Summary:

- Companies with strong profitability tend to have more stable earnings and cash flows, which can make them more resilient to market volatility.

- This article focuses on stocks with a proven track record of profitability. High-quality stocks come in all shapes and sizes regardless of their market cap.

- As markets swing up and down, my three stock picks have endured the test of time and are on an uptrend.

- Boasting exceptional profitability metrics and incredible margins, my three stocks also have solid growth and great fundamentals.

- Inflation eats into revenues and bites into profits for most companies. Selecting stocks that offer strong quant grades, highlighted by excellent profitability and momentum, can prove to be a successful investment strategy despite market declines.

Dragon Claws

How to Pick Stocks Using Profitability

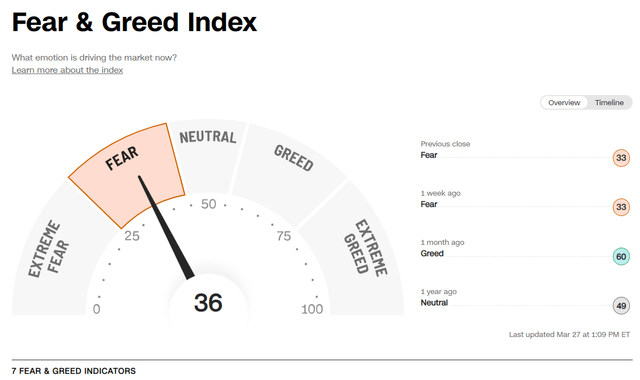

It has been a volatile year for the stock market that ended 2022 with the S&P 500 -19.95%, the Dow Jones -9.40%, and the Nasdaq -33.89%. In addition to the VIX spending 90% of its trading days above 20, a signal of high market volatility, the markets were optimistic about ringing in the new year. But wavering market sentiment continues to whipsaw between greed and fear, with fear as the driving emotion for today’s markets.

Fear & Greed Index (CNN Fear & Greed Index)

As investors’ fear thresholds are being tested, more volatility and a potential correction are in store on the heels of a banking crisis that “clipped the hawkish Fed’s wings” – a 25-basis point hike viewed by the markets as dovish. Where fear prevents some from looking for good investments, I see opportunity.

Stock picks based on profitability are typically characterized by good earnings growth and strong investment fundamentals. These types of investment characteristics lead to a company’s growth and increase in stock price, which benefits shareholders. Profitability is generally considered to be a good financial metric, as it provides valuable information about a company’s ability to generate profits and create value for its shareholders. There are several profitability metrics that investors use to evaluate companies, including gross profit margin, operating profit margin, net profit margin, and return on equity. The three stocks I’m recommending have tremendous profitability, and each of the aforementioned metrics is stellar for these stocks relative to their peers and sectors. Identifying stocks with these types of metrics can be crucial to a company’s success or demise during periods of volatility.

Companies can generate a lot of sales, but that does not necessarily mean they’re profitable. Examples include some of the popular pandemic stocks like Shopify (SHOP), Peloton (PTON), and Carvana (CVNA), which experienced a boom in sales but saw their stock prices go bust. None of these stocks experienced long-term, sustained periods of stock price appreciation because they were never profitable – spending more money on operations, marketing, and research and development at the expense of generating profits.

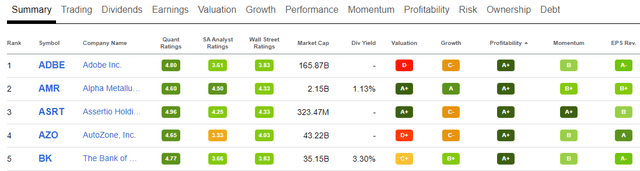

The stocks I recommend are well-rounded and rest collectively on stellar profits, strong growth, solid valuation frameworks, upward analysts’ earnings revisions, and superior long-term price momentum. With the Fed continuing to raise rates, inflation still on high, and an uncertain macroeconomic outlook, buying stocks with strong profitability offers a cushion in the event of a fall in price. Coupled with strong fundamentals that draw on excellent investment characteristics, I am highlighting three strong buy-rated stocks with A+ Profitability grades and solid fundamentals in varying sectors.

Top Stocks Quant-Ranked by Best Profitability Grades (as of market close 03/23/23)

Top Stocks Quant-Ranked by Best Profitability (SA Premium)

1. Adobe (NASDAQ:ADBE)

-

Market Capitalization: $171.95B

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 3/27): 32 out of 595

-

Quant Industry Ranking (as of 3/27): 10 out of 214

We’ve all heard the name and likely used the cloud-based document services platform Adobe Inc., shaping the business landscape. Adobe is “changing the world through digital experiences” with its subsidiaries by operating a diversified software company. With three segments: Digital Media, Digital Experience, and Publishing and Advertising, the Adobe brand has brought high-end printing and value-add to its products and services worldwide. Continuing to innovate, Adobe’s content creation never ceases to amaze. Its latest Firefly product brings a range of artistic creations through a family of creative generative Ai. This latest Ai-generated content will be able to move through automated workflows, moving between Creative Cloud and Digital Experience suites in the creation of marketing campaigns. This creation is one of the reasons Adobe maintains bullish momentum, and the stock is +11% YTD.

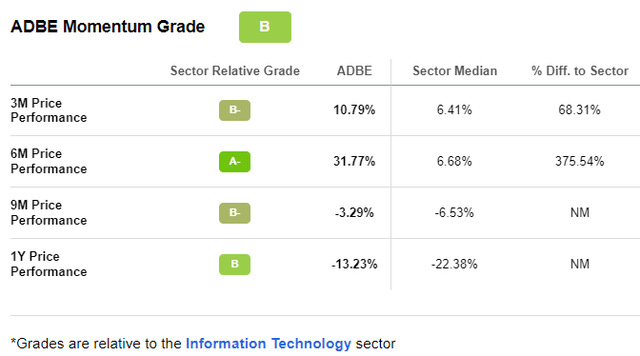

Adobe Inc. Valuation & Momentum

Adobe is bullish, with a higher 10- and 90-day average trading volume. Regarding the stock’s long-term price appreciation and quarterly price performance, it outperforms its sector median peers.

Adobe Stock Momentum Grade (SA Premium)

As investors actively purchase shares and drive the price higher, some analysts call the stock overbought as it is at a premium to the sector. Seeking Alpha’s overall valuation grade stands at ‘D,’ but the all-important PEG ratio is a C+. The ‘PEG ratio’ (price/earnings to growth ratio) is a valuation metric for determining the relative trade-off between the price of a stock, the earnings generated per share (EPS), and the company’s expected growth. Notably, the tech crash has brought down the price of many big-name companies, including Adobe. Adobe’s 52-week high is $473.49, and it’s now trading closer to its mid-range of $374/share. While prudence is needed if investing in Adobe at its current price point, as fellow Seeking Alpha Author Julian Lin points out how, many stock prices and valuations in the tech sector have been reset.

“This is a macro environment in which there is great uncertainty, but ADBE’s business model is showing resilience. ADBE is one of the most profitable names in the tech sector and is taking advantage of the lower stock prices through aggressive share repurchases. Trading at 22x forward earnings, the stock remains highly buyable for those looking for profitable secular growth.”

Delivering tremendous first-quarter earnings, Adobe shares experienced an uptick as renewed excitement about the stock highlights it as a strong buy.

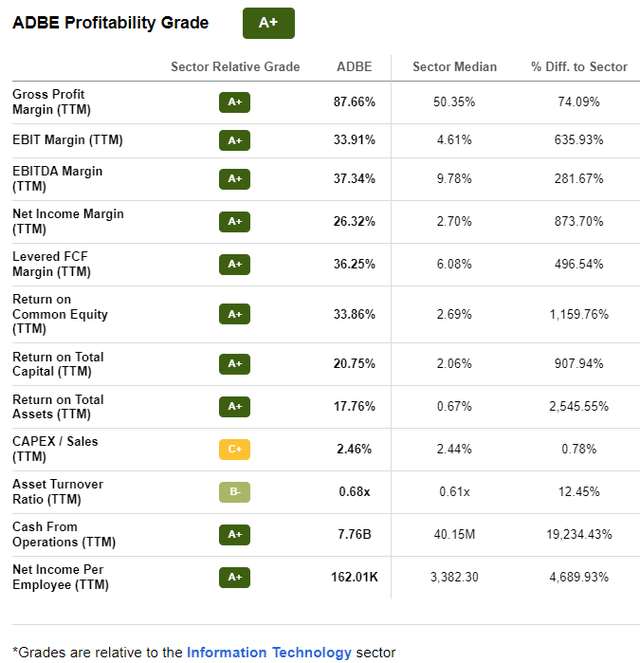

Adobe Stock Growth & Profitability

Beating top-and-bottom-line results, Adobe achieved 13% year-over-year growth, representing $4.66B in revenue. EPS of $3.80 beat by $0.12, and Adobe’s Creative Cloud set a new ARR record of $307M, with revenue of $2.76B.

Adobe Stock Profitability (SA Premium)

Strong top-of-funnel traffic has resulted in increased demand for creative cloud applications from various markets and customers around the globe. Adobe’s President of Digital Experience, Anil Chakravarthy, said it best:

“Today, digital is especially critical in enabling companies to drive profitable growth by delivering engaging and efficient customer experiences across the entire funnel, and Adobe is uniquely positioned to power experience-led growth…During the 2022 holiday season, e-commerce drove a record $211 billion with 38 days of $3-plus billion in daily spend according to the Adobe Digital Economy Index.”

Not only is Adobe’s digital experience benefitting from its increased penetration of the $110B market, but cross-selling activities have also allowed the firm to grow organically while drawing on new users in need of marketing software solutions. Adobe is driving growth and profitability through innovation and upselling, as highlighted by its strong earnings for Q1 2023, leading it to raise fiscal 2023 ARR and EPS targets.

With nearly $8B in cash and net income margins of +870% difference to the sector, Adobe’s A+ Profitability grade is well warranted. Significant opportunities for the future, strong earnings, and momentum showcase why investors make the stock a buy. Our quant ratings certainly rate this stock a Strong Buy, along with my next pick, which is quite the steel!

2. Alpha Metallurgical Resources, Inc. (NYSE:AMR)

-

Market Capitalization: $2.22B

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 3/27): 15 out of 276

-

Quant Industry Ranking (as of 3/27): 6 out of 27

Alpha Metallurgical Resources Inc. is an extremely discounted mining company with an extremely attractive risk-reward profile, capitalizing on the continued need for coal. Amid the war in Ukraine and the Eurozone having scrambled to reinstate coal plants, sustainable energy may take a backseat. And although coal prices have been volatile, AMR, the largest domestic metallurgical producer and exporter, stands to benefit from the surge, given the world’s dependence on it for heating power, coking coal blasts fuel for steel production, and many other uses.

“The geopolitical situation surrounding Ukraine poses significant long-term implications for the global steel industry. Among them are a possible readjustment in global trade flows, a shift in energy trade and its impact on energy transitions, and continued reconfiguration of global supply chains.” – World Steel Association

Having benefited from the demand in Europe, steel prices soared in 2021 by +16.5% and are forecast to grow more conservatively in 2023 by 2.2%. Where the masses have thought that coal is a dying industry, we’ve seen over the last few years that this couldn’t be further from the truth. AMR is focused on allocating capital to shareholders and is still trading at an extreme discount amid its uptrend.

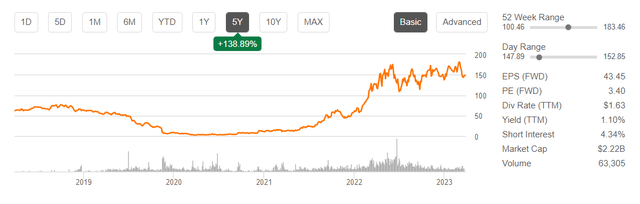

AMR 5-year Stock Performance

AMR 5-year Stock Performance (SA Premium)

AMR Stock Valuation & Momentum

As you can see from the chart above, AMR’s performance has been excellent, with bullish momentum that has allowed the stock to +138% over the last five years, and in June of last year, its one-year trading chart was +397%. With B+ momentum, AMR is outperforming its sector peers quarterly. With a nine-month price performance, a +9,000% difference to the sector, and strong tailwinds to support the stock, I hope this upward trend persists. Although the run-up in the stock price from the pandemic and War in Ukraine has started to see some moderating, AMR is still undervalued.

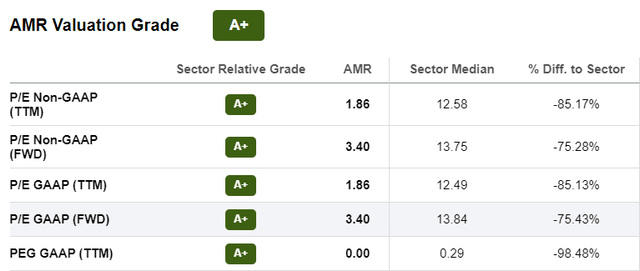

AMR Stock Valuation (SA Premium)

Forward P/E is at a 75% discount to the materials sector, and EV/EBITDA is at a 75% discount to its historical 5-Year average P/E. Given its strong performance over the last year and its momentum with short-term price as an excellent indicator of investor interest compared to the industry, AMR is one of the top picks.

AMR Stock Growth & Profitability

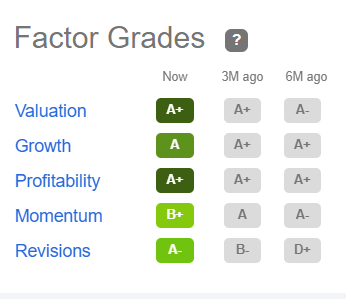

Operating in a high-demand environment that requires few supplies, AMR has pricing power, which has benefitted the company over the last few years amid surging prices and inflation. AMR’s strong cash flow and tremendous profits appeal to investors who want a fundamentally strong company. Seeking Alpha’s Factor grades rate investment characteristics on a sector-relative basis. As highlighted below, AMR’s grades in all categories indicate that this company has excellent potential and is fundamentally sound.

AMR Stock Factor Grades

AMR Stock Factor Grades (SA Premium)

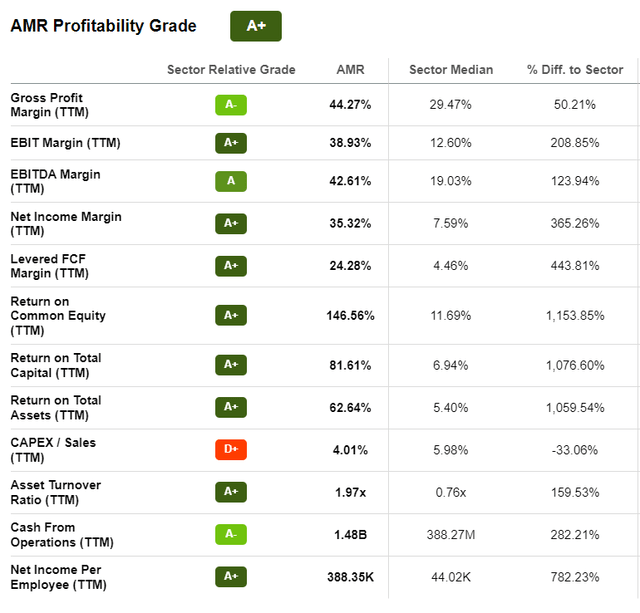

With an A+ Profitability grade, AMR’s underlying metrics are strong. With steady cash from operations and EBITDA Margins solid at 42.61%, as demand persists, we should see a rise in cash, which bodes well for the stock’s already bullish momentum. AMR’s financials have been consistently strong, despite a Q4 miss due to geological and transportation challenges. EPS of $13.37 missed by -$4.77, and revenue missed by -$56.62M. However, AMR’s record generation of adjusted EBITDA of $1.7B and $1.3B of free cash flow allowed it to pay off its term loan balance.

AMR Profitability Grade (SA Premium)

Further, by investing in its workforce through compensation and benefits, AMR returned ~$517M in buybacks and returned nearly $100M to shareholders through dividends. With a strong commitment to share repurchases, the AMR Board recently increased the share authorization by another $200M, up to $1.2B. Although commodities have had some volatile price swings, and given the pricing environment where indexes have moderated, which leaves less room to capture margin, AMR has actively managed and mitigated some of their risks, which is why this ‘Strong Buy-rated stock remains at the forefront of news surrounding coal. Although the current landscape is uncertain, consumer demand is there, and AMR, along with our next stock, ranks at the top of my list.

3. Assertio Holdings, Inc. (NASDAQ:ASRT)

-

Market Capitalization: $325.63M

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 3/27): 7 out of 1167

-

Quant Industry Ranking (as of 3/27): 3 out of 222

Small-cap pharma company Assertio Holdings is on a tear! I selected this stock last October, and it has surged +142% since the publication of 3 Small-Cap Pharma Stocks For a 2023 Melt-Up. A commercial pharmaceutical company focused on neurology, rheumatology, and pain treatments, the company’s business models keep winning for their patients, which results in a victory for the company. Assertio’s discounted price makes it very attractive, complemented by bullish momentum that leaves room for more upside. Let’s dive into the numbers.

Assertio Holdings Valuation & Momentum

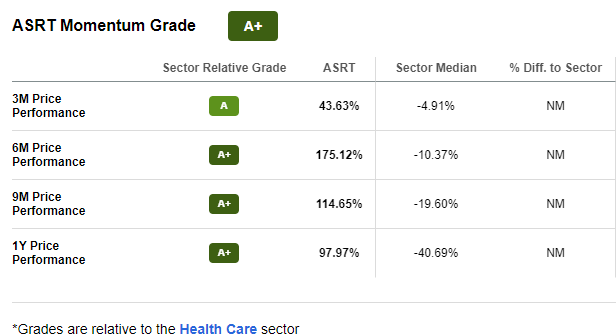

Assertio’s valuation and momentum grades are an A+. Highlighted by a one-year price increase of nearly 100% and a YTD increase of +44%, this stock is rising. Trading more than 88% below its peers, Assertio’s trailing P/E ratio is 2.88x, and its forward PEG of 0.65x, compared to the sector’s 1.98x, a -66.86% difference.

ASRT Momentum Grade (SA Premium)

Offering room for upside, ASRT’s bullish momentum is highlighted above. Outperforming the sector quarterly, shares of this stock are trading at higher prices as its 200-day moving average increases. After beating both top-and-bottom-line results, it’s no surprise I’ve added Assertio Holdings as a highly profitable company.

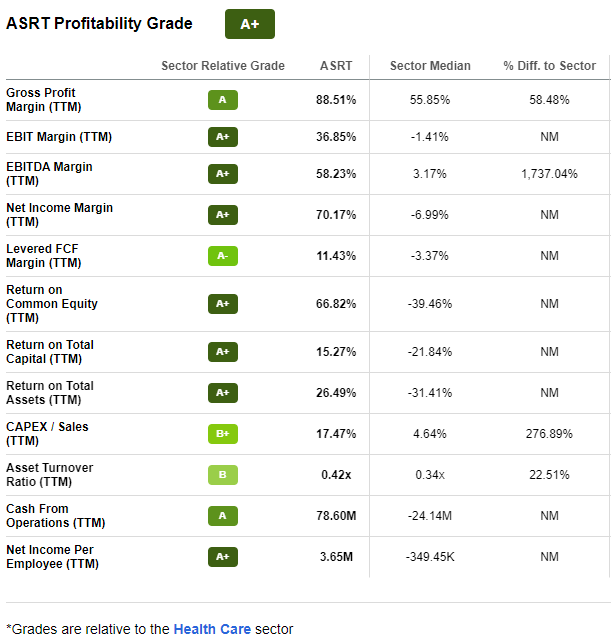

ASRT Stock Growth & Profitability

Where small-cap pharma can be an expensive industry to get into and forge a path to success and profitability, Assertio Holdings has managed to do it. Not only does ASRT develop and acquire great products and companies, but its strong leadership has also turned around the company after its near demise following a disastrous 2015 acquisition of opioid NUCYNTA. As author Jeremy Blum points out, “Assertio looks almost entirely different than two years ago. It is now a cash flow machine, with three recent guidance raises.”

ASRT Profitability Grade (SA Premium)

Using its strong cash flow, ASRT has worked to reduce debt and continues to purchase the rights of new drugs, which tend to be more lucrative and beneficial to ASRT’s business model. This stock is booming, generating high margins and a cash equivalent of ~$64.9M, a 76% increase for Q4 2023.

With recent quarterly results, Assertio Holdings’ EPS of $1.34 beat by $0.76, and revenue of $50.35M beat by $2.91M, a 51% Y/Y increase. ASRT’s net income surged by 1821% in the fourth quarter alone compared to the previous period. Q4 net product sales increased 55% compared to Q4 of 2021, and adjusted EBITDA increased 87%.

“We generated more operating cash flow this quarter than the business generated in net product sales in three of the four quarters of 2021. We’re extremely proud that the actions we’ve taken have led to these results, including the acquisition of Sympazan early in the fourth quarter, which contributed $1.8 million of net sales this quarter and to-date, in 2023, is outperforming our internal deal model expectations. We’ve come a long way in a short period of time. What I’m most excited for is what’s yet to come. We’re in a far better position now to execute on our growth plans both financially and the current environment. As the song goes today is where our book begins the rest is still unwritten,” said Dan Peisert, President & CEO of Assertio Holdings, Inc.

Each of the three companies has made improvements to their business that have been impactful from a cost perspective, they have grown organically and taken advantage of demand and pricing, as well as exited from unprofitable segments. Where market volatility has crushed many companies, eaten into profits, and stunted growth, my three stocks with the greatest profitability continue to build, improve, and offer value for those willing to make an investment in their company. Consider stocks that are strong buys, especially those with tremendous profitability and a bullish outlook.

Conclusion

Profitability metrics can help investors assess a company’s financial health and competitiveness. A company with strong profitability metrics typically has a sustainable business model, generates strong cash flows, and can reinvest profits back into the business to drive growth and create shareholder value. Profitability is key, especially in an uncertain market environment where many stocks have plunged, and lackluster earnings results and growth have fallen by the wayside. Strong Buy-rated stocks with solid profitability can be a great way to capture the upside amid volatility. A look at profitability and how profitable companies compare to those unprofitable in the same industry can be a clear indication of companies that operate more efficiently than others. Where many stocks continue declining, ADBE, AMR, and ASRT are strong quant-rated considerations for long-term investors.

Each of my picks is in a different sector and industry. While they may experience some volatility in the short term, each offers excellent fundamentals, stellar profitability, and strong momentum. Consider my three stocks with the greatest profitability. Many professional analysts covering these stocks see their robust fundamentals and consider them a buy. In addition to the three picks, we have many more Top Rated Stocks to ensure you have the best resources and options to make informed investment decisions.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.