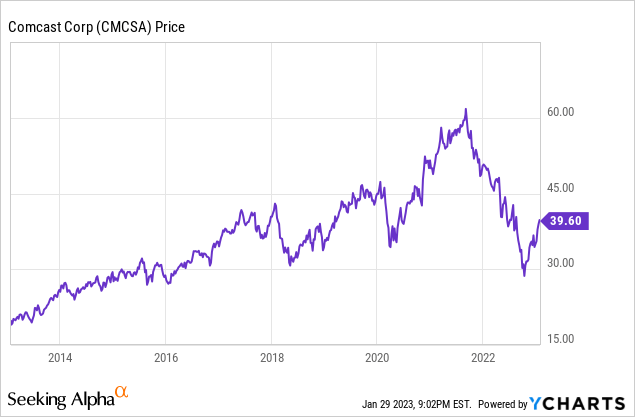

Nevertheless, the stock fell from $60 per share to less than $30 per share. The stock bottomed up and has rallied by more than 35%. What moved the stock? Further, is there any buying opportunity for investors?

While Comcast is a diversified business, about 80% of its adjusted EBITDA come from its cable communication segment, which is also the company’s “cash-cow business”–generating ~$20 billion of net cash flows (adjusted EBITDA less Capex) annually. We believe that intense competition in the cable sector has put pressure on the stock.

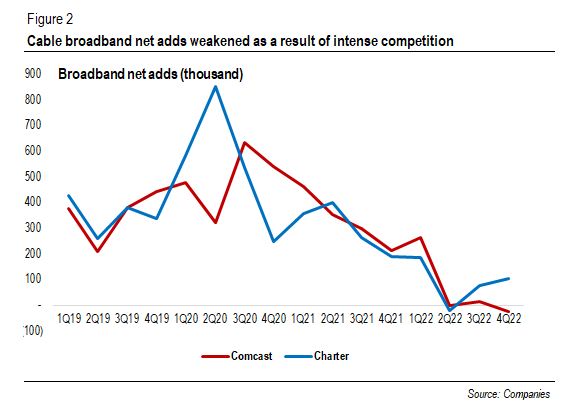

Comcast, under Xfinity brand, saw its broadband net adds slowdown in the last few quarters. The company booked 26,000 net losses in 4Q22. The figure would have been 4,000 net adds if the company had excluded the impact of Hurricane Ian in Southwest Florida.

Nevertheless, the management had not seen this coming before, as it said during the 2Q21 earnings call:

Based on our first half results, combined with the strength we’re seeing in current trends, we now expect total broadband net additions for 2021 to increase mid-teens relative to 2019.

Yet, Comcast reported 1.3 million broadband net adds in 2021, a 6% decline compared to 1.4 million net adds in 2019. We believe that FWA and fiber have intensified the competition.

Cable’s broadband net adds (Companies)

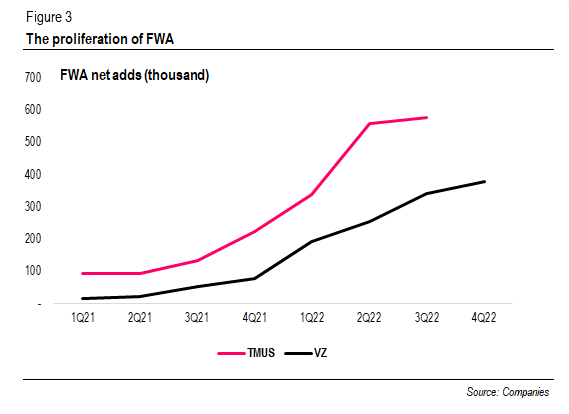

First, fixed-wireless access (FWA), well-known as the success story of 5G in the US, proliferates and has not yet shown any signs of abating. Verizon (NYSE:VZ) reported 379,000 FWA net adds in 4Q22, while T-Mobile (NASDAQ:TMUS) is scheduled to release its 4Q22 results this week, although preliminary results suggest another strong quarter.

Through its report dedicated to FWA, T-Mobile noted that “lower price” and “no annual contract obligation” were the two top reasons why customers switched, with more than half of its 2 million customers coming from cable. Indeed, the company offers only $50/month for its Home Internet with AutoPay while at the same time boasting its “price lock guarantee.” Meanwhile, Comcast recently raised prices by 3.8%, on average, just a year after another price hike.

FWA’s net adds (Companies)

The question is whether the FWA growth story will remain intact, at least in the foreseeable future. We believe it is still the case, as capacity is not an issue. But things might be different as customers increasingly demand faster speed, higher reliability, and lower latency. Research by Opensignal suggests that while FWA went toe-to-toe with fixed wireline at quiet times, FWA’s Broadband Consistent Quality score varies more significantly during busy times.

In addition, AT&T (NYSE:T) CEO John Stankey spoke during the 4Q22 earnings call that the company recognized fixed wireless as “a tool in the toolbox” to deal with “opportunities in areas that are less densely populated.” We believe that FWA will have long-term opportunities in rural areas where cable and fiber are unavailable. But for now, we believe that it will still be putting pressures on cable.

Second, the competition with fiber has been going on for years. AT&T’s management noted during the 4Q22 earnings call that the company had acquired more than 1 million net adds for the fifth straight year. Smaller cable companies, such as Altice USA (NYSE:ATUS), joined the bandwagon. Charter’s (NASDAQ:CHTR) management said last week that the company saw “a slightly higher pace of fiber overbuilds recently.”

With competition intensifying, what will cable operators do to be more competitive? Tests conducted by Speedtest Intelligence showed that cable operators significantly trailed AT&T and Verizon in upload speed. It makes sense because cable’s hybrid coaxial cable (HFC) network is initially designed to be asymmetrical. As a result, cable operators are to undergo a next-gen HFC evolution through DOCSIS 4.0, which supports up to 10 Gbps downstream capacity and up to 6 Gbps upstream capacity–enabling cable operators to deliver multi-gig, more symmetrical offerings.

To chase DOCSIS 4.0, operators must go to either one of the two paths: Full Duplex DOCSIS (FDX) or Extended Spectrum (ESD). In short, FDX utilizes the existing 1.2 GHz spectrum allocation but traditionally requires a node+0 architecture. On the other hand, the ESD path stipulates operators change actives, passives, and DOCSIS equipment that support up to 1.8 GHz. Comcast is pursuing the former, while Charter is going for the latter.

According to John Chapman, Cisco’s (NASDAQ:CSCO) CTO of Broadband Technology, the FDX in a node+2 setup will likely be more expensive because of the amplifier issue. On the contrary, the ESD will be required to “rebuild an operator’s CTMS footprint” in a distributed model, which will “slow down the ESD camp.” In other words, operators are facing a trade-off between costs and time.

Elad Nafshi, Comcast’s Cable EVP and Chief Network Officer, confirmed that the mid-split upgrade and a full-network upgrade to DOCSIS 4.0 under the FDX option cost about $200 per home passed after recent tests that utilized six amplifiers (node+6), which is “inclusive of the vast majority of the Comcast network,” rather than an expensive node+0 setup. In comparison, Charter will spend $100 per home passed, not including the DOCSIS 4.0 CPE, over the next three years. Yet, Comcast expects to start rolling DOCSIS 4.0 out “at the back end of this year,” while Charter will deploy remote PHY devices or RPD and introduce vCMTS in early 2024, a prerequisite for its DOCSIS 4.0 deployment.

We believe those network upgrades will put cable operators in a better position to compete with fiber overbuilders. One may ask whether a symmetrical offering is needed since data consumption is still highly asymmetric (less than 10% of upstream consumption). First, we believe upstream demanding applications, such as video conferencing, will gain traction in the future. Second, symmetrical offerings will allow cable operators to compete in marketing claims rather than “any real product demand,” at least as things stand.

As Charter’s management said:

It’s our view right now that the upstream demand today is much more of a marketing campaign as opposed to any real product demand. And we want to lead in those marketing claims, which is why we’re doing what we’re doing. We also have from a marketing claims perspective from a symmetrical that what we’ll be deploying here allows a fiber drop in the — as a remote OLT inside of the node. So that gives us marketing claims across the entire footprint for 25 symmetrical and over time, 50 or 100-gig symmetrical.

Looking forward, we believe that Comcast might see pressures on broadband net adds, as FWA will still proliferate at least in the near term. However, cable operators can better compete with their competitors with their network upgrades, such as spectrum split and DOCSIS 4.0. As we believe FWA’s long-term opportunities will be in rural areas, where cable and fiber are unavailable, the real competition comes from fiber overbuilders. Therefore, how do cable operators differentiate themselves from other players?

Mobile Remains Cable’s Growth Story

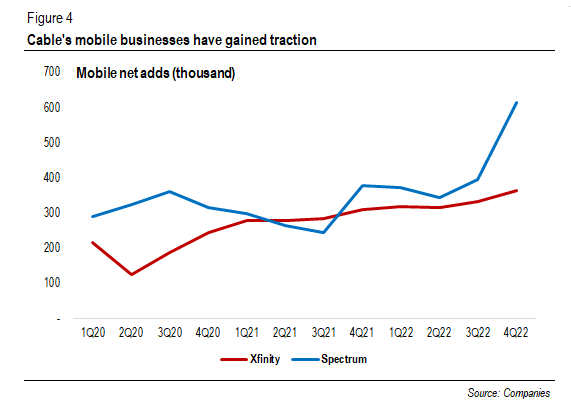

Cable’s mobile businesses have gained traction with aggressive pricing. Comcast, under the Xfinity brand, recorded 365,000 net adds in 4Q22, and Charter’s Spectrum, thanks to its recently launched Spectrum One, booked 615,000 net adds.

In our view, cable’s mobile business serves as a growth driver and a unique value proposition for its internet business. Take, for example, Spectrum One. Customers can get internet access, advanced Wi-Fi, and a single mobile line for only $49.99/month. Being more aggressive, Spectrum introduced an unlimited plan for $29.99 per line as opposed to the usual bundled plan for at least two lines.

As Comcast’s management said during the latest earnings call:

So the mobile game plan is really to support broadband. We do see continued positive results. When you package the broadband with mobile, there is a churn benefit to that. And so we’ll continue to really — that’s our — part of our core strategy is to do that.

Most cable’s mobile subscribers are also their internet subscribers since mobile is an add-on. However, Ookla found that more than 20% of the big three mobile network operators’ subscriber base accessed Xfinity’s fixed-broadband service. In other words, millions of Xfinity’s fixed-broadband customers not yet subscribed to the mobile plan present a massive opportunity for Comcast. We believe that mobile remains cable’s growth engine as customers look cheaper options.

Cable’s mobile net adds (thousand) (Companies)

Valuation

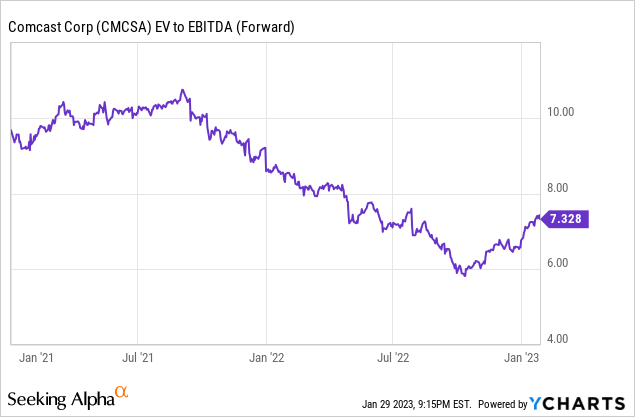

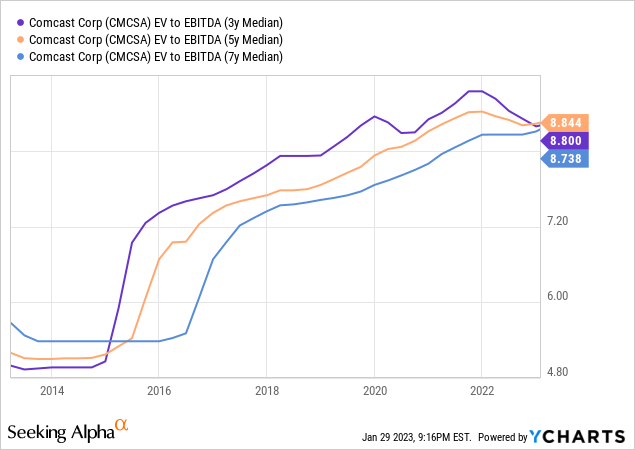

Comcast is trading at 7.3 of its forward EBITDA, lower than its medium-term median of the multiple (16%-17% discount). Data from Seeking Alpha also suggest that the stock is trading at a 17% discount relative to the sector.

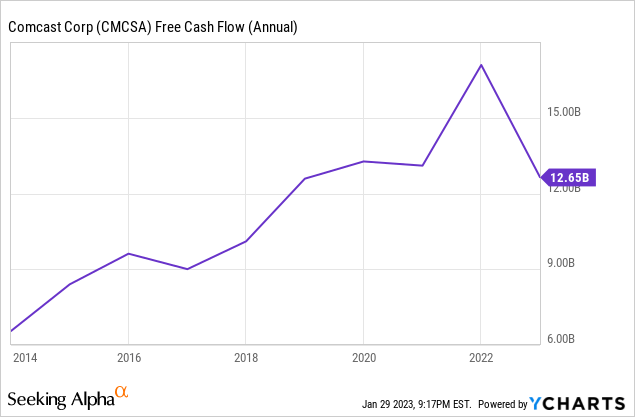

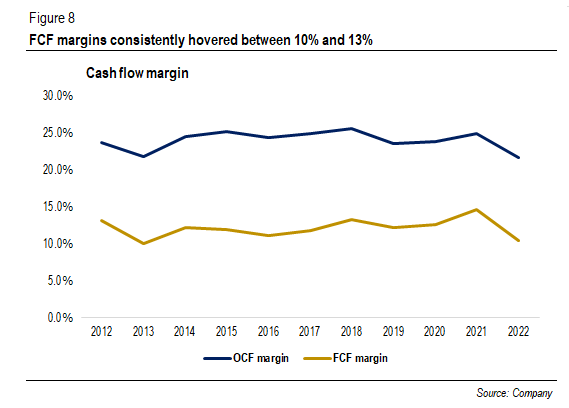

Nevertheless, are Comcast’s fundamentals worse than three to five years ago? First, we like Comcast’s ability to grow its free cash flows (4%+ annually in the last ten years). Further, the company’s free cash flow margins consistently hovered between 10%-13%.

Indeed, we note a cash flow deterioration last year partially due to rising working capital from investment in content post-COVID. But it is likely a one-time increase since the management had foreseen this beforehand and expected the number to be down from the 2022 level.

Cash flow margins (%) (Company)

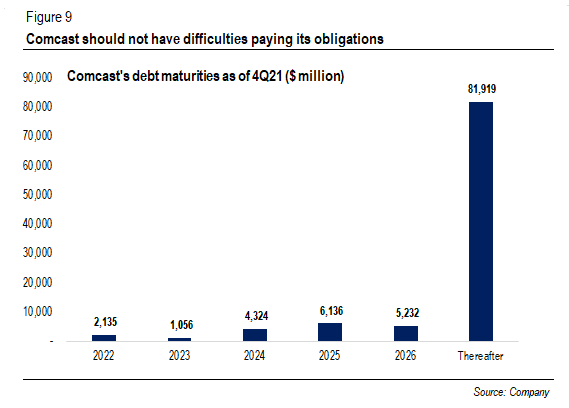

Second, Comcast had $94.8 billion in debt in 2022, while cash and cash equivalents were only $4.7 billion. While the amount of debt seems massive, the company’s net debt to EBITDA was about 2.5x, much lower than Charter, which had $97 billion net debt but only generated $21 billion EBITDA. With an average free cash flow of ~$13 billion annually, Comcast should not have difficulties paying its obligations ($4-6 billion) and dividends (~$5 billion).

Comcast’s debt maturities as of 4Q21 ($ million) (Company)

Hence, while we believe that the competition between fiber and FWA will likely intensify in the foreseeable future, we do not think that Comcast’s fundamentals have significantly deteriorated. Comcast remains a cash-generating company, and its debt level is relatively stable for years.

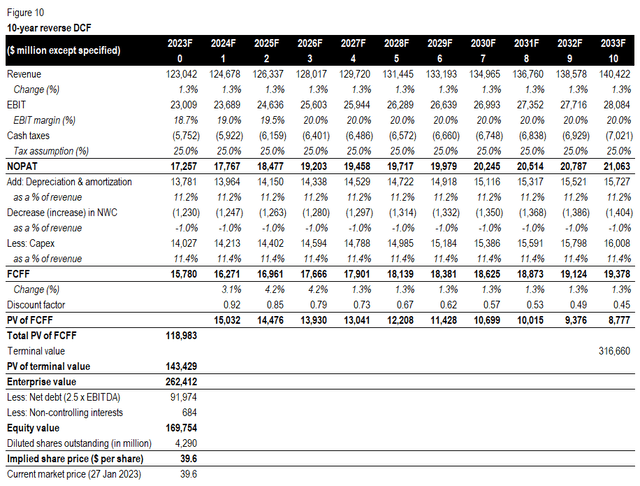

According to our 10-year reverse DCF model (8.2% WACC and 2% FCF growth in perpetuity), the market is anticipating a 1.3% top-line growth, which we believe is conservative against a three-year historical average of 3.7% (Y/Y). Assuming a 2.5% revenue growth, we arrive at an estimated fair value price of $46 per share (16% upside), implying 7.8x forward EV/EBITDA.

Our 10-year reverse DCF model (Vektor Research)

Yet, we classify a stock a bargain if the estimated fair value is lower than the market price after we forecast conservatively and apply a margin of safety. After a 35% rally, the stock still has an upside but lacks a comfortable margin of safety to serve as a cushion if our thesis turns out to be wrong. Shares are attractive at $34 per share (25% margin of safety), in our view.

Investment Risks

The cheaper option remains a top priority. We believe network upgrades will allow Comcast to compete with FWA and fiber overbuilders. While a more symmetrical offering can cater to the growing upstream demand, it is more like marketing claims, as things stand. But what if customers do not care, as they still want cheaper options?

Aggressive pricing by MNOs. While we believe that an affordable mobile plan is cable’s unique value proposition, MNOs are getting more aggressive in pricing. For example, Verizon introduced Welcome Unlimited, a 5G entry-level plan, for just $25 per line for four lines. A more aggressive approach could slowdown Comcast’s efforts to attract internet users not yet subscribed to mobile.

Conclusion

All in all, we believe that Comcast is still facing short-term challenges from fiber and FWA. Network upgrades can help Comcast compete with other players in terms of network performance and in marketing claims. Further, we like Comcast’s mobile business, as demonstrated by more than 300,000 net adds per quarter.

The market is still valuing Comcast below its long-term average. However, we do not think that the company’s fundamentals are significantly worse than before. Moreover, please note that Comcast is a diversified company, and mobile is not the only Comcast’s growth story. For example, the two-year-old Peacock, an advertising-based video-on-demand (AVOD) service having over 20 million paying subscribers, is losing money and is estimated to lose $3 billion this year. But the growth is incredible, with over 5 million new paid subscribers in 4Q22.

Lastly, we like Comcast’s ability to generate billions of cash (10-13% FCF margins), its relatively stable debt levels (2.5x net debt/EBITDA), and its decisions to repurchase its shares and raise dividends (2.9% yield). Still, we believe shares will be attractive at $34 per share. Therefore, we assign a HOLD call for Comcast. If you have any thoughts, please do not hesitate to comment below.

Disclosure: I/we have a beneficial long position in the shares of VZ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Research reports are written based on analyst(s) analysis and expectations, and the analyst(s) must include sources for external data included in the analysis. The research analyst is not responsible for any inaccuracy caused by human errors. Still, Vektor Research will make sure, with reasonable efforts, to reduce such mistakes as minimal as possible. Please note that the forecasts do not guarantee any future performance. Vektor Research, along with the analyst(s), is not responsible for any loss, expenses, and the reader’s decision-making, as we do not force readers to act towards any securities.